selimaksan/E+ via Getty Images

Investment Thesis

Despite the progress that Curaleaf Holdings, Inc (OTCPK:CURLF) has made in its revenue growth and the expansions in multiple states, it is apparent that there has been little improvement in its financial health. As a result, the company had to rely on additional debts and share dilution for its operations, expansions, and acquisitions. However, we acknowledge that this strategy was common for many cannabis companies, such as Sundial Growers (SNDL) with 2.38B of diluted shares outstanding and Canopy Growth Corporation (WEED) with $1.49B of long-term debts.

Nonetheless, we expect that the road to federal legalization will be a long and rough one, given the macro issues and the midterm election in 2022. With consensus estimates projecting legalization by the earliest 2024 though more realistically 2025, these cannabis companies would need to be very prudent in their capital management and expansions to sustain their growth and stock price in the meantime.

Given Curaleaf’s current underperformance and reliance on debt, we do not expect any significant recovery in its stock prices in the intermediate term. In addition, we expect a relatively competitive environment post-legalization, given the inevitable entrance of global players. Thus, we recommend cannabis investors patience and even more patience as the market consolidates the winners over the next few years.

Curaleaf Is Still Burning Through Its Capital

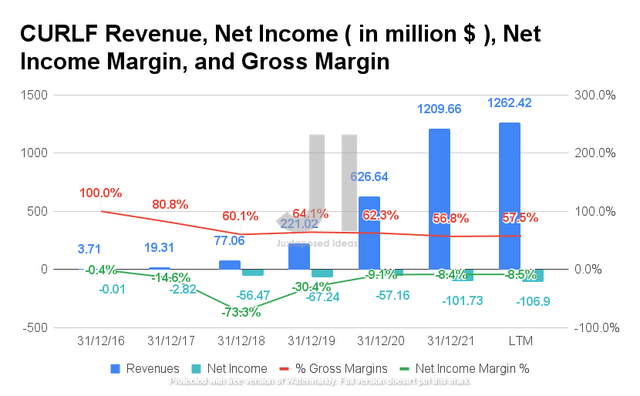

CURLF Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

Despite the robust consumer demand in the past two years, Curaleaf continued to report declining margins and deeper losses. By the LTM, the company reported $1.26B of revenues, a remarkable increase of 572.7% from FY2019 levels. However, this unfortunately did not improve its margins and profitability. Curaleaf also reported gross margins of 57.5% in the LTM, a decrease of -6.6% from FY2019 levels. In addition, the company reported a declining net income of -$106.9M and net income margins of -8.5% in the LTM, representing a decrease of -58.9% in net incomes from FY2019 levels.

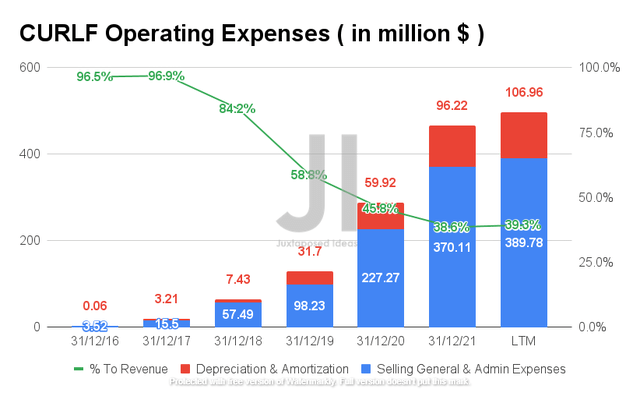

CURLF Operating Expense (S&P Capital IQ)

As a result of the boom during the COVID-19 pandemic, Curaleaf has aggressively increased its operating expenses in the past two years. By the LTM, the company reported total operating expenses of $496.74M, representing a massive increase of 382.3% from FY2019 levels. Though the ratio has been declining from 58.8% in FY2019 to 39.3% in the LTM to its growing revenue, it is evident that Curaleaf would still struggle with profitability, assuming the current rate of expansion.

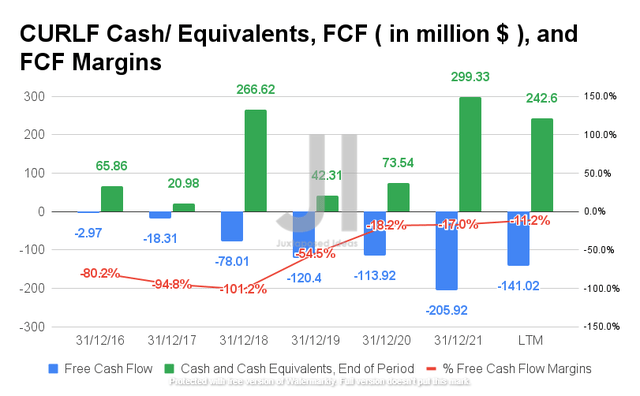

CURLF Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ)

As evident from its balance sheet and cash flow, Curaleaf is also not generating any positive Free Cash Flows (FCF). The company reported a negative FCF of -$141.02M and an FCF margin of -11.2% by the LTM. Therefore, it is no wonder that Curaleaf had to bolster its cash and equivalents with $475M of senior secured notes at 8% in 2021, on top of $300M at 13% in 2020. Nonetheless, we do not expect its cash and equivalents of $242.6M in the LTM to last long, given its increasing cash burn rate thus far. As a result, Curaleaf would likely need to raise more capital by the end of FY2022, a troubling situation given the Fed’s hike in interest rates through 2023.

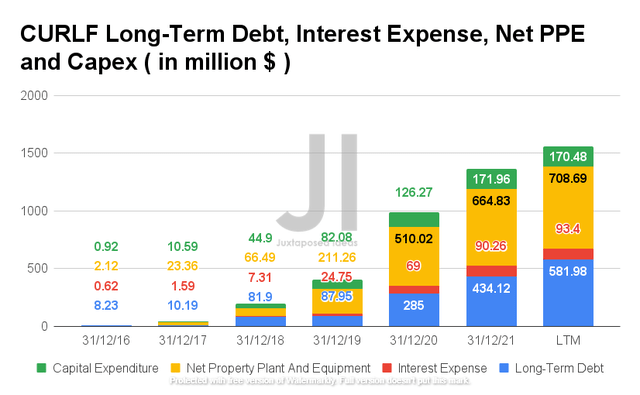

CURLF Long-Term Debt, Interest Expense, Net PPE, and Capex (S&P Capital IQ)

By the LTM, Curaleaf reported long-term debts of $581.98M with interest expenses of $93.4M, representing a massive increase of 204.2% and 35.3% from FY2020 levels, respectively. In addition, the company continued to increase its production capacity and presence with net PPE assets of $708.69M and capital expenditure of $170.58M in the LTM, representing YoY growth of 38.9% and 35%, respectively, partly through its previous acquisitions of Los Sueños and Bloom Dispensaries in 2021. Assuming that Curaleaf continues at this rate moving forward, we may expect to see it accumulate up to $2.31B in long-term debt by FY2025. Massive, given its lack of profitability till then.

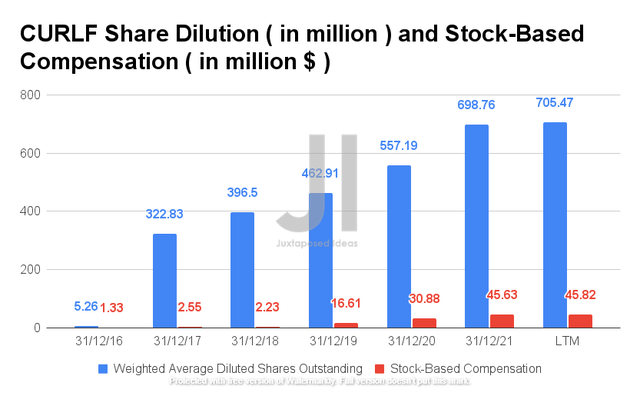

CURLF Share Dilution and Stock-Based Compensation (S&P Capital IQ)

As a result, we may expect to see Curaleaf continue its share dilution and Stock-Based Compensation (SBC) moving forward. By the LTM, the company had diluted its long-term shareholders by 77.9% since its IPO in 2018. In addition, Curaleaf continues to report elevated SBC expenses of $45.82M by the LTM, representing an increase of 2054.7% from FY2018 levels. Speculatively, since the company is not expected to report profitability until FY2025, we may see a dilution of up to 1.3B of diluted shares outstanding and SBC expenses of $205M by then. Interested investors, take note. That may just trigger the continuous decline in its stock prices and valuations moving forward.

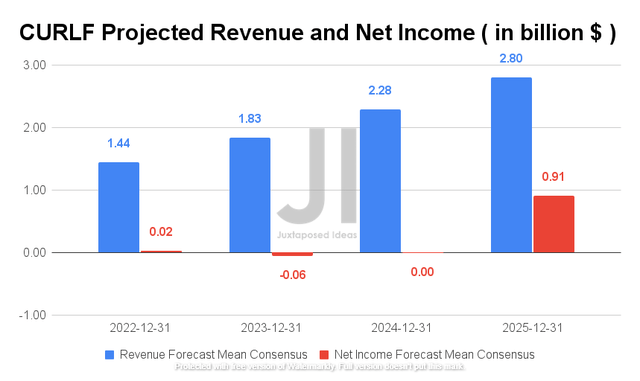

Over the next four years, Curaleaf is expected to report revenue growth at an impressive CAGR of 23.36% while also potentially reporting net income profitability in FY2025. However, given its underperformance in the past few years, we are rather skeptical of its projected $0.91B of net income for FY2025.

For FY2022, consensus estimates that Curaleaf will report revenues of $1.44B and net income of $0.02B, representing an improvement of 19.1% and 83.4% YoY. Analysts will be looking closely at its FQ2’22 performance on 8 August 2022, given consensus revenue estimates of $340.53M and EPS of -$0.02, representing YoY growth of 9.07% though a decline of -140%, respectively. Anyhow, we do not expect any stock recovery then, given how Curaleaf had also missed consensus estimates for the past seven quarters.

Notwithstanding, those interested in Curaleaf’s management and market opportunities may refer to these bullish articles by:

- Jesse Redmond – An Introduction To Curaleaf: World’s Largest Cannabis Company

- Stone Fox Capital – Curaleaf: Another Milestone Year Ahead

So, Is CURLF Stock A Buy, Sell, or Hold?

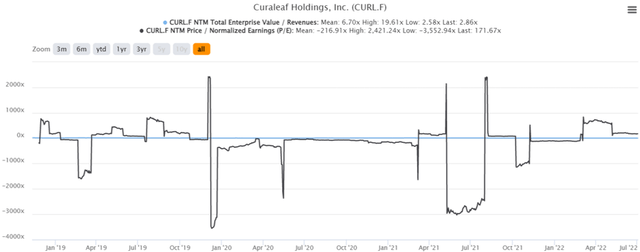

CURLF 4Y EV/Revenue and P/E Valuations

CURLF 4Y EV/Revenue and P/E Valuations (S&P Capital IQ)

Curaleaf is currently trading at an EV/NTM Revenue of 2.86x and NTM P/E of 171.67x, lower than its 4Y EV/Revenue mean of 6.7x though massively elevated from its 4Y P/E mean of -216.91x. The stock is also trading at $5.15, down 65.2% from its 52 weeks high of $14.80, nearing its 52 weeks low of $4.80.

CURLF 4Y Stock Price

CURLF 4Y Stock Price (Seeking Alpha)

Despite the strong buy rating from the consensus estimates with a price target of $11.18, we are not convinced of Curaleaf’s 117.09% upside. The company has been and will be unprofitable for the next three years, thereby accelerating its reliance on long-term debts and share dilution. Though consensus estimates that the cannabis federal legalization may occur by FY2025, we are uncertain of Curaleaf’s capability in remaining competitive then. We reckon it could be a disastrous bloodbath then, similar to the cannabis pricing wars and massive oversupplies in Canada since 2018 and California in 2021. Therefore, we are not discounting the far-fetched possibility of Curaleaf stock declining even further to new lows in the short and intermediate term.

Those looking for better-performing cannabis stocks may otherwise look at Trulieve Cannabis Corp (OTCQX:TCNNF). The company had been reporting relatively healthier financial health thus far, thereby increasing its chances of long-term success. There is also the unconventional choice in Tilray Brands (TLRY), which aims to combine its expertise in the alcohol segment within the US and medical cannabis use in the burgeoning European market. You may refer to our previous analysis here and here.

Therefore, we rate Curaleaf stock as a Hold for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment