cokada

CVB Financial Corp. (NASDAQ:CVBF) remains impeccable with its sound fundamentals. Revenue growth and stable margins show its acquisition is a good move. Likewise, its asset-sensitive Balance Sheet is an assurance of its larger capacity and growth potential. It is well-positioned, allowing it to generate more potential returns amidst inflation. Its borrowings and dividends are well-covered. So, dividend payments are reasonable and sustainable. Meanwhile, the stock price appears to have a slight decrease since the last week of June. But, it stays fairly valued.

Company Performance

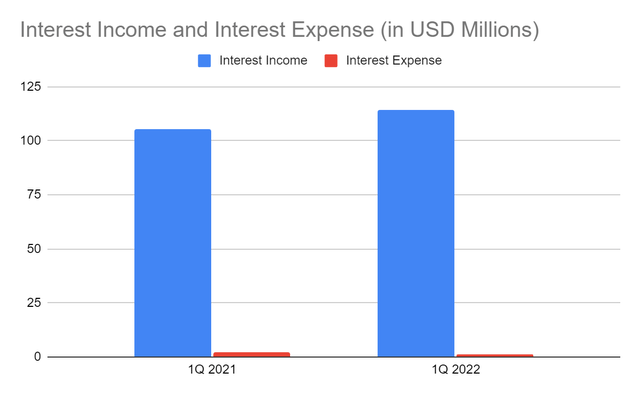

The pandemic may have hampered CVB Financial Corp. a bit, but its efficient asset management remained its strength. Its asset-sensitive Balance Sheet has always been its cornerstone, allowing it to realize higher income amidst economic uncertainties. Even better, it is now back with more robust performance and enticing growth prospects. Its interest income is $114.10 million, an 8% year-over-year growth. Thanks to the addition of Suncrest Bank, which added value to its operations. In 3Q 2021, it also showed continued revenue growth and well-managed expenses. So, the combination of these two companies will be another edge. It does not only increase its size and market visibility. The larger resources allow it to capture more potential gains. The composition of its asset-sensitive Balance Sheet is also excellent. I will discuss this part later.

Interest Income and Interest Expense (MarketWatch)

The increase is not driven by its loans. It is driven by its prudent investments. Its investment securities are sensitive to interest rates, allowing it to generate more yields. They comprise a substantial portion of assets so it has a high potential to realize more income. Of course, things may change amidst the increase in interest rate hikes. Security yields may not be as enticing as in 1Q 2022. Note that the breakeven yield rates peaked at 3% in April before decreasing to 2.4% last month. Also, unrealized losses are higher this year. Many other banks are seeing the same trend. Nevertheless, these securities appear to be more appealing today due to recession concerns. Also, volatility does not seem to go into a summer lull. It is still logical since the series of interest hikes encourage more savings than spending and borrowings. That is why yields may rebound and lead to higher investment income. I expect a rebound in returns and the convergence between the securities book and market value. These may offset capital impacts in the long run. The payoff may become better. Meanwhile, the M&A increased its loans. So, the interest rate hikes may lead to higher interest fees. It may become a win-win situation for the company.

Moreover, the company has efficient asset management. It is more evident in how it handles its investments, loans, and deposits. Amidst the lower interest rates in the earlier part of the year, it managed to realize more returns and keep its expenses lower. Interest fees on loans and interest expenses on deposits and borrowings are lower. Indeed, its capitalization on prudent investment diversification and management of loans and deposits continue to pay off. Its net interest margin without credit loss provisions is 99% vs 98%.

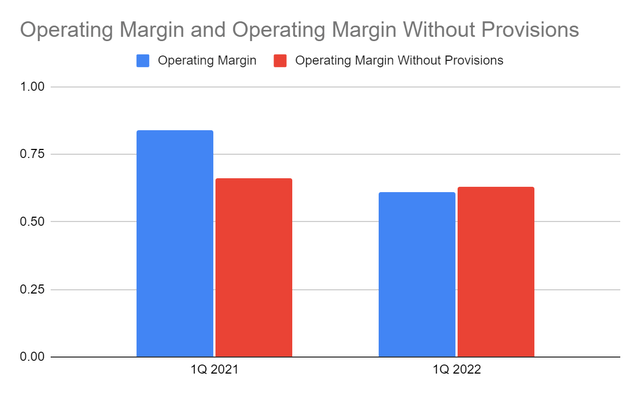

However, the operating margin is lower than in 1Q 2021 with or without the impact of provisions. Increasing provision losses are logical and conservative since it has higher loans now. Other operating expenses are higher due to expenses associated with the completion of M&A. Labor-related expenses are higher due to increased employees and their salaries and benefits. Nevertheless, the company is still profitable with an operating margin of 63% this quarter.

Operating Margin (MarketWatch)

Macroeconomic Pressures to Consider

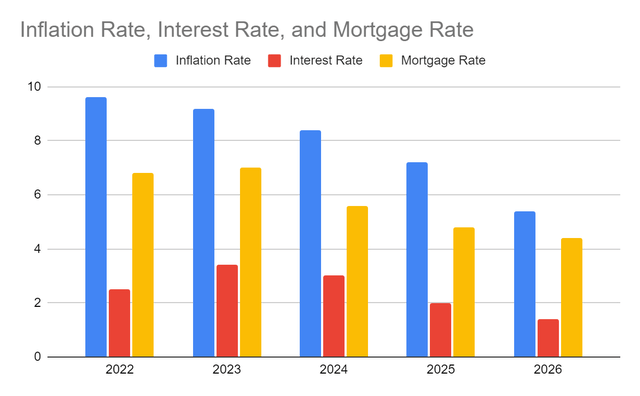

CVB Financial Corp. faces more external pressures as the economy reopens. The continued increase in prices is more evident now. In May, it had another all-time high inflation rate in four decades at 8.6%. Yet, its momentum does not seem to take a lull. Its most recent rate of 9.1% is the new all-time high. The geopolitical disturbance in Europe is another story since Russia is a primary energy source. The supply chain disruptions also affect prices. But, it is the pent-up demand that drives the upsurge. It is most evident in the housing and automobile market. So, I’m raising my estimation of inflation. It is such a shame that I first thought that inflation could slow down in the second half. This year, I estimate it at 9.6%. But in the following years, I expect the economy to stabilize. The inflation rate may drop to 5.2%.

In turn, a series of interest and mortgage rate hikes are anticipated. In fact, the Fed raised the Federal Funds rate by 75 basis points. Also, the expected interest rate was raised to 3.4% this year. It is a substantial increase from the previous estimation of 3-3.25% a few months ago. These estimations are even higher than the 1.7-2% estimation in 1Q 2022. Likewise, the skyrocketing mortgage rate is at 5.7%. It is already higher than the previous estimation of 5.1-5.3%. With that, it may not be a surprise if it reaches 7%. But from 2024-2026, I expect them to stabilize and become more manageable.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

Why CVB Financial Corp. May Stay Strong

CVB Financial Corp. continues to rebound from its slippage in the last two years. It is expanding its market visibility and operating capacity with its recent acquisition. It can also cater to more customers, especially in California. It is also well-capitalized being a part of the S&P 600. But what makes it a durable bank is its stellar Balance Sheet.

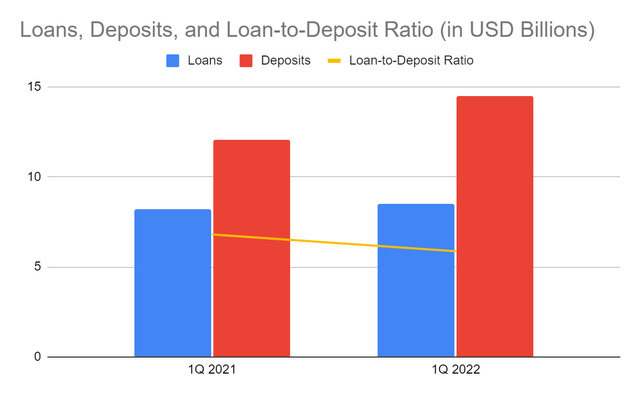

Its asset-sensitive Balance Sheet is composed of earning assets, which have attractive yields. I already discussed its prudent investment management. Loans, its primary assets, are primarily mortgage and commercial loans. That is why the bank must watch out for changes in mortgage rates. The good thing about it is that its non-performing loans and delinquencies are only 0.15% vs 0.17% in 1Q 2021. It shows that both CVBF and Suncrest are efficient in handling their loans. Also, it has a strong liquidity position, given its low loan-to-deposit ratio of 58%. It has a lot of reserves in times of defaults and delinquencies. Having this much capacity allows it to shield itself against the adverse blows of inflationary pressures. Also, the vast majority of its deposits are non-interest bearing. So, interest expenses may still be manageable amidst the interest rate hikes. It may sustain its viability with its stable revenues and expenses.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

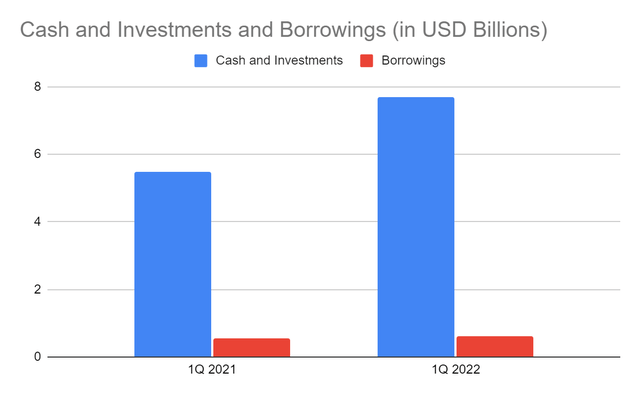

Likewise, its cash and investments, which are more liquid assets. are high. They comprise 44% of the total assets and are ten times larger than the total borrowings. As discussed earlier, they yield income, which is almost 80% higher than in the comparative quarter. The company has an impressive liquidity position that allows it to sustain its expansion.

Cash and Investments and Borrowings (MarketWatch)

Stock Price Assessment

The stock price is still in a bullish pattern. But, there is a slight downtrend in the last two weeks. At $24.54, it is already higher than the starting price. It is 2% lower than the recent highs. The PE Ratio of 17.33 shows that it is fairly valued.

Also, it appears to be an ideal dividend stock. It has a dividend yield of 3.10%, which is higher than the rest of the NASDAQ and S&P 600 components at 1.51% and 1.69%, respectively. Its five-year average dividend growth is 8.9% with a dividend payout ratio of 58%. The company is capable of sustaining its dividends. To assess the price better, we will use the DCF Model and the Dividend Discount Model.

DCF Model

- FCFF $176,090,000

- Cash $171,000,000

- Borrowings $622,340,000

- Perpetual Growth Rate 4.8%

- WACC 9%

- Common Shares Outstanding $141,626,000

- Stock Price $24.54

- Derived Value $25.17

Dividend Discount Model

- Stock Price $24.54

- Average Dividend Growth 0.08955026455

- Estimated Dividends Per Share $0.76

- Cost of Capital Equity 0.1205201097

- Derived Value $25.73

Both models show that the stock price is within a reasonable range. It is fairly valued, but there is potential undervaluation, which adheres to the PE Ratio. There may be a 2-4% upside.

Bottomline

CVB Financial Corp. continues to rebound from its slippages in the last two years. It now shows a more robust performance with well-positioned fundamentals amidst inflationary pressures. Also, it is an ideal dividend stock, given its impressive yield and adequate resources. I am bullish on the stock price, but I prefer to wait for a better entry point. The recommendation is that CVB Financial Corp. is a hold.

Be the first to comment