Denis_Vermenko/iStock via Getty Images

To earn a higher yield, one sometimes needs to take a path less traveled by others. This holds true for REITs, as some of the more popular names such as American Tower (AMT) and Realty Income Corporation (O) yield less than 5%.

This brings me to CTO Realty Growth (NYSE:CTO), which may be a better option for those seeking a combination of high yield and growth. This article highlights what makes CTO a worthy candidate at current prices, so let’s get started.

CTO: A 7% Yielder Not To Miss

CTO Realty Growth is a REIT that owns and operates single and multi-tenant retail and office properties with strong fundamentals. At present, it owns 22 properties. Notably, it also acts as the external manager for the net lease REIT, Alpine Income Property Trust (PINE), in which it has a 16% equity ownership stake worth $41M. This arrangement results in a stable stream of fee income for CTO.

Additionally, CTO seeks to acquire properties at meaningful discounts to replacement cost with below market rents. This enables it to strategically reposition properties with significant upside through lease-up opportunities.

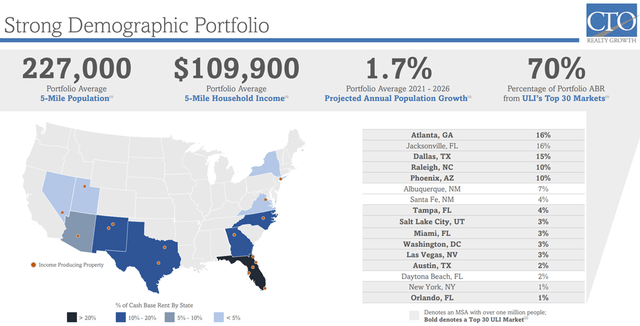

CTO focuses on markets that are projected to have outsized population and job growth, and in states with favorable business climates. At present, its 22 properties are located in the Sunbelt, and Southwestern regions of the U.S., with Atlanta, Jacksonville, Dallas, Raleigh, and Phoenix representing 67% of CTO’s annual base rent.

CTO Geo Mix (Investor Presentation)

Meanwhile, last year marked the culmination of CTO’s decade-long transformational efforts from a substantially Florida landlord to a growth market-focused one.

This is reflected by robust portfolio recycling, in which it sold 15 income properties for $162 million at a 6.0% cap rate, generating aggregate gains of $28 million. In the same year, it acquired 8 multi-tenant income properties for $249M, at the comparatively higher cap rate of 7.2%, resulting in accretive income growth for shareholders.

The portfolio also remains healthy at a 93% leased rate, and also encouraging, management is guiding for another year of robust growth with 15% AFFO per share growth this year. This could be achieved through management’s strategy of buying properties below replacement cost with some vacancies, and making investments into the properties to attract more tenants. This was highlighted by management during the recent conference call:

We like finding vacancy where we can have outsized equity returns and not as concerned about having additional cash flow right off the bat. And so that allows us to look for assets where for instance Santa Fe was a great example, where 66% occupied and a lot of low-hanging fruit.

So we like those a lot where we can buy way below replacement costs in good locations and with the robust leasing activity and tenant activity, we feel like we can do some good work there.

We are bidding on stabilized assets as well, but probably not going to be as competitive, given the capital out there chasing those sort of assets right now. I mean, you’re seeing a lot of very low cap rates for very stabilized assets. So we’d rather find something with a little bit of vacancy that doesn’t fit a lot of the other capital providers.

Risks to CTO include its slightly more levered balance sheet, with a net debt to EBITDA ratio of 6.1x, sitting just above the 6.0x mark that I prefer to see. I find it to be reasonable, however, considering that CTO is still in strong growth mode. Additional risks include a slowdown in the economy, which could put operating pressure on CTO’s tenants.

Meanwhile, CTO pays an attractive 6.7% dividend yield, which is covered by an 86% payout ratio, based on the midpoint of management’s 2022 AFFO/share guidance, and saw 8% growth this year, to $1.08 per quarter.

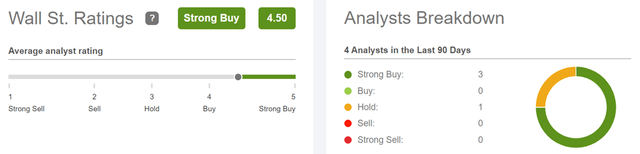

I see value in CTO at the current price of $64 with a forward P/FFO of 14.2. This is considering the growing nature of this REIT, as noted earlier. Sell side analysts have a Strong Buy rating, with an average price target of $68, implying a potential 13% one-year total return.

CTO Analyst Ratings (Seeking Alpha)

Investor Takeaway

CTO has made an impressive transition from a primarily Florida-based REIT to one that’s focused on growth markets. Unlike some REITs that pay top dollar for stabilized assets, CTO follows a differentiated strategy of buying properties below replacement cost with lower than average vacancy, then doing work to lease up the properties. I see value in CTO at the current price for high income and growth.

Be the first to comment