NicoElNino

Introduction

My last article on BlackRock’s (BLK) iShares MSCI China A ETF (BATS:CNYA) upgraded it from a Hold to a Buy. This was in May this year.

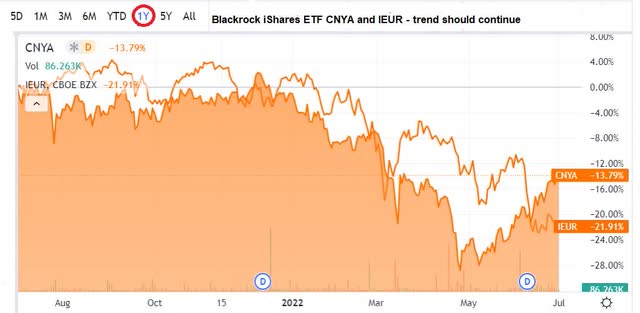

If we compare it to BlackRock’s iShares for the largest companies in Europe (IEUR), it is clear that the trend has now reversed, with CNYA down much less than IEUR.

Here is how their charts stack up

CNYA vs IEUR – trend should continue (SA)

European economy

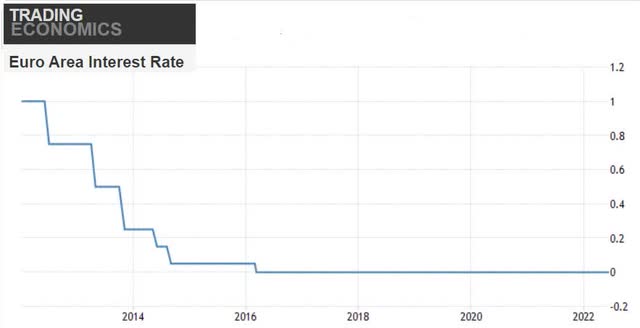

The EU has lived with zero, and in some countries negative, interest rates for more than a decade. I am no economist, but it does not seem to be a good place to be in when “money is free” or you have to pay the bank to store it for you. I think capital is just another resource, much like labor and energy. Those are surely not free, especially now.

Is now a time when “free money” ends?

Euro zone interest rate (Trading Economics)

With the U.S. Fed stepping on the accelerator and raising the interest rate, the question is how the European Central bank will react.

The eurozone is also struggling with inflation, as it recorded 8.6% y-o/y in June this year.

The ECB, which has forecasted a GDP rate of 2.8% for the eurozone this year will meet in late July to announce what they will do to the interest rate.

Speculation varies with some thinking that the initial hike will be between 0.25% to 0.50% in July with further increases in September and December. The question, as usual, is whether the ECB will follow through with multiple rate hikes or if they by then see a recession toward year-end which will cause the ECB to back off.

Unfortunately for Europe, they have put themselves in a “pickle,” being so reliant on energy from Russia. If my memory serves me right, I seem to remember that there was an American President that visited Europe a few years ago telling them they should buy American gas and rely less on Russia. His thoughts were not welcomed, but that is all history.

Now they have no options. On one hand, the EU and its members condemn Russia and at the same time, they are financing their efforts in fighting their war. It is ironic. Let us see how this winter will go. Nobody likes to get blackmailed, but it does seem like Putin has some pretty strong cards on his hand.

Something which will play out over some time is also the cost of rebuilding Ukraine.

On the 5th of July, the Ukrainian government reached out to the world for help to rebuild the war-torn country. Pictures from there are clear for all to see. It will be a huge task. They estimated a need for USD 750 billion to do so. It is anybody’s guess how long the war will last, and when the rebuilding effort can start. The world will come together and offer financial support. I believe Europe will be the one which has to make the largest contribution. European companies and their consumers can still thrive but I suppose there are risks for higher taxes on them to pay for some of it.

Why has the euro currency lost over 9% to the USD since the beginning of the year? The market is telling us that they expect more pain to come in the eurozone, I believe.

Chinese economy

It can no longer be expected that China is going to deliver growth to their GDP in the 7 to 9 % level. No country can go on with such growth for a long time.

In mid-July, the economic statistics for the last quarter will be presented to China. Expectations are low, and the consensus is on growth of just over 4%. The authorities maintain the growth target of over 5%, which was set at the beginning of the year.

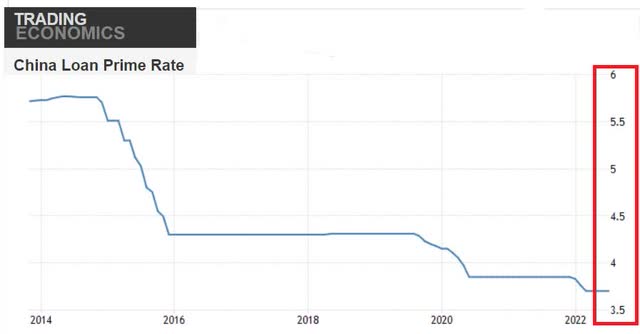

While the U.S. and eurozone have had nearly zero interest rates and are now in the market cycle where we will see increases in the interest level, the opposite is happening in China.

China’s interest rate level (Trading Economics)

The Chinese authorities have presented more stimulus packages consisting primarily of infrastructure investments. To achieve this they will sell government securities for 300 billion yuan (USD 45 billion). according to Nomura’s calculation, the total investments can be up to five times higher.

This comes on top of 800 billion yuan (USD 121 billion) that three state-owned banks were ordered to provide as loans for infrastructure projects.

In my most recent article on RIO, I was asked by some readers where all the steel would be needed. If what I just described here in this article with regards to infrastructure spending does take place, and I am quite confident that it will, there will be good demand for iron ore in the coming years.

It was pointed out in an article in Hong Kong’s leading newspaper South China Morning Post, that China has a significantly lower rate of inflation than the U.S. and a “prudent” economic policy during the first two years of the pandemic. This has given Beijing room to roll out targeted support for the economy.

It is still early days of opening up the economy in China, so it is not yet clear how it will pan out. However, even a marginal acceleration of Chinese demand should go a long way to cushion the growth drag on Asia.

China is likely past its growth trough and is expected to pick up steam in the coming months,” – Frederic Neumann, HSBC co-head of global research Asia.

Risk to the thesis

The most obvious risk is that development in China experiences further setbacks from the pandemic.

Should they reintroduce stricter restrictions on people’s movements and not make it easier for people to come to China, this would hamper the economic benefits of free movements.

Conclusion

As the article suggests, China is in a better position than many other trading blocks, like the EU. The U.S. is in my opinion somewhat better positioned than the EU as it is basically self-sufficient in energy and food. It is also unlikely that the U.S. will be as negatively affected by the war in Ukraine as the EU is.

CNYA is still a Buy and my conviction is growing stronger.

Be the first to comment