imaginima

Price Action Thesis

This is our detailed price action analysis of Coterra Energy Inc. (NYSE:CTRA) stock. We have already warned of ominous price action structures in several energy stocks that suggest investors need to be cautious of chasing momentum in so-called “cheap” energy plays that have gained significantly in 2022.

In late April, we discussed our thesis on natural gas leader EQT Corporation (EQT) as we saw menacing price structures forming. We also discussed our thesis on oil majors Exxon (XOM) and Occidental (OXY) in early June, seeing similar price action set-ups, and suggesting danger signs (See here and here).

We also saw warning signs in midstream leader Energy transfer (ET). Therefore, the point we are trying to make is, don’t get overexposed in the oil and gas plays. Despite their different business models, their price structures all bore striking warning signs of significant tops, which we usually call bull traps (significant rejection of buying momentum).

Why are retail investors still chasing to add energy companies when Energy Select ETF’s (XLE) corporate insider buys remain close to their 10 year lows (per Bloomberg data)? Furthermore, corporate insider sells are well above their 10 year highs, as insiders continue bailing out in droves.

Coupled with these ominous signals we observed in our price action analysis; we urge investors to heed them and not throw caution to the wind. We believe price action is always forward-looking and offers tremendous insights into the market’s forward intentions.

As such, we rate CTRA as a Hold for now, as it’s likely at a near-term bottom. But, we don’t encourage investors to buy the dip. Instead, investors should look for another short-term rally that forms a possible bull trap to cut exposure further.

CTRA – June’s Bull Trap Likely Ended The Party

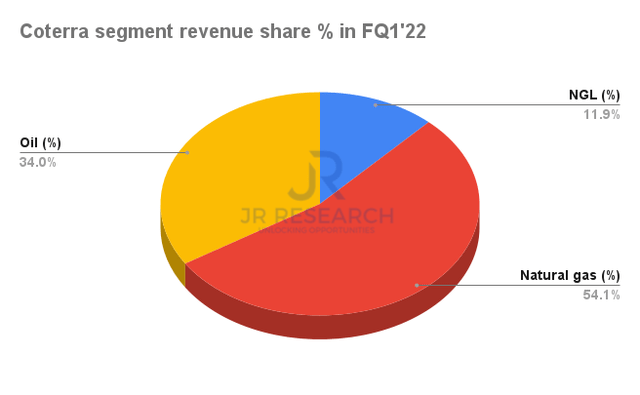

Coterra segment revenue share % in FQ1’22 (Company filings)

Following its late-2021 merger, Coterra resembles a diversified independent exploration and production company. Notwithstanding, its primary focus remains on natural gas and NGL, with a total revenue share of 66% in FQ1’22.

As a result, we observed that its price charts correspond more closely (but not identical) to EQT’s price charts, given their natural gas focus.

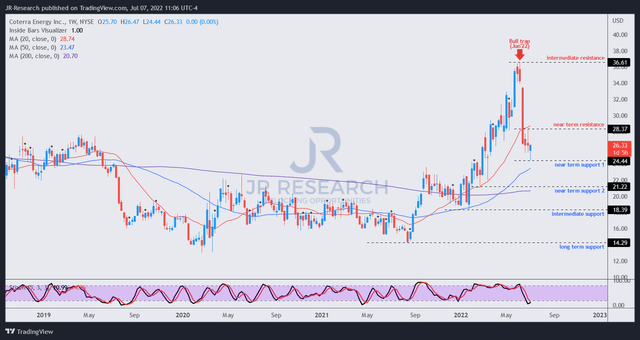

CTRA price chart (TradingView)

CTRA formed a massive bull trap in early June 2022, after a sharp run-up from the start of the year. However, the price action signals have already issued warning signs since late April, as enunciated in our EQT article.

Therefore the steep rapid liquidation of CTRA positions in June didn’t stun us, as the market capitalized on the recessionary focus to digest weak holders quickly.

However, we observed that CTRA’s technicals seem well-oversold in the near term, as it’s also consolidating at its near-term support ($24.4).

Despite that, our long-term charts indicate that the market could continue to force a steeper sell-off in CTRA after its current consolidation. Therefore, we will be on the lookout for a possible bull trap subsequently that could precede a steeper sell-off.

It’s still too early to determine an eventual sustained bottom in CTRA. But, we posit that investors looking to add exposure should consider the gap between its intermediate ($18.39) and long-term support ($14.29). However, it’s also predicated on constructive price action signals forming.

Is CTRA Stock A Buy, Sell, Or Hold?

We rate CTRA as a Hold for now.

Of course, we know CTRA last traded at a NTM FCF yield of 24.4%. Notably, the market set up June’s bull trap at a yield of nearly 20%. Is the market dumb? Are the energy insiders dumb? They can see these metrics too.

Given their collective intelligence, we believe the market and the corporate insiders know more than we do. And given the forward discounting mechanism of the market that can be construed through price action, we urge investors to heed significant caution.

Don’t buy this dip. And, watch for the next bull trap.

Be the first to comment