keithbwinn/iStock via Getty Images

I have been buying industrial stocks again for my long-term dividend (growth) portfolio. This included Norfolk Southern (NSC), which I recently covered in this article. One of the topics I discussed in that article is the risk of railroad strikes. Not only that, but the background story is much bigger as it poses a risk to the railroad’s ability to boost operating performance gains – at least in the mid term. As this is what drove stunning shareholder returns for more than a decade – t’s a pressing topic in need of more coverage. However, I’m also going to give you two railroads that I absolutely love as long-term investments. Union Pacific (NYSE:UNP) and CSX Corp. (NASDAQ:CSX) give investors coverage of the entire United States. they provide investors with decent cash flows through dividends and aggressive buybacks. Moreover, and in light of ongoing risks, both railroads offer a better risk/reward as investors are pricing in a manufacturing recession.

In this article, I will walk you through my thought process and explain what I’m making of this situation that comes with both risks and opportunities.

So, bear with me!

Union Pacific and CSX Corp.

Union Pacific ($132 billion market cap) and CSX ($63 billion market cap) are the two largest American Class I railroads. Headquartered in Nebraska and Florida, they cover the entire United States. Union Pacific services everything between the West Coast and the vertical line south of Chicago. In this territory, it (mainly) competes with Buffett-owned BNSF – and soon with the Canadian Pacific (CP) merger with Kansas City Southern. CSX services economic hotspots east of New Orleans and everything north of that. Here, it competes with Norfolk Southern. Note that CSX also covers the New England region after the Pan Am acquisition this year. This is not yet included in the map below.

ResearchGate

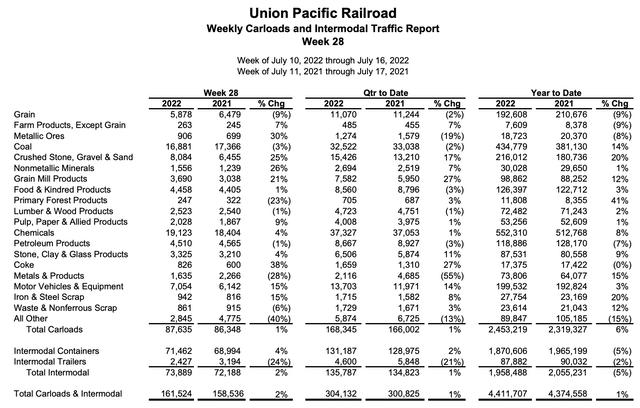

These railroads transport everything one can imagine. Union Pacific, for example, transported more than 161 thousand carloads and intermodal last week. Roughly half of the total shipments were intermodal shipments consisting of containers and trailers. This includes a lot of consumer goods. Almost 88 thousand carloads were shipped, which included mainly industrial products, energy, and grains. Fewer than 17 thousand carloads were coal shipments. After the steep decline in domestic coal use of the past 20ish years, railroads had to re-invent themselves. While coal is still a major source of income, it’s now one of many segments and unable to drive the bottom line by itself.

Union Pacific

What I’m getting at here is that railroads have basically become economic proxies. To put it very bluntly, a strong economy indicates strong tailwinds for railroads. A weak/weakening economy does the exact opposite. While this applies to more or less all industrial companies, railroads are unable to escape weakness. Their economic footprints are massive and Class I railroads are involved in every major supply chain, which is important to keep in mind given that we need to discuss the risk of strikes in this article.

The reason why I bought railroads for my dividend portfolio is that railroads have perfected the art of transportation – until now that is.

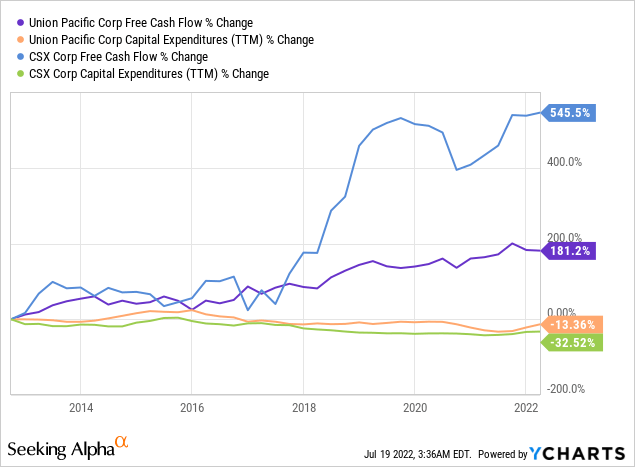

Railroads have reduced operating inefficiencies, which allowed them to cut back on capital expenditures, hence boosting free cash flow used to buy back shares and boost dividends.

Over the past 10 years, UNP has reduced capex by 14% despite a growing economy (higher need for transportation). CSX has reduced capex by a third. As a result, both railroads have seen stunning gains in free cash flow.

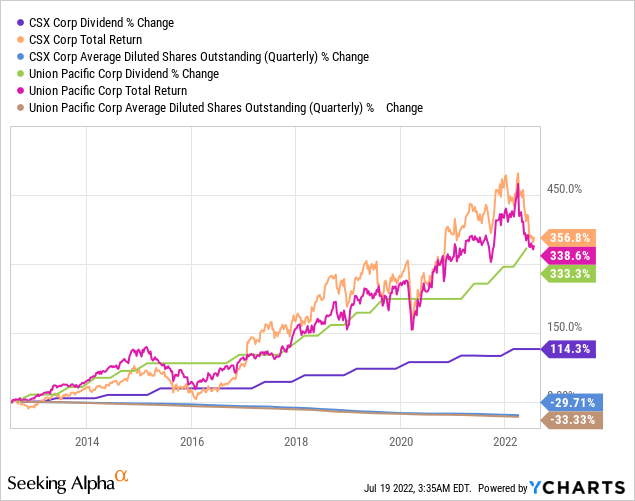

Shareholders benefited from this more than anyone else. During this period, Union Pacific and CSX returned 339% and 357%, respectively. Dividends soared by 333% and 114% with the number of shares being reduced by roughly 30% (via buybacks).

These numbers are stunning as railroads have gone from capital-intensive freight companies to lean, tech-driven, shippers.

Recession Risks

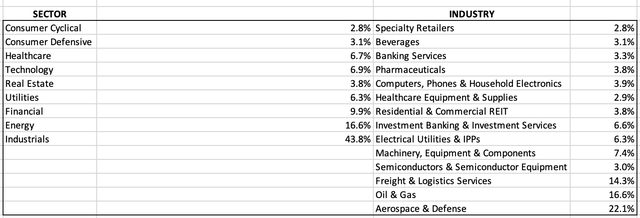

On July 18, I wrote an article to share my thoughts on industrial stocks in general – mainly because I have more than 40% industrial exposure. This exposure consists of railroads and defense companies as well as some machinery companies.

Author (Portfolio Breakdown)

As everyone knows by now, the market is in turmoil this year. And that’s no surprise. Market conditions are horrible. Yesterday, I read (I don’t recall the source) that some people are even cutting back on food spending to deal with the impact of inflation on their finances.

That’s horrible and it applies to a lot of economies besides the United States.

In general, it’s fair to say that we’re dealing with a broad range of related issues (among others):

- Supply chain issues in almost every single industry

- An energy crisis (it’s worse in Europe than in the US)

- Geopolitical tensions in Ukraine and to a lesser extent in Asia

- High inflation

- (Very) low consumer sentiment

- An aggressive Federal Reserve, which is determined to suppress inflation

All of this is bad for railroads. While railroads benefit from strong pricing, fuel surcharges, and the fact that the war in Ukraine benefits US exports of energy (including coal), agriculture products, and long-term manufacturing production in the US (supply chain relocation), investors are selling railroads.

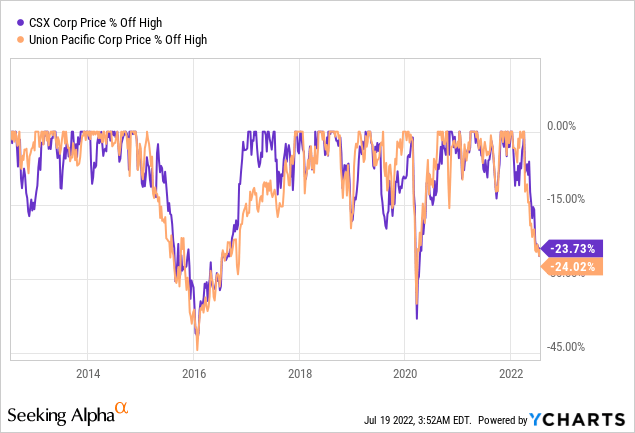

Both CSX and UNP have lost roughly a quarter of their market cap in recent months, which makes it one of the worst declines in the past 10 years.

Personally, this doesn’t bother me for one second. Railroads selling off occasionally is as common as sunshine during the summer months.

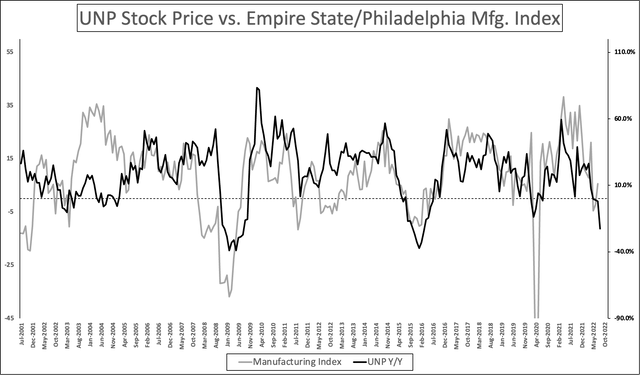

Union Pacific, for example, has a history of perfectly following economic expectations as the chart below shows (the CSX chart is almost identical). UNP and economic expectations peaked at the same time and are now both hinting at severe manufacturing recession risks.

Author

The good news is that we’re once again at a point where the risk/reward is more attractive. Whenever railroads lose a quarter of their value with economic indicators pointing at a recession, long-term investors benefit from the chance to buy at better prices.

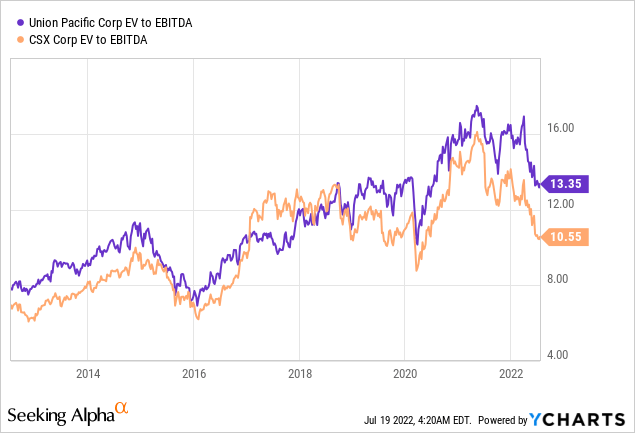

Right now, we’re dealing with the following valuations:

- CSX – 10.1x 2023 EBITDA based on a $63 billion market cap, $12.7 billion in 2023 expected net debt (1.7x EBITDA), $310 million in pension-related liabilities, and $7.5 billion in expected EBITDA.

- UNP – 12.5x 2023 EBITDA based on a $132 billion market cap, $33.6 billion in 2023 expected net debt (2.5x EBITDA), $520 million in pension-related liabilities, and $13.3 billion in expected EBITDA.

These valuations have now erased the entire post-pandemic surge, giving investors decent opportunities to either add exposure or initiate a position.

The current dividend yields aren’t bad either:

This puts the average at 2.0% with the following 10-year average dividend growth rates:

With that said, a favorable valuation is not only a good thing, it’s important as we’re dealing with bigger risks than “just” economic weakness.

Pending Strikes And Structural Problems

Let’s start with good news. Biden averted a freight railroad strike.

The bad news is that the CNN headline below ends with “for now.”

CNN

Basically, worries are that supply chain problems in the US could go into overdrive. Last week Friday, Biden prevented 115,000 railroad workers from striking. The strikes were initially planned to start on Monday this week.

Strikes would have impacted all Class I railroads, threatening to halt close to 30% of the nation’s freight. I don’t need to explain how devastating that would be.

As I said, this disaster has been avoided for now.

Yet, we’re far from finished. The Presidential Emergency Board that Biden named on Friday has no more than 30 days to come up with a solution that suits both railroads and its many employees. If it fails to come up with a suitable solution, another 30-day period starts. The so-called “cooling off” period.

In other words, negotiations could last until mid-September. At that point, the 12 unions representing railroad workers could go on strike, or major railroads could lock out the workers and try to work on a deal where Congress intervenes and imposes a labor deal to their liking. Both of these things need to be avoided. Especially because the government is already blaming inflation on big businesses. For example, Biden is blaming “big oil” for high gas prices, meat processors for high meat prices, and railroads for bad services.

Achieving a deal in the next 60-ish days would be very beneficial for railroads.

After all, they’re dealing with angry employees and angry customers.

It also doesn’t help that railroads are proposing single-worker trains to move more cargo with fewer employees. According to CNN:

Management argues the current safety equipment designed to stop a train if it is going too fast or is out of position makes the second person redundant. It would be more efficient to redeploy those workers to fixed positions on the ground to take care of many of the same tasks.

Not surprisingly, the unions call that proposal a non-starter, as well as a major safety risk to the staff and the communities that trains pass through.

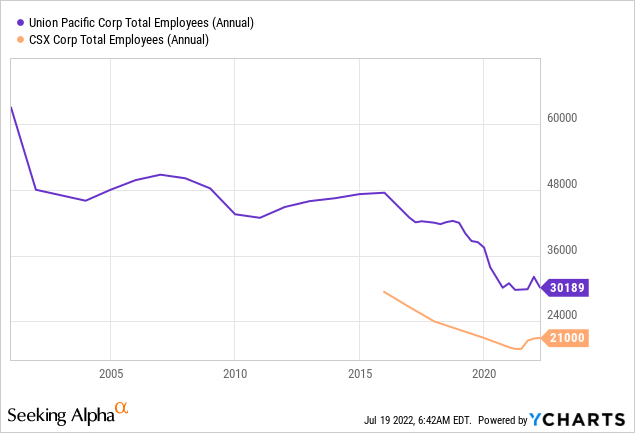

Needless to say, it’s all based on employee levels. While I don’t have a lot of data for CSX, Union Pacific had close to 48,000 full-time employees in 2015. This number dropped to 36,000 prior to the pandemic. Now, it’s at 30,000.

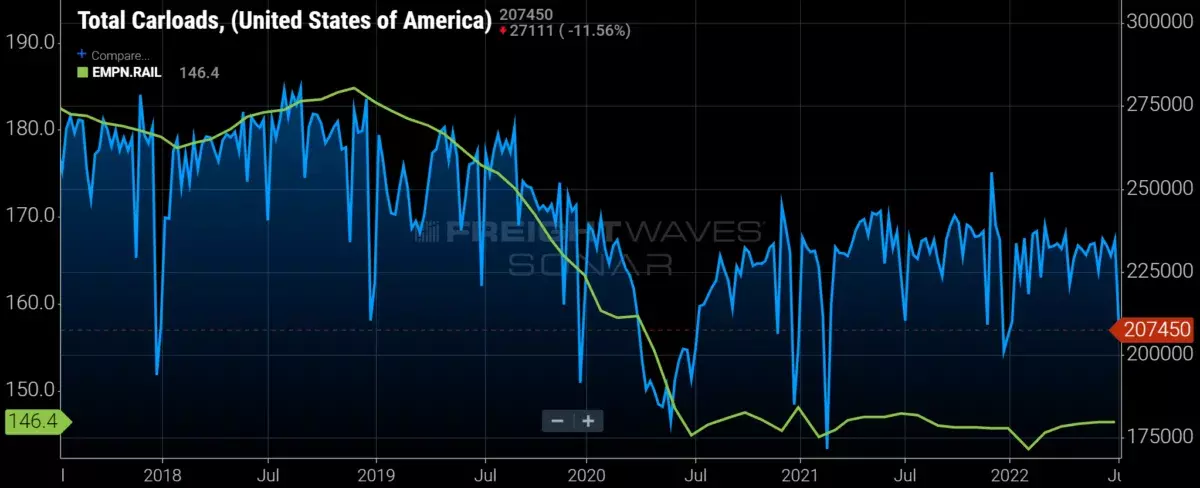

FreightWaves showed what this means for employees – in general. Post-pandemic freight volumes have picked up. Employee levels have not.

FreightWaves

This is toxic for morale as employees are already dealing with wage growth lagging far behind inflation, very long work hours, long waiting times, and the fact that many employees aren’t happy seeing that railroads struggle to bring on qualified trainees – I’ve heard way too many stories over the past few weeks.

A big driver of these problems is Precision-Scheduled Railroading (“PSR”).

PSR means that railroads have set times for when they pick up cargo from their customers, similar to commercial airlines. Prior to that, railroads used to wait for cargo.

It allowed railroads to reduce capital investments and headcount while boosting free cash flow as I showed you in the first part of this article.

CSX Transportation was one of the railroads that vigorously applied PSR tactics thanks to railroad legend Hunter Harrison, who passed away during his time at the company. This is a quote from Wikipedia:

Harrison first introduced PSR at the Illinois Central Railroad (IC), where he became CEO in 1993. He implemented it at Canadian National after they acquired IC in 1998. After retiring from Canadian National, Harrison was recruited to take over leadership of the Canadian Pacific and implemented precision railroading there. In March 2017, he was appointed CEO of CSX Transportation and began implementing PSR on its large network, but he died eight months later. His successors have continued his PSR program.

The bad news is that PSR caused dwell time in certain terminals to increase by as much as 26 hours. It was (and still is) one of the reasons why some customers are angry.

With that said, railroads will need to find a way to:

- Work on a labor deal with unions in the next 30-60 days to avoid involving the government more than it already is.

- Change PSR measures to enhance customer satisfaction – again, to avoid more government involvement.

- Spending too much money, which could hurt operating efficiencies.

According to my political contacts, there’s no talk yet of government involvement in Washington, so that’s a good thing.

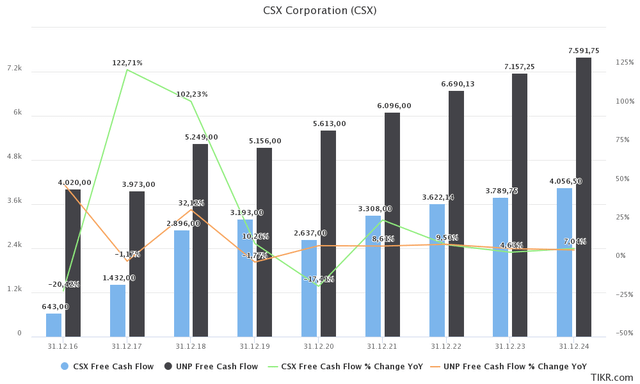

Another problem is that it’s hard to estimate what this means for CSX and UNP. So far, both companies are expected to boost free cash flow by 4% and 7% in 2023 and 2024, respectively. This could end up providing these companies with the following implied free cash flow yields:

- UNP – 5.5% in 2023, 5.8% in 2024

- CSX – 6.0% in 2023, 6.5% in 2024

TIKR.com (Expected Free Cash Flow, CSX, UNP)

These numbers are fantastic and give investors a big margin of safety. After all, I do not expect that the FCF growth rates will be as high as expected if railroads fail to reach a satisfying deal with their employees.

But then again, railroads trading 25% below their all-time high prices means that a lot of trouble has been priced in. Moreover, I’m convinced that strikes will be avoided. The impact on the economy would be devastating – and that’s putting it mildly.

Takeaway

In this article, I wanted to achieve two things. First, to give you two of my favorite long-term investments – not just in the industrial space, but in general. I decided to go with these two as they perfectly complement each other. Both distribute cash using dividends and buybacks. CSX emphasizes buybacks whereas UNP has a higher yield and higher dividend growth. Moreover, when combined, they both cover every economic hotspot in the United States, all major ports, and all supply chains imaginable.

The good news continues as investors have started to price in a manufacturing recession. This significantly improves the risk/reward for investors who either want to initiate a position or add to an existing one.

A bigger margin of safety also helps, given the big dark cloud that hangs over the industry. Hence, my second goal was to discuss the threat of strikes in the industry. Employees aren’t happy (to put it mildly), customers want better services, and the government needs to desperately improve supply chains.

While railroads are not to blame for everything – supply chain issues are very complex – they do need to figure out a way to combine PSR strategies and ongoing supply chain and labor issues. This likely means boosting salaries and bringing back more equipment.

This will reduce their abilities to improve or even maintain current operating ratios but it beats having to deal with strikes.

Yet, I’m far from bearish. As someone with significant railroad exposure, I believe we’ll enter a period where pressure on operating margins remains high. Yet, if railroads play this the right way, they can maintain very high free cash flow generation to sustain high shareholder distributions – especially if economic growth bottoms going into 2023.

In other words, CSX and UNP are both buys, but investors need to be aware of ongoing risks.

(Dis)agree? Let me know in the comments!

Be the first to comment