Ali Shahgholi/iStock via Getty Images

Picking emerging technologies doesn’t have to entail taking on inordinate amounts of risk, as demonstrated by the recent rout in once high-flying tech stocks. In fact, many established companies that offer the picks and shovels that enable technology can be a just as good if not better value proposition.

Plus, unlike their tech counterparts, these companies pay their investors a meaningful dividend in the form of cold hard cash. This brings me to Corning (NYSE:GLW), which is one such company whose share price has been beaten down. In this article, I highlight what makes GLW a solid value candidate for long-term investors, so let’s get started.

Why GLW?

Corning is a leading global innovator of materials science, and has been around for over 170 years. It specializes in the production of glass, ceramics, and optical fiber, the latter of which makes GLW a crucial partner to the telecommunications industry. Corning has a leading market share in many end markets, and its products include flat-panel monitor displays, Gorilla Glass scratch resistant glass, gasoline particulate filters in cars, and optical fiber for broadband access.

What makes Corning stand out is the robust demand for its optical fiber products that serve as the plumbing for telecoms and the emerging 5G category. Moreover, Corning is also becoming an important player to the semiconductor industry through its 80.5% ownership stake in Hemlock Semiconductor, which manufactures ultrapure polysilicon for the semiconductor and solar industries.

This stake appears to be paying off well for Corning, as Hemlock grew its sales by 38% YoY during the first quarter. Moreover, Corning’s optical segment grew by a robust 28% YoY, followed by respectable 11% growth in the Display Technologies segment.

These factors contributed to strong overall core sales growth of 15% YoY, and were driven by growing demand combined with pricing actions taken by the company to combat inflation. Plus, Corning also benefits from its economy of scale, resulting in healthy margins and operating leverage. As shown below, GLW maintains an A profitability grade, with sector leading EBITDA and Net Income margins of 27% and 13%, respectively.

These strong margins mean that Corning should be able to continue investing in R&D, thereby continuing its track record of industry leading innovation, as remarked by Morningstar below in its recent analyst report. Notably, Morningstar has assigned Corning a narrow moat and an exemplary rating for its effective capital allocation strategy.

Corning is able to use its scale to invest heavily in research and development–$1 billion or more per year–and spread these expenses across its five segments. We think centralizing R&D allows the firm to manufacture products for a materially lower cost than its competitors, all while using this hefty investment to maintain an innovation lead that results in leading share positions in its end markets.

Corning’s cost advantage and intangible assets result in a narrow economic moat, in our view. We expect Corning to continue focusing resources on opportunities that align with secular trends toward connectivity and efficiency. We view the firm as a key enabler of 5G networks, providing the fiber backbone to network operators as well as selling Gorilla Glass into phone back panels to enable millimeter wave reception.

We also expect Corning’s ceramic substrates and gasoline particulate filters to enable automotive OEMs to achieve rising efficiency standards around the world. The firm is also poised to continue dominating the market for thin display glass as it operates three of the world’s four Gen 10.5 plants–the cutting edge for 65-inch and 75-inch screens. Finally, we think the firm’s pharmaceutical glasses will continue to disrupt the market for applications in vaccines, genomics, and drug development.

Risks to Corning in the near term include potential for supply chain disruptions and increased competition intensity. However, it appears that management has adapted the company through lessons learned from COVID, and is well positioned as a low cost leader through its integrated business model, as noted by the CEO during the Bernstein Strategic Decisions Conference this month:

To meet the demand last year, we had to run our operations little to no inventory, because demand was so strong and we had to stretch our assets beyond their normal life. And so what we’re hoping to do here is take the, sort of, pause that refreshes and get our latest technology, packages on some of these extended tags, and we’ll always manage supply to be imbalanced with demand.

And Buffett says you don’t pay for the castle, you pay for the moat. So we have huge competitive advantages in what we do. So therefore, our cost is tremendously lower than all of our competition. And we can uniquely do certain products, which makes our customers lock in with us, because we’re the only ones who can enable it. So the competitive intensity in glass is relatively low, compared with panel making where they buy equipment from others, where all of our stuff is bespoke, we design it, we build it, we own it.

Meanwhile, Corning maintains a strong BBB+ rated balance sheet. It also pays a respectable 3.3% dividend yield that’s well-covered by a 46% payout ratio. Notably, GLW grown its dividend over the past 11 consecutive years, including the past 5 years with a robust dividend CAGR of 12%.

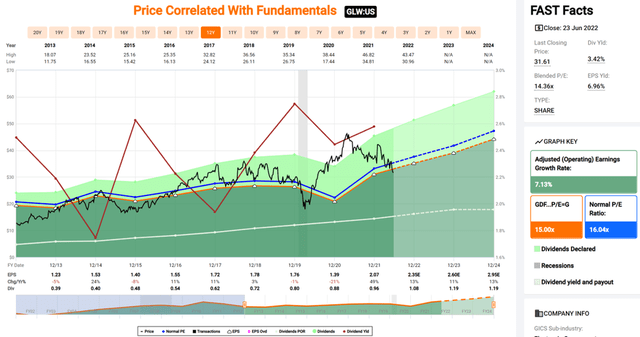

I see value in GLW given its recent share price weakness and the strong outlook. At the current price of $32.76, it trades at a forward P/E of just 13.9, sitting comfortably below its normal P/E of 16.0 over the past decade.

Analysts estimate high single-digit to teens EPS growth rates starting in Q3 of this year, and have a consensus Buy rating with an average price target of $43.50. This implies a potential one-year 33% total return including dividends.

Investor Takeaway

Corning is a market leader with a competitive moat and strong growth outlook. The company also sports a reasonably low valuation with strong EPS growth rates expected in the coming quarters. While there are near-term risks, I believe they are more than priced in at the current share price. In summary, I believe Corning is an attractive investment at current levels for its growing dividend and potential capital appreciation.

Be the first to comment