zeynep boğoçlu

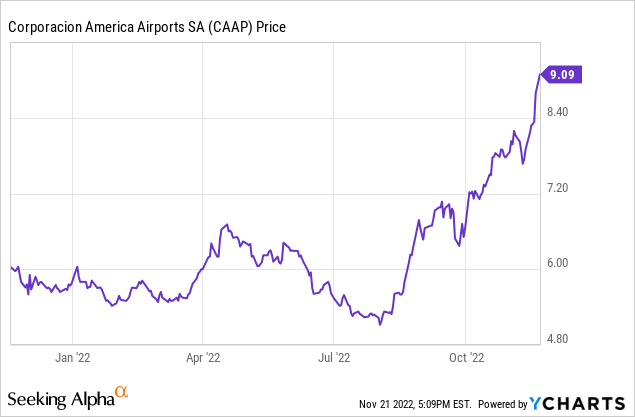

The world’s largest private airport operator by number of airports held, Corporacion America Airports (NYSE:CAAP) surged to new multi-year highs in recent days following another tremendous quarterly earnings report. Shares are now up more than 50% since the company reported its previous quarterly results.

Does this make it time to ring the register? I don’t see it that way. Sure, the stock is up a lot. But I see much more room to run. And it all comes down to those earnings, and the direction things are trending.

The Street Is Still Sleeping On This Company

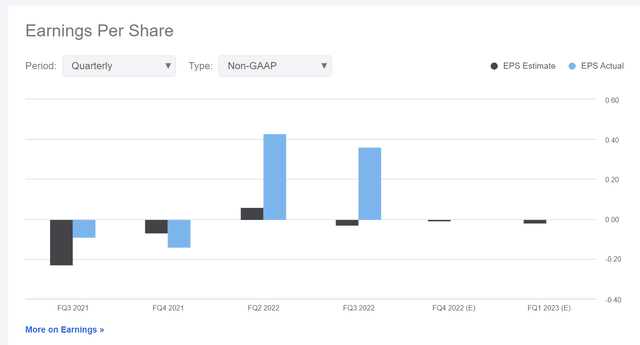

Last quarter, I pointed out that analysts had been wildly off the mark, with CAAP’s Q2 earnings of 43 cents per share absolutely blowing away the analyst expectations of a 6 cent profit.

But maybe that was just an aberration. Was there something that caused CAAP’s earnings to be unusually high or be one-off in nature?

No, no there wasn’t. Despite that, analysts seemingly didn’t get the message and continued to project mere breakeven results into 2023. Fast forward to Q3 results, and the company once again blew away expectations:

CAAP earnings projections (Seeking Alpha)

For Q3 ’22, CAAP delivered earnings of 36 cents per share versus analyst expectations of a small loss. One quarter is a data point, two makes a trend. Revenues surged 112% year-over-year, and the company jumped from being at essentially breakeven a year ago to making a large amount of net income.

The numbers show that the company has structurally improved its business and is now strongly profitable even on traffic levels that are still well below 2019 levels. CAAP’s management told analysts that they had cut 20% of the cost base during the pandemic but seemingly folks were still modeling CAAP as if it had the same unit economics as it did in 2019.

What We Learned In Q3

I published my Top Idea report about CAAP stock in October. That remains my long-form analysis of the company’s outlook and I recommend reading that for a summary of the company’s developments in recent years. So, what’s new subsequent to that report?

For one thing, last week’s Q3 results show that EBITDA through the first nine months of the year hit $339 million. With traffic and profitability trending up and the holiday travel season upon us, a strong Q4 should be expected as well. In other words, we’re looking at close to $500 million of adjusted EBITDA for full-year 2022, and well above $600 million for 2023.

Shares are currently selling at around 6.5x EV/EBITDA on a trailing basis, and closer to 5x looking forward. See the prior article for much more detailed math.

Longer-term, I believe shares should trade for at least 8x EV/EBITDA and thus shares are worth closer to $20 instead of $9 where we are today.

CAAP shares have moved up 50% since the prior quarter’s earnings report, which is fitting as that was the inflection point where the company went from breaking even to being strongly profitable. Shares are now at less than 6x forward earnings (based on annualizing the last six months of results) and a similar level of EV/EBITDA. Such low ratios are not warranted for a solid quality fast-growing enterprise such as this one. I expect shares to continue to rally as the company posts more strong quarterly numbers and thus screens better and garners more attention.

CAAP Is Preferred Bidder For Two Nigerian Airports

What else might draw attention? CAAP announced this quarter that it is the preferred bidder for two new airport concessions in Nigeria. From the Q3 conference call:

Finally, as part of our development ambitions, we were named preferred bidders to run Abuja and Kano airports in Nigeria this month. We are now in talks with government officials about the terms of the concession agreements and we will update you on this matter as we make progress.

I can’t give you exact details on the financial terms here yet since nothing is finalized. However, we can get an idea of potential size. The Kano Airport appears to not be a significant airport in terms of scale, mainly just servicing domestic flights in Nigeria. It has just a couple of international routes and traffic has been well under 1 million passengers per year in recent years. I would view Kano as no more than a rounding error in CAAP’s future value.

The Abuja Airport, however, is quite promising. Passengers had been flat in the 4 million annually range until recent years, but had advanced to 5.5 million just prior to the pandemic. Traffic recovered to nearly full pre-pandemic levels in 2021.

I believe these figures could go much higher going forward. Abuja will never overtake Lagos in demand, of course. But Abuja is the capital city of Nigeria, and capital cities always tend to swing above their weight in terms of attracting international routes. Diplomats, lobbyists, non-governmental organization workers, etc. have disposable cash and want to fly direct.

The city of Abuja itself also has 1.7 million people. That’s not a huge city by emerging market standards, but it’s enough to have some traffic generational capabilities even aside from its status as a capital city.

To that point, the Abuja government tried twice to make major expansions to its airport. In 2006, a $101 million contract was awarded for expanding the airport with shopping, a hotel, private parking, and so on. However this contract was soon revoked. In the 2010s, the government made a contract process for the building of a second runway, but this was later withdrawn due to unexpectedly high costs. That said, the government was able to complete the construction of a new terminal building in 2018 which expanded the airport’s capacity to 15 million passengers annually.

This all speaks to an asset which has been underutilized. With a responsible owner and access to outside capital, there should probably be room for more runway capacity and a lot more monetization (hotel, shopping, warehouses, etc.)

CAAP has a buy & build model. It tries to acquire assets where it can put more capital to work making big expansions and modernizations. This is in stark contrast to the Mexican airport operators, which focus on free cash flow above all else. Mexican airport operators generally run with the intention to maximize the amount of dividends that they can pay.

CAAP, however, appears to be aiming to maximize its EBITDA. This is why I don’t believe we’ll see a meaningful dividend or share buyback from CAAP in the near future. Instead, look for them to keep finding more assets to put money into. We’ve seen big expansions at one of the Buenos Aires airports, Florence, and Brasilia within the CAAP family. Now CAAP is likely to put up some money upfront to win the Abuja Airport and then, under its leadership, hopefully expand it to 15 million passengers or more in coming decades.

CAAP is currently on pace to handle about 75 million passengers annually combined across its properties, and this figure should be closer to 85-90 million once we’re fully past the pandemic-induced drag on results.

Adding the Nigerian airports will tack on something like 6-7 million to that number immediately, or something like 7-8% overall, though do note that CAAP would own 51% rather than 100% of these new concessions. In any case, growth in earnings and EBITDA is also likely to be less since I’d imagine that Abuja has a significantly lower revenue rate per passenger and EBITDA margin than the average CAAP holding.

The upside, however, is that given that these airports are probably not very profitable today, CAAP should be able to get in at a fairly attractive price. Build some new shopping and other amenities and you get more revenues and higher margins.

Long story short, these Nigerian airports aren’t a game-changer for the thesis. But they are a validation of CAAP’s buy and build model and further the company’s footprint while incrementally reducing reliance on the core Argentine holdings. And this is a repeatable process. CAAP started with just the Argentine airports and has incrementally built the rest of the business over the past 20 years. Over a longer time horizon, they’ll keep attaching new cities and countries to the map.

Let’s take a different tack here. Despite the recent rally, CAAP still has a market cap of just $1.4 billion. For that, we get nearly all of Argentina’s commercial airports, plus the capital cities of Armenia, Brazil, Uruguay, Nigeria and a couple of significant tourist airports in Italy and Ecuador.

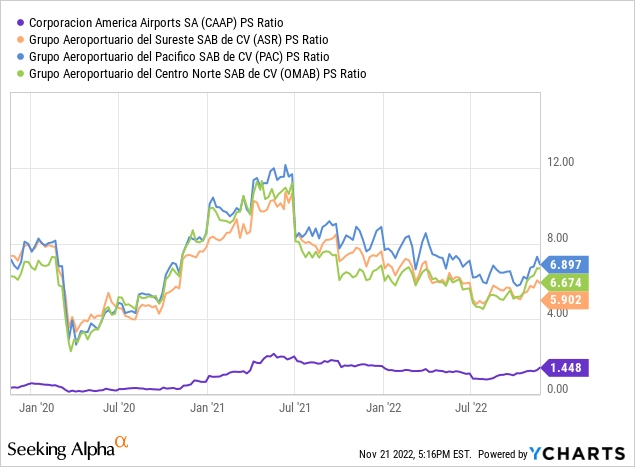

Sureste Airports (ASR) has a market cap of more than $7 billion for Cancun, Medellin, a JV in San Juan, Puerto Rico and a bunch of other smaller Colombian and Mexican airports.

I’d argue Buenos Aires, Brasilia, Florence and Pisa, Italy, Guayaquil, and Montevideo, Uruguay are at least on par with Cancun, Medellin, and San Juan.

Does that mean CAAP should have the same market cap as Sureste? No. Sureste has a far higher EBITDA margin (more optimized assets) than CAAP and Argentina understandably receives a significant governance discount versus Mexico. That said, are we going to look back and say maybe 5x the market cap for ASR’s grouping of airports was a bit excessive compared to CAAP? Yes, I think we might.

One final valuation metric, let’s think about price/sales. CAAP is now selling at 1.4x trailing revenues and less than 1.0x forward revenues. Here’s the comparison against the relevant Mexican airports:

Again, we can debate how much of a valuation discount CAAP deserves against the Mexican peers but this is ridiculous.

CAAP is going to produce more than $1.5 billion of revenues in 2023 against a market cap of $1.4 billion. Over the longer-term, airports tend to earn at least 50% EBITDA margins, and can get close to 70% with capable management and favorable concession agreements.

Airports are natural monopolies and have consistently grown at several times global GDP. What multiple would people pay for a software company with 60% EBITDA margins and 10% annualized top-line growth? 5, 7, 10x revenues? The airports serve as functional equivalents from a financial standpoint. And indeed, the Mexican airports have historically traded between 5 and 10 times revenues. And I’d argue that is perhaps too low, though that’s a topic for another day.

Regardless, CAAP at 1x forward revenues is just silly. And to get to 2x forward revenues, you have to add another $1.5 billion or so to the market cap, which takes CAAP stock up to $19 from the current $9 price. I’d argue 2x sales is still too low, but it’s a starting point.

I could keep going, but you get the point. CAAP stock is still profoundly mispriced at $9. Admittedly $9 is a slightly less egregious valuation than $6 last quarter or $2/share back in 2020. But this is still a global airport empire selling at far below any reasonable calculation of its fair value today, to say nothing of where it will be as its growth projects and acquisitions bear fruit.

Be the first to comment