YvanDube

After the market closed on September 22nd, the management team at Costco Wholesale Corporation (NASDAQ:COST), one of the largest retailers in the world and a major player in the membership warehouse space, reported financial results covering the final quarter of the company’s 2022 fiscal year. For the most part, financial performance provided by the company was quite positive. Unfortunately, the firm has not released all financial data covering that time. At least not as of this writing. But based on the data we do have now and some estimates we can arrive at based on financial performance covering the first three quarters of the year, it is easy to say that shares of the enterprise are rather pricey. Although it is true that the fundamental performance of the company continues to improve, this priciness, both on an absolute basis and relative to similar players, should make investors think twice about buying the stock.

A solid quarter from Costco

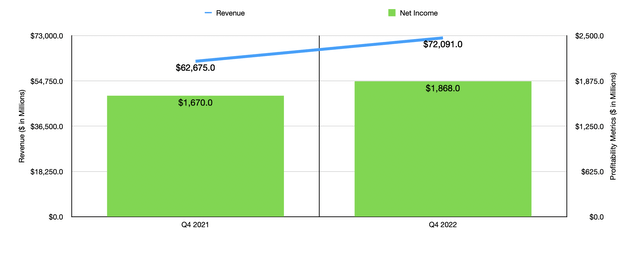

With 838 warehouses spread across the globe and a market capitalization of $221.3 billion, Costco Wholesale had to become one of the largest retailers on the planet. Over the years, the management team at the company has done a solid job growing the firm. That growth has extended through the 2022 fiscal year in its entirety. To see what I mean, we need only look at financial performance covering the latest quarter that management just announced financial data for. Consider, for starters, the revenue picture. Sales for the quarter came in $72.09 billion. This represents a sizable increase of 15% over the $62.68 billion generated the same quarter one year earlier. It’s also roughly $90 million higher than what analysts anticipated for the quarter.

Author – SEC EDGAR Data

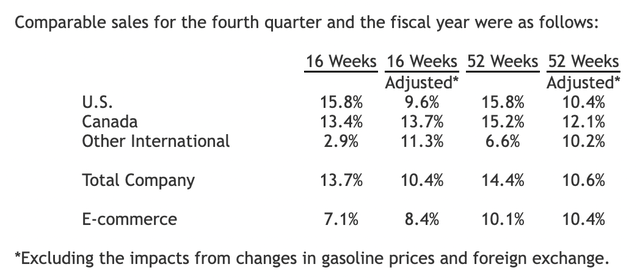

This increase in sales for the company was driven largely by strong comparable store sales growth. In the latest quarter, this figure came in at 13.7%. On an adjusted basis, it was a more modest but still impressive 10.4%. The strongest growth for the company came from here at home. In the US market, comparable store sales growth was 15.8%. In Canada, meanwhile, this figure was 13.4%. The only real weakness the company saw involved its other international operations excluding Canada. Comparable store sales in its other markets, which consist of Mexico, Japan, the UK, South Korea, Taiwan, Spain, France, China, and Iceland, came in at just 2.9%. After certain adjustments related to gasoline inflation and foreign currency fluctuations, it would have been far higher at 11.3%.

Costco Wholesale

This top line strength in the US was aided significantly by gasoline inflation and foreign currency fluctuations. Without those, the increase would have still been strong at 9.6%. Also in the US, customer traffic grew by 5.2%, while globally this number was 7.2%. The other key component to the increase in comparable store sales involved transaction value. In the US market, growth was 10%. And worldwide, it averaged 6%. During the year, the company also benefited from the opening of 23 new locations, which ultimately added some to its top line. Another thing that must be stressed is the strength of the company’s membership structure. Globally, membership fee income during the quarter came in at $1.33 billion. That was up by 7.5% year over year, aided by all-time high renewal rates. The overall number of paid household members came in during the quarter 65.8 million. That’s up 6.5% compared to the same time one year earlier. What also grew by 6.5% year over year was the number of cardholders, with that number ultimately ending the quarter at 118.9 million. Overall paid executive memberships end of the quarter 29.1 million. That’s up by 4.3%, or 1.2 million, over the third quarter of the year. Though not a terribly significant portion of the enterprise from a revenue perspective, memberships should be high-margin in nature. And finally, the company saw e-commerce sales grow by 7.1%.

On the bottom line, the picture gets a bit trickier. For instance, we do know that the company reported earnings per share of $4.20. That matches what analysts anticipated. In absolute dollar terms, net income came in at $1.87 billion. That compares to the $1.67 billion reported one year earlier. Unfortunately, however, the firm has not yet released all of the financial performance covering the final quarter of its 2022 fiscal year. So we don’t know exactly how much operating cash flow or EBITDA the company reported. But given that net profits increased by 11.9% year over year, and both adjusted operating cash flow and EBITDA were higher year over year for the first three quarters, it’s probable that the fourth quarter was positive for those as well.

Author – SEC EDGAR Data

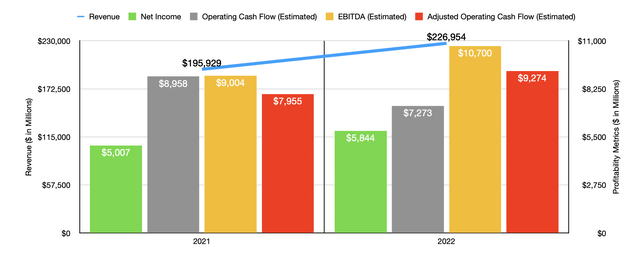

Thanks to this strong performance for the company, sales for the entirety of the 2022 fiscal year totaled $226.95 billion. That translates to a 15.8% increase over the $195.93 billion generated for the 2021 fiscal year. Net income ended up coming in at $5.84 billion. That’s 16.7% above the $5.01 billion that the company reported for 2021. Again, we cannot yet know what other profitability metrics looked like. But if we were to analyze the data based on what the company saw during the first three quarters, we should anticipate operating cash flow of $7.27 billion, down from the $8.96 billion generated in 2021, and EBITDA of $10.70 billion, up from the $9 billion seen one year earlier. If we adjust for changes in working capital, then a rough estimate for her operating cash flow would be around $9.27 billion. That’s up from the $7.96 billion reported in 2021.

Author – SEC EDGAR Data

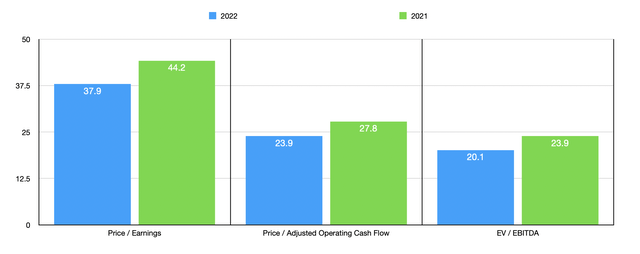

Assuming that these numbers ultimately come to fruition, then we can calculate that the company is trading at rather lofty levels. The price to earnings multiple, for instance, would be 37.9. This compares to the 44.2 that we get when using data from 2021. The price to adjusted operating cash flow multiple would be considerably lower at 23.9. This is still lofty but is lower also than the 27.8 reading that we get using data from last year. And finally, the EV to EBITDA multiple would come in at 20.1. That compares to the 23.9 reading that we get using data from 2021. As part of my analysis, I also compared the company to five similar firms, with two of them being much more similar in nature than the other three. On a price-to-earnings basis, these companies ranged from a low of 9.1 to a high of 26.6. On a price to operating cash flow basis, these companies ranged from a low of 4.2 to a high of 17.6. And using the EV to EBITDA approach, the range was between 3.8 and 13.1. In all three cases, Costco Wholesale the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Costco Wholesale | 37.9 | 23.9 | 20.1 |

| Walmart (WMT) | 26.6 | 17.6 | 13.1 |

| BJ’s Wholesale Club Holdings (BJ) | 21.1 | 14.4 | 12.8 |

| Target (TGT) | 17.4 | 14.1 | 10.3 |

| The Kroger Co (KR) | 13.8 | 6.1 | 5.9 |

| Albertsons Companies (ACI) | 9.1 | 4.2 | 3.8 |

Takeaway

From both a revenue and profitability perspective, there is no doubt that Costco Wholesale posted strong results for its quarter. These results were also instrumental in helping the company achieve strong performance for the entirety of its 2022 fiscal year. Clearly, the company is a quality operator in its space and it continues to grow at a reasonable clip. But this does not necessarily make it a great investment opportunity. Given how expensive shares are, I was very close to rating it a ‘sell’, reflecting my belief that it would measurably underperform the broader market moving forward. At the end of the day, however, its strong year-over-year performance, particularly the growth associated with increased traffic, as well as the fact that it has cash in excess of debt of $4.49 billion, significantly reduces the risk should the broader economy suffer materially, it caused me to be less pessimistic about the foreseeable future of the enterprise. Ultimately, given the totality of the circumstances, I do believe that a more appropriate rating for the company right now would be a ‘hold’, with the view that it is likely to generate performance that more or less matches the market for the foreseeable future.

Be the first to comment