bjdlzx

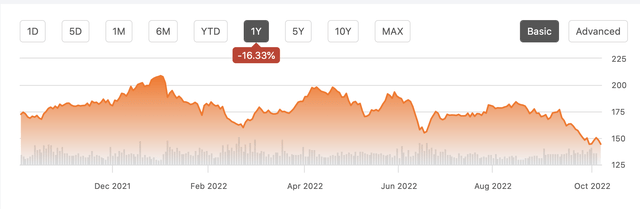

Shares of Crown Castle (NYSE:CCI) have been a poor performer over the past year with the stock sitting at a new 52-week low. Given the increasing need for wireless infrastructure as mobile data usage increases, this performance may be surprising. However, it is consistent with the performance of many other real estate investment trusts (REITs), which have been hammered by higher interest rates. Still with a history of strong dividend growth, which should continue well into the future, getting in at a 4% yield is an attractive entry point.

First, it is important to note the underlying business continues to perform well. In the company’s second quarter, site rental revenue rose by 10% to $1.57 billion, driving a 26% increase in income from continuing operations to $421 million and a 13% increase in adjusted EBITDA to $1.08 billion. Adjusted funds from operations (FFO) came in at $1.80, and this measure is critical to track as it provides context as to how much CCI can pay out in dividends. This measure was up a more modest 5%, and was a bit short of the $1.91 consensus. Much of this shortfall was due to the timing of revenue from fixed-rate inflation escalators in its long-term contracts. This timing issue is a key reason adjusted FFO grew more slowly than other figures, and it does even out over time. Indeed the company maintained its AFFO guidance of about $7.36 per share and 10% revenue growth to about $6.3 billion.

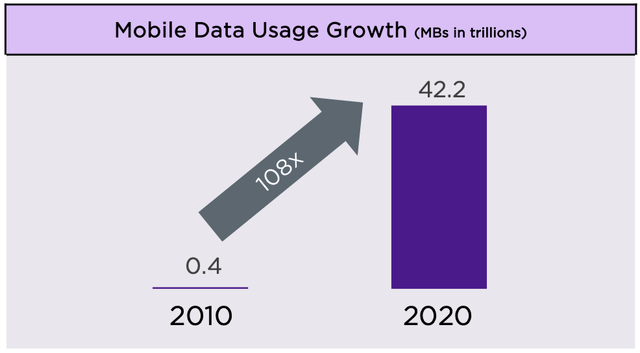

Crown Castle has been a long-term beneficiary of growing wireless data usage. After all, the more we rely on wireless networks, the larger the capacity those networks need to have, and so the more infrastructure they need. The major carriers like Verizon (VZ), T-Mobile (TMUS), and AT&T (T) will rent space on CCI’s infrastructure to operate their network rather than owning all of the cell phone towers and small-sites themselves. As you can see below, mobile data usage has exploded an extraordinary 108x since 2010.

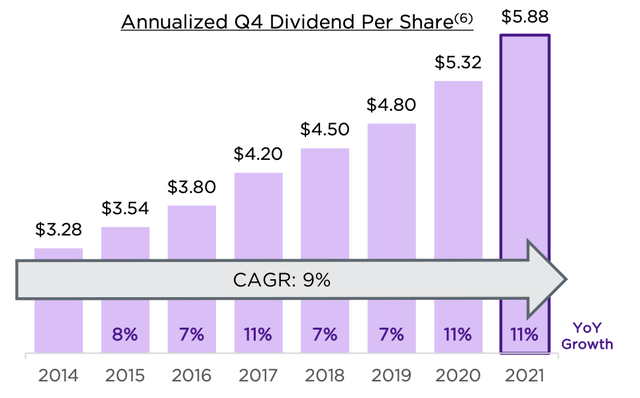

Crown Castle has been a significant beneficiary of this growth, building out a larger network of assets. This has enabled it to be a steady dividend-grower with an 8-year growth rate of about 9%. At its current $5.88 dividend rate, it is just paying out 80% of its adjusted FFO. CCI typically does its annual dividend increase in December, and given this sustainable coverage level and growing FFO, another 7-10% dividend increase is likely in my view.

Importantly, this explosive growth in the wireless industry that has fueled a great decade for Crown Castle is unlikely to end soon. We are still in the early innings of 5G, and accordingly, the wireless industry anticipates 25% annual data usage growth through 2027. 5G, with its greater speed, reliability, and capacity, provides both opportunity for greater commercial use, with companies like John Deere (DE) building smart tractors, and consumer use with eventually some consumers using wireless internet rather than broadband to stream Netflix (NFLX) and others.

Meeting this demand requires much more infrastructure. In fact, over the past two years, nearly 62,000 cell sites were adding, more than the growth seen in the seven years from 2011-2018. With a portfolio of 40,000 towers, 115,000 small cell sites, and 85,000 miles of fiber, CCI is at the center of this growth industry. While we are all familiar with towers, an increasing growth area for the business are small cell sites as carriers are trying to increase the density of their coverage in urban centers to have the capacity to meet soaring data demands.

These sites are usually affixed on utility poles or the side of buildings, rather than being stand-alone structures. Because of how important they are to urban 5G, small cell sites are expected to grow at least at a 15% pace over the next four years. As with the more established tower business, when CCI rents a small cell site to a carrier it does so for a term of 10 years, providing a set stream of cash flow. Indeed, the company has $42 billion in signed contracts to fulfill, with an average term of about 7 years. This provides CCI with extremely predictable cash flow over the medium term.

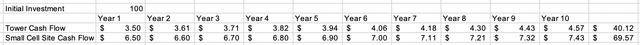

Relative to towers, small cell sites provide a higher starting yield of 6-7% vs 3-4%, so for the same capital outlay, year one cash flow is twice as high-this is a positive. Offsetting this, the annual price escalator is just 1.5% vs 3% for towers. As a consequence, if costs rise substantially, margins get squeezed more quickly in small-cell sites. Given the elevated inflation environment we are in, this has been a concern for the stock.

While I recognize this risk, I think it is important to remember the power of the higher starting yield. Below, I show the 10-year cash flow of a $100 tower or small cell site investment, using the 3% and 1.5% escalators. Even with the slower growth rate, small-cell sites throw off substantially more cash flow. When a contract term ends after 10 years, there is also the potential to reprice higher in a new contract if costs have risen that much faster.

I also think it is important to understand the inflation risk, which management discussed on their last earnings call. CCI doesn’t build sites speculatively; it negotiates with a carrier before deploying a node. So if building materials cost or labor have risen, those price increases are embedded and the cost of a node will be $110 instead of $100, that $110 will be the basis for setting the negotiated 6-7% starting yield. From then on, CCI bears the operational risk. If the cost of maintaining the site rises faster than expected, that cost is borne by CCI, but conversely if they operate the site better, they benefit. Either way, the contract rises 1.5% per year.

CCI also has significant operating leverage in managing this business. While the starting yield is 6-7%, that assumes having just one carrier. Because it is already renting the space for the equipment from a utility, or other landowner, it can have that asset service the networks of two or three carriers. By adding a second tenant, its yield nearly doubles to 10-12%, and mid-teens if it gets a third. Because all major carriers want space in big US cities, the ability to double-up its infrastructure and boost yields is a powerful way to support cash flow. For these reasons, I don’t think investors should be scared off by the lower 1.5% escalator rate.

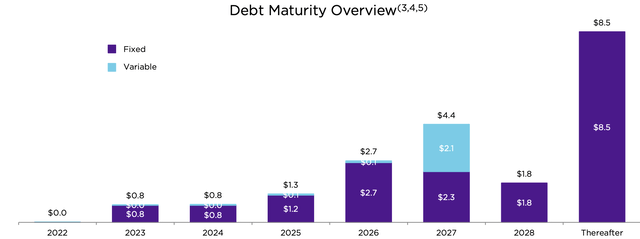

It is also important to note that CCI funds much of its expansion with debt while having and being committed to an investment grade balance sheet. Critically as you can see below, CCI has very little maturing over the next two years, and its debt’s weighted average life is 8.7 years. Management has been aggressive in locking in low interest rates. In 2015, its average life was just 5.4 years. At the same time, 84% of its debt is fixed rate, up from 68% in 2015. This significantly reduces how much CCI is impacted by higher rates. Interest expense is about 11% of CCI’s cost structure. With this cost largely fixed, the fact its contracts have 1.5-3% price escalators provide more room than it seems at first.

Overall, CCI has been a proven dividend grower, and it will be able to sustain that trajectory in coming years given its exposure to the secular growth in wireless data usage. While the fact it has fixed-rate escalators rather than contract escalators that rise as fast inflation has caused some concern, the higher starting yield of small cells, ability to lease them to multiple tenants, and fixed rate debt help to mitigate those concerns. I would expect CCI to continue to grow its dividend at a 7-9% pace, paving the way for low double-digit returns with a starting yield of nearly 4%. I would be a buyer at least down to a 3.5% yield or $168 a share, representing 15% upside. Patient investors can own CCI and enjoy a steady rise in their dividend income.

Be the first to comment