vovashevchuk/iStock via Getty Images

Crescent Point Energy’s (NYSE:CPG) stock price increased by 80% in the last six months. Crescent Point is an oil and gas company based in Canada. The company was well-positioned to improve its cash flow and debt condition due to the increased oil and gas prices during the last year. As the geopolitical tensions in Europe and the Middle East are going on, I expect CPG’s net debt to funds flow ratio to decrease to below zero sooner than expected. CPG is undervalued and has an upside potential to reach around $13.

In its 1Q 2022 financial results, Crescent Point reported adjusted funds flow from operations of C$534 million, or C$0.92 per share, compared with 1Q 2022 adjusted funds flow from operations of C$262.7 million or C$0.49 per share. The company’s net income increased from C$21.7 million, or C$0.04 in 1Q 2021 to C$1183.6 million, or C$2.03 per share in 1Q 2022. In the first quarter of 2022, Crescent reported crude oil and condensate average daily production of $92971 bbls/d, down 2.4% (YoY). On the other hand, the company’s NGLs average daily production (bbls/d) increased by 28% (YoY). Finally, crescent natural gas average daily production (mcf/d) increased by 111% (YoY). Due to the increased NGLs and natural gas production, the company’s total average daily production increased from 119384 (mcf/d) in 1Q 2021 to 132788 (mcf/d) in 1Q 2022, up 11.2%. CPG’s total average selling price increased from C$58.65 in 1Q 2021 to C$ 91.43 in 1Q 2022.

In the first quarter of 2022, CPG’s netback and adjusted funds flow from operations netback increased by 78% (YoY) and 83% (YoY) to C$62.33 million and C$44.68 million, respectively. Crescent increased its drilling and development expenditures from C$105.6 million in 1Q 2021 to C$188.2 million in 1Q 2022. In the first quarter of 2022, Crescent Point increased its quarterly dividend by 40% to US$0.065 and repurchased 13.5 million shares, worth US$110 million. “As a result of our execution, improving financial position, and focus on returning capital to shareholders, we are further increasing our dividend,” the CEO said. “We also remain active on our share repurchase plan given our compelling valuation and the investment opportunity it provides to enhance our per-share metrics,” he continued.

Market outlook

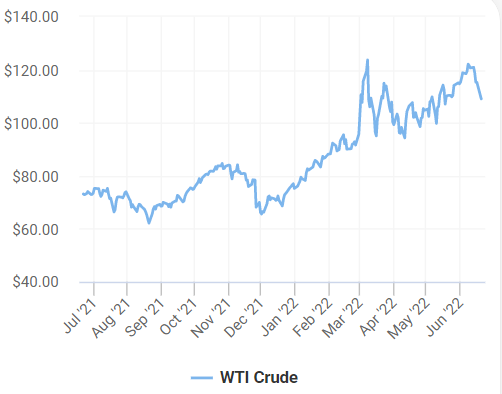

Due to the increased oil and natural gas prices, energy companies benefited from the market condition in the last year. Figure 1 shows that WTI crude oil price increased from $73 per barrel on 21 June 2021 to $109 on 20 June 2022. Recently, EU leaders agreed to ban Russian oil imports by 90%. Moreover, west sanctions against Iran are continuing. Thus, I don’t expect oil and natural gas prices to fall. Thus, the market condition is in favor of CPG.

Figure 1 – WTI oil price

oilprice.com

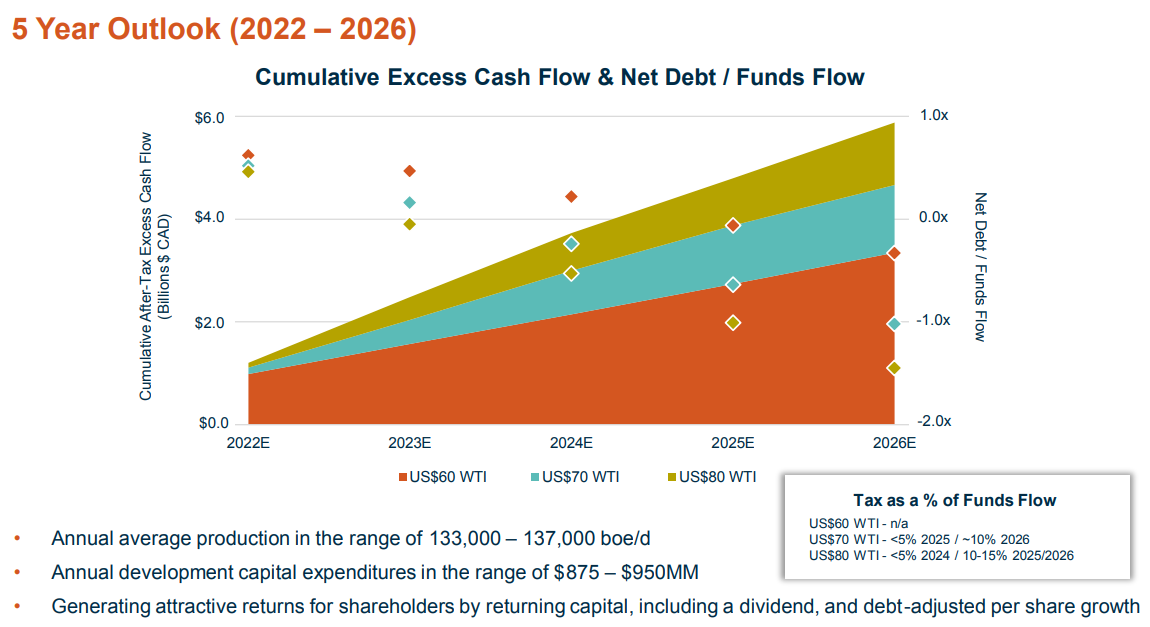

Crescent expects to generate $1.2 to $1.4 billion of excess cash flow in 2022, at US$80/bbl to US$100bbl WTI for the rest of the year. According to Figure 2, the company expects net debt to funds flow ratio of around 5x in 2022. The company expects that with a WTI crude oil price of US$80 per barrel, its net debt to funds ratio will decrease to below zero in 2023. Moreover, with a WTI crude oil price of US$80 per barrel, Crescent estimates a cumulative after-tax excess cash flow of more than C$2 billion in 2023. I expect oil prices and natural gas prices to remain high as long as the level of tensions in Europe remains high. Thus, the net debt to funds ratio of Crescent may move below zero sooner than expected. Also, the cumulative after-tax cash flow of the company may increase to C$2 billion before the end of 2023. The company expects total 2022 average production of 133000 to 137000 boe/d and excess cash flow of $1.2 to $1.4 billion. With WTI oil price of around $100 for the second half of 2022, and the current level of NGLs and natural gas prices, I predict an excess cash flow of more than $1.4 billion for Crescent Point.

Figure 2 – Cumulative excess cash flow & net debt / funds flow

CPG’s 1Q 2022 presentation

CPG performance outlook

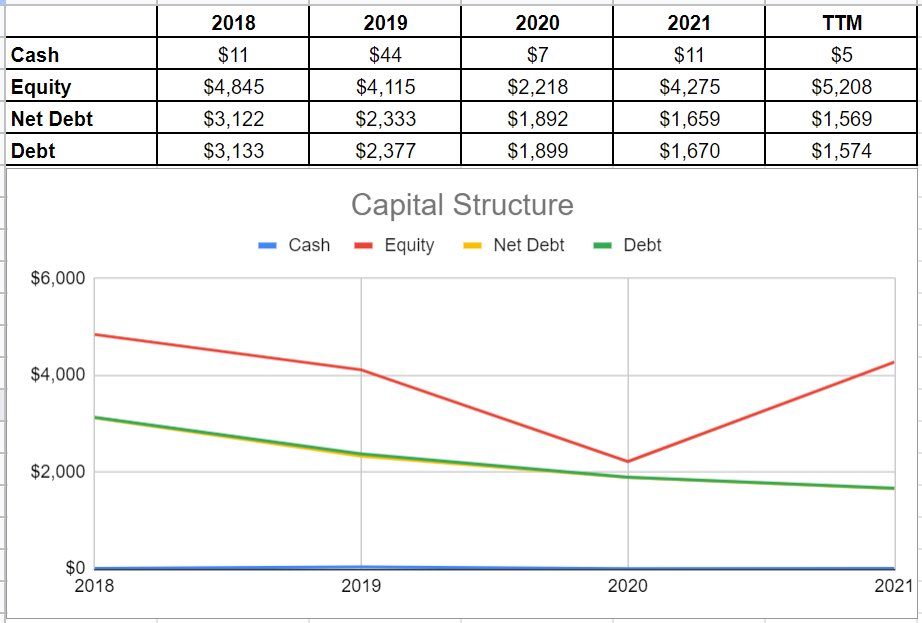

Scratching beneath the surface and analyzing the company’s capital structure shows that after a severe drop in total equity in 2020, down 46% from $4115 million in 2019 to $2218 million in 2020, it increased back to $4275 million in 2021. Also, we observe that Crescent point’s net debt shrank to $1659 million in 2021 versus its level of $1892 million at the end of 2020, with a 12% decline. CPG’s current net debt is well beneath its net debt of $2333 million at the end of 2019 when the WTI oil price was about $57/bbl. In the company’s last report, cash and equivalents have declined by 54% to $5 million. CPG’s debt amount is far lower than its equity level. Thus, by analyzing the company’s capital structure, Crescent Point’s healthy position could be seen (see Figure 3).

Figure 3- CPG’s capital structure (in millions)

Author (based on Seeking Alpha data)

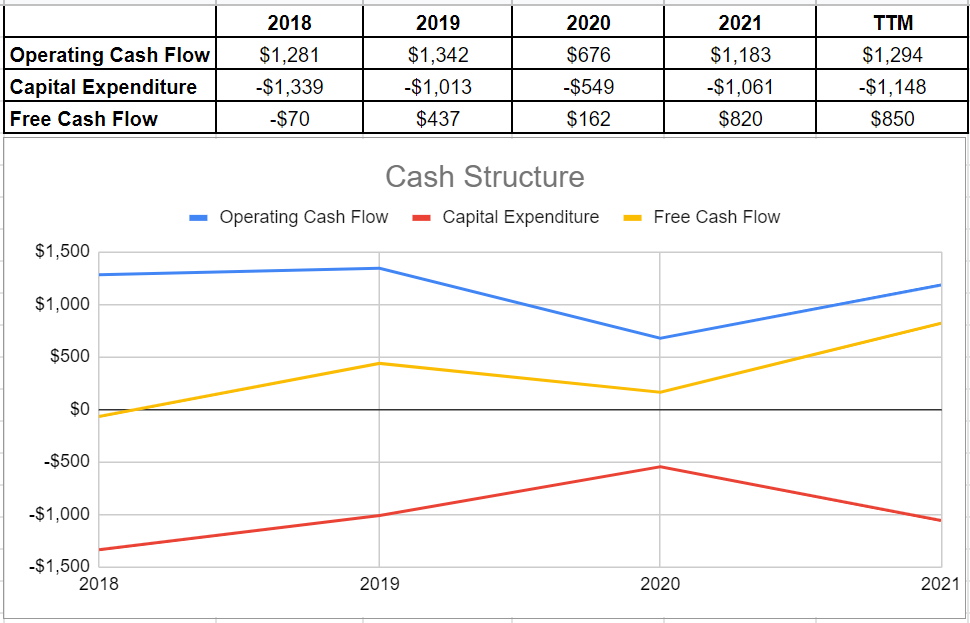

Analyzing Crescent Point Energy’s operating conditions indicate that CPG’s operating cash flow surged amazingly from $676 million at the end of 2020 to $1183 million at the end of 2021. This amount is very close to the result of $1342 million in 2019 before the COVID-19 pandemic started. On the other hand, CPG’s capital expenditure saw a massive increase from $549 million in 2020 to $1061 million in 2021. When all was said and done, the company ultimately produced $820 million free cash flow in 2021 compared with the previous level of $162 million in 2020 (see Figure 4).

Figure 4- CPG’s cash structure (in millions)

Author (based on Seeking Alpha data)

CPG stock valuation

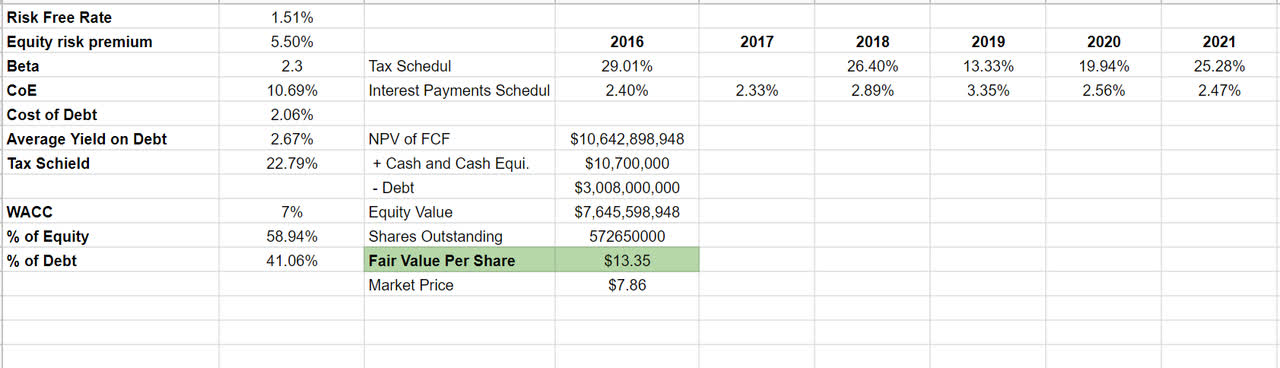

Analyzing Crescent Point Energy’s financial condition indicates that the stock is a good scope for investment, with healthy and well-performed cash and capital conditions. Albeit fairly volatile due to the fabric of the industry, I consider Crescent Point stock undervalued. Even if the oil price declines, the company will be preserved because of the company’s free cash flow generation ability. Moreover, the management’s hedging strategy will help them to be conserved from unpredictable downturns in oil prices in the future. Apart from the company’s performance analysis, I used Discounted Free Cash Flow model to evaluate the stock’s fair value. Notwithstanding being quite conservative, the DCF model indicates that the stock, based on its return in the future, is undervalued and has an upside potential to reach around $13 (see Table 1).

Table 1- CPG stock valuation

Author

Summary

In terms of the market outlook, oil and gas prices will remain high as long as the war in Ukraine and west sanctions against Iran are going on. In terms of financial condition, the stock is a good scope for investment, with healthy and well-performed cash and capital conditions. In terms of valuation, the DCF model shows CPG is undervalued and is worth $13 per share. With WTI oil prices above $100 per barrel, CPG stock is absolutely a buy.

Be the first to comment