Wavebreakmedia/iStock via Getty Images

Corning (NYSE:GLW) is a company that we covered before; for readers that would like an introduction to the company, we recommend reading our previous article. Back then we thought Corning was fairly valued, and since then it has underperformed the market, decreasing a bit while the market went up somewhat. This happened despite an excellent performance by the company, which has compressed the valuation metrics and made the company a solid buy at these prices, at least in our opinion.

Fourth-quarter 2021 sales rose 10% year over year and 2% sequentially as Corning’s end markets continued to rebound from 2020. Double-digit growth in the display, optical, and life sciences segments more than offset seasonal weakness in specialty materials and continued automotive supply constraints in environmental technologies. Margins declined primarily due to inflationary pressures. Management is renegotiating pricing contracts across Corning’s end-markets and sounded confident that gross margin will expand in 2022.

Corning has been adding manufacturing capacity for its optical fiber products, which makes us confident this business will continue growing at a good pace and fuel Corning’s revenue growth for the next few years. We think this segment will be the main growth contributor for the foreseeable future.

It is important to note that Corning battled margin pressure throughout 2021, but new pricing arrangements and a renewed focus on profitability should improve the outlook for 2022.

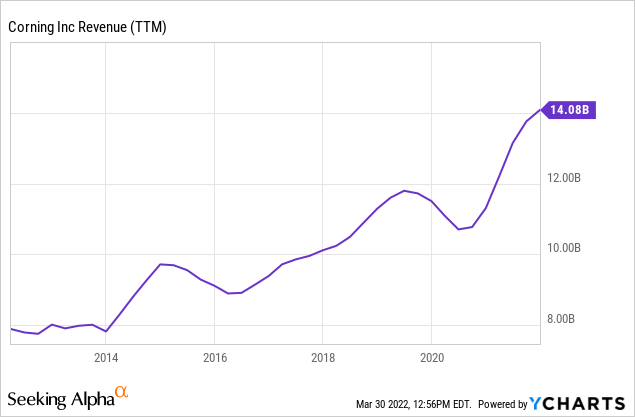

Financials

For the last 5 years revenue has tended to grow for Corning, even if there is a cyclical component to it. The trailing twelve-month revenue stands at ~$14 billion, after a significant increase during the last 12 months.

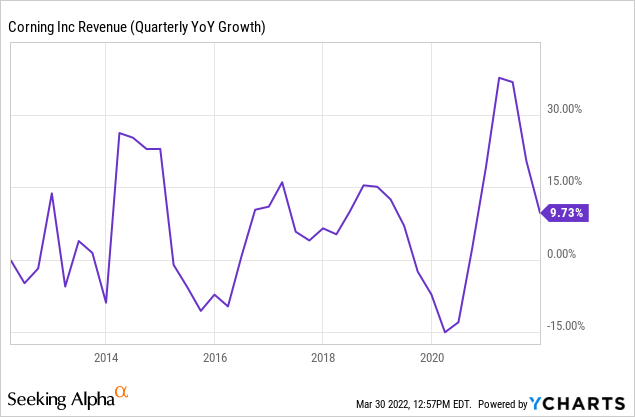

As can be seen below, revenue growth has wildly oscillated, from more than +30% to -15% in the last five years. This unfortunately is likely to continue, but we will not be too disappointed as long as the general trend continues to be up, and growth continues to outpace inflation by a significant margin.

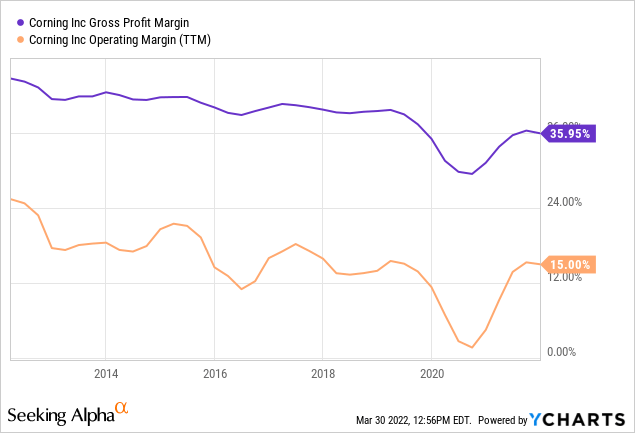

Unlike revenue, margins have been trending in the wrong direction; both gross profit margin and operating margin have in general trended downwards the last few years, with a significant dip during the period of Covid lock-downs in 2020. On the positive side, management is confident that margins should improve during 2022.

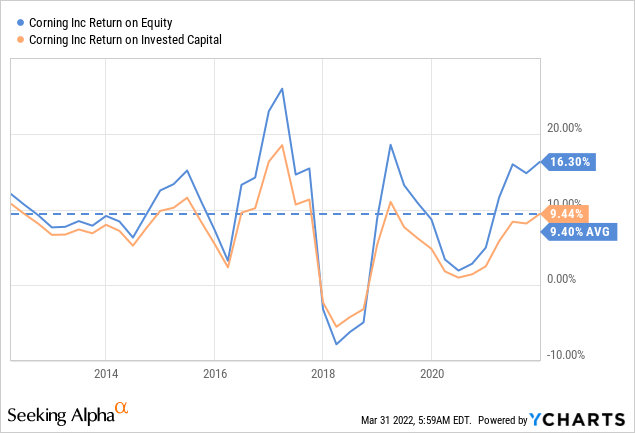

Something we like about Corning is that despite being relatively capital intensive, it earns pretty decent returns on equity. As can be seen below, despite the cyclicality its ROE tends to average ~9%.

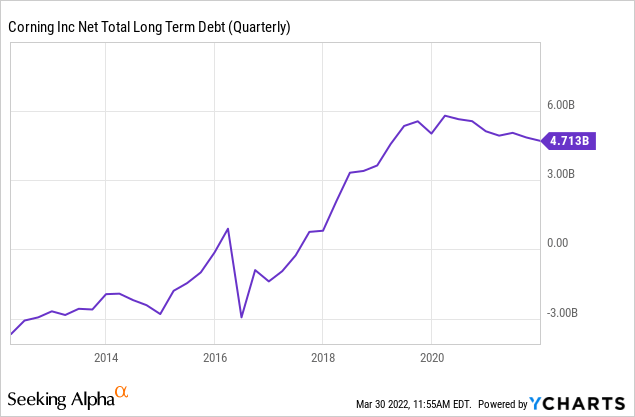

One area of concern for many investors has been the significant debt that the company has accumulated in order to finance both CapEx and share repurchases. Fortunately, net total long-term debt appears to have peaked early in 2020 and has been decreasing.

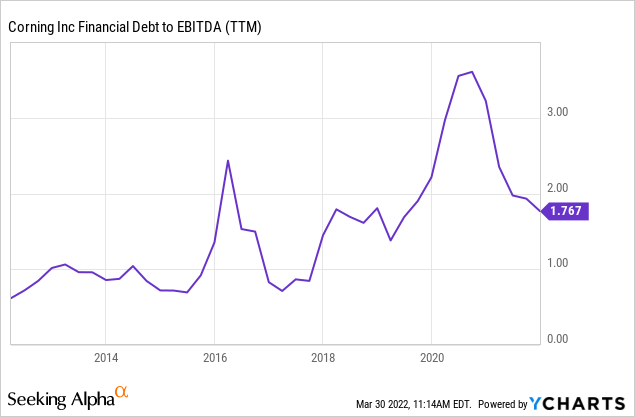

The slight reduction in debt, together with improved profitability has drastically lowered leverage ratios, reducing debt to EBITDA to less than 2x, from more than 3x previously. With this improvement, we are now less concerned about the strength of the balance sheet and can be more relaxed that the company will not find itself with liquidity issues.

Valuation

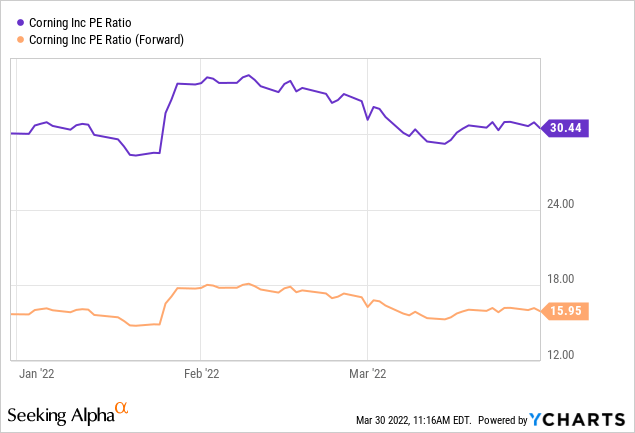

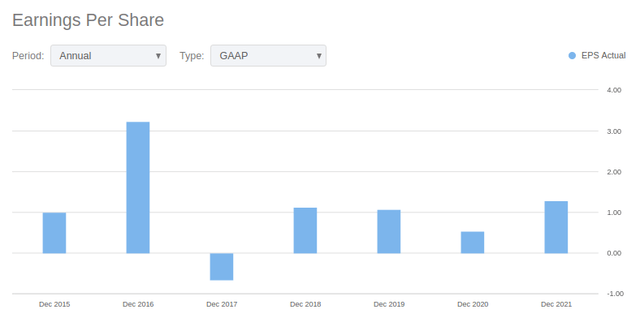

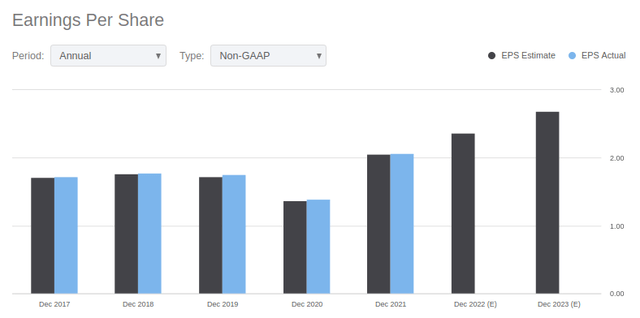

Shares look cheap with a forward P/E ratio of ~16x, however, investors should be aware that this multiple is based on non-GAAP earnings. The trailing twelve-month multiple shown below is for GAAP earnings, therefore don’t expect earnings to double, since the main factor in the TTM and forward multiples is one being GAAP and the other non-GAAP. In Corning’s case, GAAP earnings have consistently been below non-GAAP earnings over the last few years, so we would caution the use of non-GAAP numbers.

To show in more detail this discrepancy, we show below the annual GAAP earnings for Corning for the last few years, followed by a graph from Seeking Alpha showing the non-GAAP numbers.

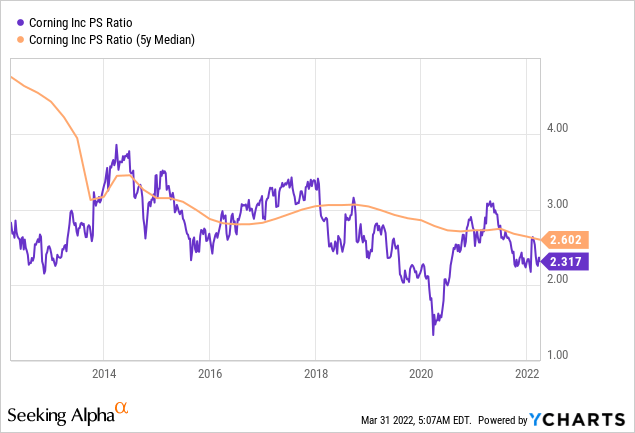

Another way of looking at the valuation is by inspecting the price/sales ratio, and where it stands now compared to its historical values. As it stands the PS multiple is currently ~2.3x, and that is considerably below its 5-year median of 2.6x. We can therefore say that shares appear to be somewhat cheaper than average by a little more than 10%.

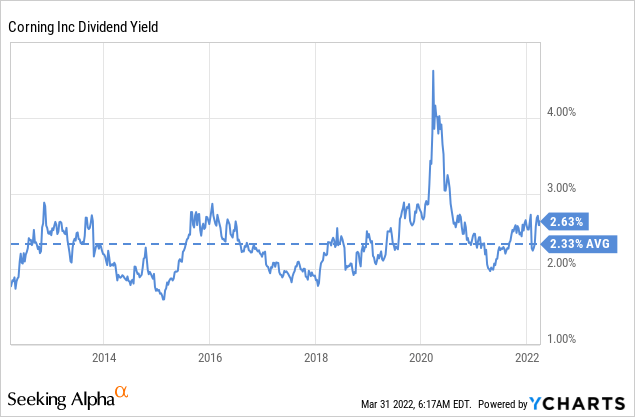

Similarly, the current dividend yield is above its historical average by about 15%, pointing to some undervaluation in the shares. We find the dividend particularly attractive given how low interest rates still are, and that Corning has a strong history of raising its dividend.

Conclusion

We think that investors can do a lot worse than invest in Corning at current prices, and we view shares as somewhat undervalued. We think it can be argued the undervaluation is somewhere between 10% and 20% using historical metrics like dividend yield and price/sales. We find shares particularly intriguing given our expectation of sales growth and gross margin expansion throughout 2022, fueled by continued strong optical fiber demand and the beginning of a rebound in automotive production.

Be the first to comment