Dolores Preciado/iStock via Getty Images

The US federal government considers marijuana a Schedule I drug along with heroin and cocaine. Schedule I classification means the government laws define pot as a drug with a higher potential for abuse and little medical benefit. Meanwhile, in 2022, 37 US states have legalized pot for medical purposes, and 19 have made recreational use legal.

Over the past few years, cannabis businesses have sprung up like weeds, with the leaders trading on the stock market. Pot stocks are highly speculative because their success depends on US Federal legalization, which remains elusive in August 2022. The differences in federal and state laws create severe roadblocks for the burgeoning pot business, inhibiting traditional bank financing and customer services. Federal laws prohibit dispensaries in states that have legalized cannabis from accepting credit cards. They can only collect cash or charge customers’ debit cards. Transporting pot across some state lines from production to consumption points can carry severe trafficking penalties when crossing state lines where pot remains illegal.

As of early August 2022, Curaleaf Holdings, Inc. (OTCPK:CURLF) is a leading cannabis company with the highest market cap compared to 29 companies in the sector. One catalyst could propel the stock higher after falling steadily since early 2021.

Pot stocks have gone up in smoke – CURLF is no exception

Tom Petty, the late rock-and-roll icon, wrote, “The waiting is the hardest part.” Investors in pot stocks have taken “it on faith” and have taken “it to the heart” as they have watched their investments go up in smoke since early 2021.

There were high hopes that the incoming Biden administration would legalize pot in early 2021, soon after the 46th president took the oath of office. However, the blunt force of inaction caused the leading cannabis companies to burn cash, and the lack of a legislative initiative has stoned the asset class.

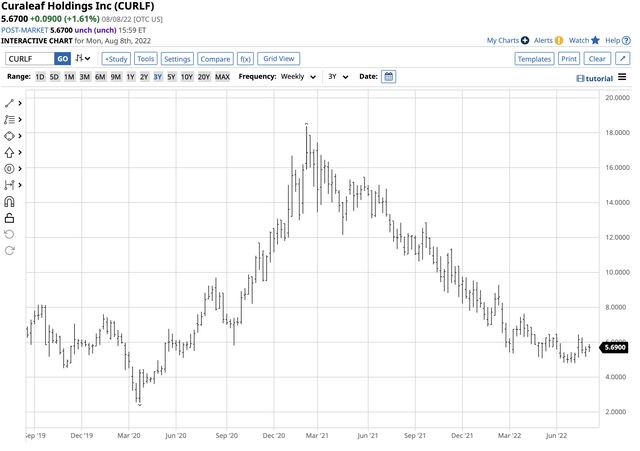

Curaleaf Holdings is the leading US cannabis operator, and its shares have disappointed investors since the February 2021 high.

The chart highlights the decline from the February $18.38 high to a low of $4.7945 in mid-July 2022. After the 73.9% drop, the stock was trading not far above the low at $5.67 on Aug. 8.

Tilray (TLRY), another leading pot stock, did even worse, dropping from $67 in early 2021 to $3 in July, a 95.5% decline. TLRY shares reached $300 in September 2018.

CURLF has the leading market cap of 29 companies in the sector

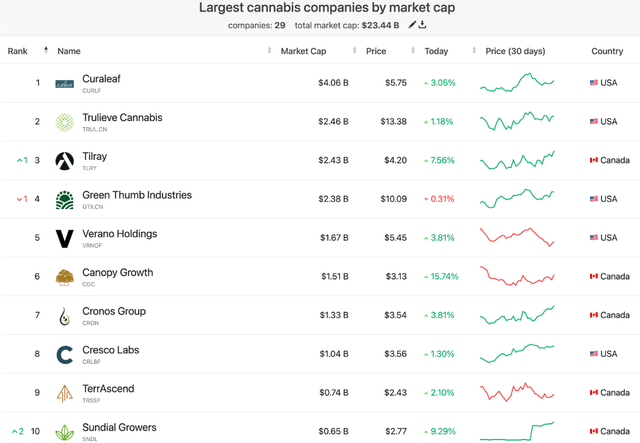

The most recent top publicly traded cannabis companies are:

Leading Cannabis Companies by Market Cap (Companiesmarketcap.com)

The chart shows that of 29 companies in the cannabis sector, CURLF leads with a $4.06 billion market cap, 17.32% of the total value of the leading 29 companies. CURL is the only company with a market cap above the $2.5 billion level.

The main catalyst: Hunger for US federal tax revenue

CURLF has a significant market share, but the stock performance has been miserable. However, there’s hope that the buzz will return to the stock, pushing it higher if the US government decides its revenue thirst is never-ending.

The latest legislation and victory for the Biden Administration is a slimmed-down Build Back Better program, addressing climate change, increasing corporate taxes, and refunding the Internal Revenue Service to bolster tax receipts. The US marijuana industry now suffers from a lack of state and federal government coordination that would open the floodgates for traditional financing and revenue collection. Moreover, it would allow the federal government to levy excise taxes on pot, paying for new spending and reducing the deficit. The ultimate catalyst for CURLF and the many other cannabis operators is action from Washington, D.C. The waiting has been the hardest part, and it continues in August 2022.

CURLF gets good grades and operates in two segments

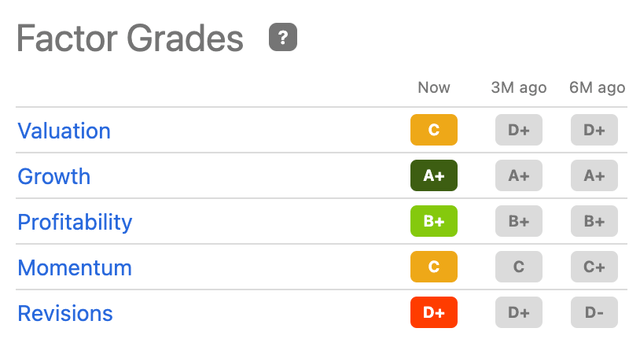

Seeking Alpha’s Quant Rating for CURLF shares is currently a hold.

CURLF Factor Grades (Seeking Alpha)

Factor grades have improved, but revisions remain problematic, likely a function of cash burn. The company gets its highest grade in growth.

In Q1 2022, the company reported in-line EPS normalized actual of a 2.0 cents per share loss but beat EPS GAAP actual by one penny. Revenue was $313.07 million, which was $2.64 million below consensus estimates.

The market had expected CURL to earn one cent in Normalized EPS and lose three cents per share in GAAP EPS in Q2, with the consensus for revenues at the $335.30 million level. The number came in at $337.553 million. While the net loss per share was four cents, CURLF increased Q2 revenue by 8%, Q2 adjusted EBITDA of $86 million was an 18% increase sequentially and a 2% year-on-year rise, and the company generated $12 million of positive operating cash flow for the first half of 2022. Like all businesses, inflation impacted results as “SG&A expenditures due to increased headcount in support of new store openings, higher levels of expenses related to research and development activities, as well as higher sales and marketing spend, and an increase in professional fees.“

The data is not stunningly bullish, but the prospects for legalization make the stock a buy at the $5.65 per share level on Aug. 8.

Curaleaf operates in two segments, cannabis and non-cannabis. The cannabis segment produces and sells pot through retail and wholesale channels. The non-cannabis segment provides professional services, including cultivation, processing, retail consulting, back-office administration, IP licensing, real estate leasing, and lending facilities to medical and adult-use cannabis licenses under management service agreements.

As of June 16, 2022, CURLF operated 134 dispensaries and 26 cultivation sites in twenty-two US states. Further growth of the cannabis sector depends on US federal legalization. The non-cannabis sector could turbo-charge revenues and growth in the coming quarters, given the company’s know-how in marijuana services. Moreover, CURLF’s inexpensive market cap and leadership position make the company an attractive takeover candidate that could provide accretive returns for an acquirer.

The cream of the crop – The top of the bud with risk as tobacco companies wait in the wings to vacuum up the scraps

CURLF is an attractive company in a suffering industry waiting for the US federal government to legalize its products. The prospects for new tax revenue flows via legalization could open a floodgate of earnings for the marijuana industry, with the leading companies capturing the lion’s share. It also could attract new well-capitalized companies looking to buy into the sector through aggressive acquisition.

Tobacco companies are the leading candidates for M&A activity.

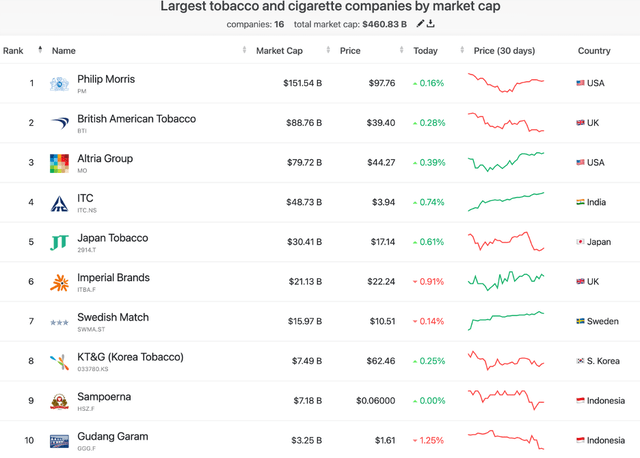

Leading Tobacco and Cigarette Companies (Companiesmarketcap.com)

The chart highlights two of the leading three tobacco companies, Philip Morris (PM) and Altria (MO), with a combined market cap of $231.26 billion or just over 50% of the top 16 publicly-traded tobacco and cigarette companies. Meanwhile, six of the top 16 are US companies, but the other four have market caps below $1.3 billion, lower than CURLF. PM and MO are candidates to make aggressive acquisitions in the cannabis sector upon Federal legalization, and CURLF is a leading target.

Pot investors have been patient and have persevered since the stocks had made lower highs and lower lows since early 2021 when the hopes for prompt legalization went up in smoke. The waiting has been the hardest part, but it could be worthwhile if Washington DC decides the tax receipts are too hard to ignore.

Be the first to comment