Tevarak/iStock via Getty Images

Unless you’ve been living in a cave for the past five years, you’ve undoubtedly heard about cryptocurrencies. You’ve also likely been asked about what cryptos are and whether you should invest in them—or, perhaps, why you haven’t invested in them yet.

It’s hard not to get caught up in the crypto frenzy when you see how a single Bitcoin rose in value from just over $5,000 in March 2020 to over $60,000 just over a year later in April 2021. Cryptocurrencies, most notably Bitcoin, have shown the ability to generate outsized returns for those who time their investments correctly. Cryptos could potentially be a worthwhile investment for retail and institutional investors seeking diversification and potential return—and who are willing to stomach the volatility. Adding crypto to your portfolio is like adding an erratic closing pitcher with a 100 mph fastball to your baseball team. It could potentially be a game changer, but watch out for the wild pitches. Case-in-point: in the past week, Bitcoin is down nearly 30%.

What about crypto in DC plans? We call foul. Because when it comes to defined contribution plans, the game is different. Adding cryptocurrency into a DC plan would be like adding that same pitcher to a basketball team. No matter the fastball potential, the player just doesn’t fit the game. In the same way, we don’t view cryptocurrency investments as suitable for defined contribution plans. Or for plan participants, either.

Here are two reasons why: investment risk and legal and regulatory risk.

Investment Risk Of Cryptocurrency In DC Plans

Defined contribution plans are intended to be retirement savings vehicles—and increasingly should be able to provide retirement income. This means the investments should certainly generate investment returns, but while also being cognizant of risk. This risk awareness becomes especially true as a participant gets closer to retirement age, since time horizons shorten and a severe market downturn can significantly impact retirement savings if a portfolio is overexposed to too much risk.

What this has typically meant for most DC participants is that they should reduce their allocation to growth assets—such as equities—and increase their allocations to capital preservation assets—such as bonds—as they get closer to retirement. Over long-term periods, equities have significantly more return potential, but also more risk.

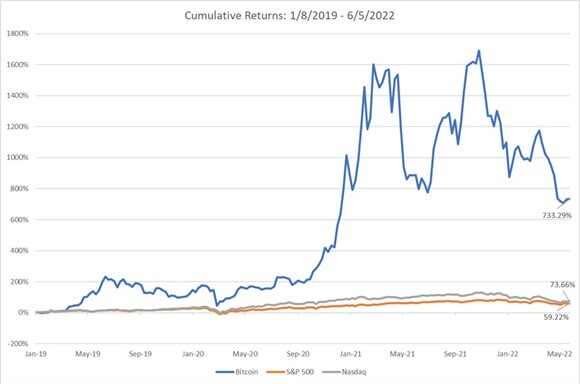

Cryptocurrencies are like equities on steroids, even when compared to the Nasdaq index, which is itself a higher-octane equity index, due to its greater weighting of small cap and technology stocks. Crypto returns certainly can be phenomenal. Since Jan. 7, 2019, Bitcoin (the most common investment associated with cryptocurrency) has returned 733% vs. a return of 74% for the Nasdaq and 59% for the S&P 500:

Source: S&P 500, Nasdaq, Bitcoin

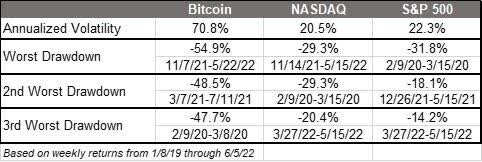

But these outsized returns come with a significant cost—as you can see from the chart below—in the form of major volatility and drawdown risk. Since Jan. 7, 2019, Bitcoin has more than 3x the level of annualized volatility compared to the S&P 500, and there have been multiple instances of a drawdown of approximately 50% of the invested money in a short period of time, versus typical maximum drawdowns of 20-30% for equities.

Imagine the impact of a 50% drawdown on a plan participant close to retirement. This level of risk could severely hamper a participant’s retirement plans, or even potentially ruin them if they invest a significant portion of their assets in cryptocurrencies at the wrong time. And when DC participants lose a lot of money …

Legal And Regulatory Risk Of Cryptocurrency In DC Plans

… there is always a heightened legal risk for plan sponsors. The risk of losing a significant amount of money was a key reason why the Department of Labor, in its compliance assistance release on March 10, 2022, cautioned plan fiduciaries “to exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants.”1 Despite this caution, Fidelity has announced that it will allow DC plans on its record-keeping platform to include cryptocurrency investments, of which the DOL had “grave concerns”.2 Furthermore, Jerry Schlichter—whose firm, Schlichter Bogard & Denton, is the poster child of plaintiff lawsuits against DC plan sponsors and service providers—warned that “any employer who would follow the Fidelity lead by offering cryptocurrency [in a] 401(k) plan is exposing itself to very serious risk of a fiduciary breach.”3 While we do not always share Schlichter’s views for DC plans, we would agree with his sentiment here. Even if you don’t agree, this note should certainly raise concerns for any DC plans considering crypto. Is the addition of crypto worth the legal risk?

The Bottom Line

One day, maybe someone will invent a game where fastball pitchers add value on a basketball court. And maybe someday cryptocurrencies will fit well within a DC plan. Cryptocurrencies and their markets have evolved at warp speed in recent years. So it could happen. But, in our view, it has not happened yet. Until it does, the investment and legal/regulatory risk illuminate why, at this point, we do not recommend that any defined contribution plan offer cryptocurrency investments, whether it’s in their plan menu or within their brokerage window.

¹ Compliance Assistance Release No. 2022-01

² https://www.ignites.com/c/3622614/465124?referrer_module=searchSubFromFF&highlight=crypto

³ https://www.ignites.com/c/3622614/465124?referrer_module=searchSubFromFF&highlight=crypto

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-12063

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment