Feverpitched/iStock via Getty Images

Cornerstone Building Brands, Inc. (CNR) received a firm proposal on February 13, 2022, to take the company private by its 51% majority owner Clayton, Dubilier & Rice (CBR) at $24.65 per share. Shares naturally rose from its Friday close of $18.40 to close at $22.44, up almost 22%. The bid has been characterized as a “best and final” offer by CBR. This bid spread of $2.21 represents a 9.8% upside on the current share price. If you have been long shares, this is already a nice return but the question is whether it is worth continuing to hold shares to close this spread. This article looks at the information we know now to try to assess the risk of a deal break.

First, CBR is a majority owner of CNR which understandably makes it very unlikely for a competing bid to come in. In CBR’s letter of offer, they also explicitly state that they don’t want to take part in any alternative transactions; I read this as being unwilling to listen to higher offers for its current stake. In the same letter, they also refer to the $24.65 offer as being a 75% premium to CNR’s closing price on February 4, 2022, before the speculation about an offer began to gather steam, as documented by Bloomberg. This fact pattern confirms that this is a last and best offer.

CBR is also going to pains to ensure that minority shareholders are treated fairly. The 75% premium is quite substantial to the closing price; even to the previous 52-week high of just under $20 back in June, this is over 25% from that high point. The company also notes this in its offer letter:

At the outset of our exploratory discussions with the Special Committee and its advisors regarding a potential transaction, we stated that we would only be willing to consider a transaction that is expressly conditioned on the procedures described in Kahn v. M&F Worldwide Corp. and its progeny. Accordingly, any potential transaction would (among other things) have to be (1) approved by a fully empowered special committee of non-management directors that are independent of CD&R, the CD&R Funds and their affiliates and (2) subject to a non-waivable condition requiring the approval of the holders of a majority of the shares of Common Stock that are not owned by the CD&R Funds or their affiliates. Consistent with those prior discussions, we reiterate that our Proposal is expressly conditioned on these procedures.

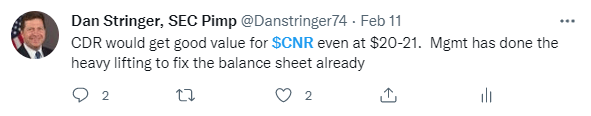

Although standard conditions, I believe they are taking pains to ensure the minority shareholders are treated fairly, which should lead to both a quick tender offer as well as avoiding any potential litigation that could result if they are not treated fairly. My own speculation put the lowest offer that would be potentially acceptable at between $20 & $21:

Twitter comment (Twitter)

This price is far above this number and combined with the stated logic behind the bid, I believe this is a fair bid. The fact shares are trading below the offer price would indicate that the market does not expect the price to be sweetened. However, the 9.8% gap would seem to indicate that there is some risk to the deal not closing. I tend to think this represents more of a lack of details available as well as the fact that management at CNR has not officially approved or recommended the deal. CNR has setup a committee to evaluate a potential transaction in its response to CBR. Once CNR evaluates the deal and makes a recommendation to shareholders, a timeline for closing (assuming shareholder approval) should be possible.

Conclusion

I believe CBR has taken great pains to go about this transaction to remove any impediments to CNR approval. Offering a decent premium to recent trading and ensuring minority shares are involved all give a good risk reward of this deal spread closing quickly. With the relative market weakness recently, a 9.8% arbitrage represents a fairly good return for a deal that doesn’t seem to have a lot of risk of not closing.

Be the first to comment