CoffeeAndMilk/E+ via Getty Images

Introduction

Coty (NYSE:COTY) is down 41% YTD, however, in my personal opinion, we now have an attractive entry point for a long position. Despite the fact that the company operates in the discretionary segment, which suffers more than others from rising inflation, pressure on profitability and lower consumer confidence, the company is able to work effectively in the current macro environment. Thus, thanks to successful product positioning (innovative products, new looks, and disruptive campaigns), price growth and sales volumes in the main sales markets, the company managed to demonstrate strong operating and financial results for fiscal year 2022, showing growth in revenue and growth in profitability.

Review of 4Q results (ended 30 June)

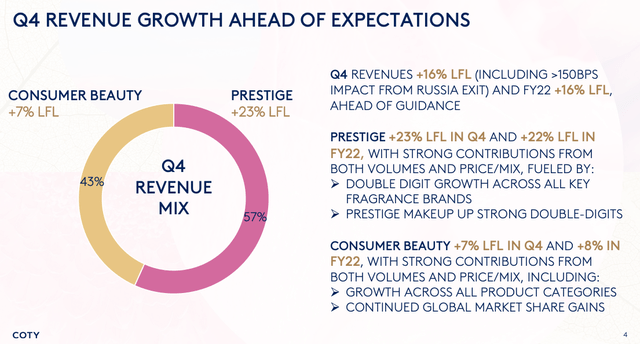

Despite rising inflation, the company managed to demonstrate not only revenue growth in the main markets but also an expansion of the gross margin. The company reported better-than-expected revenue and in-line EPS. Revenue growth was 10%, and LFL growth was +16%, including over 150 bps of negative impact from exiting its Russia business.

Revenue by segment

The company posted a positive LFL in both consumer beauty (+7%) and prestige (+23%) segments. In both segments, the company continued to increase its market share, successfully passed on inflation to the end consumer and increased sales. Revenue growth in the prestige segment was 16%, thanks to strong sales trends among brands such as Hugo Boss, Burberry, Chloe, Calvin Klein and Gucci Beauty. Revenue growth in the consumer beauty segment was 3%, but the company continued to increase its own market share in both segments.

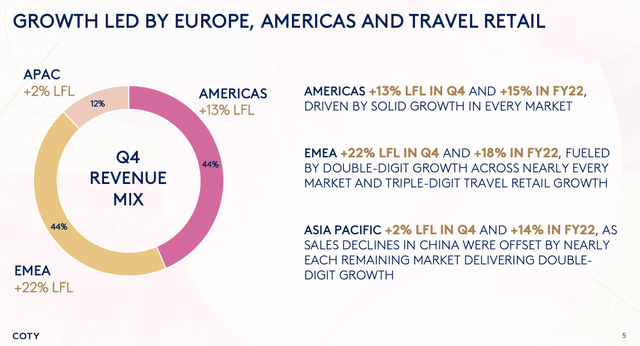

Revenue by geography

The company demonstrated revenue growth in all markets: Americas +14% (LFL +13%), EMEA +10% (LFL +22%), Asia Pacific -2% (LFL +2%). The decline in the APAC region is due to the COVID lockdown in China, which put pressure on sales, however, the easing of COVID restrictions in China should support sales in the following quarters, which is one of the drivers of revenue recovery. In addition, the effect of pent-up demand will support the next quarter’s results, in view of the growth of the share of urbanization in China and the recovery of consumer income.

Margin

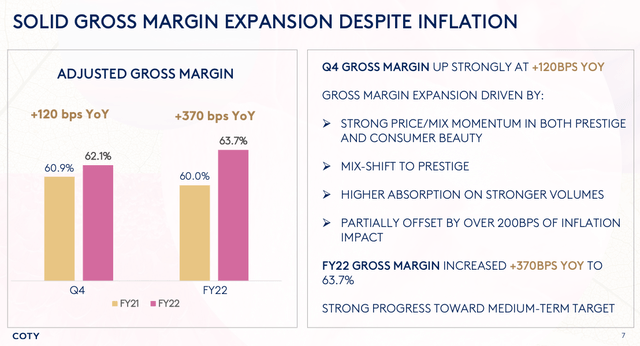

Despite rising inflation and input cost pressure, the company managed to increase its gross margin to 61.8% (+140 bps), adj. gross margin up to 62.1% (+120 bps) due to higher prices, favorable product mix and higher sales volumes. The operating loss was $77.4 mn. due primarily to $31.4 million of impairment charges and $45.9 million of costs related to the exit of Russia. 4Q22 adjusted operating income of $65.1 million rose from $45.3 million in the prior year, driven by a $14.9 million reduction in depreciation expense.

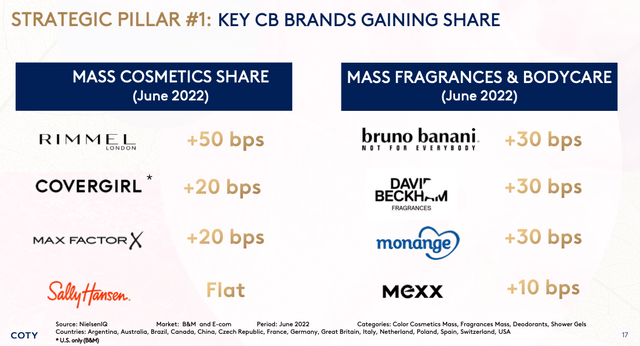

Market share

It is important to note that the company continued to increase its market share growth in both segments. In the consumer beauty segment, the market share growth was supported by the repositioning of key brands. In addition, adidas is currently undergoing a repositioning that should support market share in the coming periods. In the prestige segment, market share also increased, thanks to a recovery in sales to pre-pandemic levels and an increase in product range. In addition, management claims that there is still enough room in the segment to expand the product line and distribution channels.

Strategy update

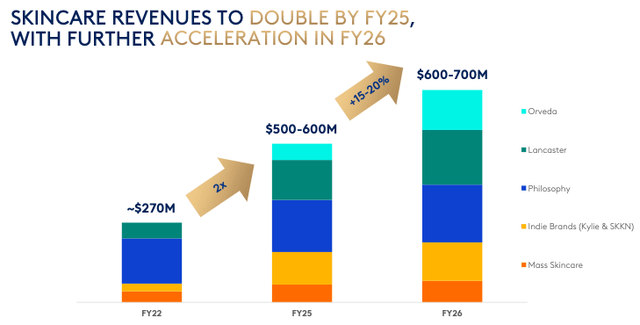

On September 22, 2022, the company pleasantly surprised the market with a new strategy, where the company plans to double the skincare business until 2026. Thanks to the new strategy, the company will be able to demonstrate an increased LFL of +8-9% in the next quarter, as well as increase the gross margin at a faster pace, which is especially important in the current macro environment.

I like that the company will continue to improve the product mix. Thus, the company aims to increase the share of prestige and reduce the share of mass cosmetics, which will have a positive effect on the profitability of the core business.

Thanks to the trend towards premiumization and control of operating costs, revenue growth will outpace the growth rate of expenses, as a result, the company will be able to demonstrate an improvement in profitability in the long term.

Drivers

Revenue growth: The company will continue to successfully pass on rising incoming costs to the end consumer. An increase in premium brand share will also help increase prices and market share.

Easing of COVID restrictions in China: While Q2 LFL in the APAC region was only +2%, the easing of COVID restrictions in China will boost demand for the company’s products in the coming periods, which should support revenue growth.

Growth in profitability: The company, according to the strategy, will continue to increase the share of premium brands (favorable product mix), which is a positive factor for operating profitability, as consumers in the premium segment are less sensitive to price increases.

Risks

Macro: Rising inflation and deteriorating consumer confidence may have a negative impact on demand for the company’s products, as a result, revenue growth may slow down.

Growing share of premium brands: If the company fails to meet its stated plans to increase the share of premium brands in its product mix, this may be negatively perceived by investors, as it will put pressure on profitability.

Conclusion

In my personal opinion, the company’s current strategy is clearly in line with current market trends and investor demands. Thus, the company continues to work successfully with the product mix, maintains and increases sales volumes and plans to increase operating profitability. Against the backdrop of declining YTD quotes and strong reporting for the 2nd quarter, I conclude that the company is successfully coping with inflation, increasing sales and profitability. I believe that the 1Q23 (fiscal) report will serve as a catalyst for the growth of the company’s shares.

Be the first to comment