Shares in Copart (CPRT) have fallen almost 33% since the market sell-off began, catching our attention. We thought it was an opportunity to buy shares in Copart, an excellent business protected by a moat.

It came to our surprise however, that expectations already baked in the share price remain too optimistic. We found out that the market is expecting Copart to grow revenues by 11% for 9 years to justify its current share price of $70 doing a reverse DCF model.

We see a low probability for Copart of achieving such growth rate for a long period as competition from IAA (IAA) is going to intensify due to the steps they are taking to grow their business.

Copart is a company we would love to buy. We are just waiting for a better entry point.

Business Overview

Copart is the leading player in the salvage auto market. They are the middlemen, connecting mostly insurance companies and buyers of salvage vehicles.

Most vehicles sold on Copart’s platform are sold by insurance companies when they classify the vehicle as a total loss. People buy salvage vehicles for many different reasons. They could be car dismantlers, vehicle rebuilders, small used dealerships or the general public. Transactions happen primarily through Copart’s virtual bidding auction platform, for which the company charges a fee.

The industry is dominated by two key players, Copart and IAA. Copart is the bigger company with revenues of $2B compared to $1.4B for IAA. In terms of market caps, Copart has a market cap of $15.7B, while IAA has a market cap of $3.8B.

The biggest difference between the two players is that Copart has a big presence in international markets, while IAA just started expanding operation in Canada and the U.K. On the other hand, Copart does business in Canada, the U.K, Brazil, Germany, Ireland, Finland, the U.A.E, Oman, Bahrain, and Spain. Copart’s revenue is distributed as follows: 81% in the U.S, 19% international.

While Copart’s operations are mostly done online via their virtual auction platform, IAA does both on-site and on-line auctions. However, IAA has already started its transition to a primarily online auction marketplace that they expect to be completed by 2021.

Is Copart A Good Business?

By looking at return measures for Copart, one could notice that the business is protected by barriers to entry, economies of scale and network effects. Below is the company’s return measures and profitability margins:

Source: quickfs.net

The table above shows an impressive historical trend in both return and profitability measures. The evidence of barriers to entry is noticeable by how the company has been able to sustain high returns of invested capital. Usually, if a company has high returns, it would attract competitors into their market looking to get a piece of the pie. If the industry has no barriers to entry, competitors would flood the market until their returns equal their cost of capital.

In the case of Copart, the industry is protected by regulations that limit the number of yards that can be used to store salvage vehicles:

Source: investor presentation

This has allowed Copart to not only sustain but grow their returns on capital measures as they become a bigger company, enjoying economies of scale as they grow their business. The economies of scale can be observed by their increasing operating margins, which is also a proxy for operating leverage. As revenues grow, their fixed costs remain relatively stable increasing the bottom line.

The size of Copart in their industry also allows them to enjoy network effects. For a new company wanting to enter the salvage auction market, they would need a high source of suppliers (insurance companies) and a high network of buyers. Lack of numbers on each side and their business model fails.

Is Copart Cheap?

This is where we have our doubts about an investment in Copart and the return we could get as shareholders. By doing a reverse DCF analysis, we estimate that there is too much growth embedded in the stock price to justify current valuations. This is even after a steep decline in share price due to the market sell-off as a consequence of the coronavirus, where shares in Copart have fallen from a high of $104 reached in February to a current price of $70, a 33% drop.

To get an idea of the market-implied expectations in Copart’s share price, we need to look at analyst estimates:

Source: unhedge.com

The consensus view is growth in revenues of 11.1% for the three-year period and EBIT margin expansion to 39.2%.

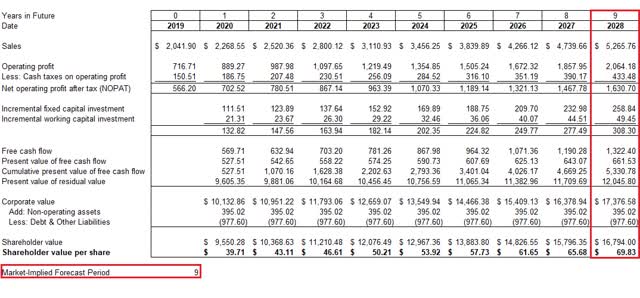

Using the above information, we built our reverse DCF model to get a market-implied forecast period for the stock:

Source: author estimates

There are two key observations from doing the reverse DCF model. The first one would be the market-implied forecast period. At 9 years, the market is expecting Copart can grow revenues by 11.1% per year for nine years to justify a stock price of $70. The second observation relates to sales. To justify the current price, Copart sales would have to be around $5.2B, more than double current sales.

Why Growth Could Be Challenged

There is a good possibility that Copart could grow revenues by 11% for nine years. After all, the company has had an impressive 10-year CAGR in revenues of 10.6%. An 11% growth rate is something the company has achieved in the past. Yet we see some reasons it might have trouble accomplishing the same feature in the future.

The advantage Copart has had over IAA and other competitors is that it has operated mainly as an online auction platform. By doing so, they were able to increase their market reach without being constrained to doing business in a physical location, as compared to IAA which due to their hybrid business model (on-site/online) they could only reach a certain radius of interested buyers if their auctions were held in a yard. In their last annual report, Copart discloses that 55.2% of total vehicles sold were made to members located outside the state where the vehicle was registered. Out of that 55.2%, 32% of sold vehicles were made to out of state members and 23.2% were sold to international customers. Copart also expanded internationally very fast while IAA kept most of their focus in their U.S. market.

These two reasons, that made Copart gain market share, are going to be challenged in the upcoming years, as IAA is transforming its business model to become a primarily online auction business and has plans to expand internationally:

First, let me review the progress on our key initiatives. We continue to make great progress enhancing our international buyer network. Our efforts in digital marketing, market alliance partnerships and in-country visits are showing strong results. We now have market alliance partners in 12 countries, and international buyers continue to represent a growing percentage of our overall volumes.

For the year, we drove double-digit growth in international buyer activity and units sold internationally increased by over 20%.

We are well underway in rolling out our digital-only auction to most of our branches throughout the U.S. and in the current environment, we are accelerating the rollout. – IAA Q4 conference call

It’s going to be interesting to observe the competitive dynamics between the two companies and how disciplined they are in their pricing strategy for the purpose of gaining market share. We believe that competition is coming to Copart from IAA though, and that could put a dent in their high growth rates.

Conclusion

We are waiting for the market to give us a better entry point if that ever happens. Copart has always traded at premium multiples and deservedly so. They are a great company protected by a huge moat with good growth prospects.

A lower share price would calm growth expectations already baked into the current price of $70 per share.

We don’t feel too comfortable holding the stock knowing that the business would need to grow at low-double digits for 9 years to justify its price. With recent developments at IAA, those growth expectations might become too high to achieve, even for an excellent business as Copart.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment