Phynart Studio/E+ via Getty Images

A Quick Take On D-Market

D-Market Elektronik Hizmetler ve Ticaret A.S. (NASDAQ:HEPS) went public in July 2021, raising approximately $681 million in gross proceeds from an IPO that priced at $12.00 per share.

The firm operates an online shopping website and marketplace for consumers in Turkey.

Management is working through a hyperinflationary period where the Turkish Lira is devaluing quickly, dropping against the U.S. dollar from $0.12 to $0.056 in the past year, so I’m on Hold with HEPS for now.

D-Market Overview

Istanbul, Turkey-based D-Market was founded to develop a consumer-centric online shopping portal with a merchant marketplace while providing either in-house or 3rd party delivery services for over 44 million SKUs.

Management is headed by Chief Executive Officer Mehmet Murat Emirdağ, who has been with the firm since 2017 and previously held senior positions at Instacart, Zynga, Microsoft and Unilever.

However, the company recently announced that CEO Emirdağ would step down at the end of 2022 and would be succeeded by Nilhan Onal, who will come from Amazon’s European fashion unit.

The firm promotes its service through its mobile app, online website and related social media as well as through offline means and word of mouth.

D-Market’s Market & Competition

According to a 2021 market research report by ecommerceDB, the ecommerce market in Turkey was an estimated $11 billion in 2020 representing a 43% increase over the prior year.

The Turkish ecommerce market was just behind Poland’s in terms of size and just ahead of Switzerland, according to the report.

The main drivers for this expected growth are an expanding middle class with greater internet connectivity and aging offline shopping infrastructure.

Also, the top three ecommerce sites accounted for 20% of online revenue in Turkey, so the market remains considerably fragmented.

Competitive or other industry participants include:

D-Market’s Recent Financial Performance

-

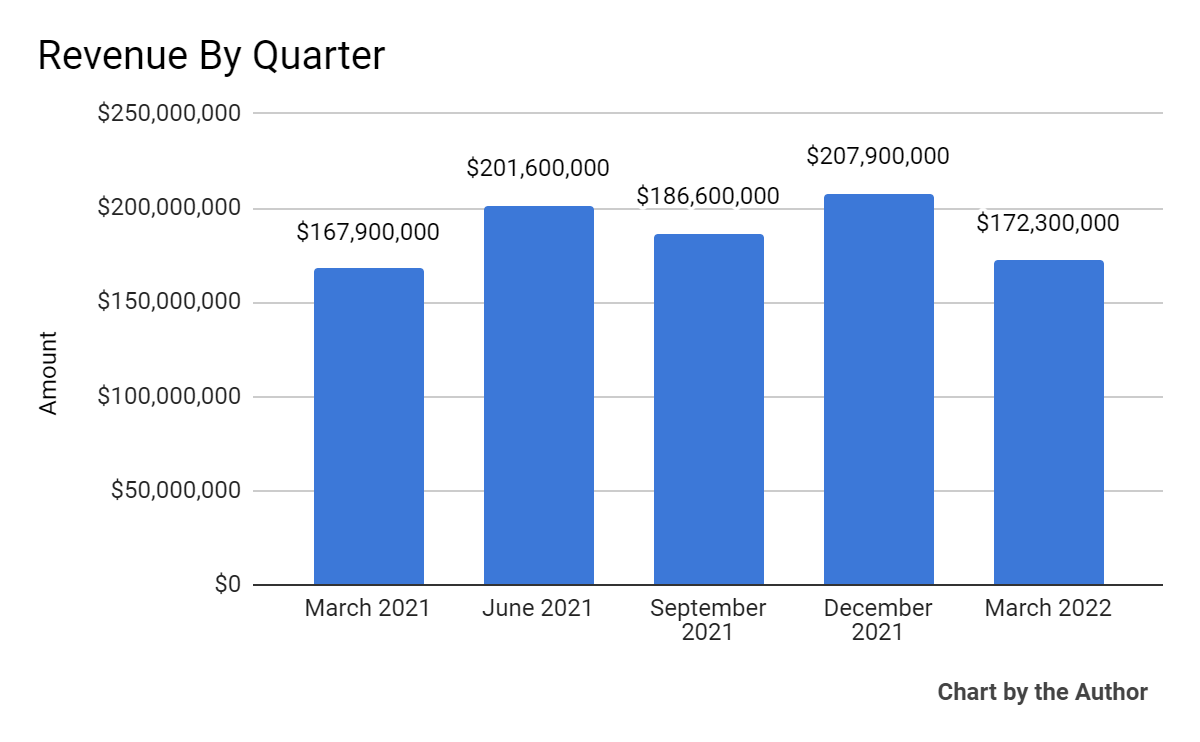

Total revenue by quarter has grown unevenly in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

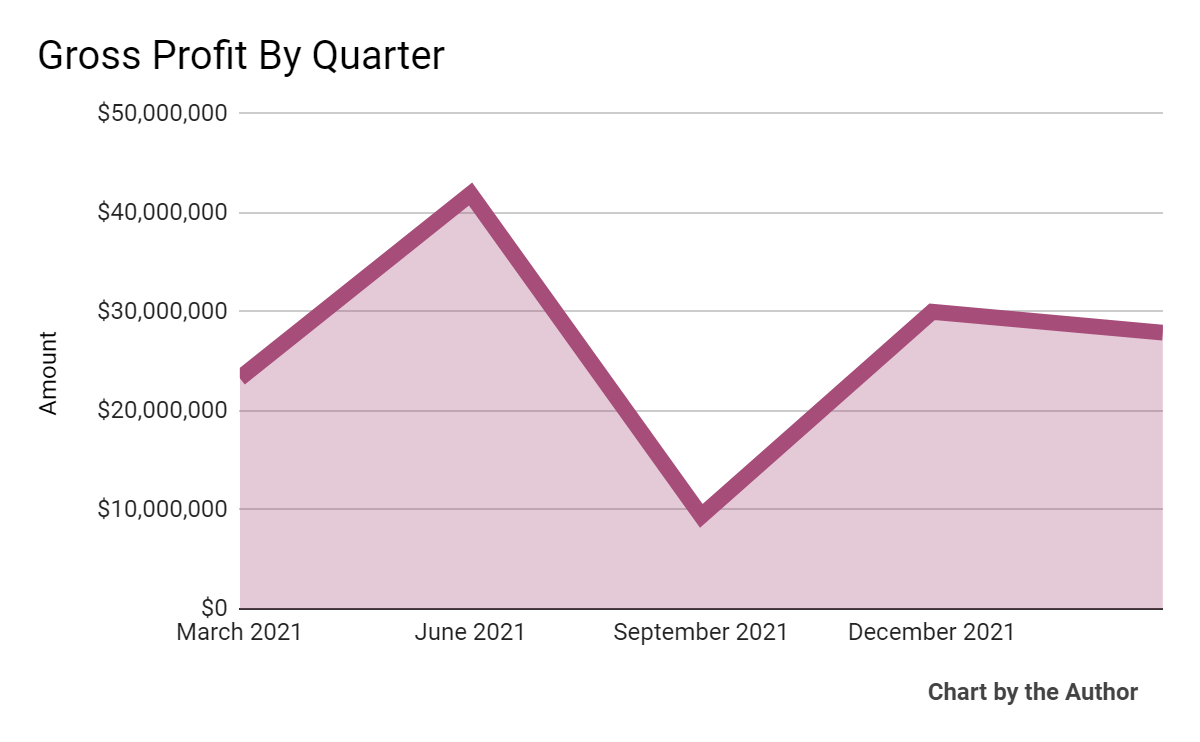

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

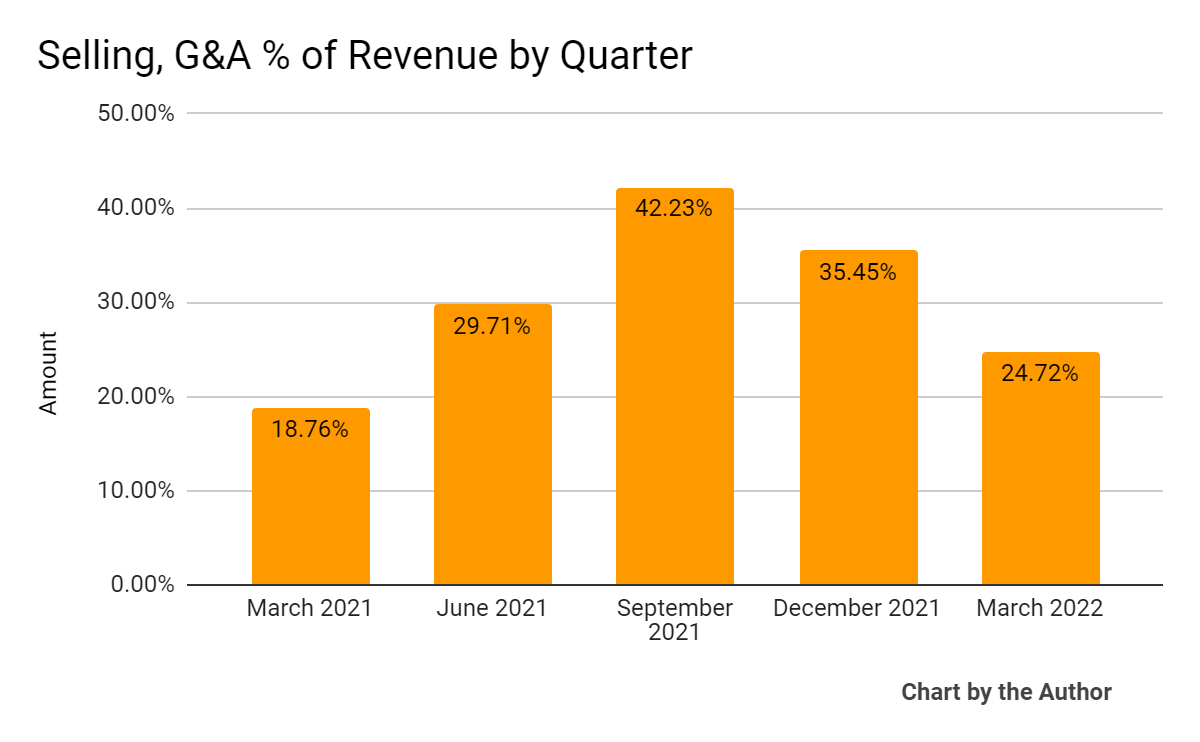

Selling, G&A expenses as a percentage of total revenue by quarter have varied significantly, as the chart shows below:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

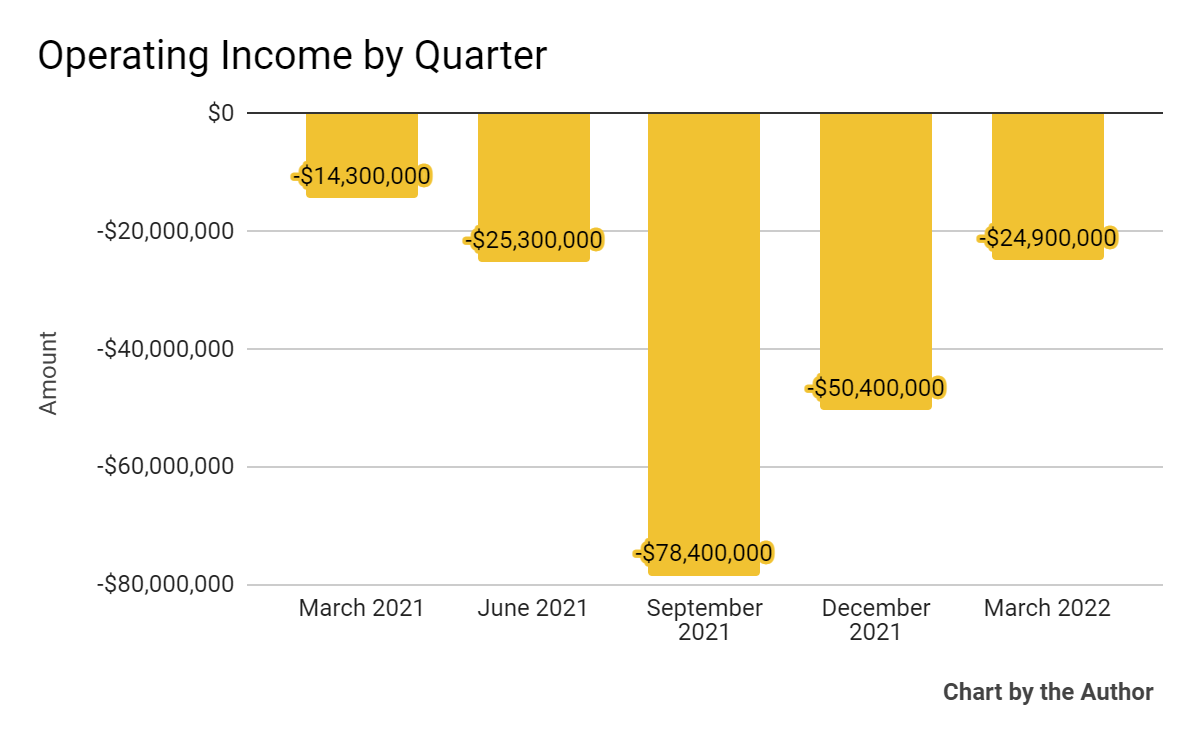

Operating losses by quarter have fluctuated substantially in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

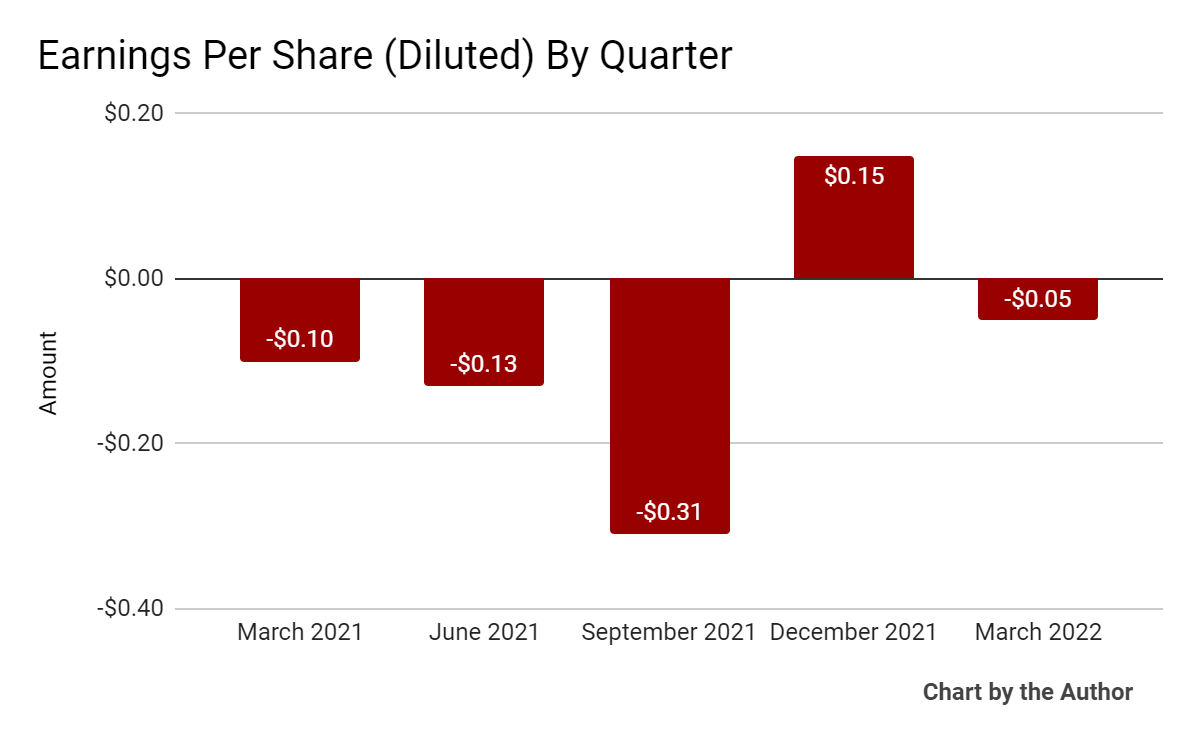

Earnings per share (Diluted) have been negative in four of the last five quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is IFRS)

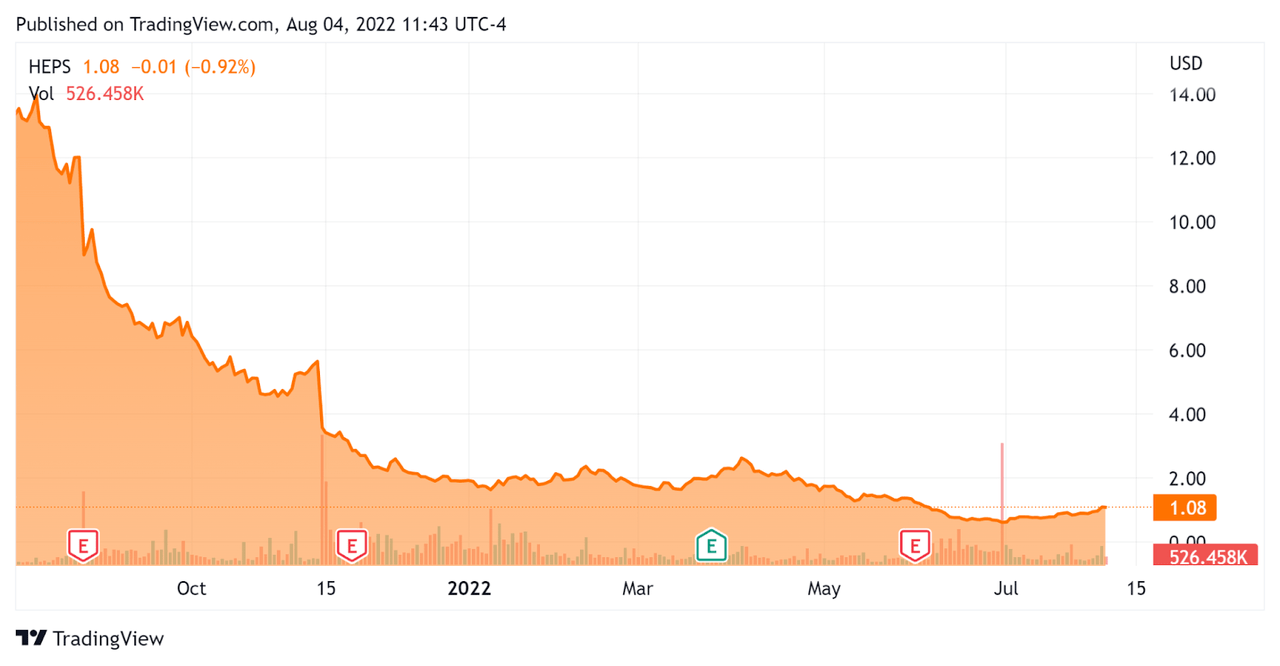

In the past 12 months, HEPS’ stock price has dropped 91.3% vs. the U.S. S&P 500 index’ fall of around 5.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For D-Market

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$136,560,000 |

|

Market Capitalization |

$355,340,000 |

|

Enterprise Value / Sales [TTM] |

0.23 |

|

Revenue Growth Rate [TTM] |

35.63% |

|

Operating Cash Flow [TTM] |

-$70,230,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.34 |

(Source – Seeking Alpha)

Although the company is not an enterprise software firm, the Rule of 40 is a relevant software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

HEPS’ most recent IFRS Rule of 40 calculation was only 14% as of Q1 2022, so the firm need improvement in this regard, per the table below:

|

Rule of 40 – IFRS |

Calculation |

|

Recent Rev. Growth % |

36% |

|

GAAP EBITDA % |

-22% |

|

Total |

14% |

(Source – Seeking Alpha)

Commentary On D-Market

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the challenging macroeconomic environment it faces in Turkey due to rising inflation and the “continued devaluation of the Turkish Lira.”

Also, the company faces difficult supply chain conditions as well as knock-on effects from the war in Ukraine.

The firm’s gross merchandise value [GMV] grew 84% year-over-year, driven by increasing frequency of orders and the additions of new customers.

Management also cited growth in the use of its Hepsipay wallet service, with 7.1 million “opened wallets,” a strong increase from 5.2 million in Q1 2021.

As to its financial results, revenue grew by 82% year-over-year in nominal terms. Gross contribution margin was 8.3%, a 1% decline from a year ago.

The company spent more on advertising and marketing during the quarter due to a “more competitive market environment,” and its G&A expenses rose by 0.9% of GMV.

Notably, management said it couldn’t predict the future impact of IAS29, Financial Reporting in Hyperinflationary Economies on their future financial statements.

It expects a cost inflation of a stunning 65% for 2022.

For the balance sheet, the company ended the quarter with $158.7 million in cash and equivalents, a sharp drop versus the end of Q3 2021 when it had $454 million.

The company is using large amounts of free cash flow but management said it has “no plans to raise any capital for another 18 months from March 2022 onwards,” but this may be optimistic.

Management did not provide forward guidance other than an expected GMV growth of around 50%.

Regarding valuation, the market is valuing HEPS at an EV/Revenue multiple of 0.23x.

The primary risk to the company’s outlook is the continued ultra-high inflation in Turkey, which reached 61% at the end of Q1.

In response, consumers there are shifting their purchases to lower cost items which may face supply chain delays due to sharply increased demand.

While D-Market is bringing in a new CEO and seeking to generate more margin from various financial services, the company is burning through cash, probably by delaying its payables function, so will likely need new funding sooner rather than later.

I don’t envy management working through a hyperinflationary period where the Turkish Lira is devaluing quickly, dropping against the US dollar from $0.12 to $0.056 in the past year, so I’m on Hold with HEPS for now.

Be the first to comment