simpson33/iStock via Getty Images

Investment Thesis

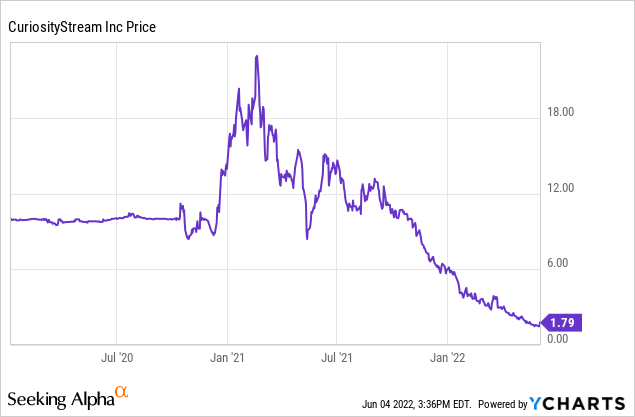

CuriosityStream (NASDAQ:CURI) is a streaming company that went public in 2020 through a SPAC merger with Software Acquisition Group. The company hit an all-time high early last year but has since been plummeting amid the broad sell-off of high-growth tech stocks. The share price is now down over 90% from its all-time high, trading at $1.79. CuriosityStream is founded in 2015 by John Hendricks, the founder and former Chairman of Discovery Communications, the global media parent company of Discovery Channel. Unlike most streaming services such as Netflix (NFLX), Disney (DIS), and HBO (WBD) which focuses on tv-series, CuriosityStream focuses almost solely on documentaries. Their streaming service adds new binge-worthy films and series each week ranging from topics such as space, geology to biology.

According to Statista, The SVoD (subscription video on demand) market is forecasted to grow from $82.43 billion this year to $115.90 billion in 2026, representing a CAGR of 8.9%. The market is expanding rapidly with cord-cutting continuing to accelerate as households are seeking more flexibility. The documentary market is relatively untouched by other streaming giants, giving CuriosityStream a lot more room to grow. Their focus on the documentary landscape with premium factual content has been successful so far and the trend is acting as a tailwind for the company. The company is successfully capitalizing on this opportunity and is growing rapidly.

Clint Stinchcomb, CEO, on new opportunities

The first of these, which we built early on in our development, is a well-engineered streaming platform that can scale globally. Our territorially adaptive, easy to navigate, and localizable streaming platform now serves Curiosity subscribers in over 175 countries and territories and enables us to launch, with existing capital and engineering resources, regional SVOD services such as the service we recently launched in Germany in partnership with Spiegel.

The company is also offering all its quality content at a discounted price compared to its peers. Its subscription price of $2.99 per month and $19.99 per year is very competitive compared to the $13.99 per month for Netflix’s standard plan. This resulted in them capturing a lot of subscribers quickly. It also gives CuriosityStream room to raise prices in the future as the current price is way lower than other streaming services. Besides the revenue from subscriptions, the company also sells its rights for certain documentaries to other streaming services. This helps them diversify their revenue stream by generating licensing revenue. It also recently launched “Curiosity Now Free”, an ad-supported streaming TV channel, in order to capture more users that are reluctant to subscribe. This will help CuriosityStream generate ad revenue to further increase its revenue sources.

I believe the company is a strong buy at the current price. It is operating in a niche market with very few competitors. The SVoD continues to expand which will provide a tailwind for the company. It has a competitive price which gives them room to raise prices in the future. The company is also growing revenue and subscribers rapidly and is diversifying its revenue stream.

Financials and Valuation

The company recently announced its first-quarter result for FY22 highlighted by strong top-line growth. It reported a revenue of $17.6 million, up 77% from $9.9 million a year ago. Total paying subscribers is approximately 50 million, an increase of 50% YoY (year over year). Gross profit of $5.8 million compared to $5.7 million a year ago, this is largely due to gross margin falling from 58.2% to 32.8%. EBITDA loss widened from negative $(15.1) million to negative $(19.3) million. Net loss improved from negative $(18.8) million last year to negative $(15.9) million. Operating cash flow was negative $(12.3) million, approximately flat compared to negative $(12.6) million a year ago. The company ended the quarter with a strong balance sheet. It has $85 million in cash with only $5 million in debt. Revenue guidance for the second quarter of $21.3 million, representing a continued strong growth of 38.6%.

The highlight of the quarter is that the company now expects to generate positive operating cash flow in the first quarter of 2023. This is huge as the company is finally showing some progress in improving profitability, which has been its Achilles Heel for a long time.

Clint Stinchcomb, CEO, on the company moving forward

“Our global platform, library of over 10,000 titles, and millions of loyal subscribers have established Curiosity as a valuable media brand. With the commitment to positive cash flow from operations we are announcing today, we are firmly establishing Curiosity as an enduring company that will continue to delight our subscribers in the years to come.”

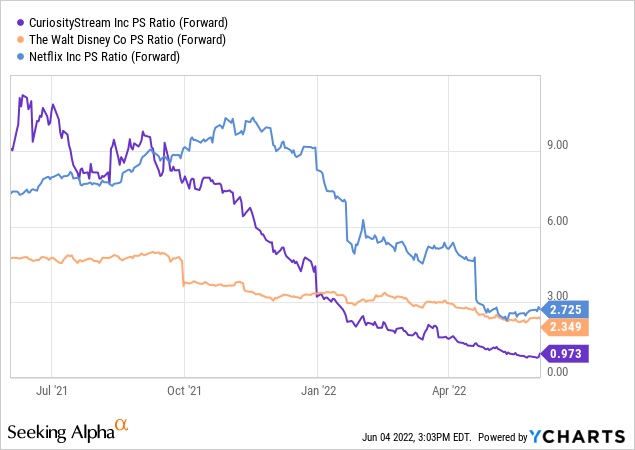

CuriosityStream is still not profitable with a negative cash flow, therefore, we can only value it using the P/S (price to sales) ratio. After the massive 90% drop in share price, it is currently trading at a P/S ratio of 0.97, which is very cheap for a company growing revenue at over 70% YoY. From the chart below, you can see that its valuation is significantly lower than its peers. Both Netflix and Disney are trading at a 100%+ premium compared to CuriosityStream. For sure, Netflix and Disney are much more established but they are also growing much slower. Netflix also reported a loss in subscribers last quarter while CuriosityStream increased its subscriber count by over 50%. I believe the current valuation is very cheap given its strong growth rate and significant discount to its peers.

Conclusion

I believe CuriosityStream has a huge upside from here. It has established a strong presence in a niche market with sticky subscribers. It is able to maintain its churn rate at a low single-digit rate. There is certainly a risk that other streaming companies will start focusing more on documentaries but I don’t see that happening soon as the ROI is not attractive. The cost of production for documentaries is too high yet the market is relatively niche. It is probably easier and more cost-efficient for companies to just buy documentary licenses from CuriosityStream instead.

The company is showing very strong growth in revenue and subscribers. I believe the growth can continue as the SVOD market continues to expand and the company increases its revenue streams by offering an ad-supported TV channel. Profitability is an issue for the company but the management team addressed that they expect positive operating cash flow for the first quarter of FY23. This gives relief to investors that are worried about the progress regarding profitability. The company is now trading at a very cheap valuation with a PS ratio of 0.97, which is significantly lower than its peers. If we take the company’s cash into account, it is actually almost trading at cash value with an enterprise value of only $2.37 million. It is also possible that larger streaming companies will try to acquire CuriosityStream with the current valuation being so compressed. I believe the company is a strong buy at the current price and presents a great opportunity for investors.

Be the first to comment