PrathanChorruangsak/iStock via Getty Images

We are bullish on Chicago-based Cresco Labs Inc (OTCQX:CRLBF). Profits will be worth the wait for retail value investors. Investors will need patience until Cresco fully absorbs a company mega-takeover. We wrote about Cresco Labs before, and we own shares.

Big Puff

In mid-July, we spoke and exchanged emails with a Cresco Labs SVP Investor Relations Representative. The representative informed us that Cresco is on target to execute the all-stock, $2B acquisition for rival MSO Columbia Care (OTCQX:CCHWF) before year’s end. On November 4, Cresco Labs and Columbia Care jointly

announced the signing of definitive agreements to divest certain New York, Illinois, and Massachusetts assets (the “Assets”) to an entity owned and controlled by Sean “Diddy” Combs (the “Transaction”). The divestiture of the Assets is required for Cresco to close its previously announced acquisition of Columbia Care (the “Columbia Care Acquisition”). The Transaction is expected to close concurrently with the closing of the Columbia Care Acquisition. Total consideration for the Transaction is an amount up to US$185,000,000 (the “Purchase Price”).

The announcement cautions there remain legal hurdles, but managements of both companies are optimistic. Additional assets are targeted for divestiture through other venues. Both boards of directors have approved the remaining plans and are awaiting review clearances from committees and government regulators.

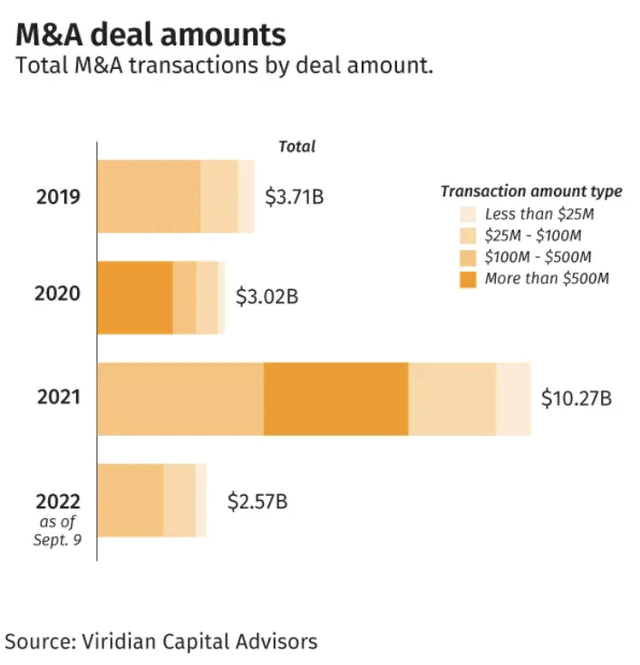

In 2022, there have been M&As valued at $2.57B. The Cresco/Columbia deal nearly doubles that figure.

M&A Cannabis Activity (mjbizdaily.com/marijuana-mergers-and-acquisitions-cool-in-2022/)

This is a huge undertaking by Cresco shareholders. Cresco’s market cap is $1.33B. Columbia Care’s market cap is $648M. The share prices for both companies toppled this past year, so investors will not know the final numbers until the deal is revealed. Columbia’s shares dived 52% this past year to $1.50. The 52-week high was $3.86 at the close of 2021. Cresco Labs’ share price tumbled 60% over the last year; it is down -52% in the 10 months of 2022. The S&P/TSX Cannabis Index is down 66.75% for the last 12 months.

Footprints are increasingly important in the cannabis business. Cresco is number one in Illinois and Pennsylvania, where Columbia Care has a tiny presence. Columbia is a leader in Colorado and places where Cresco has few or no operations. Where products overlap, the Cresco strategy is to market them as Best, Better, and Good. We do not yet know if Cresco will rebrand Columbia retail stores with the Cresco Sunnyside signage.

Risks

In our last article, we predicted the Cresco share price will hover in the $3 range. One recent assessment of analysts’ average price targets puts it in the $10 range. We have seen a value of over $15 per share. But we caution on the need to be conservative. Basing a target price on historical multiples (PE and PB ratios, price to cash flow, past returns, and growth numbers) ignores risks in a mega-venture like this one.

A huge risk looms for investors. Management has built a behemoth operation with good revenue growth based on customer service satisfaction. We believe management can do it again, but this is a huge mega-venture, taking risk tolerance to a new level for what will be the largest company in a highly regulated industry.

Other factors are in play, too. The cannabis industry suffers pressures from federal regulations. State governments having legalized marijuana are ecstatic over the tax revenue. The federal government however refuses to decriminalize cannabis; it limits companies from banking cash and making loans, using wire/Internet services to process transactions, transporting products across state lines, and marketing cannabis. This situation is unlikely to change, especially if a more conservative Congress is elected to office in the mid-term voting.

Traders of cannabis stocks use non-traditional trading sites. We had an experience where a stock advisory website refused articles about cannabis stocks. Despite enticing comments from some quarters, we do not see regulations relaxing. Revenue will not grow as fast as it might otherwise.

Another caveat for shareholders is Cresco’s level of debt. Cresco Labs has a higher cash-to-debt ratio than 82% of others in its industry. Its debt-to-EBITDA is near the worst ratio. So is Cresco’s debt interest coverage capability.

One last concern is the $185M sale price of assets. Early estimates suggested divestitures will bring $250M to $500M. More money will come with more sales to be announced. Will they generate $100M or more? The company representative we talked with informed us that some proceeds from the divestitures will pay down the debt. Other income will be for working capital and to cover capital expenditures Cresco incurs acquiring and upgrading Columbia’s assets (CAPEX). Will there be enough?

The next Cresco Labs earnings report date is November 15, 2022. Columbia Care will report about Q3 on November 14, 2022.

The Companies

Cresco Labs and Columbia Care are vertically integrated, multi-state cannabis operators. The companies grow, manufacture, and distribute consumer-packaged goods under brand names and medical marijuana. Cresco has 350 products and over 5,000 branded SKUs.

- Cannabis in vape pens, live resins, disposable pens, and extracts under the Cresco brand

- Vape carts, vape pens, flower, popcorn, shake, pre-rolls, shorties, and concentrates under the High Supply brand

- Vapes and gummies under the Good News brand

- Vapes and edibles branded as the Wonder Wellness Co. brand

- Tinctures, capsules, salves, and sublingual oils are sold under the Remedi brand and Reserve brand

- Cannabis flowers sell under the Cresco Labs and FloraCal brands

- Mindy’s Edibles make and sell cannabis chocolate and toffee confections, fruit-forward gummies, hard sweets, and taffy under the Kiva brand that also produces cannabis-infused edibles, including chocolate confections, gummies, mints, and tarts.

- Other cannabis-infused edibles sell under the Sunnyside brand, which is used as the name for the company’s retail outlets.

- The firm has a healthy-sized wholesale business selling bulk and finished goods to other cannabis distributors, and company-owned retail channels in numerous states.

- SEED™ Social Equity & Education Development™ is to develop tangible pathways into the industry for these communities. SEED’s year-round work focuses on three pillars: Business Development, Education & Workforce Development, and Restorative Justice.

Cresco Labs operates in 10 states, where it has 21 production facilities. It holds 54 retail licenses and owns 54 dispensaries. Columbia Care has licenses in 18 U.S. jurisdictions and formerly in the E.U. It operates about 100 dispensaries and 32 cultivation and manufacturing sites. Columbia owns brand names and a similar product mix. Both have valuable proprietary technology platforms.

Valuation

Seeking Alpha authors and Wall Street analysts agree with us that Cresco Labs stock has serious potential growth opportunities. The Quant Rating from SA was upgraded to hold this fall after a strong sell rating through much of June and July.

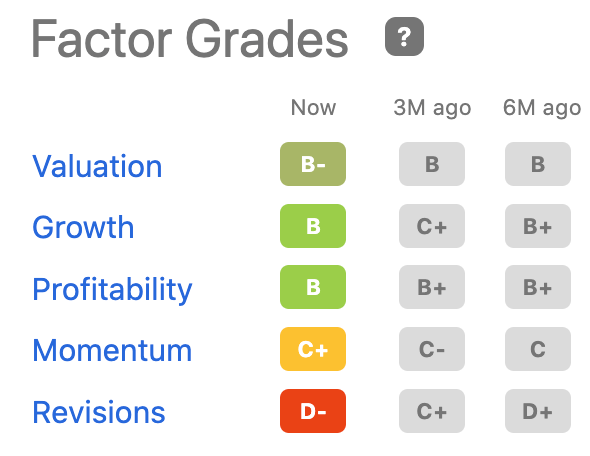

Columbia Care

Factor Grades Columbia Care (seekingalpha.com/symbol/CCHWF)

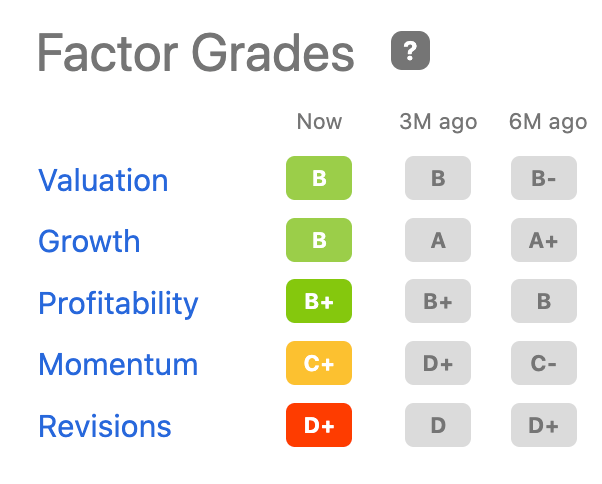

Cresco Labs

Cresco Labs Factor Grades (seekingalpha.com/symbol/CRLBF/ratings/quant-ratings)

The EPS will be a loss of a few cents per share in the next Cresco quarterly report if sales do not meet expectations. Some states are reporting softer-than-expected marijuana sales, but the prevailing sentiment is 2022 revenue will be up 7% to 10%. Cresco’s three-year EBITDA growth rate is better than 70% of its competitors. We expect it to improve in the next three to five years. Gross margin was last reported to top 50%. The operating margin was near 12%. Net margin improved last quarter. We expect the trend to continue.

Takeaway

More states are going to legalize adult use. Tax collections are too enticing to ignore. The legal market’s biggest advantage is the purity of products in an age when drugs are being cut with killer ingredients. 92% of Americans support no restrictions on the availability of medical marijuana. Uses for medical cannabis are expanding.

Cannabis-derived ingredients are showing up in supermarket beverages. A food company Warren Buffett is holding invested in a cannabis company.

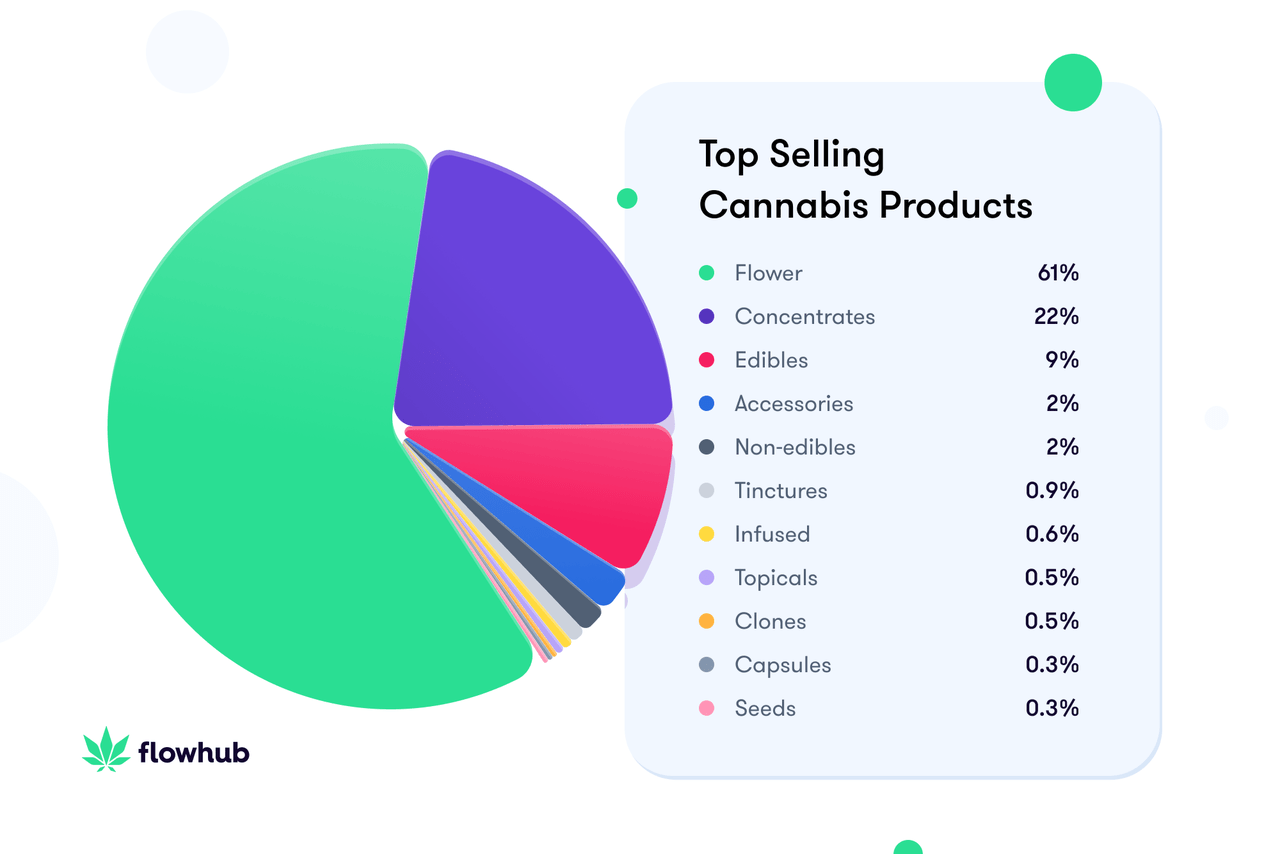

Top Selling Products (flowhub.com/cannabis-industry-statistics#:~:text=The%20cannabis%20industry%20supports%20428%2C059,cannabis%20as%20of%20January%202022)

The industry already supports over 428K jobs. It created nearly 300 jobs a day in 2021. The newly formed U.S. Cannabis Council is an association of businesses lobbying for legalization and other matters. Medical marijuana is leading the way and its uses are expanding; once a state allows medical marijuana, it is a brief time from med-to-rec legalization.

Cresco Labs and the soon-to-be subsidiary, Columbia Care, are vertically integrated operators. A hefty percentage of holdings are in agriculture to cultivate cannabis. We remain moderately bullish about Cresco Labs, but risks have increased with the mega-venture. If you do not buy a cannabis stock for personal reasons, keep in mind the Dr. Seuss quip that “You’ll miss the best things if you keep your eyes shut.” We are not going back to prohibition.

Be the first to comment