shaunl/E+ via Getty Images

Costamare (NYSE:CMRE) is a leading owner and provider of containerships and dry bulk vessels for charter with 76 containerships and 46 dry bulk vessels operating to date. I have participated in the stock price appreciation of CMRE since the end of 2021, and I believe that it still possesses upside with limiting downside, demonstrating a worthy risk-return trade off with the existing ‘stagflation’ outlook. This is mostly due to its competitive edge with fleet diversification and size in both the containership and dry bulk market, secured long to medium-term cash flow, and role as a potential inflation hedge.

Fleet diversification and size as the competitive edge

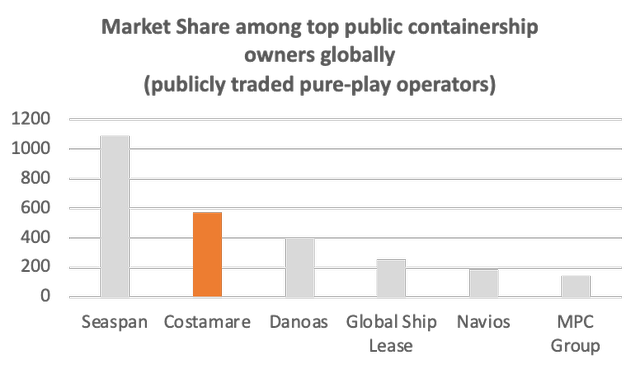

Compared to its peers, CMRE has a considerably diversified fleet with significant fleet size, especially in the containership market where it possesses a market-leading position. In the fiercely competitive shipping industry, Costamare’s large fleet size enables itself to secure businesses with large international liners, such as Maersk (OTCPK:AMKBY) and ZIM Integrated (ZIM), through potentially superior pricing and delivery capabilities. The pent-up demand from COVID lockdowns globally and worsening port congestion in China are contributing to Costamare’s booming overall revenue growth of 72% as its revenue is expected to remain at high levels, creating a new norm for the shipping industry.

Containership Owners Fleet Size (Author)

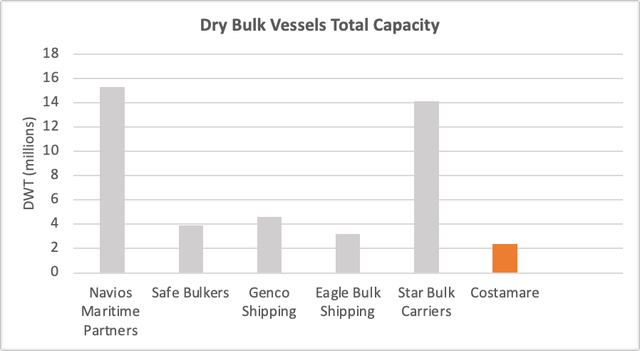

Meanwhile, Costamare’s entrance into the dry bulk business is expected to diversify its income stream that is dependent on short-term time charter rates, as compared to the long-term fixed charter rates in the containership market. However, it currently has limited capacity to compete with its larger peers with greater dry bulk capacity. With the orderbook for newbuilding dry bulk vessels sitting at an all-time low of 6.6%, Costamare is being cautious and disciplined when it comes to fleet expansion, and the company will have to navigate through tough times to exert dominance in this market. In the medium to long-term, Costamare’s dry bulk capabilities could play a significant role in capturing top line growth as the containership market steadies in demand over time.

Dry Bulk Vessels Capacity (Author)

Sum of the parts with secured revenue streams

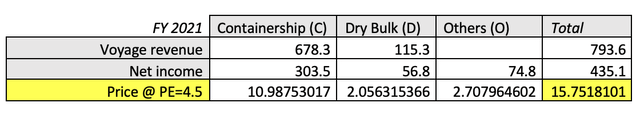

Costamare’s revenues are mostly generated through two business segments focusing on containership and dry bulk vessels charter, in addition to some additional income from the sales of assets and securities. Hence, a simplified sum of the parts valuation can be carried out to assess its fair value, as its containership business has contracted $3.3 billion worth of revenues with a weighted average duration of 4.1 years.

Assuming an average industry P/E ratio of 4.5 (Marine Transportation Industry Valuation), the company’s fair value evaluated using the simplified sum of the parts stood at $15.75 per share, which is quite aligned to the company’s current share price that trades at a slightly lower P/E.

Sum of the parts valuation FY 2021 (Author, CMRE SEC Filings)

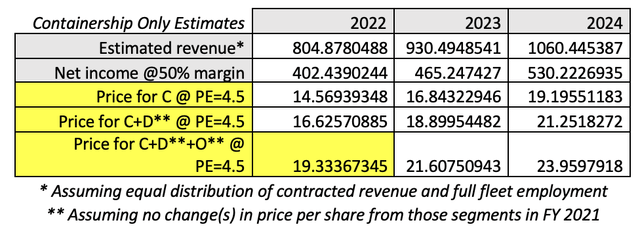

Considering the $3.3 billion of contracted revenue as future estimated revenues with given assumptions, Costamare could be valued at $19.33 per share at the end of FY 2022. The assumptions include no changes in price per share from dry bulk and other segments in FY 2021, and steady net income margin at 50%. These underlying conditions have potential room for improvement as the dry bulk market recovers, while larger fleet size allows room for margin increment.

As the shipping demand is expected to remain at high levels with limited possibility of significant competitive threat in the short term, Costamare’s stock price could appreciate by 33% to $19.33 within 6-12 months as displayed in the table below.

Sum of the parts fair value estimates (Author, CMRE SEC Filings)

Wild Card: Dry bulk market dynamics

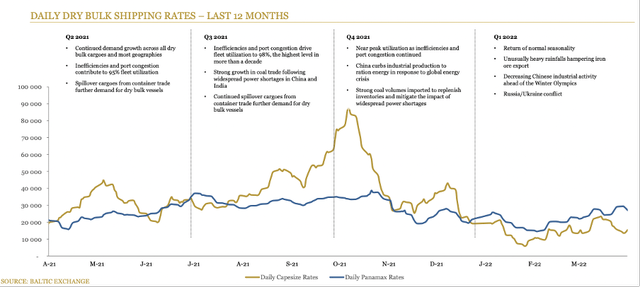

The residual development of its stock price could come from the fluctuations of Baltic Dry Index (BDI) that tracks the average price for dry bulk material transport due to high correlations between them.

CMRE vs BDI prices (TradingView)

With slowing economic outlook and improving port congestion, BDI has dropped significantly from its peak in late 2021. Despite newbuilding orderbook sitting at a historic low level, Costamare is well aware that such numbers could quickly increase, hence leading to an oversupply that significantly deteriorates the charter rates. The concerning supply-demand dynamics within the dry bulk market could indicate slow growth in the segment in the short term. However, this article does not aim to speculate the development of BDI, hence leaving the dry bulk segment as a wild card.

Daily dry bulk shipping rates (Baltic Exchange)

Inflation hedge with improving cash flows

Costamare’s asset-heavy nature demonstrates its potential as an inflation hedge amid the stagflation macroeconomic outlook. Its business model as a ship owner and provider enables itself to possess some degree of pricing power, while its greatest cost contributor, the vessels’ operating expenses, is less influenced by soaring inflation pressure as it does not pay for fuel prices.

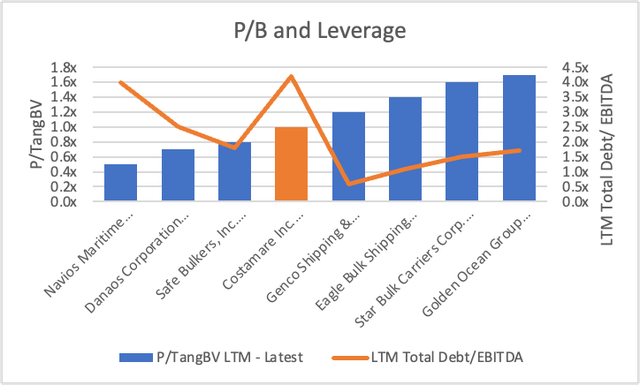

When compared with peers, Costamare’s P/B of 1.0 sits within the range of a better end (lower P/B is better). However, it has significantly higher leverage compared to the rest with similar book value ratios (lower total debt/ EBITDA is better). That may reflect Costamare’s recent fleet growth and it would have to impose greater financial discipline to minimise its substantial debt risk.

P/B and leverage peer comparisons (Author, Capital IQ)

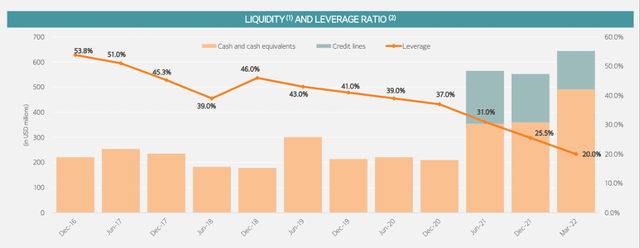

And, that is exactly what Costamare has been trying to do. The company brought down its leverage ratio to 20% and improve the liquidity position. It now possesses liquidity of $644 million to capture future growth, while maintaining a low quick ratio of 0.8 (lesser than 1 is good) to ensure sustainable leveraged growth.

Liquidity and leverage ratio (CMRE)

Risks

There are three key risks (competitive environment, sustainability-related regulations, and interest rate hike) that could be highly associated to Costamare’s business model.

Firstly, great competition within the shipping industry may harm the business’s top line over time if Costamare does not keep up with fleet growth and innovation. Costamare has to find a good balance between conserving stable financials and fleet development in order to withstand any competitive pressure in the future.

The company is also expected to keep up with IMO requirements and other rapidly evolving sustainability standards imposed by the US and EU. With the potential inclusion of maritime shipping into the EU Emissions Trading System (ETS) from 2022, Costamare may have to look for ways to better decarbonise its fleet and navigate its role within the carbon market.

Lastly, Costamare’s debts are all subject to variable interest rates, which will be negatively affected by the rising interest rate environment as major central banks began their tapering programmes. Hence, the company has taken hedging approaches to minimise the substantial harm it could bring to the net income margin.

Conclusion

Under the existing macroeconomic landscape, Costamare has steady growth outlook with undervalued financials for the short to medium term. As the company demonstrates improving discipline and good capital management, the risk-reward in buying the stock is lucrative and suitable for most investors looking for decent growth-value mix.

Be the first to comment