John M. Chase/iStock Unreleased via Getty Images

Corning Incorporated (NYSE:GLW) is a global leader in specialty glass and ceramics. It was formerly known as Corning Glass Works and was founded in 1851. The company engages in panel display technologies, optical communications networks, environmental technologies (including glass solutions for automobiles), specialty materials, and life sciences businesses. In the Seeking Alpha community, the company is very well-rated. Although our internal team is positive about the company’s long-term goals, we are also more cautious about a likely slowdown in consumer spending activities.

Indeed, looking at the divisional level, display technologies and specialty materials account for almost 40% of the company’s total revenue line and are divisions very much exposed to consumer demand. Display Technologies’ margins were back to growth after a five-year period of constant decline. We are more positive about the automobile division and optical communications (both account for 42% of the total company’s turnover); however, lower vehicle production is also expected for 2023 and is not playing any favorable role in Corning’s revenue growth.

Despite that, in the past, Corning was able to experience revenue growth even in a declining market. For instance, between 2016 and 2021, smartphone volume CAGR declined by 2%, whereas the company’s display segment increased top-line sales by 12%. The same positive trajectory was recorded in the Automobiles division, where Corning’s ability is focused on its product MIX, which is in fact considerably higher than that of competitors; in addition, content per car stands at $100, while in the past was at $50.

Corning outperforming the market

It is also important to highlight its strategy execution called “More Corning“. The company’s intellectual property and portfolio synergies should be a key supportive catalyst for long-term profitability. The glass leader is targeting: 1) a shared manufacturing process in its core technology and 2) a common sales platform within its divisional segments. This should support economies of scale and scopes.

Q3 Results

Corning just released its quarterly accounts. The company sales stood at $3.67 billion and were up by 1% year-on-year. Cross-checking analyst consensus, turnover was slightly above expectation, while EPS was in line. Regarding the main division key takeaways, here are our main considerations:

- Display Technologies segment turnover was at $686 million, down by 28% on a yearly basis. According to Corning, sales decreased in line with the market and the company was able to maintain flat prices;

- Optical Communications’ top-line sales stood at $1.32 billion and were up by 16%. This was mainly due to broad-based strength across cloud solutions, 5G, and broadband;

- As already mentioned, Specialty Materials sales were below Wall Street analyst consensus and recorded $519 million in sales under 7% on a yearly basis and missing by almost $100 million the average estimates. This lower demand was driven by lower consumer expenditures on tablets and smartphones.

- Both Environmental Technologies and Life Sciences sales were up, respectively by 10% and 2% versus the same period last year. The Healthcare division results were partially offset by a decremental demand for COVID-19 diagnostic solutions.

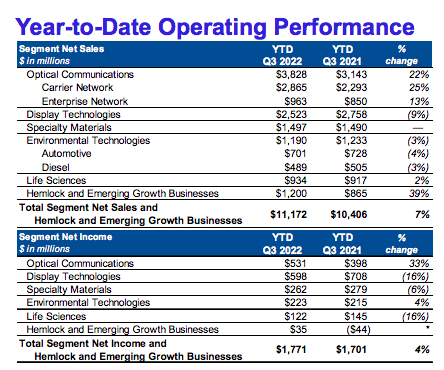

Corning 9M results comps

Conclusion and Valuation

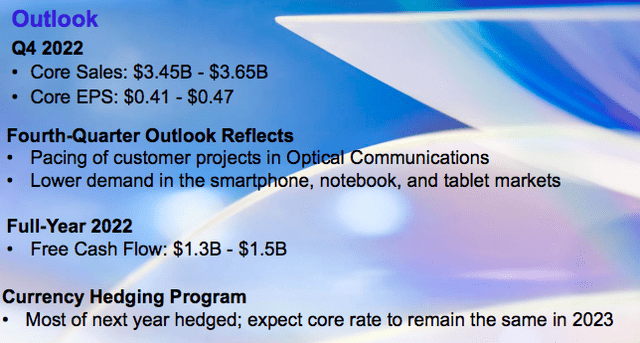

Gross margin was once again down. This was partially due to the lower volume in the Display division. Important to note is the fact that the company is guiding for lower revenue growth in Q4, including a decline in Optical Communications sales. Here at the Lab, we believe that the negative stock price performance was more due to the management’s future indication than the Q3 results. Indeed, comparing Wall Street estimates, the average Q4 revenue forecast was set at $3.85 billion with an EPS of $0.55, whereas Corning indicated a midpoint of $3.5 billion in sales and non-GAAP EPS between $0.41 and $0.47. For the above reason, we are more cautious in our 2023 Corning forecast and we are projecting an EPS of $2.5 per share. We decide to value the entity with a 14x P/E on our 2023 number, reaching a valuation of $35 per share, and assigning a neutral rating to the company. The main risks include FX, higher logistic costs, slower product demand, market share loss and higher energy prices.

Be the first to comment