piranka

Thesis

Calamos Long/Short Equity & Dynamic Income Trust (CPZ) is a fairly new closed end fund that IPO-ed in November 2019. The fund falls in the global multi-asset bucket since it can invest in both equities and fixed income on a global basis. Per the fund’s literature, CPZ employs:

- A cornerstone long/short equity strategy—a first in the listed US closed-end fund space—and a fixed income strategy work together to access global opportunities.

- CPZ’s design intends to optimize market complexities, such as volatility, low and negative interest rates, and high equity valuations.

- CPZ seeks to provide competitive distributions and capital appreciation by engaging in equity risks more efficiently.

Source: Fund Fact Sheet

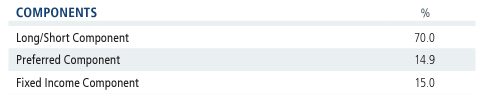

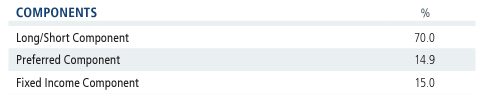

Currently the fund has a 70% equities allocation, a 15% preferred securities bucket and a 15% fixed income sleeve:

Components (Fund Fact Sheet)

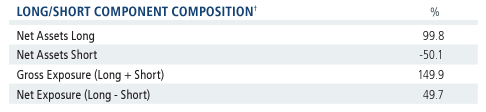

The fund is U.S. centric with over 80% of the portfolio components coming from the North American geography. In terms of the net equity position an investor should note that the fund has an approximate 50% short position within the equity sleeve:

Long / Short Component (Fund Fact Sheet)

All of the positioning has resulted in a robust performance in 2022, with the fund being down only -3.16% versus a -12.8% performance in the S&P 500. On the long/short equity side the fund tries to identify individual securities that outperform the index by going long those securities while shorting the index. The fixed income sleeve and preferred components are used to juice up the fund’s returns / dividend yield.

Ultimately an investor is buying into a management team here – as an investor you really do not know how the fund positioning is going to be next week or next month. The fund has a dynamic global allocation mandate and could switch easily to being completely long equities or overweight fixed income. As an investor you just do not know. There is not enough historical data to derive reliable multiple cycle analytics for CPZ, but on a 1-year lookback the fund has posted a negative Sharpe ratio with a 17.7 standard deviation.

CPZ can be a good story long term, and it has demonstrated its ability to outperform during a tough down market in 2022. At this stage we cannot foretell how the fund is going to change its positioning and short stance as the market continues to move forward. As any asset class which is long risk as CPZ is, it will post a positive performance upon recovery, but depending on the long/short allocation it will be a dampened one. We would like to see more historical performance here during multiple market cycles to better understand the portfolio manager’s ability to adapt and generate alpha before we can jump to any conclusions regarding CPZ. The fund has demonstrated its ability to be in the same cohort as other equity long/short funds and is using its fixed income sleeve to juice up the dividend yield. We feel it is too early to be able to think about buying or selling CPZ and we would like to see more data and trading patterns develop before having a recommendation on the name. We are therefore on Hold for CPZ.

Holdings

The fund has an equity sleeve, a preferred component, and a fixed income bucket:

Asset Class Allocation (Fund Fact Sheet)

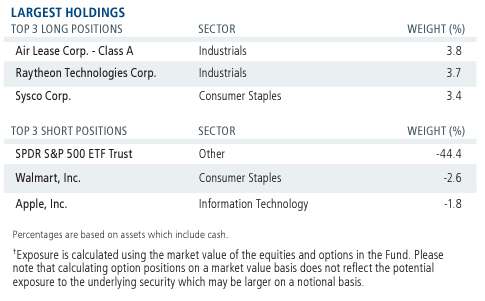

On the equity side the vehicle is long individual stocks while short the index:

Long short positioning (Fund Fact Sheet)

We can see that the majority of the short positioning is concentrated in the S&P 500 index with some small short positions on individual names. Some of the long/short positioning was successful while other ones underperformed:

We can see that the Air Lease (AL) long versus the index did not really do much with both tickers being down an equivalent amount in 2022. This means basically a net 0% total return for the fund. However the net long in Sysco (SYY) versus the index did deliver, with SYY actually up on the year while the index is down – the position delivered both on the long leg as well as on the short side.

Performance

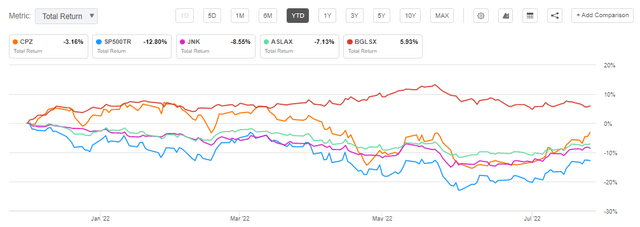

The fund is down only -3% year to date:

YTD Total Return (Seeking Alpha)

We can see how the fund’s long/short focus has helped it dampen the delta driven loses this year. The S&P 500 is down more than -12% currently while pure junk bonds are down more than -8%. Two other players in the equity long/short space, namely ASLAX and BGLSX are in the same cohort performance wise as CPZ. ASLZX has slightly underperformed CPZ while BGLSX has outperformed.

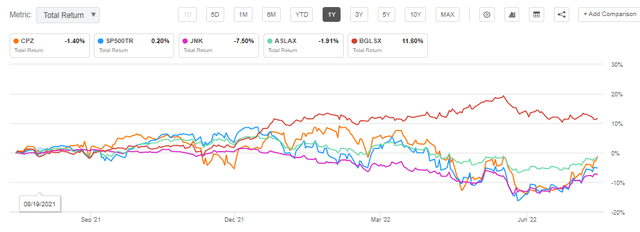

On a 1-year time frame the fund is fairly flat from a total return perspective:

1-Year Total Return (Seeking Alpha)

On the respective time period we can see a clear outperformance from Boston Partners Global Long/Short Fund (BGLSX) while the other instruments are in the same cohort.

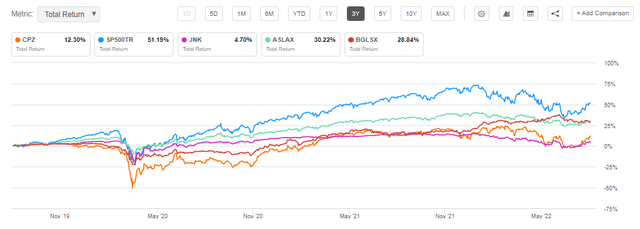

On a 3-year time frame the fund is up only 12.3%:

3-Year Performance (Seeking Alpha)

The fund is fairly new having IPO-ed only in November 2019 hence the total return performance is limited. So far, we can think about this fund as a vehicle with less upside during a market up-cycle but also with dampened downside during a risk-off environment.

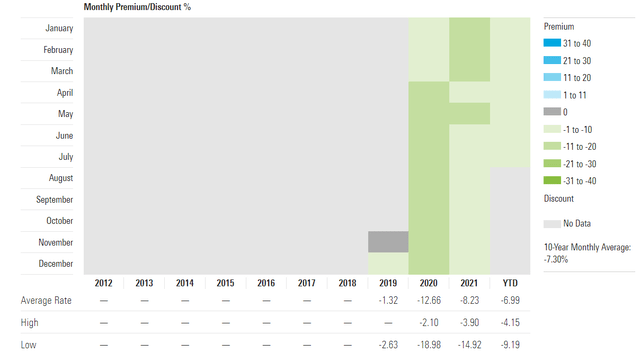

Premium / Discount to NAV

The fund has traded at a discount to NAV since inception:

Premium/Discount to NAV (Morningstar)

We feel the discount to NAV is due to the multi-asset flexibility the asset manager is allowed. The investor community does not have enough track record from the fund’s side to determine the exact dynamic of a multi-cycle performance, hence it will give it a discount until the fund “proves” itself. Expect the discount to persist and only start narrowing when the fund consistently posts positive results that are easily identifiable from a risk factor perspective during multiple market conditions.

Conclusion

CPZ is a global multi-asset fund that has a North America equities concentration. The CEF is set-up as a long/short fund and has successfully navigated a rocky 2022, so far being down only -3.16% year to date. The fund has a broad mandate and substantial flexibility regarding allocations and timing, making it a bit of a black box from an analysis perspective. The key to CPZ is underwriting the manager and the track record. Calamos manages several very successful funds and is establishing a decent track record for CPZ. So far, the identity of the fund revolves around finding alpha generating equity positions which are underwritten with delta hedges against the broad market via short SPY positions. The fund also juices up its dividend via its preferred/fixed income sleeves. Although the fund is up since inception its implied annual performance is fairly low at approximately 4% and we would like to see more of a track record for the vehicle. We are therefore on Hold for CPZ.

Be the first to comment