putilich/iStock via Getty Images

A Quick Take On CS Disco

CS Disco, Inc. (NYSE:LAW) went public in July 2021, raising approximately $224 million in gross proceeds from an IPO that was priced at $32.00 per share.

The firm provides an online SaaS legal case management platform for law firms, enterprises and government clients.

Given management’s focus on continuing to grow headcount despite a looming economic slowdown, increasing operating losses and lowered revenue guidance, my outlook for LAW is on Hold for the near term.

CS Disco Overview

Austin, Texas-based CS Disco was founded to develop a SaaS system with integrated capabilities and machine learning technologies for the administration of legal matters.

Management is headed by Co-founder and CEO Kiwi Camara, who previously obtained a J.D. from Harvard Law School.

The company’s primary offerings include:

-

Ediscovery

-

Legal document review

-

Case management

-

Machine learning/AI modeling

The firm prices its solution based on usage and seeks to ‘land and expand’ its offerings within each medium to large-sized organization.

CS Disco’s Market & Competition

According to a 2020 market research report by Absolute Market Insights, the global market for legal operations software was an estimated $1.4 billion in 2020 and is expected to reach $5.2 billion by 2029.

This represents a forecast CAGR of 15.8% from 2021 to 2029.

The main drivers for this expected growth are a presence of large law firms in North America combined with ample legal software players providing increased capabilities.

Also, large organizations appear to seek online solutions that can be easily used throughout their organization providing large amounts of data capacity and processing power from SaaS-delivery systems.

Major competitive or other industry participants include:

-

Consilio

-

Epiq Systems

-

KL Discovery

-

Large professional service firms

-

Legacy on-premise software

-

Everlaw

-

Logik Systems

-

Relativity

-

Reveal Data

-

Smaller, application-specific firms

CS Disco’s Recent Financial Performance

-

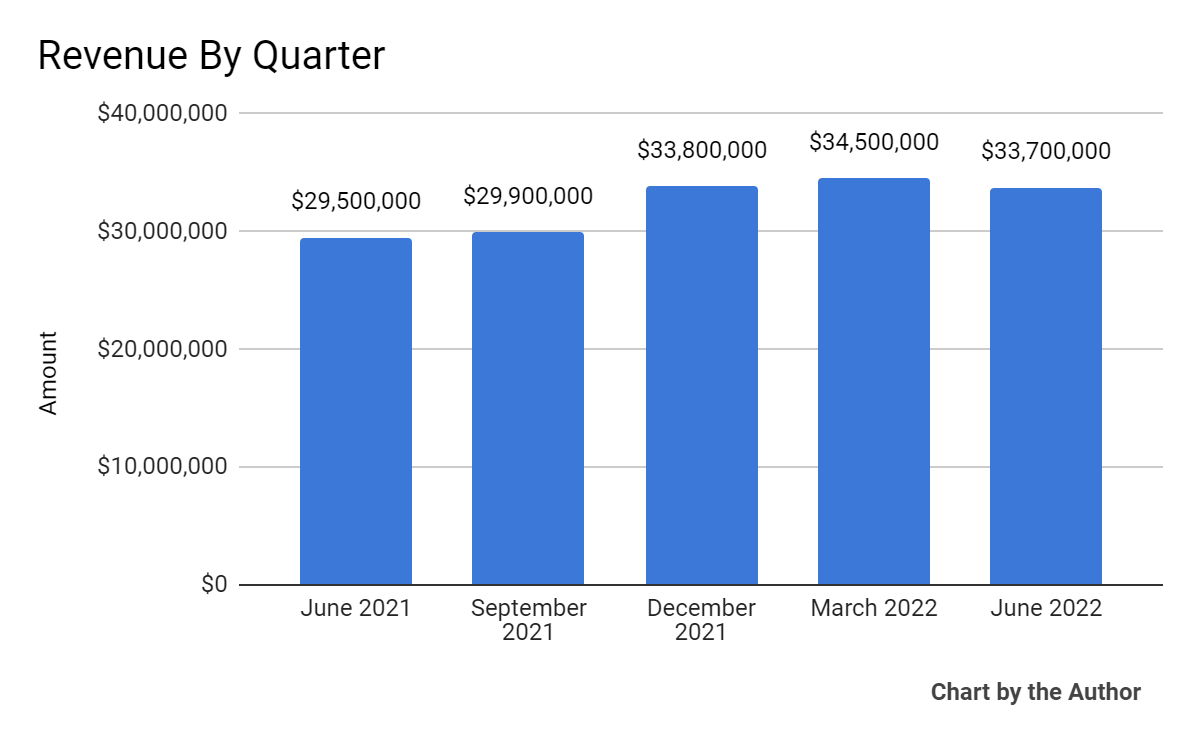

Total revenue by quarter has flattened in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

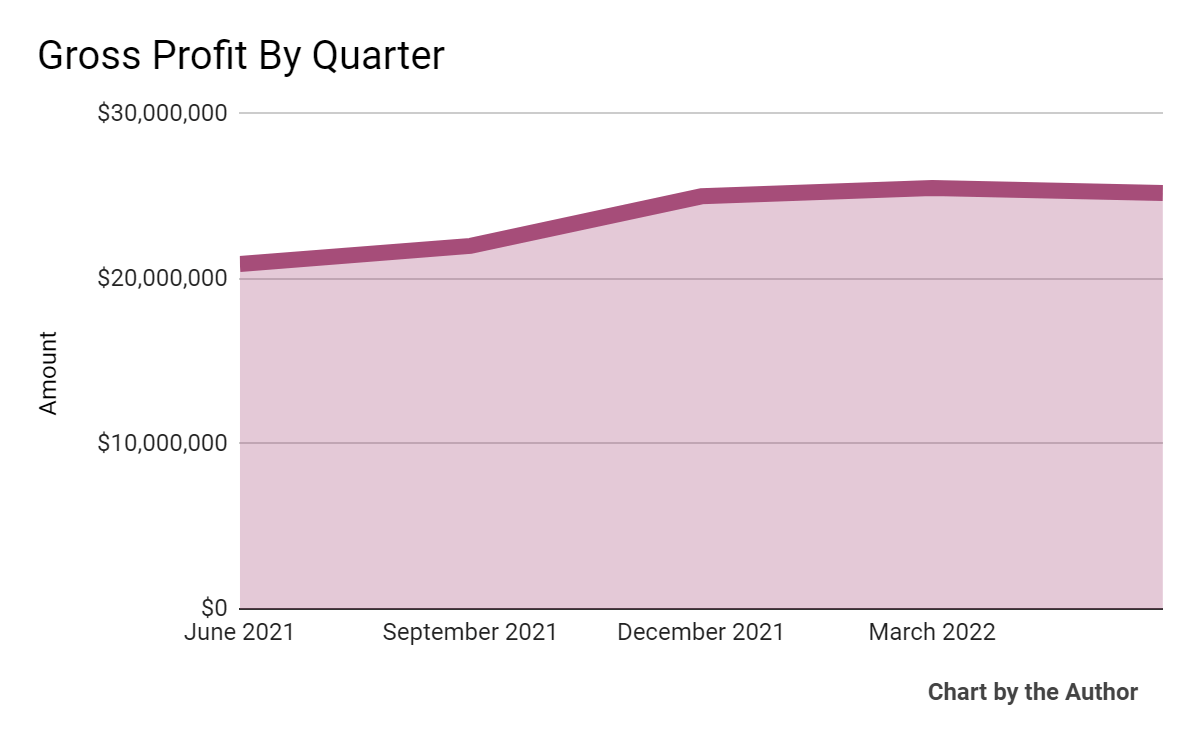

Gross profit by quarter has also plateaued recently:

5 Quarter Gross Profit (Seeking Alpha)

-

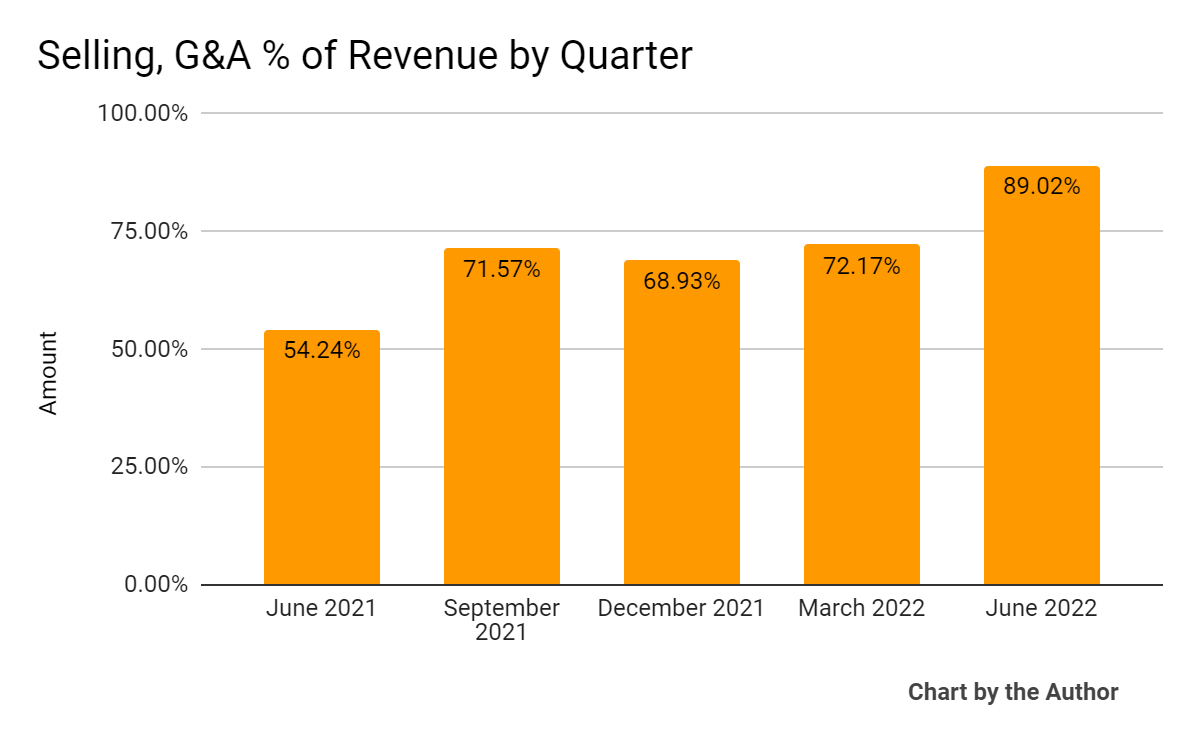

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly in the most recent quarter:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

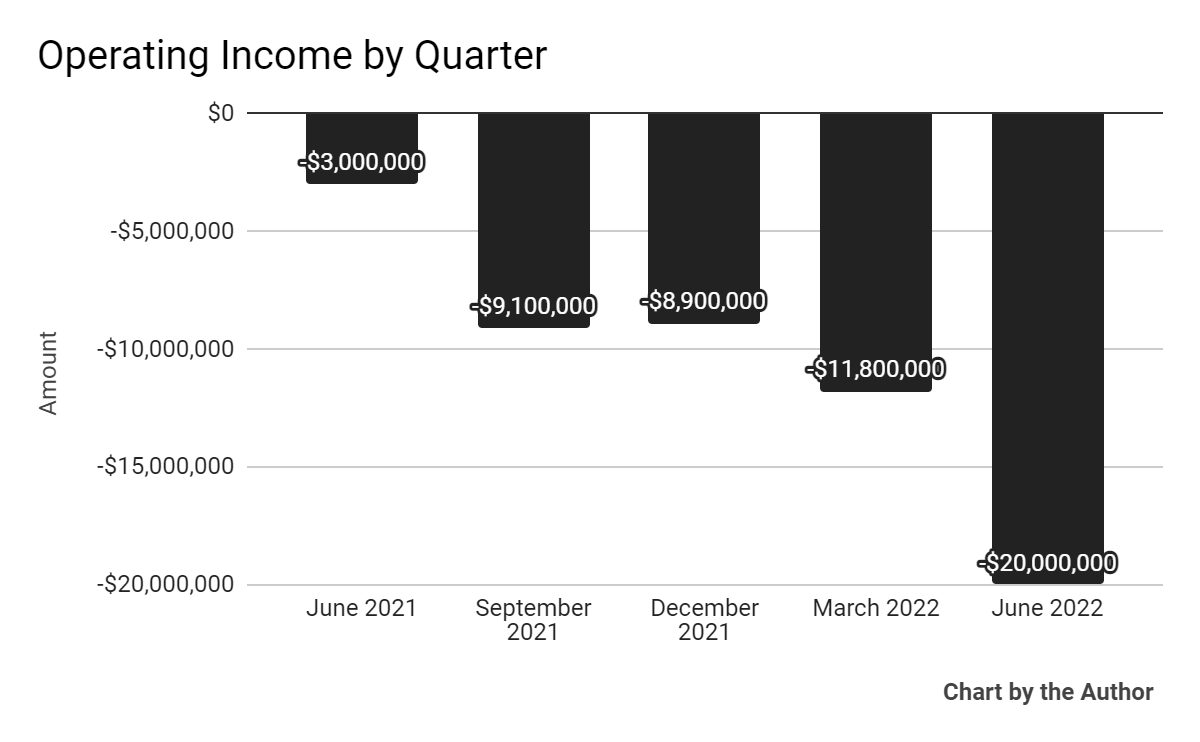

Operating losses by quarter have worsened substantially in Q2 2022:

5 Quarter Operating Income (Seeking Alpha)

-

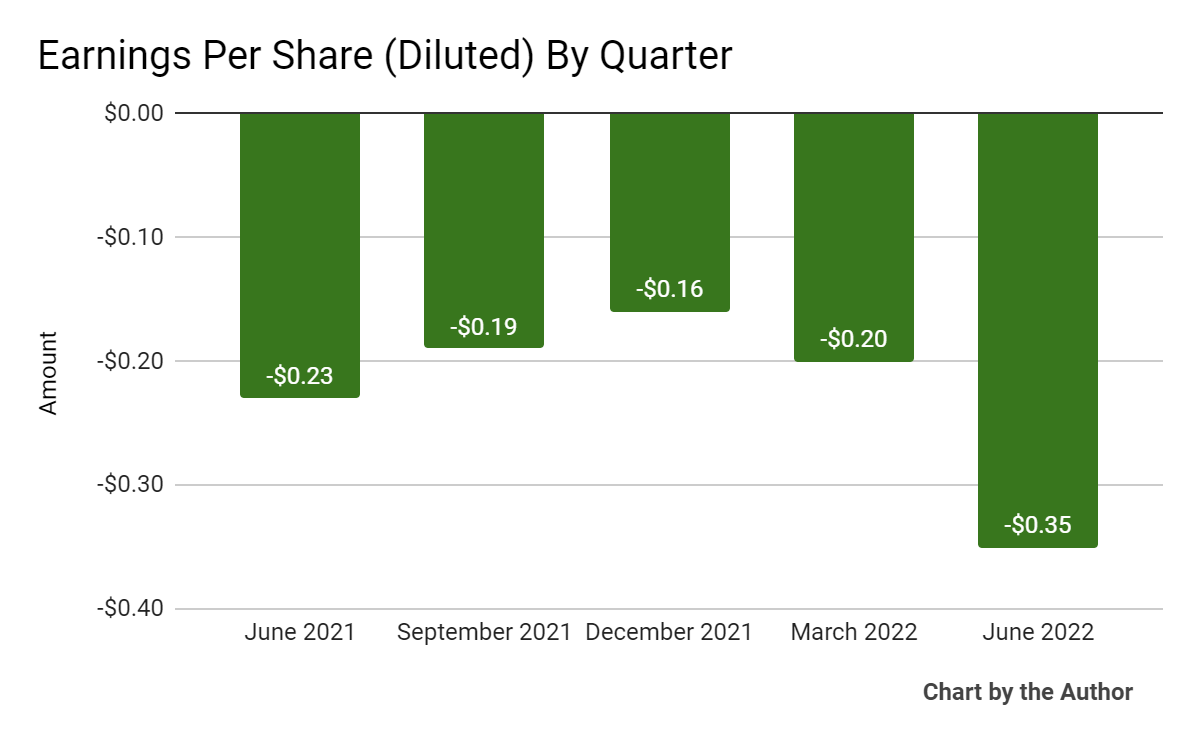

Earnings per share (Diluted) have also worsened recently:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

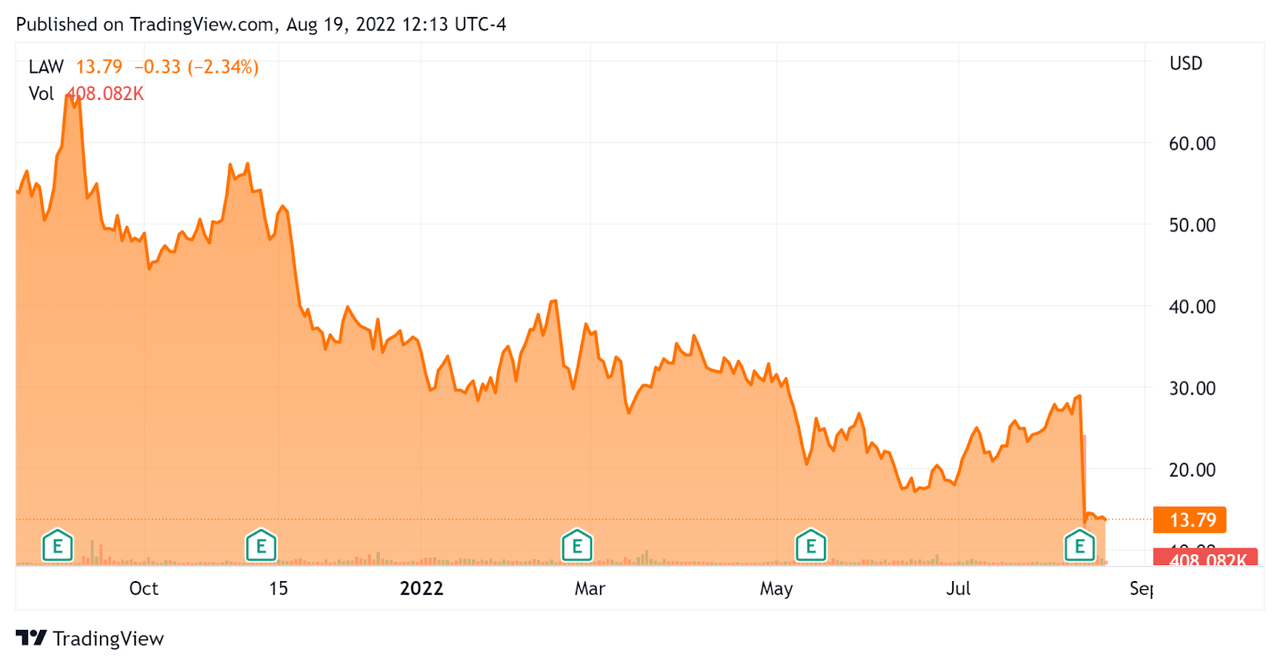

In the past 12 months, LAW’s stock price has dropped 74.6% vs. the U.S. S&P 500 index’ drop of around 3.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For CS Disco

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

4.64 |

|

Revenue Growth Rate |

50.3% |

|

Net Income Margin |

-38.2% |

|

GAAP EBITDA % |

-37% |

|

Market Capitalization |

$828,750,000 |

|

Enterprise Value |

$611,760,000 |

|

Operating Cash Flow |

-$33,650,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.90 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LAW’s most recent GAAP Rule of 40 calculation was 14% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

50% |

|

GAAP EBITDA % |

-37% |

|

Total |

14% |

(Source – Seeking Alpha)

Commentary On CS Disco

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted growth in the company’s customer count, to 1,255 by quarter end representing a 27% increase year-over-year.

CEO Camara believes that its Ediscovery product will produce strong demand “during periods of economic contraction, as our customers deal with less cyclical parts of the law.”

However, its products that touch upon more volatile areas such as corporate transactions and capital markets, see greater volatility.

As to its financial results, total revenue rose by 14% over a high comparable. Also, the firm’s Review product generates higher than typical volatility because it is priced based on usage.

Gross margin rose from 71% a year ago to 76%, but this growth may be due to typical fluctuations in customer usage.

Sales and marketing rose to 52% of revenue from 36% last year as management continues to scale up its business despite a slowing economy.

Notably, management did not discuss any retention metrics, unusual for a subscription software company.

For the balance sheet, the firm finished the quarter with $228.2 million in cash and equivalents, while generating a much higher negative ($22.2 million) in operating cash flow.

Looking ahead, management reduced its forward revenue guidance for the full year 2022 to only 17% growth at the midpoint due to headwinds from its Review line and expected macroeconomic softness in the second half of 2022.

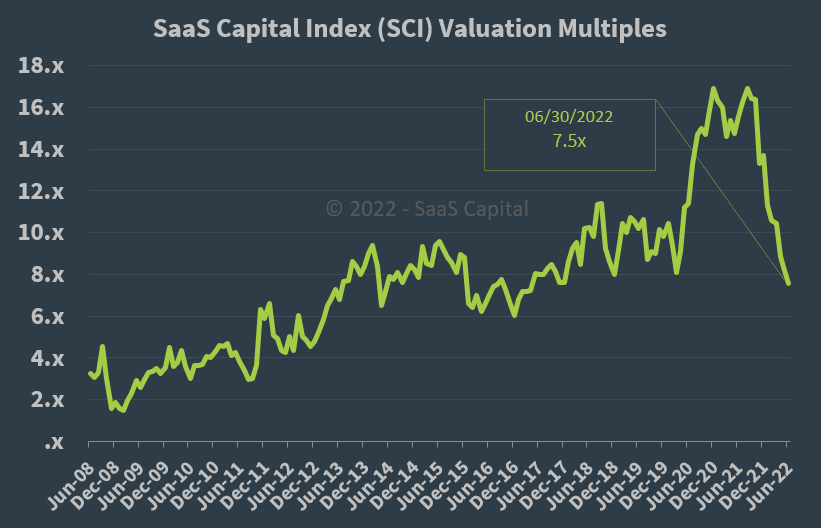

Regarding valuation, the market is valuing LAW at an EV/Sales multiple of around 4.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, LAW is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles, lower usage of its cyclical products and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic slowdown as 2022 progresses.

However, given management’s focus on continuing to grow headcount despite a looming slowdown, increasing operating losses and lowered revenue guidance, my outlook for LAW is a Hold in the near term.

Be the first to comment