anamejia18/iStock via Getty Images

Cryoport (NASDAQ:CYRX) is a company that deals in medical supplies. Their primary focus is on the life sciences industry as they provide temperature-controlled supply chain solutions. Specifically, the company has invented and manufactured “Cryoport Express,” a liquid nitrogen dry vapor 2- to 8-degree Celsius solution. This allows manufacturers of fertility treatments, sperm banks, genetics companies, and biopharmaceutical industry companies to ship temperature-sensitive labs and samples safely. Cryoport operates as a business-to-business solutions company, which means that they don’t sell directly to customers, but rather market their services to other businesses. The company is continually adapting its technologies, innovations, and logistical methods to provide the most efficient possible solutions no matter the circumstances. In a constantly changing world, Cryoport does its best to be the most affordable, adaptable temperature-controlled shipper on the market.

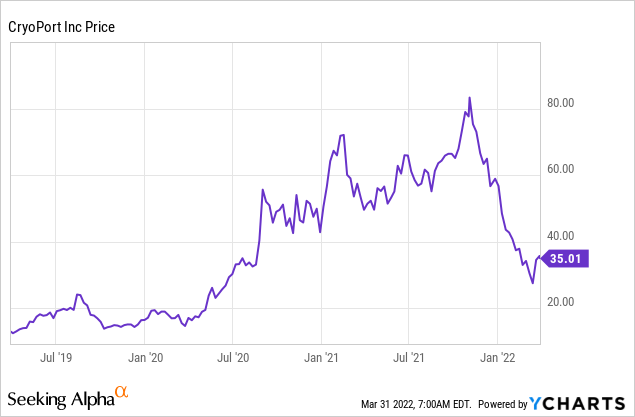

ycharts.com

This article aims to prove that it is a worthy investment despite the many risks of investing in Cryoport. The main reason for this is their dominance in their field. Despite their relatively small market, their place in it gives them stability and continuously increases revenues. The cost of operations is a touch concerning, especially given their negative net income postings in each of the last four years. Still, the overwhelming trend in the financials shows a company that is consistently growing and improving. This trend is one that I believe is likely to continue. For that reason, I have Cryoport as a buy, and I believe investors should pursue this stock with a bullish investment strategy.

Reasons for Optimism

The company has several reasons to be optimistic about its future prospects. The first among them is the market that they fall into. The medical supply market has enjoyed a nice surge because of rising health concerns and the pandemic surge. While their projected growth rate isn’t robust, it reflects a slow, steady growth pace that has been consistent over several years within the market. As the need for new innovative medical technology evolves, so too will the market. As it stands, the medical supply market is projected to expand its size to $189 billion by 2028 at a CAGR of 4.5%. This helps to prove another facet of the company’s slow and steady approach that has, to this point, paid off.

Another interesting factor in looking at the future potential of the business is its structure. In contrast, many other competitors in their market rely on selling their products directly to hospitals, doctors, or individual patients; Cryoport markets and sells their products directly to other businesses. They have cemented themselves as a vital link for moving samples and lab substances to and from various facilities temperature-controlled. This business approach is known as B2B, and it has several advantages. The first advantage of this business style is that it has considerable market appeal. While it’s technically in the medical supplies market, the services the company sells are coveted by a wide range of other businesses in other markets, mainly the very lucrative biopharmaceutical market. Because of this and the fact that B2B companies generally sell their products in bulk, Cryoport has an extensive pipeline that generates more profits than many of its medical supply competitors.

Cryoport also recently launched an initiative to buy back $100 million worth of common stock and convertible senior notes in an effort to focus on shareholder return. This capital reallocation could have a very positive net effect for shareholders as it could very well lead to a gain via company dividends to be paid out. Generally, when a company repurchases its own shares, it’s in an effort to increase its market value by eliminating any excess dilution from its distributed shares.

Company Risks

Despite the lucrative upside to investment in Cryoport, it also has its share of risk factors. One of those factors will be covered more thoroughly in the finance section, which is the negative string of net income totals over the last four years. Another cause of concern for the company comes from recent events. A recent fire in one of the company’s manufacturing plants in New Prague, Minnesota, will likely slow down production rates, adversely affecting profits in 2022. While the company doesn’t expect this to be a lasting effect, it is difficult to say until the full extent of the damage has been determined and repaired.

Another more negligible risk comes from the company’s reliance on outside partnerships to generate profits. While many of these partnerships are with more lucrative companies from more lucrative markets, that is not necessarily positive. Money is power in the market, and contractual obligations are an intelligent way to keep Cryoport’s fees down while keeping the partnership. Any alteration to the chemical market that forces their cost of production to spike up could leave them beholden to selling their products at a contractually agreed rate. This could lead to a massive loss.

Financial Overview

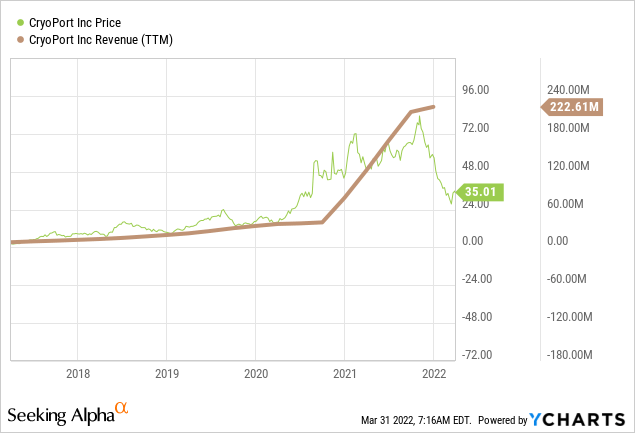

ycharts.com

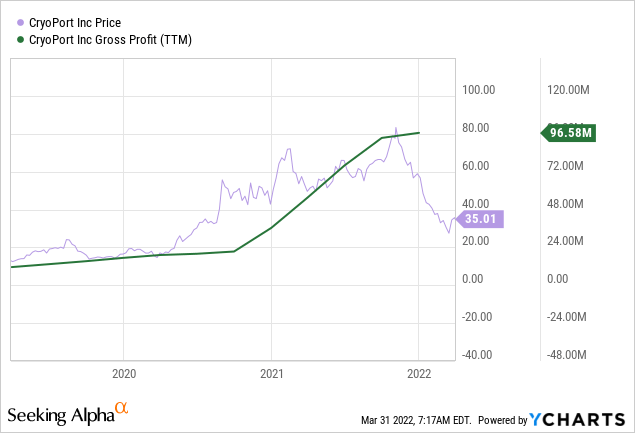

Company revenues have increased every year since 2018. In 2018 the company made $19.6 million in revenue. In 2019 that number increased to just under $34 million. In 2020, revenues improved again, this time exponentially to a staggering $78.6 million. In 2021 that number nearly tripled again, with Cryoport reporting $222.6 million in revenues. Gross profits have averaged around 40% of the revenue or better in each of those four years. In 2018 the company took home $10 million in gross profits. In 2019 the company made, even more, taking in $17 million in profits. 2020 increased profits again, this time to $36 million. 2021 saw the company set a record in profits, sweeping in an impressive $96.5 million.

ycharts.com

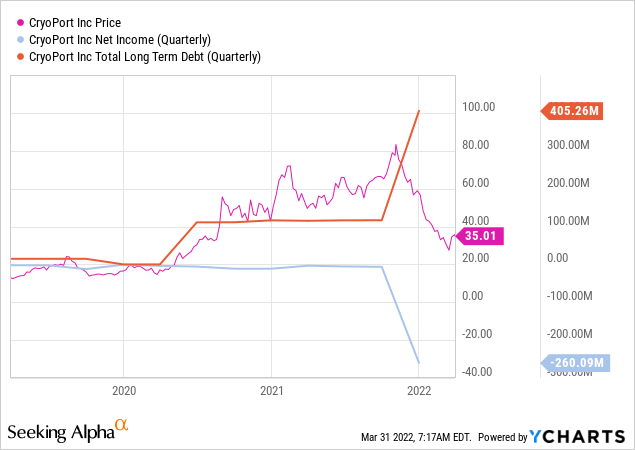

One of the more problematic reads from Cryoport’s financials resides in the net income column. In each of the last four years since 2018, the company has posted negatives for net income. Revenues and gross profits have increased impressively but have not yet resulted in positive numbers. In 2018 the company posted a net income of negative $9.5 million. In 2019 the company reported a negative net income of $18.2 million. The net income total declined again in 2020, this time to a loss of $32.7 million. It got worse again in 2021, with the company posting a negative net income rating of $ -260 million.

ycharts.com

The company has also managed to amass a large sum of long-term debt over the last four years. In 2018 the company had just $14.7 million in debt. In 2019 the company paid down almost all of its debt, getting its debt total down to just $9,000. In 2020 the debt ballooned back up to a robust $116 million before nearly tripling in 2021 to an astounding $405 million. The fact that they have continued to invite in debt while at the same time posting a negative net income rating could undoubtedly be seen as a significant concern.

ycharts.com

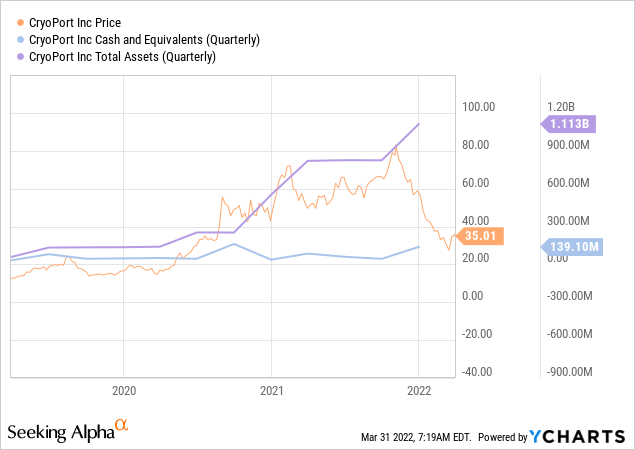

However, the company has done well to safeguard itself through acquisitions, expansion, and cash flow. In 2018 the company held just $37 million in cash. In 2019 that number grew to $47 million. 2019 saw a decline in cash, with the company closing the year at $36 million before exploding to an unprecedented $139 million in 2021. Additionally, the company closed out 2021, holding a robust $1.1 billion in assets, leaving them well-positioned for whatever turns the market takes.

Conclusion

Cryoport represents one of the lower yield “risk-reward” stocks on the market and could easily be overlooked. There are significant risk factors at play when considering an investment, such as the company’s negative net income rates and its inability to pull those numbers into the positives despite record-setting revenues. It’s worth wondering if the cost of production will eventually sink them. With that being said, their robust pipeline and their position within the market leave them primed for continued growth. This would be a stock that an investor would have to be willing to grow with. However, in my estimation, it is one that could pay off handsomely down the road. For those reasons, I believe the future is bullish for Cryoport.

Be the first to comment