microgen

As of the leading businesses in the nascent psychedelic therapy segment of the biotech industry, Cybin (NYSE:CYBN) is working to develop novel medicines for mental illnesses like depression and alcohol use disorder. Similarly to other companies in the psychedelics space, the last couple of years have been unkind for its investors, with the total return of its shares falling by 66.6% so far this year alone. But, given the highly detrimental impact of the Federal Reserve’s tightening campaign on risk assets like Cybin and other young biotechs, the decline in its shares isn’t indicative of its ability to generate returns in the future, and there’s still a significant amount of upside for investors, provided that the risks are tolerable to them.

There are three components to the bull thesis for buying and holding Cybin stock for the long-term. First, the biotech is sufficiently funded, and its lead pipeline program shows great promise in light of the scientific literature describing the efficacy of its approach. Second, its use and ongoing development of enabling technologies will provide it with ample opportunities to stake intellectual property claims and potentially to make superior-quality therapies as well. Third, the company is well-led, and insiders are buying its stock. And while it doesn’t constitute a reason to buy the stock in and of itself, its valuation is presently at an acceptable level to start a new position. Let’s explore each of these components in more detail and then tie it into an investment strategy.

Finances are as good as can be expected

Like most early-stage biotech companies, Cybin has no revenue or earnings of any kind, and it is unlikely to generate any revenue from sales of a therapy product for at least the next few years. Drug development collaborations funded by larger competitors in the pharma industry might yield some revenue between now and the possible commercialization of one of its therapies, but at present it doesn’t have any such deal on the horizon. So its principal challenge is to commercialize at least one of its pipeline assets before its money (and its ability to raise money) runs out.

While it has CAD$29.93 million in cash and equivalents right now, its TTM cash burn of CAD$51.52 million means that it will need to raise more capital sometime in the next year. Currently, it has an at-the-market equity program which it can use to issue new shares worth up to CAD$38.4 million. That’d give it a total of CAD$68.33 million in cash, which would be sufficient for at least a bit more than an additional year of operations.

Furthermore, taking out a loan at an acceptable interest rate shouldn’t be a problem, as it currently has zero debt of any kind. Given that its TTM research and development (R&D) expenses are CAD$21.98 million, pausing its earlier-stage and lower-priority preclinical work to focus on more advanced clinical-stage programs could also help to extend the cash runway a bit further. The takeaway is that Cybin has multiple viable routes to continue funding its operations, which means that it has a good chance of keeping the lights on long enough for its flagship pipeline project to clear critical hurdles in clinical trials.

Intellectual property opportunities abound, with even more in the pipeline

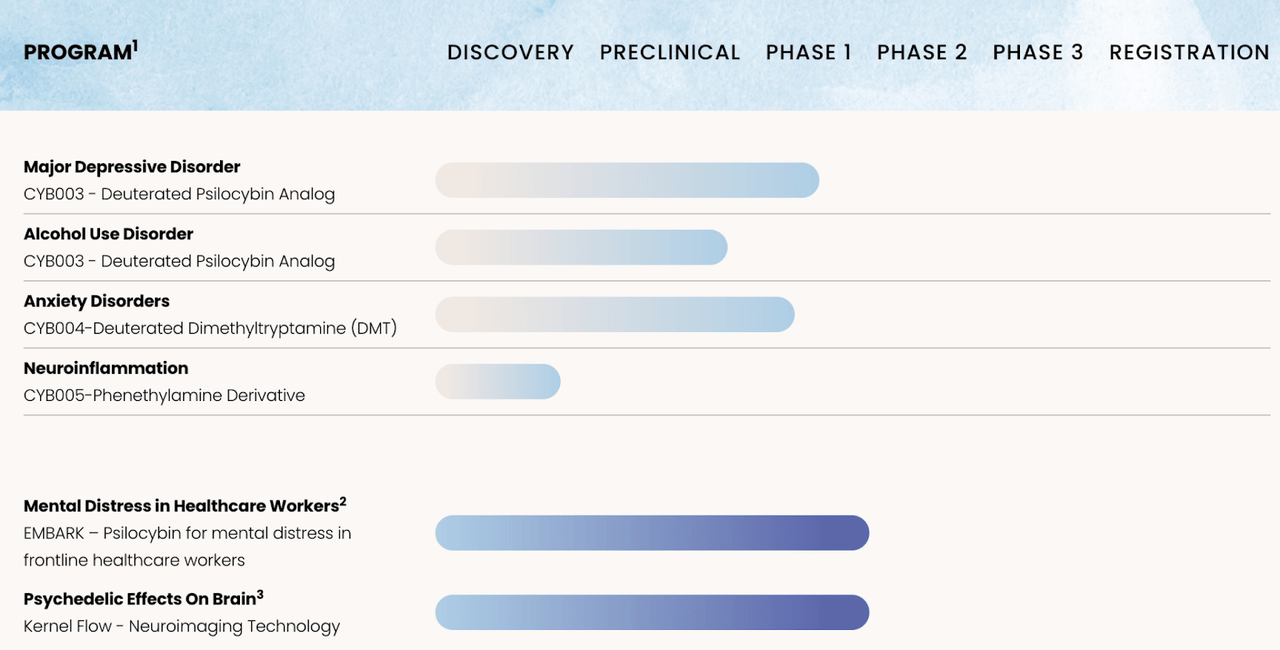

As a psychedelic medicine developer, Cybin’s chances of success rest on its ability to advance its programs through clinical trials and ultimately get the stamp of approval from regulators in advance of commercialization. Cybin’s pipeline has a small handful of early-stage programs, all of which pertain to psychedelic therapies or enabling technologies, as shown below:

Cybin’s drug development pipeline. (Cybin company presentation.)

As you can see, the pipeline is diverse in terms of the targeted indications of its programs as well as the source material for the molecules under investigation. That’s favorable, as it reduces the risk of a failure in one of its programs leading to broader investor pessimism about the company’s chances of success. The company claims to have more than 50 preclinical programs investigating the benefits of novel psychedelic molecules, which means that in the long-term it’ll likely be able to move many more projects into the clinic as funding allows.

One important constraint for psychedelic biotech businesses is that the well-characterized psychedelic molecules like psilocybin are naturally occurring, and thus are not patentable. Therefore, companies must add value via innovations which build on or improve the safety or efficacy of the natural molecules in order to stake out intellectual property protections for their products and to thereby have the opportunity for a defensible market share if their therapies are eventually commercialized. In Cybin’s case, these innovations take the form of making chemical modifications to the natural molecules to change their properties in ways that are favorable for treatment, developing drug delivery systems, developing treatment protocols, and developing other technologies that streamline the therapeutic process in some way.

Its flagship therapy program, CYB003, which is currently in phase 1/2a clinical trials, is intended to treat major depressive disorder, and it’s designed as an orally-administered medicine which patients receive in parallel with psychotherapeutic support delivered by a trained clinician. The therapy is based on the molecule psilocybin, commonly known as the active ingredient of “magic mushrooms”, but it’s modified via a chemical process called deuteration. In preclinical trials in animal models, deuteration of orally-administered psilocybin allegedly led to a shorter-acting therapeutic effect which ramped up more rapidly and penetrated the blood-brain barrier more effectively than non-deuterated psilocybin. With those advantages, CYB003 could be administered in concise and controllable therapeutic sessions, which would be a substantial improvement over the 8 to 10 hours a traditional psilocybin experience might last.

Whether those favorable results will hold up in human subjects remains to be seen, but even if it doesn’t, the chemical modification will ensure that the company’s competitors won’t be able to copy its product right out of the gate due to IP protections. In prior clinical investigations of psilocybin for depressive disorders, the data have shown tremendous promise, though presently there are no formulations of psilocybin with regulatory approval to be on the market for any purpose. Though it’s premature to discuss psilocybin in any formulation as a cure for depression, robust and durable symptomatic reductions appear to be common, and side effects largely appear to be mild, transient, and rare. That doesn’t entirely de-risk the company’s approach, but it should give investors a measure of confidence that it isn’t swimming in entirely uncharted waters with its flagship program.

Key enabling technologies could make for competitive advantages in the future

Cybin’s technology development activity is one of the main pillars in support of the bull thesis for the stock. Specifically, in Q4 of last year it initiated a phase 1 feasibility study in collaboration with Kernel, a business developing a quantitative neuroimaging headset. The idea of Kernel’s product is that psychedelic drug developers can use it to noninvasively gather quantitative data on activity in a patient’s brain before, during, and after they receive treatment with a psychedelic medicine.

That’s a critical capability to develop, as it could give Cybin a rich data set describing how its therapies affect patients, freeing the company from the need to rely on patient-facing questionnaires for efficacy assessments. “The entire system is the size and look of a bicycle helmet,” quipped Cybin CEO Doug Drysdale in the company’s Q3 earnings update of FY 2022. And it’s also a capability that its competitors completely lack, forcing them to use older and significantly more logistically cumbersome and more invasive technologies like fMRI scans. While the final results of the Kernel collaboration’s trial won’t be out until the end of the year, Cybin’s pioneering use of its technology is likely to be something that competitors try to emulate, as it could easily be a major cost-saver and value-enhancer down the line.

Though it remains to be seen whether the Food and Drug Administration (FDA) is receptive to data like that produced by Kernel’s headsets in the context of a company’s regulatory submissions to get a medicine approved, the data could also be directly beneficial to Cybin’s stock price. If the biotech can advertise itself to investors with deeper and more detailed data about the efficacy of its candidates than the competition, it’ll have an easier time convincing buyers on the margin to initiate a new position. But for now, such benefits are speculative.

Industry endorsements are piling up and insiders are acting bullish

Another green flag for Cybin is that its peers and its company directors are showing quite a bit of confidence in where it’s headed. On November 5 of this year, it won the award for the best psilocybin company of the year at the 2nd annual Microdose Awards held as part of the Wonderland Miami psychedelic medicine conference. In 2021, it also won company of the year at the same conference. Those accolades support the idea that it’s a leader in the psychedelics space.

In terms of insider activity, its insiders hold 20.22% of Cybin’s outstanding shares, which is quite high for an early-stage biotech. It’s also a point in the company’s favor because it means that the financial interests of shareholders and company officers are more likely to be in direct alignment. Insiders at major competitors like Atai Life Sciences (NASDAQ: ATAI) and Mind Medicine (NASDAQ: MNMD) only hold 9.28% and 12.2% of the companies’ outstanding shares, respectively.

Multiple insiders, including the CEO and CSO, have been buying more shares of Cybin; in March, the CEO made two purchases worth $60,800 in total. In the last 12 months, there were 15 instances of directors buying shares, and only 1 instance of a sale. Such purchasing activity indicates that directors aren’t too concerned about the stock’s drop. Instead of cutting losses, they’re adding to their positions, perhaps because they interpret Cybin’s shares to be selling for cheap.

The valuation isn’t a barrier to investment

While its value is largely in its personnel and its intangible assets like intellectual property and trade secrets, a basic valuation analysis shows that Cybin isn’t priced too expensively. Take a look at the table below depicting Cybin’s price-to-book (P/B) ratio and market cap in comparison to its competitors within the psychedelics industry:

|

Company |

Market cap |

P/B |

|

Cybin |

$73.91 million |

1.5 |

|

Mind Medicine |

$101.82 million |

0.6 |

|

Atai Life Sciences |

$485.19 million |

1.6 |

|

COMPASS Pathways (NASDAQ: CMPS) |

$421.93 million |

2.1 |

|

Numinus Wellness (OTCQX:NUMIF) |

$48.06 million |

1.3 |

Source: Compiled by author with data from Ycharts.

None of the above competitors have any products on the market, though Atai and COMPASS Pathways are somewhat further along with their flagship programs than Cybin. Nonetheless, Cybin’s stock is valued roughly in the middle of the road, which means that it is unlikely to be especially vulnerable to multiple compression stemming from a falling market.

Risks are substantial, but in-line with the competition

Investors should recognize that Cybin is an early-stage biotech that’s subject to major risks from its pipeline programs failing to demonstrate strong results in clinical trials. Thanks to the aforementioned body of evidence supporting the idea that psilocybin might be an effective therapy for depression, these risks are somewhat lower for CYB003 than what might be expected of another early-stage candidate. Of course, there is still the (small) risk of the business running out of money to advance its candidates even after reporting a success in the clinic.

There is also the much larger risk of hard regulatory barriers, principally the illegality of psilocybin and its derivatives for any purpose in the U.S. That’ll need to change before the company can make a dollar of revenue from sales of any medicine, and it could take years. In other words, treat Cybin as a speculative investment and size your position accordingly.

Now is a good time to start a position

Regarding the best strategy and the best time to invest in Cybin, it’s important to remember that this stock is a long-term play that won’t have any fundamentals-based mechanism for rewarding shareholders for at least a few years. In the meantime, its share price will likely be buoyed (or dampened) by its clinical trial data readouts. Buying immediately after a favorable readout is likely to lead to short-term losses, so it’s preferable to buy well in advance of such events to avoid paying the hype tax.

Investors should get their first update on CYB003’s safety characteristics in early 2023, per management. As psilocybin has a long history of human use and a well-established safety profile when administered under controlled conditions, it would be quite surprising if the safety data is unfavorable. Efficacy data will come later, and it’ll have a larger impact on the stock. Likewise, the company plans to report the results of its phase 1 collaboration with Kernel before the end of 2022. If in the course of the update management indicates a broadening of the collaboration to include additional pipeline programs, it’ll be a major catalyst, but there isn’t much potential for a downside move, as Kernel’s technology isn’t currently in use for more advanced projects like CYB003.

And all of the above implies there is a window of opportunity to start a position in the stock right now, with the objective of holding shares until shortly after the company commercializes its first therapy, assuming it ever does. Investors should take care to prepare themselves for the possibility of near-term losses when using this strategy, however. Pre-revenue biotechs aren’t known for being attractive places to park money during a bear market, even if their chances of multiplying in value can make them into winning investments in the long-term.

Be the first to comment