nimis69/E+ via Getty Images

Investment Thesis

Coterra (NYSE:NYSE:CTRA) is a cheaply valued natural gas player. In fact, I make an impassioned argument that investors don’t need to overthink what is relatively simple. The world needs natural gas beyond this winter.

Meanwhile, investors have abandoned the energy trade for fear that in a recession, the price of natural gas will trade lower.

However, I argue that even though Coterra’s share price is back to where it was in March of this year, the underlying thesis has not changed. In fact, as you’ll see, the thesis has now improved.

The Natural Gas Trade Rolled Off, Why?

To answer the above question, two different aspects have surfaced in the past few weeks, that have worried investors. We’ll first discuss inventory levels, before discussing rate hikes and the impact on Coterra.

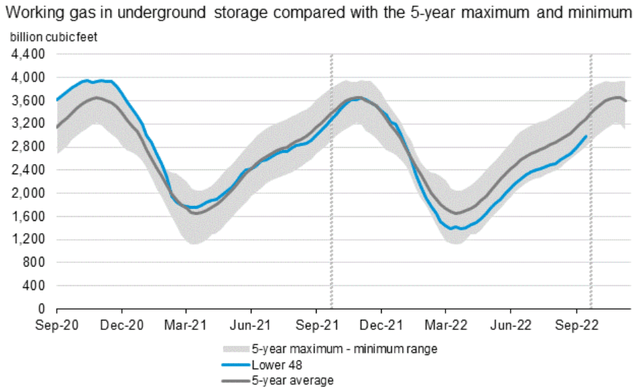

Approximately two weeks ago, on the 15th of September, the EIA’s report came out and took investors by surprise. It showed that gas storage levels had climbed from 54 bcf in the prior week to 77 bcf.

Essentially, this was not congruent with the narrative of a shortage of natural gas supplies and investors sold off from Coterra and other natural gas companies.

Then, more recent reports have continued to reflect further increases in natural gas inventories in the US, to the point that last Thursday saw inventories reach 103 bcf.

For investors that were already jittery, that headline was all that was needed for investors to exit their natural gas positions.

After all, think about it from the institutions’ and hedge funds’ perspectives. Energy has been one of the few pockets of the market that had actually been working in 2022.

So, given that hedge funds were more likely than not holding some gains in this space, particularly compared with other areas of the market, investors felt compelled to take profits off the table. They needed to offset some of the losses in other sectors of the markets.

Meanwhile, what the graph above shows is that natural gas prices remain towards the lower end of the 5-year average.

Simply put, there’s little ambiguity, that supply remains constricted, see the blue line for the lower 48.

And this leads me to discuss the second point. Investors have come to believe that if interest rates rise, this will dampen demand.

And while there are some elements of truth in that thesis, I believe that it’s an idea that has been carried away too far. There’s more nuance to this argument. And that’s what we’ll discuss in the next section.

Thinking Further Than This Winter

The market has become incredibly short-term oriented with investors unwilling to properly price equities until there’s a clear signal from the Fed that it’s done with raising rates.

Right now, there’s so much hope in the market that the Fed could be done with tightening market conditions. There are all kinds of considerations floating around for why the Fed can’t continue on the path that it’s on.

However, I don’t believe that Coterra shareholders need to be overly troubled by ”Fed-action”. Why?

Because there’s no valid reason for US natural gas prices to remain 6x to 7x cheaper than natural gas prices in Europe. After all, it’s a commodity. Yes, there are some transportation and cooling considerations that restrict a pure arbitrage taking place. However, over time, I believe there’s going to be arbitrage between prices in the US and elsewhere in the world.

For now, there’s difficulty in getting natural gas out of the US. But that’s not going to be the case forever. Indeed, at some point, the Freeport LNG facility will be back in operation.

And beyond that, as we look to start 2023, there’s really very little appetite from natural gas companies to ramp up capex. And why should they?

From regulatory bodies to shareholders, nobody wants to increase natural gas production. There’s just so much stigma against ramping up natural gas production. And what about management teams?

For their part, the management teams that have survived the previous bear market have learned the lessons from the previous down cycle from 2015 all the way to 2020. Again, nobody is overly keen to seriously resolve the energy crisis.

Incidentally, the simple fact that Coterra’s share price has gone nowhere since March 2022, tells you that the market itself doesn’t believe there’s much sustainability in natural gas demand.

And perhaps the most mind behind perspective is that everyone is so compelled towards getting off their dependency on fossil fuels and to double down on EVs. But how will EVs charge? Is there a scenario where a Tesla (TSLA) auto charges? Of course not! A Tesla gets charged mostly by burning fossils.

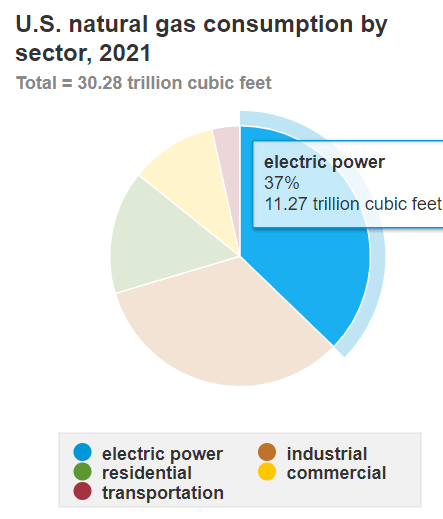

EIA natural gas uses

As you can see above, of the total natural gas uses, electric power and industrial uses, which include agriculture, account for 66% of the total usage. Moreover, roughly a third of the electricity production comes directly from burning natural gas.

Natural gas is simply not replaceable. That’s the biggest takeaway. Not this winter, and not next year either.

The Bottom Line

As it stands today, despite knowing all we know, investors are fleeing from energy stocks. Even though we are just as dependent on natural gas as we’ve ever been. No, that’s wrong. We are more dependent on natural gas than we’ve been in a long time.

We simply can’t prosper economically until we get access to cheap energy supplies. And as long as Europe continues to suffer from an energy crisis, there’s going to be an opportunity to monetize the discrepancy between low energy prices in the US and in Europe. And that’s going to fundamentally support US natural gas prices.

Presently, investors are only asked to pay 5x this year’s free cash flow for Coterra. Think about that for a moment. That’s the market saying that after 5 years of elevated free cash flows, this business has no terminal value. Oh my!

Be the first to comment