bumbumbo/iStock via Getty Images

Investment summary

A number of potentially overlooked features has us bullish on the Cutera, Inc (NASDAQ:CUTR) share price. As seen in Exhibit 1, shares have just tested and rejected long-term resistance levels, whilst setting higher-lows in a strong display of support. The question is, if CUTR can extend the move back above the $48 resistance level, or if the market has overlooked the idiosyncratic premia in this name.

Exhibit 1. CUTR 5-year price action

Note shares have tested and rejected long-term resistance levels at the c.$48 level and look to test long-term support levels in the ascending triangle shown below.

The squeeze is becoming tight and we are paying close attention for a breakout above the neckline of the resistance level shown.

Q2 Earnings Strong

Total revenue of $64.2 million (“mm”) was up 10% YoY, driven by a 27% YoY growth in North American capital equipment sales to $25mm. This was primarily a result of an increase in salesforce headcount related to the launch of AviClear. With net capex of $7.9mm, we estimate CUTR’s capital intensity increased ~10% following the jump in labor costs. The company also raised $240mm in convertible debt, retiring 50% of already existing convertibles on the balance sheet and increasing liquidity.

Capital equipment revenue was strong with a $43.7mm clip, also a record quarterly result. Again, the increase was attributed to the increase in salesforce. In particular, international capital equipment sales lifted 17% YoY to $18.4mm on the back of a strong rebound in European markets. Meanwhile, the company’s Australia and New Zealand (“ANZ”) footprint saw a 26% YoY gain to $5.2mm in capital equipment revenue.

Recurring revenue grew 11% YoY and has grown to $20.6mm built from a coupling of skin care service and consumable products, despite an 18% YoY decline in the former. Moving down the P&L, non-GAAP R&D came in at $5.7mm relative to $4.5mm the year prior as the investment in AviClear was recognized. It brought GAAP OPEX of $45mm down to a net loss of $47.27mm or ($2.53) per share, down from a gain of $0.43/share last year. This stemmed from a booked loss of $34mm on the loss of extinguishment of retired convertible notes.

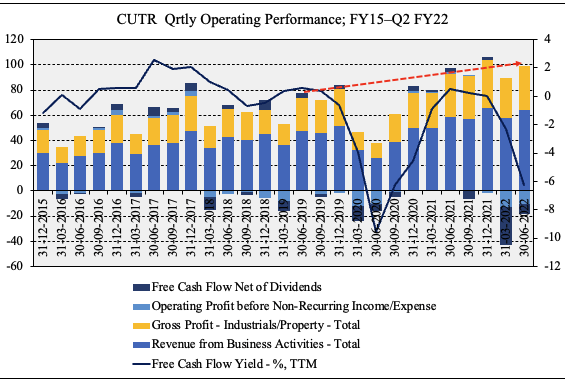

As seen in Exhibit 2, quarterly operating metrics continue to tick up for the company and show strength coming into a weakening economic outlook. Profitability below the top-line continues to stretch higher on a sequential basis whilst operating margins remain thin, but steady.

Exhibit 2.

Data: HB Insights, CUTR SEC Filings

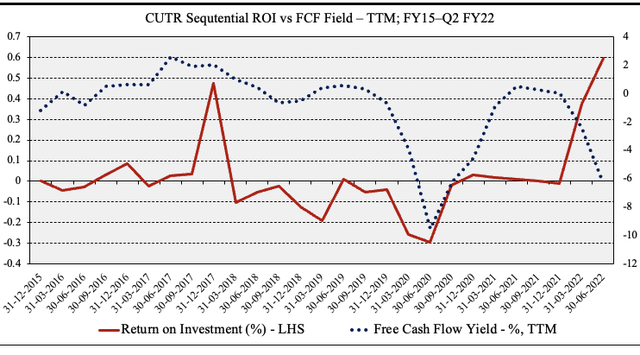

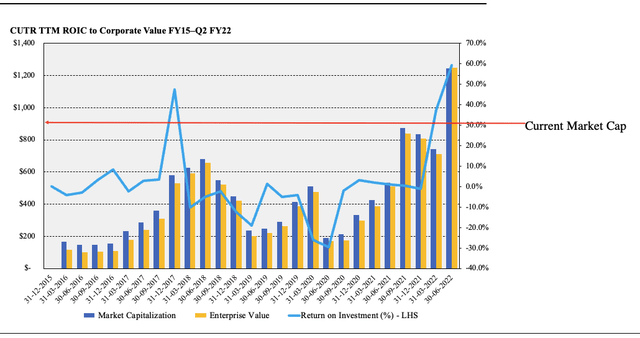

Return on invested capital also strong

As seen in Exhibit 3, return on invested capital (“ROIC”) has also garnered momentum in recent quarters. We note that the company’s FCF yield has also turned negative, indicating that it invested more money than it made from Q3 FY21 to date. Some might say the negative FCF is in itself a negative for the company. However, with the corresponding increase in ROIC towards c.60% in Q2 FY22, this more than outweighs the company’s WACC hurdle of 9.3%, and suggests

Exhibit 3. TTM ROIC has pushed higher whilst TTM FCF remains negative, indicating a healthy return on investment cycle by estimation

Note: Return on investment – LHS ; FCF yield – RHS

Data is presented in percentages [%] and is on TTM data. Calculations of quarterly invested capital include capitalized R&D investment as intangible assets that is expensed on the income statement under GAAP accounting. For more information on the calculation, kindly reach out via message or comment (Data: HB Insights Estimates, CUTR SEC Filings)

In other words we are getting record high quarterly ROIC from CUTR albeit at a shade above FY21 market capitalization, as seen below. We also note that plastic surgery and its derivatives are free from the overhang of CMS and reimbursement/rates, therefore giving us greater confidence in estimating the mean for CUTR’s ROIC looking ahead.

Exhibit 4. Profitability metrics continue to be attractive for CUTR and we are now receiving record ROIC near FY21 levels of market capitalization

Valuation and Conclusion

CUTR is trading at a discount of 3.4x TTM sales, but is very richly priced at more than 37x book value – well above the GICS Health Care sector peer median of 2.16x. The question becomes, is this premium worth it. Firstly, factoring in the company’s ROIC as listed above, this is an attractive feature. What’s lacking is earnings when looking ahead. If corporate value is a function of earnings and return on investment, then CUTR lags in the earnings department right now.

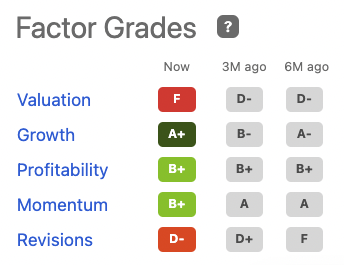

Seeking Alpha’s quantitative factor grading also has CUTR rated an ‘F’, the worst grade, for valuation. However, in terms of growth and profitability, it is in the green, as seen below.

Exhibit 5. Quantitative Factor modelling points to strengths in profitability in growth, but lagging in valuation.

As a composite, the quant system has it rated as a hold.

Data: Seeking Alpha Quant Factor Grades, CUTR

We estimate FY22 sales of $258mm for the company, with this stretching up to $305mm by FY23. We feel it is reasonable CUTR will bring this to FY22 EBITDA of $6.2mm and $19.2mm in the corresponding years. Shares are also priced at 3.4x forward sales, and assigning this multiple to our FY23 top-line estimates sets a price target of $52.90. With this in mind, we rate CUTR a speculative buy.

Be the first to comment