JHVEPhoto

Engine giant Cummins Inc. (NYSE:NYSE:CMI) is on the cusp of leading a potential long-term transformation in the trucking market, one that could possibly see hydrogen-powered engines arise at scale. Cummins expects hydrogen engines to compete on a cost-basis with diesel engines by 2030; Cummins VP of New Power Engineering Jonathan Wood said, “the future of heavy-duty land transport would be hydrogen fuel cell or battery electric, as economies sought to meet zero-emission targets.”

With the hydrogen trucking market expected to reach ~$35 billion by 2030 under some estimates, Cummins is positioned ahead of the curve with its hydrogen engines already reaching the market. A North American debut in partnership with Daimler Truck North America is scheduled for 2024, further opening up the potential for Cummins to lead this transition. Cummins’ attractive 3% yield and valuation support a positive outlook on the stock, should the hydrogen shift take longer than anticipated to materialize.

Hydrogen Engine Market Outlook

Although much of the decarbonization trends in the automotive industry are primarily focusing on battery electric vehicles as the overarching green winner, hydrogen is garnering attention in the trucking sector due to its quick refills, lighter weight, and emissions reduction abilities. Research from the DOE places an average range of 750 miles for a 10 minute fill time at 8kg/min, and 600 miles range on a 6 minute fill time. Battery electric vehicles (“BEVs”) simply cannot compete in the trucking sector in terms of refill times — hydrogen best suites long-distance trucking scenarios.

Allied Market Research is forecasting the hydrogen-powered engine market to reach $34.7 billion by 2030, further growing to $87.3 billion by 2040 — again, hydrogen applications in the trucking industry are a secular shift, and so the revenues and profits stemming from hydrogen will not arise until the industry can get off the ground. In Cummins’ case, mass production of its hydrogen engines is not expected to commence until 2027, leaving nearly 60 months until efficiencies at scale can arise.

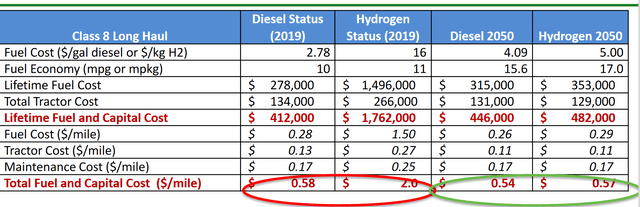

The DOE is forecasting hydrogen to be cost-competitive with diesel over the long-term; the DOE is forecasting out to 2050. Other estimates for fuel cost project hydrogen’s cost per kg to fall far below $5 per kg in that frame, or to reach $5 per kg by 2030, 20 years earlier than anticipated.

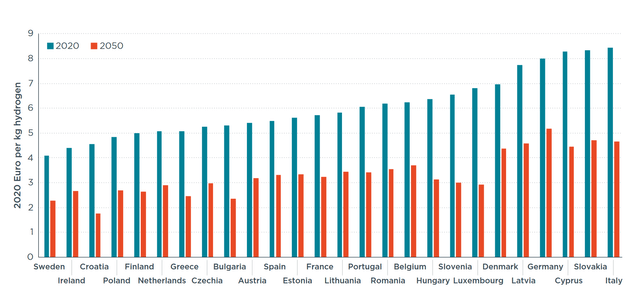

For example, the ICCT estimates that a majority of European nations can reach sub-$4 per kg costs by 2050, with a handful of countries already below or near the $5 per kg range. The organization also is predicting the total production cost (hydrogen production and fueling station cost) to reach parity by 2030 or earlier with a $3 subsidy per kg, thus accelerating the shift to hydrogen by accelerating price parity with diesel.

In anticipation of substantial long-term growth in this sector, major players in the industry are already making plans for hydrogen. Bosch is investing $200M for hydrogen fuel cell production for truck applications, inviting Nikola (NKLA) to join the project. Nikola is set to use Bosch’s fuel cells when production of its class 8 hydrogen truck begins next year. Hyundai is expanding hydrogen fuel cell applications, unveiling hydrogen-powered cleaning and sprinkler trucks, among other vehicle. The OEM is also moving forward with commercialization in Germany, with seven logistics firms adopting 27 XCIENT fuel cell trucks into fleet service.

Cummins has a deep footing in the engine market, supplying large-scale customers like Paccar Inc. (PCAR), Navistar, and Volvo Trucks North America under long-term agreements. With a partnership with Daimler Truck North America’s to upfit the market-dominating Freightliner with hydrogen-powered engines, the opportunities to expand in the sector are large.

Class 8 Leader

In the Class 8 truck engine market, Cummins finds itself holding a tight grip on the market — it commands over one-third share. Cummins’ X15H hydrogen combustion engine is targeting this segment, leaving it primed to disrupt the market due to its entrenched positioning as a leading supplier.

In the engine segment, in 1H 22, Cummins “supplied a leading 47,713 Class 8 diesel engines, or 35.5% of the 134,373 used, Wards Intelligence reported.” Cummins also dominates the “Class 8 engines under 10 liters, Group 1, category. Its 9,281 engines earned an 86% share of the total 10,808 engines in the segment.” With Cummins also looking to produce a 6.7L engine, future applications in the sub-10L segment also leave the OEM poised to capture substantial share in the secular hydrogen shift.

In the truck segment, competitor Daimler Truck North America’s Detroit Diesel “inched ahead of Cummins in the number of Class 8 engines 10 liters and over, Group 2, with 39,588 compared with 38,432.” DTNA’s market-leading Freightliner, which commands nearly 40% of the Class 8 truck market, and its “niche Western Star brands were the only truck makers to use Detroit engines.”

Outside of DTNA, every truck manufacturer “used some Group 2 Cummins engines, according to Wards.” Paccar’s Kenworth Truck and Peterbilt Motors brands “accounted for 61.3% of them, 11,996 and 11,595, respectively.”

Freightliner’s market share is actually quite positive for Cummins — DTNA and Cummins recently partnered to upfit Freightliner trucks with hydrogen fuel cell engines in North America. This leaves a very large customer base outside of Cummins’ engine customers for hydrogen applications to tap into and capture, signaling another stream of potential revenue for Cummins.

Hydrogen Plans

Cummins has announced plans to produce both a 15L (for Class 8) and a 6.7L (for Class 6) hydrogen engine. The engines are expected to go into full production in 2027. GM of Hydrogen Engines Jim Nebergall said that “customers are responding favorably to this practical technology.” Even though these hydrogen internal combustion engines will not be available for quite some time, fleets are already signing deals to acquire the engines.

Werner (WERN) has signed a letter of intent to purchase 500 of the hydrogen engines upon availability, as it plans to integrate Cummins’ natural gas and hydrogen engines into its fleet. This represents about 6% of Werner’s entire 8,800 fleet, a sign of confidence in the technology and its commitment to 2035 decarbonization goals. However, the 500 engine total represents merely a drop of the bucket in Cummins’ total volume, just about 0.5% of its projected 2022 volumes — this shows the potential for long-term growth into 2030 and beyond as fleets decarbonize.

Transport Enterprise Leasing signed an MOU for the hydrogen engines as well, with plans to integrate the engines into its heavy-duty truck fleet. Buhler Industries’ (OTCPK:BIIAF) Versatile brand will integrate the engines to lead in the decarbonization of the agricultural sector.

In terms of production, Cummins has not outlined any details, aside from a targeted 2027 full production launch. However, details can be gleamed from the X15N, the natural gas engine, which has seen ~24,000 units produced in the span of 10 months. If Cummins replicates this scale in 2027/2028, it could easily produce 25,000 to 30,000 engines in an initial 12 month ramp.

In addition to the hydrogen engines, Cummins is moving forward with its hydrogen fuel cell powertrain. It has partnered with Daimler Truck North America to upfit Freightliner trucks with hydrogen fuel cell powertrains in North America. Initial units are expected to be available in 2024 under this partnership, upon successful validation. Freightliner’s 7,855 unit volume YTD through July represented a 34.4% y/y growth, putting it on a track to easily surpass 2021’s 8,355 unit volume — this leading position can enable solid growth in this hydrogen collaboration and a substantial revenue stream.

Cummins Outlook: Initial Revenue Projection, Industry Factors

While it’s difficult to attempt projecting revenues for a hydrogen engine system that is not planned to be in production until 2027, Werner’s 500 engine commitment provides a bit of insight. Assuming a hydrogen engine sells for ~$40,000 to $45,000 upon initial production launch, Werner’s commitment provides ~$20 to $22.5 million in revenues. If hydrogen engine production can reach 25,000 per year by 2028, Cummins could generate just over $1.0 billion in revenues. The key here, however, is Cummins growing market share in the Class 6/8 engine market — the incremental benefits to selling hydrogen engines is slim to none if it simply replaces diesel engine market share without adding to it. Gaining market share via hydrogen and natural gas engines, given Cummins’ entrenched positioning in the market, still may be challenging, but will be extremely beneficial by boosting revenues from additional volume.

The nascent hydrogen industry is wildly incomplete, and will take years and billions in funding to reach the equivalent of the EV industry, let alone the diesel/fossil fuel industry. Building out hydrogen funding stations and related infrastructure, hydrogen fuel production, etc., will be costly and time-consuming. Subsidies also may play a role downstream, as hydrogen trucks, such as Nikola’s, may require subsidies to fuel fleet uptake.

Cummins’ 2027 timeline gives the industry time to be built, for infrastructure to arise so that fleets can adopt hydrogen engines without infrastructure limiting its usage. However, hydrogen offers a compelling range and emissions dynamic for the transportation sector, especially with cost parity expected over the next decade. Cummins is well positioned to capture market share and growth in a potential secular shift to hydrogen engines.

Be the first to comment