peshkov/iStock via Getty Images

Crescent Energy (NYSE:CRGY) just announced another acquisition. The company is likely to make several acquisitions in the future because that was the main purpose of creating the company in the first place. Management believes there are a fair number of good deals out there and wants to take advantage of those good deals.

This is actually a switch for KKR (Kohlberg Kravis & Roberts) because the firm usually does leverage deals and then deleverages as fast as possible. But that strategy really did not work very well in this industry. This time around the deals are going to be done with the aim of keeping the financial leverage low. The profits will be made through accretive deals and operating leverage.

This management usually has a fairly high bar or goal for profits from any venture. They do not always achieve that goal. They do succeed more often than not. The combination of a very experienced management and low debt reduce some of the risk of this venture. The fast growth can create a logistical optimization nightmare. However, management experience should be able to handle the acquisition optimization process.

Still this oil company is far more likely to grow through acquisitions with some organic growth. That plan may not be suitable for all investors because this is not a traditional upstream company growth plan. Nonetheless this is a crowd that is knowledgeable about deal making. So, this company should have an interesting future.

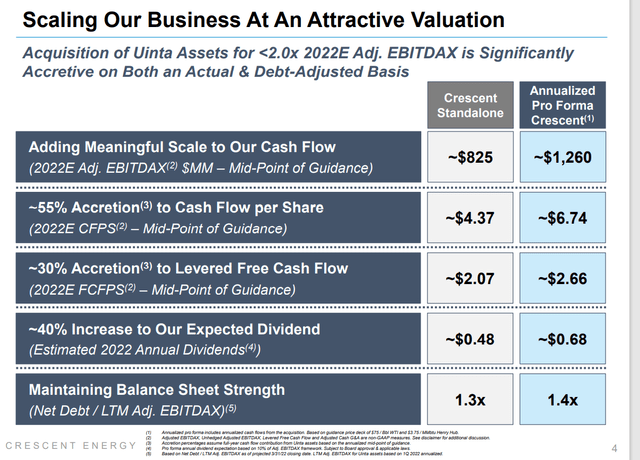

Crescent Energy Acquisition Benefits Detailed (Crescent Energy Acquisition Presentation February 2022)

The relaxation of discipline comes from the “fine print” at the bottom of the slide. The commodity price assumptions have risen from the assumptions used in the previous year. That adds a little bit of risk to the forecast benefits of the deal. As long as management can hedge to protect the first year or two, the fast payback of the initial investment should assure a decent deal. There is always the risk that the forward curve moves into disappointing territory before all the hedges can be executed.

Management did a recent filing that has some proforma adjustments for the acquisition. That history will not mean much as selling prices have materially changed in the current fiscal year. There is a hedging program in place that is detailed in the filing. But no one ever hedges 100%. So, the current fiscal year is likely to being with quite a lot of good reports.

Any of the acquisitions done in 2020 and 2021 were likely done with far more conservative pricing assumptions. Those deals that have formed the company are likely to show profits far beyond the expectations made at the time of the deals. That alone likely makes the current stock price cheap.

It also points out that deals during periods of strong pricing are likely to be made at lower multiples because both the buyer and the seller recognize a cyclical pricing peak (which could be right now). The real question is “is the newer pricing assumptions used above conservative enough?”. That is really up to the individual investor to decide. The current pricing environment will likely make any management look like geniuses. The real key will be company performance during the next cyclical downturn.

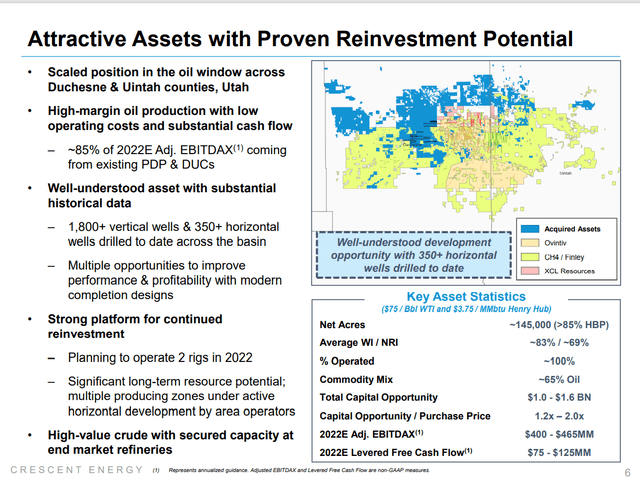

Crescent Energy Discusses Acquisition Profit Potential (Crescent Energy Acquisition Presentation February 2022.)

The strategy appears to be one of reinvesting cash flow in (hopefully) highly profitable wells. The sheer number of vertical wells appears to make this an “Austin Chalk” situation where operators used horizontal drilling combined with modern completion techniques to revive the interval production. If that is the case, then the payback period of horizontal wells in this play could be very short at these prices. That would allow for at least two wells to be drilled with the same capital in one fiscal year.

Such a scenario would lead to rapid cash flow growth without debt expansion. A hedging program will preserve the ability to increase production during the beginning of a downturn if management deems that the proper strategy. The result would be a lot more production during periods of weak pricing to provide adequate cash flow until commodity prices recover to begin the next industry cycle.

Should the company succeed in keeping the debt ratios low when commodity prices are weak, then the company would be in a position to continue bargain hunting during a time of more conservative pricing assumptions. The risk of course is that any one of a number of assumptions made above may prove to be unattainable in the future. This is a very low visibility industry. So, all kinds of unpleasant surprises are possible.

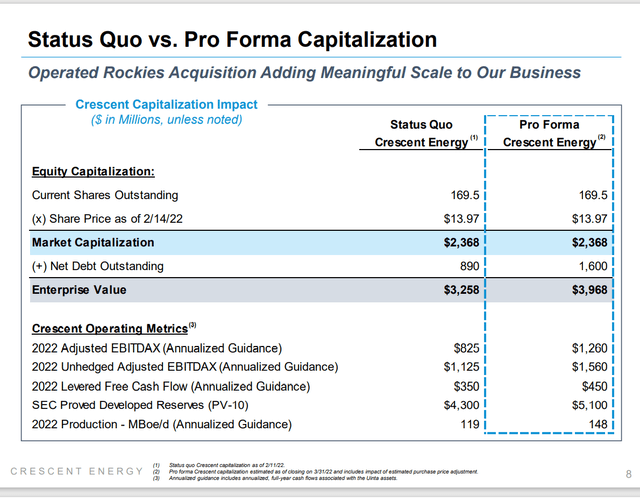

Crescent Energy Pro Forma Debt Analysis Including The Acquisition (Crescent energy Acquisition Presentation February 2022.)

Clearly the balance sheet of the company is strong enough for an all-cash deal. The guidance has been updated as a result of this proposed acquisition. The guidance will only last long enough to get management to the next deal. The only risk is the ability of management to generate sufficient cash flow during the next downturn to keep debt ratios low enough to avoid a financial crisis. The fast payback of the investment price is therefore critical. The likely plan to hedge production would provide considerable safety to the “return of the investment price fast” assumption.

The filing noted before does adjust this slide somewhat. But it does not appear that the adjustments are material, and this slide is an excellent summary (as opposed to a lot more detail in the filing). However, whenever a company updates financials, it is a good idea to review a current filing that updates information.

At this point Crescent Energy has a presence in several basins where operating improvements or attractive profit growth are available. The chances of failure decrease due to the diversification into several basins.

There is a lack of operating history by the company as it currently exists (let alone with a significant new acquisition to optimize). The market may keep the stock at a discount until investors are comfortable with the company growth plan and the ability of management to achieve the goals of these acquisitions.

Nonetheless, the company trades at a good bargain without any value for the experienced management that is bargaining for these acquisitions. Should management succeed in gaining the confidence of the market, then a higher price is likely to result.

There is always a risk of the backers taking the company private if a large discount persists. The backers can then either sell the pieces or merge the company at their leisure for a profit. Right now, though, management appears to want the benefits of a public stock. Therefore, it will be interesting to see how this rather unique operating plan works out in the future. The current price appears to have a lot of failure priced in. So, it will not take much success to create a significant revaluation upward.

Be the first to comment