Vertigo3d/E+ via Getty Images

Every large cap REIT on the market today had to start somewhere, and it’s in those early years that investors enjoyed the most outsized gains. That was the case for well-respected REITs such as Realty Income Corp. (O), which got its start from a humble Taco Bell restaurant, and Welltower (WELL), which used to be called Health Care REIT, and grew like gangbusters in its early years.

This brings me to the up-and-coming REIT, CTO Realty Growth (NYSE:CTO), which is still in its early growth innings. In this article, I highlight what differentiates CTO and why it’s an attractive investment at present, so let’s get started.

Why CTO?

CTO Realty Growth is a REIT that owns and operates single and multi-tenant retail and office properties with strong fundamentals. Notably, it also acts as the external manager for the net lease REIT, Alpine Income Property Trust (PINE), in which it has a 16% equity ownership stake worth $39M. This arrangement results in a stable stream of fee income for CTO.

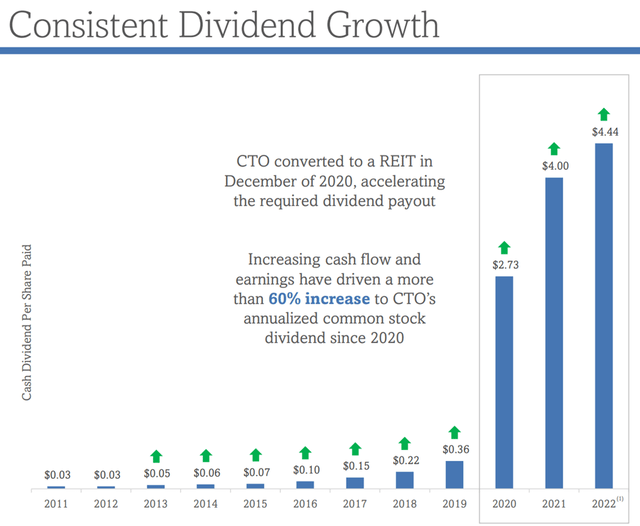

Perhaps unbeknownst to some, CTO actually has 46 consecutive years of paying a common dividend, with growth in the past 10 consecutive years. It converted to a REIT only in recent years, in December of 2020, and dividend payouts have accelerated since then, with a 60% increase since conversion.

CTO Dividends (Investor Presentation)

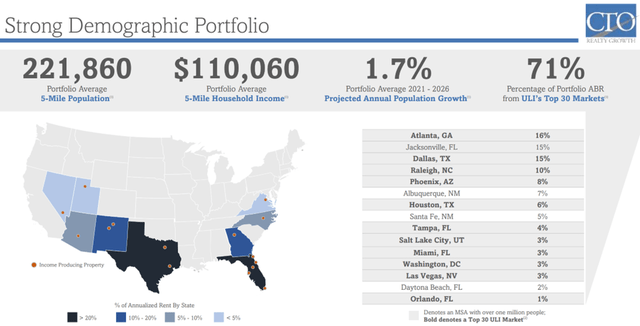

At present, it owns 21 properties covering 2.8 million square feet that are spread across the growing southern reaches of the U.S. CTO targets regions with high population density and high average household income. As shown below, 71% of CTO’s annual base rent stems from the top 30 U.S. markets, as defined by the Urban Land Institute.

CTO Locations (Investor Presentation)

CTO’s management seeks to differentiate itself through asset-level value creation. This means that rather than herding through lots of stabilized properties at low cap rates, it seeks to acquire properties at meaningful discounts to replacement cost with below market rents, then performing value-added activities to reposition the property and lease up the tenant base. This is reflected by the strong 17.7% YoY same property NOI growth that CTO saw during the first quarter, while maintaining a healthy 93% leased occupancy rate.

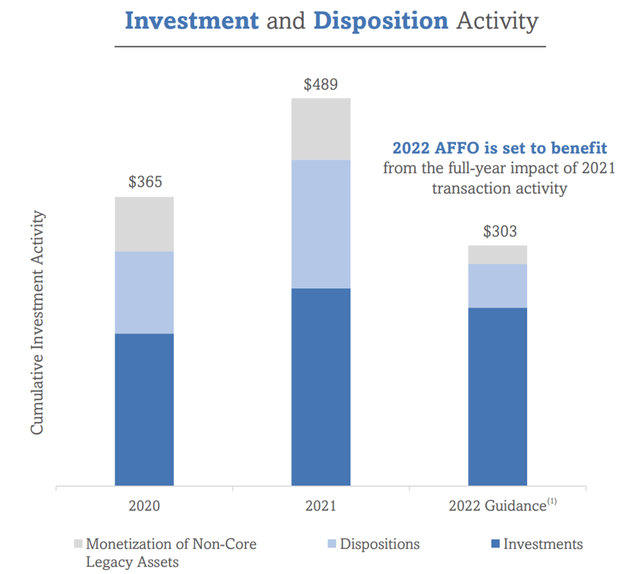

Moreover, management is active in recycling capital to fund new investments with more attractive investment spreads. As shown below, total cumulative investment activity was a robust $489 million last year, with an additional $303 million planned this year.

CTO Investment Activity (Investor Presentation)

Looking forward, management plans to de-risk its portfolio of its remaining office properties while seeking to attain same store NOI growth from new tenants in the second half of the year, as noted during the recent press release:

As we look to expand our portfolio, our team has done an excellent job continuing to find attractive opportunities in an increasingly competitive environment, committing more than $77 million of capital to well-located retail properties in the Houston, Atlanta and Dallas markets.

For the balance of the year, we have a solid runway of Same-Store NOI growth from new tenants expected to open their doors in the back half of 2022 and we continue to focus on accretively selling our remaining office properties to provide capital for additional acquisitions.

Our balance sheet remains well-positioned to fund prospective external growth opportunities and we’re hopeful our newly announced stock split improves the accessibility and liquidity of our stock for the benefit of our current and prospective shareholders.

Meanwhile, CTO maintains a healthy balance sheet with a net debt to Pro Forma EBITDA of 6.0x, along with a respectable fixed charge coverage ratio of 3.4x. This lends support to the 7.2% dividend yield. The dividend was recently raised by 3.7% and is well-covered by a 76% payout ratio based on the first quarter AFFO per share of $1.48 (pre 3 for 1 split).

Risks to CTO include potential for an economic slowdown in the second half of the year, which may prolong CTO’s office disposition plan. In addition, higher cost of debt could make future acquisitions less accretive should the level of competition for deals remain stable.

Nonetheless, I see value in CTO at the current share price of $20.65, with a forward P/FFO of 13.0. This is considering CTO’s long growth runway in its core markets, and with analysts expecting high single digit FFO per share growth in the second half of the year. Sell side analysts have a consensus Buy rating with an average price target of 23.13. This implies a potential one-year 19% total return including dividends.

Investor Takeaway

CTO Realty Growth is an up-and-coming, well-positioned REIT with a long growth runway in its core markets. The company has a healthy balance sheet, dividend coverage, and a differentiated strategy for value creation compared to most REITs. I see CTO as being an attractive income and growth play for long-term investors.

Be the first to comment