ArtRachen01/iStock via Getty Images

Introduction

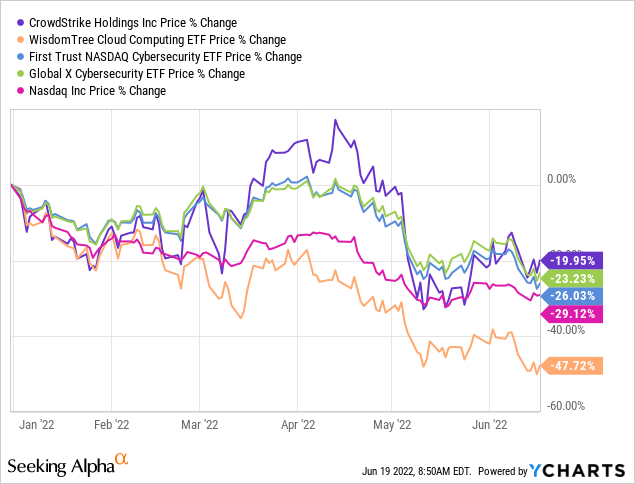

I published an article concerning CrowdStrike (NASDAQ:CRWD) back in December 2022, when the stock was trading roughly 30% off its recent high. Since that time, the stock has tanked an additional 22.7%, just slightly worse than the S&P 500, which is down 19.7% in the same time frame.

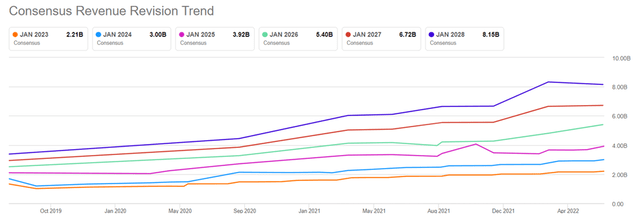

Back then, the forward consensus Wall Street revenue expectations looked the following

- FY2023 revenue of $2 billion (YoY growth of 40%)

- FY2024 revenue of $2.65 billion (YoY growth of 32%)

Today, those same consensus expectations look the following

- FY2023 revenue of $2.2 billion (Q1 2023 reported as of 2nd of June)

- FY2024 revenue of 2.9 billion

In other words, CrowdStrike is doing better than previously anticipated, but down 22.7% during that six-month timeframe. For those already invested, or considering it, the valuation is down, and performance is up – that’s what I’d like to call a favourable offering for those looking to build their position.

Six months ago, when I last covered CrowdStrike, the company traded at a price to sales ratio of 35.9, a very high valuation even at a point in time where the market had already begun to fall, while today, it is standing at a P/S ratio of 22.5 and forward P/S ratio of 16.9. As I discussed in my last article, with such a lofty valuation, there is absolutely no room for failure, and the reason CrowdStrike holds its own so well, also outperforming its peer ETFs, is that it continues to deliver, growing its Q1 2023 revenue by 61% YoY compared to an expected 52% growth.

Cloud security companies, like CrowdStrike, continue to stand against the strong market drawdown, but it only takes one slipup at this point, for companies to see their stock price getting hammered. As such, despite having improved its financials, while the valuation has gone the other way, valuation risk remains in the picture, and initiating a position here, should only be considered for those willing to hold their position for many years.

The Reasons I’m So Fascinated With This Company

In my last article I uncovered CrowdStrike’s business model in detail, which I won’t this time, but here are a few highlights, otherwise I propose going back to my first article.

- CrowdStrike offers cybersecurity solutions anchored in the cloud, based on a SaaS (software as a service) model. These solutions are built around an AI, which improves its intelligence every time it encounters a threat or breach.

- As the AI becomes smarter, it strengthens its resilience towards cyber related threats, but also makes it increasingly difficult for new competitors to match the services provided by CrowdStrike.

- This creates a strong network effect benefitting CrowdStrike, as every new or existing customer benefits from the combined AI knowledge growing over time.

- CrowdStrike is recognised by Gartner as an EPP (End Point Protection) leader, based upon strength of vision and ability to execute.

- CrowdStrike took its point of departure in what the legacy cybersecurity industry did wrong – it was inflexible, complex and failed to provide the security, which customers relied upon. CrowdStrike remains founder led and carries high ambitions, considering itself a category leader.

- The total addressable market continues to expand, with cybersecurity being an industry undergoing strong growth. A cyber-attack impacting a Fortune 500 company can cost in the hundreds of millions of dollars, making whatever they pay for cybersecurity related expenses come off as peanuts. In a digital age, one can ask, how can companies live without state-of-the-art cybersecurity?

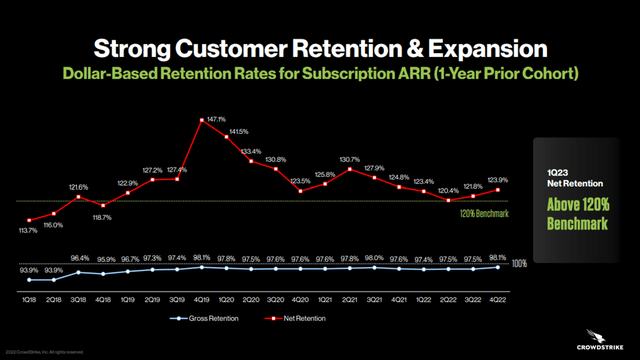

CrowdStrike is in a unique position, enjoying a growing moat making it a very tough choice for customers to go elsewhere once they are in the fold, especially as CrowdStrike’s AI improves over time. This also translates into the two strongest selling points when it comes to being a CrowdStrike shareholder. Namely, the dollar-based retention rate and the gross retention – two of the main sources of my fascination with the company, and strong belief in the positive outlook.

- Dollar-Based Retention Rate: showing how much revenue the company makes from its existing customer base over time. For the past 16 quarters, the company has exceeded a dollar-based retention rate of 120% suggesting that customers are pleased with the service they are procuring, to the point where they spend more money with CrowdStrike over time. A strong sign of customer satisfaction.

- Gross retention: Showing the number of customers the company manages to keep on its books as time passes, with the best possible outcome being 100%, which of course is an unrealistic achievement given some customers come and go, others go out of business and so on. Gross retention is at 98% and has been in that ballpark for 18 quarters in a row – extremely impressive.

CrowdStrike Investors Centre Q1-2023 Presentation

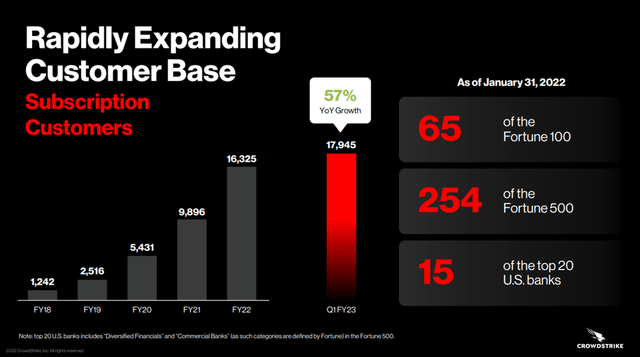

Once we combine that with the development within the customer base, it’s outstanding. Since my latest article, CrowdStrike improved its customer base with the following

- 57% YoY growth

- 2 of the Fortune 100 companies

- 18 of the Fortune 250 companies

- 1 of the twenty largest U.S. banks

CrowdStrike Investors Centre Q1-2023 Presentation

Having 75% of the largest U.S banks as your customer, 50% of the Fortune 500 and 65% of the Fortune 100, is just extremely impressive and speaks volumes about the value CrowdStrike brings to its customers.

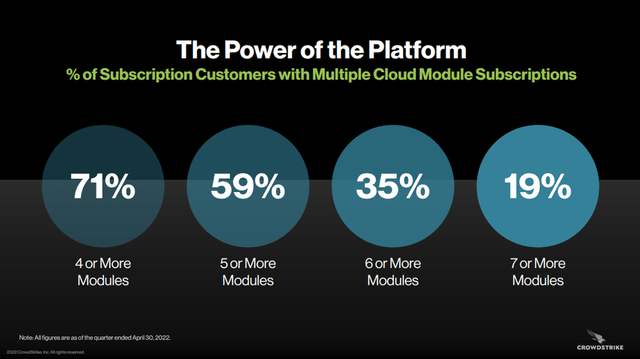

Not only is CrowdStrike getting more of the largest companies on board, but those same companies also come to subscribe to a growing amount of CrowdStrike’s services. In fact, all categories shown in the slide below are growing YoY.

CrowdStrike Investors Centre Q1-2023 Presentation

Not only can CrowdStrike go wide, but it can also go deep when it comes to entrenching its customers, as they utilise a growing number of modules during their customer life cycle.

- % of subscribing customers utilising 4+ modules equal 71% (7 percentage points growth YoY)

- % of subscribing customers utilising 5+ modules equal 59% (9 percentage points growth YoY)

- % of subscribing customers utilising 6+ modules equal 35% (8 percentage points growth YoY)

- % of subscribing customers utilising 7+ modules equal 19% (no YoY comparison available)

All of this translates into CrowdStrike being a very interesting company within the cybersecurity ecosystem, and also leads to the stock performing better than its peer ETFs. These are some of the reasons underlining why I’m fascinated with the company, and its offering.

Q1 2023 Financial Performance And Target Operating Model

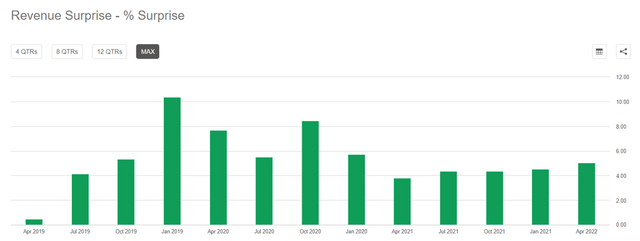

CrowdStrike delivered another strong performance in its most recent quarter, having beaten consensus revenue expectations thirteen straight quarters. Consistently beating expectations turn into a compounding effect over time, which is also the reason why, forward guidance and expectations have grown considerably since my latest article only half a year ago. Highlighting the Q1 2023 performance on a high-level basis and it appears as follows

- Revenue growth of 61% YoY to $488 million, compared to a guidance of 52% growth.

- Operating loss of $31.5 million, compared to $85 million YoY

- ARR (Annual Recurring Revenue) grew 61% YoY to $1.92 billion

- Free cash flow of $158 million (35% growth YoY)

- Cash and cash equivalents on balance sheet of $2.15 billion (29% growth YoY)

- Total debt $772 million, up from $0 one year ago

- 17.945 subscribing customers (57% growth YoY)

- FY-2023 guidance of $2.198 billion in revenue (52% YoY growth up from previously expected 48% growth)

All across the board, CrowdStrike just delivers. Most importantly in times like these, the company is cash flow positive, but even if that should change, the company has a strong net cash position, ensuring ample financial flexibility. In such uncertain times as the ones we are in, balance sheet strength matters greatly, and is also a prime reason as to why I’m willing to expand my existing position. A high growth company needs a resilient balance sheet, should the macro environment turn sour beyond what has already transpired.

CrowdStrike just improved its guidance, while once again, outperforming the consensus expectations from Wall Street when it concerns revenue growth. Such a track record can compound considerably over time, for the benefit of shareholders. Even now, during uncertain times, management is confident enough to lift the outlook just a little bit. We won’t know until the year is up, but I can only imagine that management has decided to lift guidance in a conservative manner, otherwise we wouldn’t be looking at thirteen straight quarters of revenue outperformance. In other words, CrowdStrike may end up beating its own improved FY2023 guidance by the time we make it to the end of the year.

Naturally, the raised guidance was a conversation point during the earnings call, where management was asked if they experienced any slowdown when speaking to customers. The answer was a clear no, cybersecurity, according to management, remains a top priority amongst senior management of their customers.

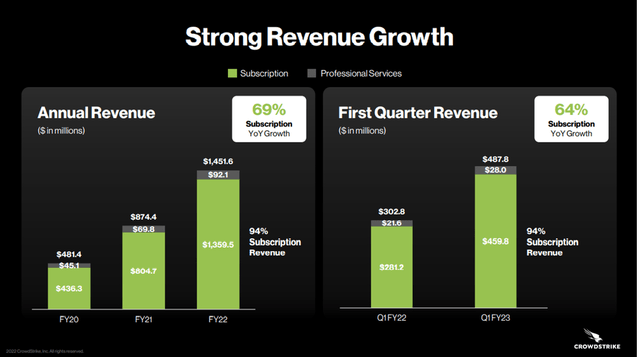

CrowdStrike Investors Centre Q1-2023 Presentation

If we zoom in a bit on the revenue performance, the Q4-2022 revenue growth was 63% YoY, with Q1-2023 revenue growth being 61% YoY – almost no slowdown whatsoever. The services provided by CrowdStrike is sticky.

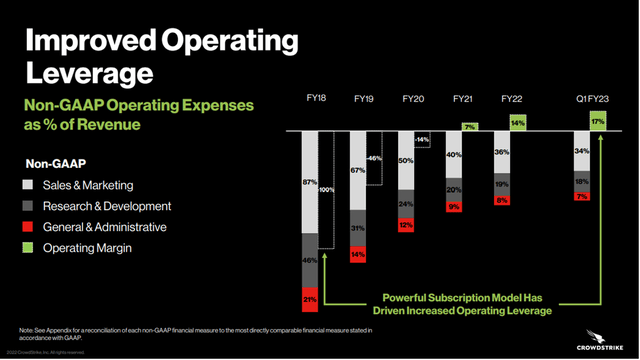

However, no business is perfect, and neither is CrowdStrike, who still has some way to go, in order for management to state the company has reached its target operating model. At this point however, CrowdStrike has taken considerable steps on route to reach its target operating model, having shown considerable operating leverage on route.

Below are non-GAAP targets as a percentage of revenue

- Subscription gross margin target is 77-82%, currently at 79% (total gross margin at 77%)

- Sales & marketing at 30-35% of revenue, currently at 34%

- Research & development at 15-20% of revenue, currently at 18%

- General & administrative at 7-9% of revenue, currently at 7%

- Operating margin at 20-22%+, currently at 17%

- Free cash flow margin at 30%+, currently at 32% and 30% for FY2022.

The development over the past years, look the following.

CrowdStrike Investors Centre Q1-2023 Presentation

CrowdStrike’s financials are moving in the right direction and the company is in possession of a strong balance sheet, allowing the company to fuel its growth either organically, via acquisitions or just in general stay padded should the economy turn against the company for a while.

Valuation And Risk

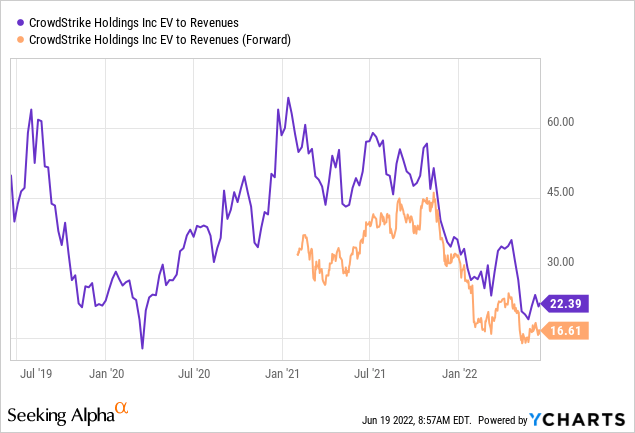

CrowdStrike was expensive half a year ago, and still is so today, but naturally less so given how the financials continue to improve and surprise, while the stock is trading 44% off its recent high, being 17% down YTD.

The company remains unprofitable on a GAAP basis, while being down less than its tech peers due to continued strong top-line growth and still carries a high valuation. If the macro environment gets really tough, not even CrowdStrike will manage to escape a substantial drawback, and that is assuming the company just continues to perform. Should the company underdeliver on any major business metric, the response will be relentless. We’ve seen Pinterest (PINS) suffer greatly from a slowdown in growth, Unity (U) getting hammered for internal data issues and so the examples go. This market doesn’t allow mistakes, and that’s also why I’ve pressed the need for having a long horizon if one wants to invest in companies such as these, including a high performer like CrowdStrike.

For as long as the company continues to outperform, it will be allowed to trade at a premium, and it rightly should so. Quality carries a premium, that’s just how it is. Even so, that quality comes at a bargain compared to earlier, as we are moving closer to previous lows seen from a valuation perspective.

Observing CrowdStrike from an EV to revenue standpoint, and the company is at its lowest since the IPO, expect for the Covid-19 market crash. If we instead consider the valuation from a forward EV to revenue standpoint, the price is now very close to the market wide sell-off back in March of 2020.

Currently, CrowdStrike trades at the following P/S ratios, according to Wall Street consensus expectations

- FY2023 forward P/S of ~17 (Revenue exp of $2.2 billion)

- FY2024 forward P/S of ~13 (Revenue exp of $2.9 billion)

- FY2025 forward P/S of ~10 (Revenue exp of $3.8 billion)

A valuation the company can grow into, but not exactly cheap either, but should the company continue its streak of revenue beats and secure a FY2025 revenue of $4.3 billion instead, the forward FY2025 P/S would be ~9. This would be slightly above the most bullish revenue consensus estimates for FY2025, but the company does have a proven track record of overperformance.

From a price to sales ratio standpoint, just as was the case for the EV to revenue multiple, it also represents a level close to its lowest since the IPO, when measured on the forward P/S that is.

Trading at the lowest it has done since the IPO is in no way a guarantee, and I stick by my conclusion that should the macro environment get really tough, CrowdStrike will see its share price trend further downwards in conjunction with the broader market, and its peers. In such an environment, companies may cut back on their budgets, and this would inevitably impact CrowdStrike.

Closing Remarks

I believe the case is strong for CrowdStrike. The company is operating in a growing market, its financials consistently improve while holding an FCF margin of 30%. Recognised as a category leader, while having beaten revenue expectations thirteen quarters in a row – all of that, with the valuation having come down significantly, despite the continued improvement in underlying financials.

CrowdStrike remains expensive from a valuation standpoint, but strong performance on all parameters also justifies a premium. The valuation is close to what, historically, has represented valuation low points, but that is no guarantee that we won’t have to cross those levels, should the business outlook toughen for CrowdStrike in these economically uncertain times. That is a very real possibility, and also a reason why I always utilise a dollar cost averaging approach when building my position, within this high growth, no GAAP income stocks. Similarly, I hold with a time horizon counting many years, to allow for the thesis to unfold itself.

On the basis of these reasons, I’ve expanded my position in CrowdStrike in recent weeks at $151 and $161.9 per share.

Be the first to comment