esvetleishaya/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 8th, 2022.

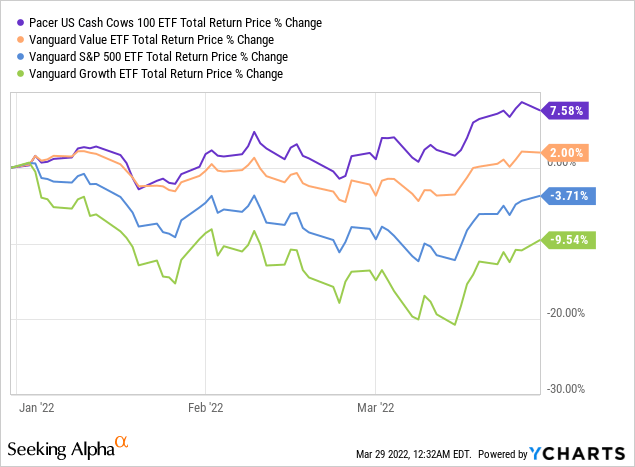

Value stocks have outperformed YTD, as investors reassess frothy tech valuations in the face of higher interest rates, surging inflation, and geopolitical risk. Growth offers the strongest potential long-term returns, but when times are tough cash is king, and investors flock to cheap, cash-flow generating companies. Which is where the Pacer US Cash Cows 100 ETF (BATS:COWZ) comes in.

COWZ invests in U.S. stocks with above-average free cash flow yields. Cash cows, basically. COWZ’s underlying holdings are comparatively cheap, which should lead to strong, market-beating returns when valuations normalize. This has been the case YTD, and the trend is set to continue. In my opinion, at least. The fund is a buy, and particularly appropriate for investors looking for value funds. As COWZ only yields 1.4%, it is not an effective income vehicle, nor particularly appropriate for income investors.

COWZ Basics

- Investment Manager: Pacer ETFs

- Expense Ratio: 0.49%

- Dividend Yield: 1.41%

- Total Returns CAGR 5Y: 16.93%

COWZ Overview

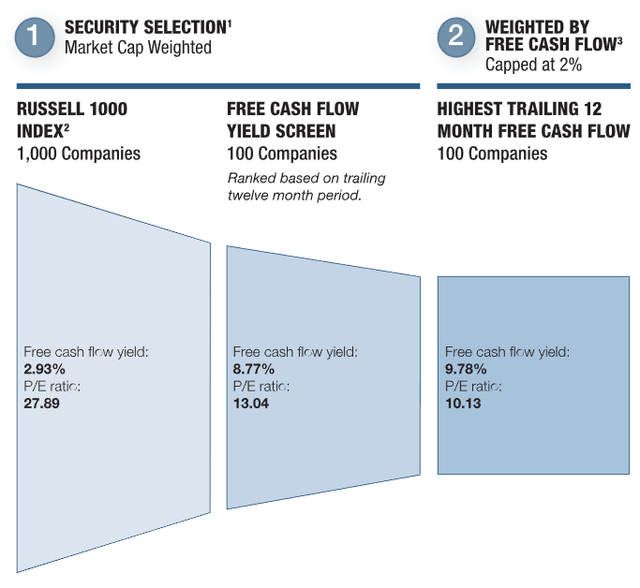

COWZ is an equity index ETF. It is a relatively simple fund, which invests in the 100 companies with the highest free cash flow yields within the Russell 1000 index, a broad-based U.S. equity index. It is a cash flow weighted fund: the higher the cash flow, the greater the weight. Weights are capped to ensure a modicum of diversification. Both the fund and the Russell 1000 index have several other inclusion criteria, centered on liquidity, size, etc., criteria, but nothing particularly impactful. COWZ is a simple fund, investing in U.S. stocks with strong free cash flow yields. A quick summary of the fund’s index / security selection.

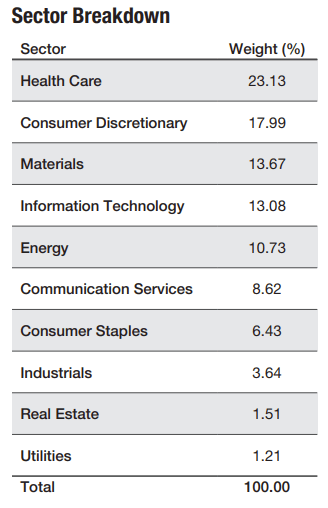

COWZ is a surprisingly well-diversified fund, with exposure to most relevant industry segment. The fund is overweight energy and materials, two sectors with comparatively cheap valuations.

COWZ Corporate Website

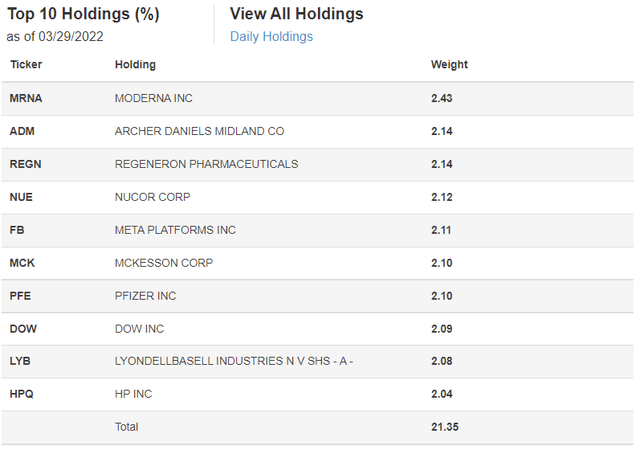

COWZ’s holdings themselves are reasonably well-diversified, with the fund investing in 100 stocks, and with the top ten of these accounting for just 21% of the value of the fund.

In general terms, COWZ only somewhat less diversified than a broad-based equity index fund like the S&P 500. As such, the fund could be a relatively large holding in an investor’s portfolio.

COWZ’s focus on cash flow is relatively rare amongst value funds, and a benefit for the fund and its shareholders. Earnings can be massaged, accounting book values rarely conform to actual market prices, but cash flow doesn’t (easily) lie, and is generally a more accurate measure of a company’s financial performance. Although this is the case, few value funds consider, let alone focus, on cash flow when constructing their portfolios, but COWZ does.

COWZ’s focus on companies with strong cash flow yields results in a fund with a comparatively cheap valuation. As per fund filings, COWZ sports a free cash flow yield of 9.8% versus only 2.9% for that of the Russell 1000 index, a very large, significant difference. COWZ’s 10.1x PE ratio is also significantly lower than the 27.9x of said index. Although not pictured above, and as per fund filings, COWZ sports a 3.0x PB ratio, also lower than the 4.2x PB ratio of the index. COWZ is also cheaper than other broad-based U.S. equity indexes, including the S&P 500.

COWZ’s cheap valuation is the fund’s most important characteristic and core investment thesis, and provides investors with several significant benefits.

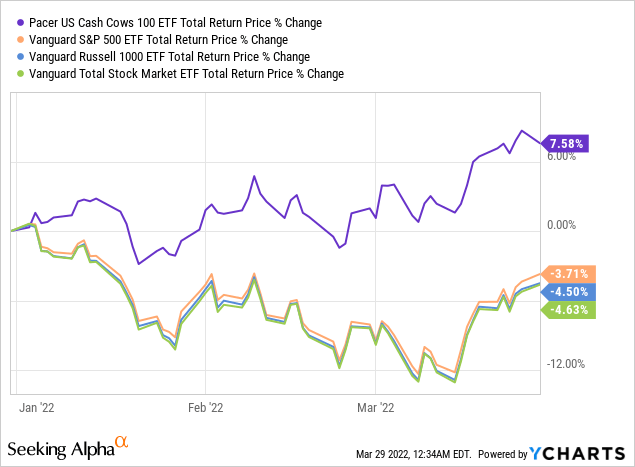

First, and most importantly, cheap valuations could lead to strong, market-beating returns if these were to normalize. This has been the case YTD, with the fund outperforming relative to most broad-based equity indexes, and by quite a large margin. Outperformance was due to valuations normalizing, buoyed by rising commodity prices, inflation fears, the prospect of higher interest rates, and geopolitical risks.

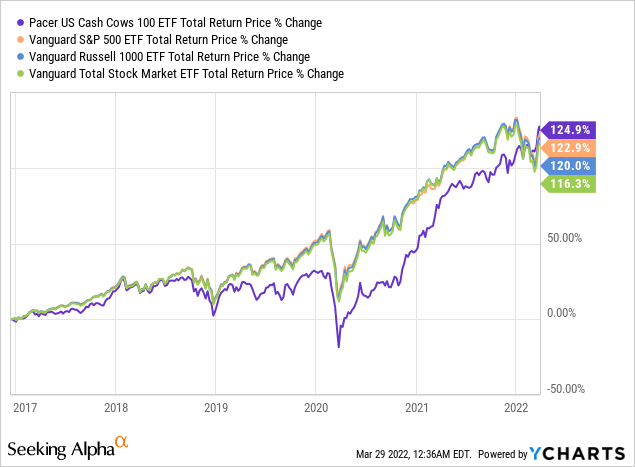

COWZ is also one of the few value funds that have outperformed U.S. equity indexes since inception, although only very slightly so. Still, these are broadly positive results, especially considering recent tech / growth outperformance. COWZ has performed reasonably well even under tough industry conditions, a benefit for the fund and its shareholders.

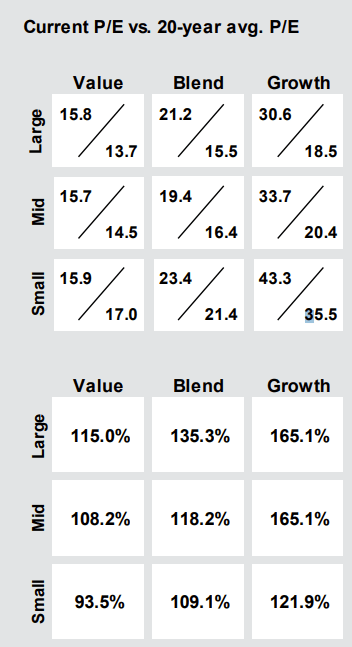

Valuations are strongly dependent on investor sentiment, especially in the short-term, and sentiment seems poised to continue rewarding cheap value stocks over more expensive growth and tech stocks. This is partly because markets remain fearful of rising inflation, the potential for higher interest rates, and continued political risk, and partly because large-cap growth stocks remain significantly overvalued relative to the market, and to their historical averages. In fact, as per J.P. Morgan, large-cap growth stocks remain 65% overvalued relative to their historical average, a very significant percentage.

J.P. Morgan Guide to the Markets

On a more negative note, and as can be seen above, large-cap value stocks are also overvalued relative to their historical averages, although by much less. Conditions are such that most U.S. equities should see losses if valuations were to normalize, but these should be significantly lower for value stocks. This has been the case YTD, with growth significantly underperforming, but value holding steady. As mentioned previously, valuations are such that value seems likely to outperform moving forward, but the possibility for significant gains seems quite low. Value simply does not offer sufficient value for significant gains to be all that likely, in my opinion at least.

Second, cheap valuations serve to somewhat reduce the possibility of significant losses, at least under current conditions. Remember, growth stocks are significantly overvalued relative to their historical averages, while value stocks are only slightly overvalued. Worsening economic conditions or market sentiment should

Finally, cheap valuations help make returns less dependent on fickle market sentiment. Companies with strong generation of cash can always choose to distribute said cash to shareholders, in the form of either dividends or share buybacks. Both of these, especially dividends, boost returns, and are not dependent on investor sentiment to do so. COWZ’s underlying holdings generate just slightly under 10% of cash, per year, after CAPEX. COWZ’s underlying holdings could choose to distribute said cash to shareholders, ensuring a 10% yield / shareholder return without considering possible dividend growth, capital gains, etc. These would be strong returns, all things considered. Most companies and equity indexes, including the Russell 1000, have much lower cash flow yields, and so are dependent on capital gains and investor sentiment for their returns.

COWZ’s strong free cash flow yield is the fund’s most important benefit, and core investment thesis.

Conclusion

Value stocks and funds could outperform if valuations normalize, as has been the case YTD. COWZ is a large-cap U.S. equity value fund, focusing on stocks with above-average free cash flow yields, and offers investors a particularly strong way to benefit from continued value outperformance. COWZ is a buy, and particularly appropriate for investors looking for value funds.

Be the first to comment