Olemedia

The vast majority of commodities have fallen significantly during the last few months. However, lithium is the exception. Supported by fast-growing demand, the battery metal is holding its ground. The bigger players are hungry for new deposits, resulting in an increased M&A activity. Deals are happening at prices close to or even exceeding the estimated NPVs of some projects. At the same time, Cypress Development Corp. (TSXV:CYP:CA)(OTCQX:CYDVF) is trading at about 0.13x its project’s estimated NPV and just achieved an important milestone.

Lithium market overview

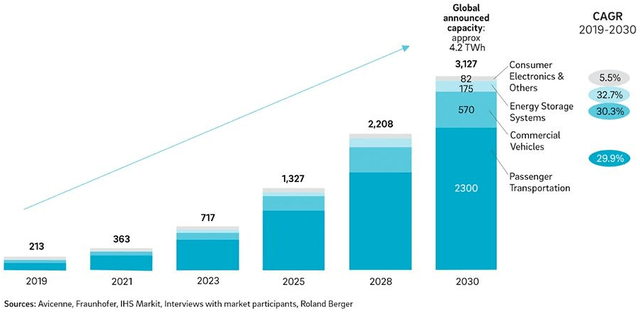

In the 21st century, the world is changing at a fast pace. Energy transition is one of the main areas of change with electrification at the center stage. ICE engine vehicles are being replaced by EVs and the importance of energy storage has never been more crucial. A key element of these trends is lithium-ion batteries. Their demand is projected to grow at a CAGR exceeding 30% to 2030.

Global demand for lithium-ion batteries (Consultancy.uk)

However, there’s the real possibility that supply won’t be able to match the demand, which will lead to shortages and slow down the transition. In such environment, I expect lithium prices to remain strong. Currently, lithium carbonate is priced north of US$70k/tonne.

Geopolitical considerations

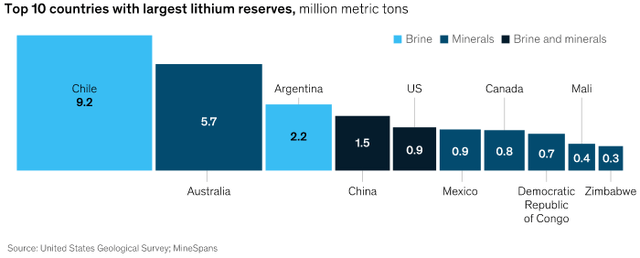

In addition to the overall supply challenges, there’s a geopolitical caveat as well. The significant dependence on one major supplier, such as the case of the EU’s oil and gas imports from Russia, proved not to be a wise strategy. In the case of lithium, the majority of reserves are located in South America, more specifically Chile and Argentina.

Lithium reserves (McKinsey & Company)

Recently, the newly elected Chilean government demonstrated intentions to tighten regulations and get the state involved in the lithium space by creating a state-run company. Moreover, Latin America is not famous for political stability and strong property rights.

For these reasons, it’s crucial for the USA to strive for critical minerals independence, just like it did with the Shale revolution, which made it an exporter, rather than an importer of energy. I expect that such measures will be taken and lithium projects in the USA will become a cornerstone of the country’s energy transition goals.

Company Overview

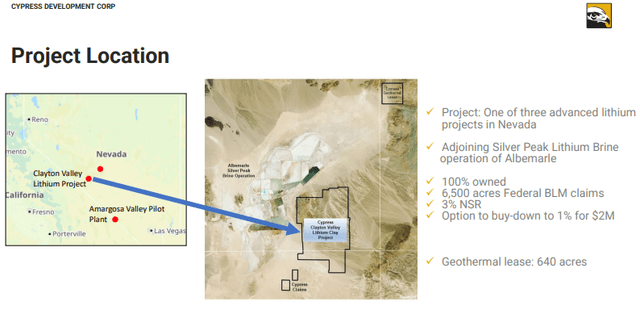

Cypress Development Corp is a Canadian lithium company with an advanced-stage flagship asset located in Clayton Valley, Nevada, USA. It’s a claystone-bearing lithium deposit, which the company plans to operate using an acid leaching extraction process. As of 30 June 2022, it has 146.3M shares outstanding, which puts the market cap at around US$131.7, taking into account the last closing price of US$0.90 per share. According to data from Yahoo Finance, insider ownership amount to just 4.11%, which I find pretty low for such a small company. Institutional ownership is also very low at 0.18%. Although a higher percentage would’ve been a positive sign, the lack of institutional presence at this stage is not that surprising, given that the company is not part of an index, which has ETFs tracking it. In addition, the market capitalization is still small and the shares are not very liquid with both characteristics being generally undesirable by the majority of institutional investors.

Clayton Valley Lithium Project (Corporate presentation)

The company conducted a pre-feasibility study (PFS) of the project in 2020, which was subsequently amended in March 2021. The estimated NPV of the study was over US$ 1B with an IRR of 25.8%, using a discount rate of 8% and lithium carbonate (Li₂CO₃) price of just US$ 9.5k/tonne in the base case. A more optimistic assumption, keeping everything unchanged, except Li₂CO₃ price, which was hiked by 50% to US$ 14.25k, yielded an estimated NPV of over US$2B.

Since then, Cypress has demonstrated the viability of its planned extraction process through a pilot plant facility, which began operations in 2021. The project was further de-risked in 2022 as the company released the results of its sonic drilling program, reaffirming the resource assumptions in the pre-feasibility study. Another key milestone was achieved in September, when it was confirmed that battery grade Li₂CO₃ with purity of 99.94% (99.5% cut-off) was derived from the pilot plant. The next important landmark for the company will be the completion of a feasibility study (FS), which is expected towards 2022 year-end.

Cash and liquidity

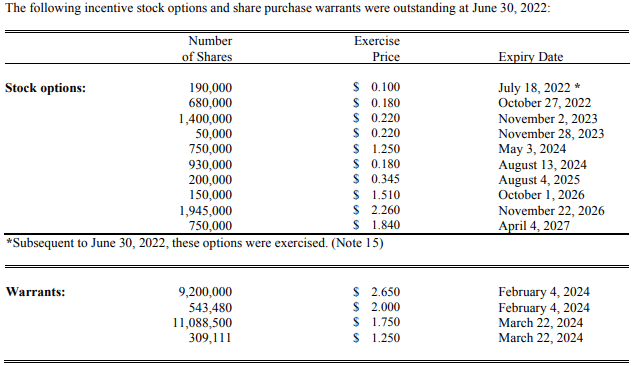

As of Q2’22, the company has cash and equivalents of CAD$34.3M, which is 48.3% higher YtD. The increase is due to offerings done in February 2022, when a little over 9M new units (one share plus one warrant with a strike of CAD$2.65) were issued at a price of CAD$2.00 per unit. There is no debt on the balance sheet as well. When it comes to the cash burn, in the first 6 months of 2022, CFI and CFO outflows amounted to CAD$5.2M and CAD$1.4M, respectively, bringing the cash burn to CAD$6.6M in H1’22. However, it has to be taken into account that the drilling program was started in H1’22 and probably the majority of expenses related to it were incurred and paid before 30 June. Going forward the company will probably register outflows, related to the completion of the feasibility study, but overall I expect a lower cash burn in H2’22.

Warrants and options outstanding (Cypress Development)

The existing warrants and options could also be a source of liquidity of above CAD$48M, if all of them are exercised, however, the share count will increase by about 25.9M shares in such a scenario.

Given the cash burn of the company and the current cash and equivalents, I think that Cypress won’t tap equity markets in the coming years, unless it decides to do so in relation to funding the construction of its project.

Project financing

Turning to the financing of the Clayton Valley Lithium Project it has projected initial capital costs in the PFS of US$493M. However, given the significant inflation in the meantime, the actual number is probably higher by at least 15-20%. Realistically, it will be very hard for Cypress to try to fund the project on its own. An equity offering of that size, especially in the current risk-off market environment doesn’t look like a viable idea. After the release of the FS and further project advancement, the company could also start to sign binding take-off agreements, which then to be used for obtaining debt financing. ioneer (IONR), another advanced-stage lithium company, went on such path, signing off-take agreements for nearly 90% of its expected production. However, as it’s unlikely for a project to be entirely debt financed in case of no cash flow positive company, Ioneer also teamed up with Sibanye Stillwater (SBSW), which will provide US$490M for 50% stake in the flagship Rhyolite Ridge project. I think this is a very possible path for Cypress, given that mining majors are on the hunt for lithium exposure, as evident from the increased M&A activity. Considering the location of the project in Nevada, USA, this is an advantage that Cypress has over places like Argentina, which is seeing a lot of lithium deals, despite the political risk. A combination of some debt financing and a JV with a mining major will allow for the project to be fully financed, while maintaining some further upside for existing shareholders. However a path where Cypress is entirely taken over should not be ruled out as well.

Valuation

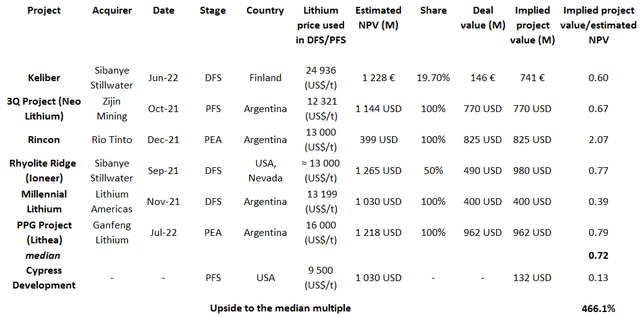

In light of the expected lithium boom, mining majors are trying to get exposure to the metal. In addition to the above-mentioned JV with ioneer, Sibanye Stillwater acquired an additional 19.7% stake in the Kelibar lithium project in Finland an with estimated NPV of EUR1228M for EUR146M. The Chinese giant Zijin Mining (OTCPK:ZIJMF) took over Neo Lithium for about US$770M, which project 3Q has an estimated NPV of US$1144M. Another mining major – Rio Tinto (RIO) expanded into the green metals space by acquiring the Rincon Lithium project for US$825M, which according to PEA data has an estimated NPV of US$399M. Lithium-focused majors also were active on the M&A market. For example, Ganfeng Lithium (OTCPK:GNENY) acquired the PPG Project in Argentina, which has an estimated NPV of US$1218M for US$962M. The American company Lithium Americas (LAC) acquired for US$400M Millennial Lithium, which project in Argentina has an estimated NPV of US$1030M.

For the purposes of valuation I will use data from these deals on the lithium market, all of which were concluded during the last year. The ratio of interest will be estimated NPV/implied company value. The estimated NPV figure will be the one indicated by the PEA/PFS/DFS of the particular project, while the implied company value would be dependent on the deal price tag, except for the case of the Clayton Valley Lithium Project of Cypress, where the current market cap will be used.

Relative valuation (companies’ data; author’s calculations)

The data shows that Cypress Development trades at a significant discount to even the lowest multiple and the upside, when using the median value is 466.3%. Note, that for all six transactions the lithium price used was notably higher than the one used by Cypress in its PFS. Moreover, in a recent interview, the CEO of the company – Bill Willoughby indicated that the FS will likely use lithium carbonate prices between US$20-30k/tonne. I expect this to lead to a significant increase of the estimated NPV of the project and positively affect the share price.

Besides good the good economics of the project, there are other characteristics of the Clayton Valley Lithium Project that make it a good takeover target. The relatively close proximity to the Tesla’s (TSLA) Gigafactory in Nevada is one of them. There were even rumors in the past that the EV company is in talks with Cypress for a potential acquisition in 2020. Although the talks didn’t lead to anywhere then, the project has achieved important milestones in the meantime and even if Tesla is not the owner of the lithium project, it will very likely be a customer, given the convenient logistics.

Risks

Lithium price risk – Most commodities have already been hit by the recession fears and have declined significantly YtD. Although lithium is holding his ground if recession fears materialize there could be some price impact. However, the bigger threat will be if, due to a technological breakthrough, lithium ends up being substituted as main component in batteries. For example, recently scientists from the MIT have presented an aluminum-sulfur battery. However, as with any new invention, scalability will be the key in order to rival lithium-ion batteries.

Water access risk – The operations of the Clayton Valley Lithium Project will require water. However, water in Nevada is scarce and its use is regulated. In 2021, Cypress purchased a water rights permit from Nevada Sunrise (OTCPK:NVSGF), which was subsequently extended to 28 August 2022. In its Q2’22 fillings, Cypress announced that it has submitted an Application of Time in order to prevent permit forfeiture and is waiting for a response. If for some reason Cypress loses access to water or its amount is reduced, the operating activities of the project in Nevada will be severely affected.

Slow permitting risk – The USA, although politically stable, has been notorious for its slow permitting process, which takes on average 7-10 years. However, as geopolitical tensions around the world are on the rise, the political leadership of the USA may finally realize the importance of domestic supply of critical resources and work towards cutting red tape to speed up the permitting process.

Construction costs risk – In the current inflationary environment the cost of construction will most certainly be affected. Fortunately for Cypress, the prices of lithium have also rallied significantly during the past year, which will counterbalance the effects of higher CAPEX on the project’s estimated NPV, but still the initial outlay will be higher than the one in the PFS.

Interest rates – Although Cypress is debt-free at the moment, rising interest rates environment still has an impact on the company. In a scenario, when the Clayton Valley Lithium Project is being valued by a potential acquirer, higher risk-free rates would lead to lower valuation, all else being equal.

Conclusion

Energy transition in a world of increasing geopolitical tensions highlights the importance of reliable supply. Cypress Development has a promising project in Nevada, USA. The company recently achieved an important milestone, by demonstrating that the lithium from its production process exceeds battery-grade levels. The close proximity of the project from Tesla’s Gigafactory is another positive characteristic as the latter will likely be a future customer. Meanwhile, the M&A activity in the lithium space is high with mining majors striving to get exposure to the “green” metal. The location of Cypress’ project and its promising economics could make it a potential target very soon. At the same time the company is trading at barely 0.13x estimated NPV/market cap, while recent deals indicate median acquisition multiple of around 0.72x or 5.5x higher. For this reason, I rate the company a speculative buy.

Be the first to comment