Galeanu Mihai

CrowdStrike (NASDAQ:CRWD) has crashed alongside the rest of tech. Unlike many tech victims which were arguably outright bubbles, CRWD is legitimately a high-quality company that just got a little too close to the sun. The cybersecurity sector remains a high-growth secular story as evidenced by the company’s ability to sustain elevated growth rates. While CRWD is still not as cheap as other tech stocks even after the crash, the company’s secular growth, positive cash flow generation and strong balance sheet make it a buyable risk-reward in the market today.

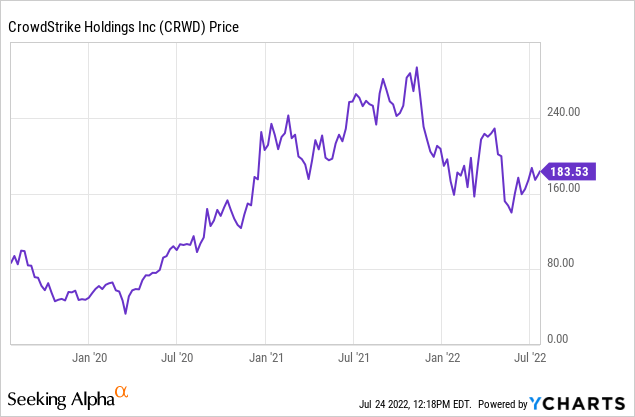

CRWD Stock Price

CRWD peaked at $298 per share in late 2021 and recently traded hands at around $184 per share.

I last covered CRWD in April when I called it a buy on account of the market-beating potential. The stock has since fallen another 21%, improving the valuation proposition further.

CRWD Stock Key Metrics

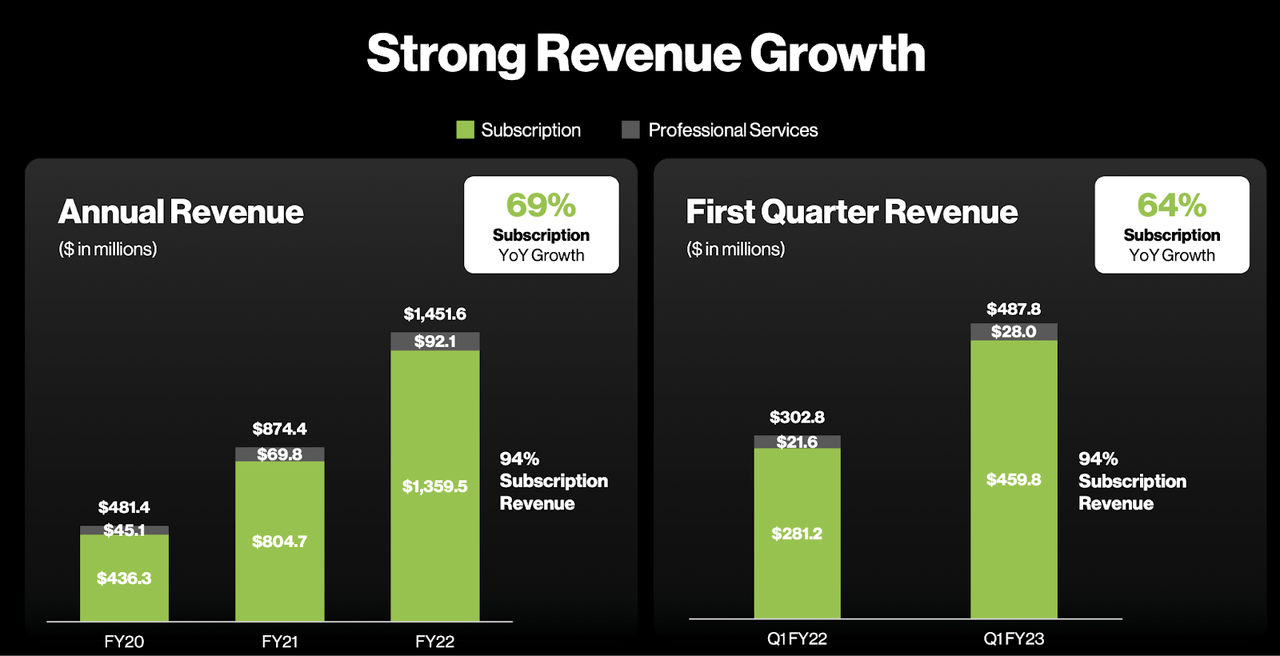

CRWD is one of the few tech companies that has not experienced a depression in growth rates post-pandemic. The company showed 64% growth in the latest quarter after posting 69% growth last year.

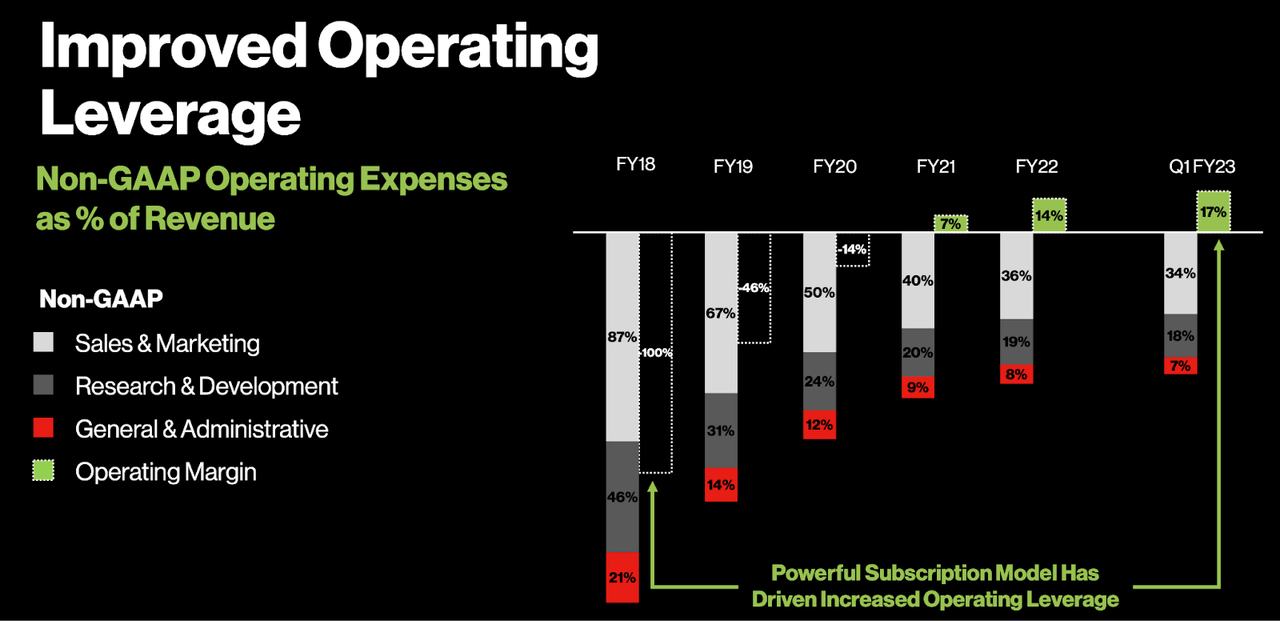

FY23 Q1 Presentation

CRWD accomplished this through two factors. First, it continued to rapidly grow customers, with its customer count growing 57% year over year. CRWD is a clear market leader in cybersecurity as evidenced by its strong market share among the largest companies.

FY23 Q1 Presentation

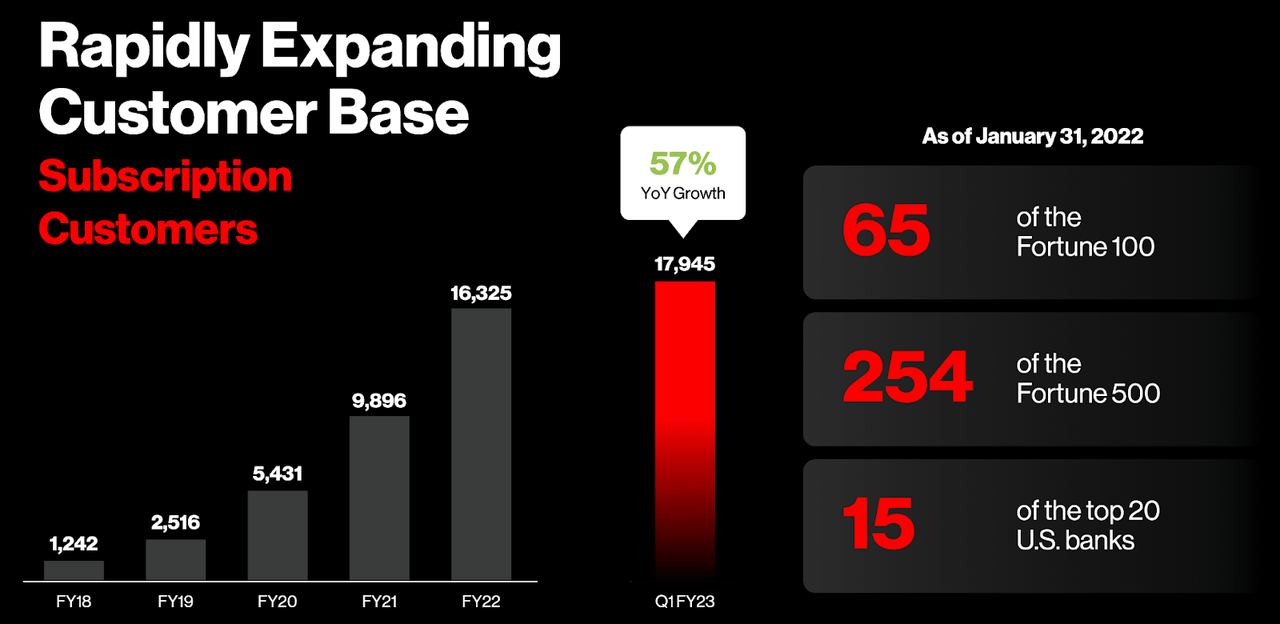

Next, CRWD delivered strong dollar-based retention rates above 120% for the 16th consecutive quarter.

FY23 Q1 Presentation

That high and consistent dollar-based retention rate has arguably helped CRWD sustain a premium multiple relative to tech peers, as it helps assure greater clarity into the growth outlook.

Unlike cash-guzzling peers, CRWD is profitable albeit on a non-GAAP basis.

FY23 Q1 Presentation

CRWD guided for the next quarter to see up to $516.8 million in revenues and for the year to see up to $2.2058 billion in revenues (representing 52% year over year growth). The company ended the quarter with $1.8 billion of net cash, though I note that the large cash balance is largely due to the $1.2 billion of deferred revenue.

Is CRWD Stock Undervalued?

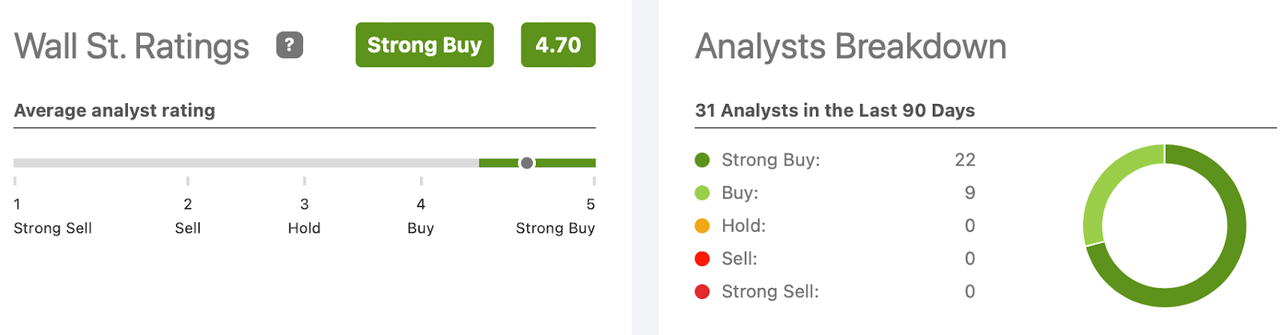

Wall Street analysts seem to think so, with an average 4.7 out of 5 strong buy rating.

Seeking Alpha

The average price target of $232.57 per share represents 27% potential upside.

Is CRWD Stock A Buy, Sell, or Hold?

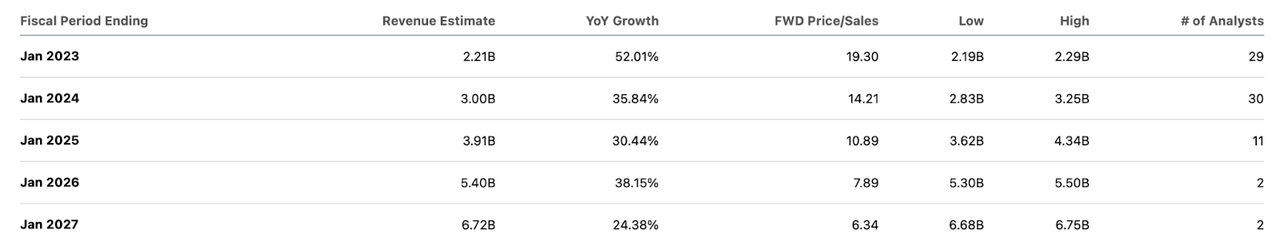

At its April investor seminar, CRWD guided for $5 billion of ARR by FY26. Consensus estimates call for $5.4 billion of revenues instead.

Seeking Alpha

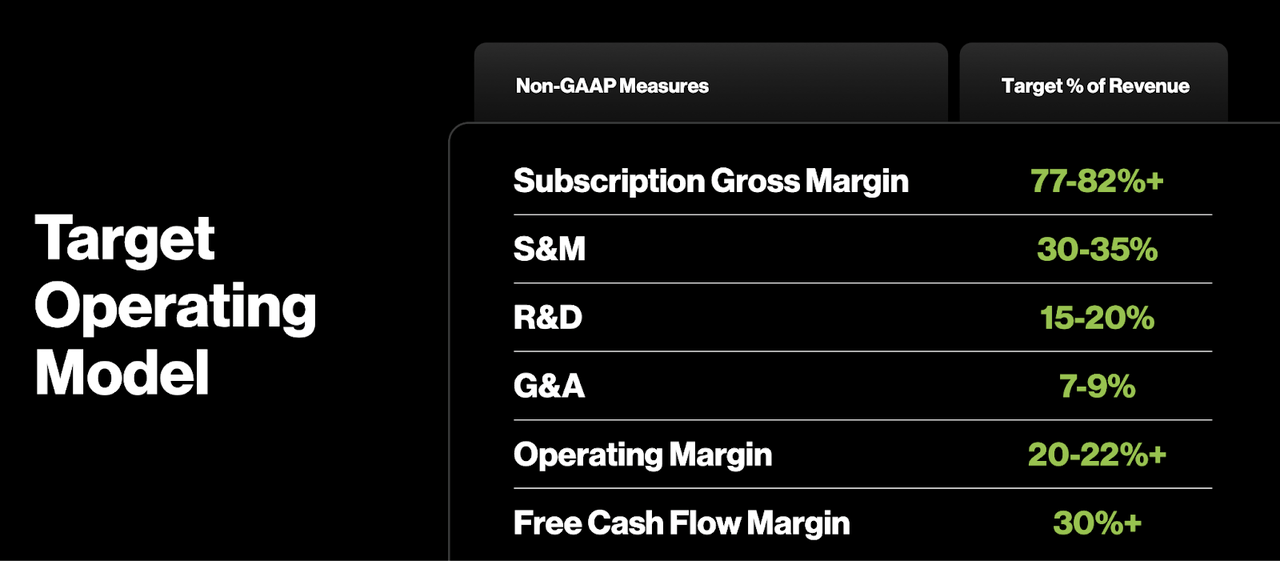

CRWD has guided for at least 22% operating margins over the long term.

FY23 Q1 Presentation

At 19x sales, CRWD is not nearly the cheapest pick in the tech sector. Yet that premium is arguably deserved considering the company’s strong financial position and ability to sustain elevated growth rates over the long term. Assuming a 2x price to earnings growth ratio (‘PEG ratio’) and 25% long term net margins, I could see CRWD trading at 12.5x sales by 2026, representing a stock price of $291 per share. Based on that target, the stock has around 14% annualized return upside over the next 3.5 years. That is enough to beat the market, but I could see CRWD outperforming my assumptions for profitability and sustaining growth for longer than many expect. Given the premium valuation, the key risk here is failure to over-deliver. If CRWD turns out to be just an “ordinary” tech stock, then I could see its valuation compress to the 1x PEG ratio based on where other tech stocks are trading. The stock might trade down to as low as 9x sales or $114 per share, representing nearly 40% downside. I find such a scenario unlikely due to the hyper-growth cybersecurity story, but it is always possible that competition from the likes of SentinelOne (S) or others slow down the growth engine. I am less concerned about financial risk as the company is flowing cash and has a cash rich balance sheet – the main issue is valuation. Another risk is if the company suffers a cyberattack that damages its reputation – the company has the unappetizing position of being judged for failure and not necessarily for preventing attacks. I rate the stock a buy for those looking to invest in the cybersecurity sector but note that there are far more compelling opportunities elsewhere in the tech sector.

Be the first to comment