EzumeImages/iStock via Getty Images

Cosmos (ATOM-USD) has been dubbed the “internet of blockchains.” The goal of the project is to allow communities and other blockchains to express their own values without being at the mercy of other entities for infrastructure. For example, if a blockchain development team wanted to build a proof of work chain that connects to Cosmos, that team is allowed to do that even though Cosmos is a proof of stake system. The founders of Cosmos want to protect the sovereignty of blockchains and applications yet still provide interoperability with other chains.

Founders and Key Support

The original founders of Cosmos are Ethan Buchman and Jae Kwon. Kwon developed a consensus algorithm called Tendermint in 2014 with the specified purpose of addressing speed, scale, and environmental issues from proof of work blockchains. Cosmos utilizes that Tendermint algorithm. Ethan Buchman is the President of the Interchain Foundation and the CEO of Informal Systems. Informal Systems is the lead developer of Cosmos. Buchanan has a background in biology, neuroscience, engineering systems and computing.

There is definitely a philosophical lean to these entities that filters down to Cosmos as well. In his appearances publicly and in podcasts, Buchman talks about the sustainability of proof of work blockchains, environmental concerns, and the localization of blockchains and money. Buchman from a recent appearance:

Everyone is trying to build the one true solution to solve all of the world’s problems. That mentality in itself is a little bit troubling. What I’m hoping for is that we can focus on more local problems and geographically local communities to better support the systemic issues around globalization and the supply chain. Rather than everyone trying to be the one grand global financial solution, we can have more diversity of solutions and have them be a little more region specific to address problems in a particular area.

In addition to localizing economies and applications, Cosmos is an attempt at addressing energy consumption concerns that some cryptocurrency skeptics have with blockchain technology. Intentionally or not, I think Buchman has done a good job positioning Cosmos as a viable ESG play in the event that institutions start allocating larger portions of portfolios to the digital asset market.

Notable Applications

There is a difference between the Cosmos Hub which is the original blockchain in the ecosystem and the Cosmos SDK which is a bit like an enterprise solution for building other blockchains in the system. The Hub is the home of the ATOM tokens. The SDK is what is used by other platforms that build in the ecosystem.

I think a good way to frame Cosmos is as a layer-0 blockchain. Where Ethereum is a layer-1 that has layer-2 chains like Polygon (MATIC-USD) built on top of it, Cosmos is far more chain agnostic and attempts to allow for connection with any chain that wishes to join the ecosystem. Two of the top five tokens in the Cosmos ecosystem are Terra (LUNA-USD) and Crypto.com’s native token Cronos (CRO-USD). Terra and Cronos are notable examples of Cosmos-based chains though there are over 250 different apps and services in the ecosystem according to Cosmos. Defi, stablecoins, and payment processing are all utilities that Cosmos currently supports on the network.

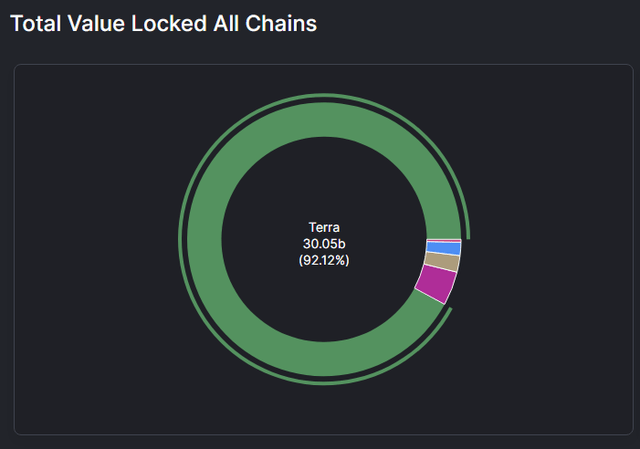

Cosmos Ecosystem TVL (DeFi Llama)

There is quite a bit of total value locked, or TVL, in the Cosmos ecosystem. At 92% of it, Terra is the overwhelming reason for that TVL growth according to Defi Llama. The only other Cosmos projects with TVL approaching or eclipsing $1 billion are Osmosis (OSMO-USD) at $1.3 billion and Kava (KAVA-USD) at $638 million. However, please keep in mind that many or most of the key metrics and dollar-denominated figures in this article are as of article submission and could potentially change drastically given the volatile nature of the digital asset market.

Market Cap and Top Tokens

The ATOM token specifically has a market cap of $7.1 billion. The current circulating supply of ATOM is 286,370,297. ATOM is ranked as the 23rd largest blockchain according to CoinMarketCap. The market cap of the entire Cosmos ecosystem of tokens is just under $83 billion. The top 5 tokens in the ecosystem are below:

| Token | Cosmos MC Rank | Total MC Rank | Market Cap |

|---|---|---|---|

| LUNA | 1 | 8 | $34.7b |

| (UST-USD) | 2 | 13 | $17.9b |

| CRO | 3 | 19 | $10.7b |

| ATOM | 4 | 23 | $7.1b |

| (RUNE-USD) | 5 | 42 | $3.2b |

Source: CoinMarketCap.com

While hosting four tokens in the top 25 by total market cap is impressive and shows the viability of the Cosmos network, Terra makes up a very large portion of the total ecosystem market cap at over 63% between just the LUNA and UST tokens.

Tokenomics

ATOM is not like a typical blockchain token that I have covered for Seeking Alpha before. There is no supply cap to the token. It’s actually a highly inflationary token by design. The creators of ATOM specifically want to incentivize staking the token as a way to generate rewards. The level of inflation changes depending on how many of the ATOM tokens have been staked. The lower the level of staking, the higher the inflation becomes to incentivize more staking.

Not having a supply cap isn’t what makes ATOM unique. Ethereum (ETH-USD) for instance, doesn’t have a supply cap either. What makes Cosmos different from Ethereum is the rewards payout for staking isn’t in the native token. It can be paid out in any number of different tokens from chains that engage with the network. Because of this, I don’t think we can categorize ATOM as a utility token, it’s really more of a staking token. And that’s it. When paying fees for using the network, the ATOM token isn’t required. For some, this will be seen as a bug. For others, it is a feature.

Another way holders staking ATOM tokens have been rewarded in the past is through the “airdrop” model. When new projects come into the Cosmos ecosystem, the managers of those projects will occasionally reward ATOM holders with the native tokens of their project. Again, this sort of reward requires staking ATOM tokens on the network rather than buying and holding them in an exchange or even in a custodial wallet.

Summary

Cosmos is a very interesting system. The ATOM token is not a token that I would recommend buying to just hold. If you do that, you’re probably going to get eaten by the token’s intentional inflation. To generate serious returns with ATOM, holders of the token have to stake it. Even then, the reward isn’t in ATOM itself. There are inherent risks with staking any token. Security concerns are something to consider. When you stake your tokens, you are giving up control of the asset.

Though I believe the Cosmos ecosystem itself has some merit, I personally don’t have exposure to ATOM at this time as an investment. I think a better course might be to find the chains and tokens that are in the Cosmos ecosystem and bet on those individually instead if you are a buy and hold investor. If you’re a very active cryptocurrency participant who understands staking, ATOM is probably worth a look.

We’re Getting Closer

My Seeking Alpha marketplace service Heretic Speculator PRO is coming in the next couple of weeks. As we get closer to the launch, I’ll get into more of the details about the service and the value proposition for subscribers. If you’re interested in digital assets, it’ll be right up your alley. Make sure you follow me so you don’t miss out on the best pricing!

Be the first to comment