da-kuk/E+ via Getty Images

It’s been about 19 months since I posted my cautious article about Casey’s General Stores (NASDAQ:CASY), and in that time, the shares have returned about 19.7% against a gain of 28.15% for the S&P 500. Being the sort of person I am, if I were previously bullish, I’d highlight the relatively good return. Since I was cautious, though, I’m going to write about “relative underperformance.” This is the kind of behaviour that friends and family have come to expect, and barely tolerate. In all seriousness, though, I thought I’d review the name yet again today to see if it’s worth buying. I’ll make this determination by looking at the most recent financial history here, paying particular attention to the sustainability of the dividend. I’m also going to look at the stock as a thing distinct from the underlying business. Finally, I’ve traded options on this name in the past, and want to comment on those, also. I highlighted a risk to trading this type of option in my previous article, and I feel obliged to remind investors of it.

My writing can be “a bit tough to take.” I get that. For those people who want more than they can glean from the title and three bullet points above, but don’t want to be subjected to all of my silliness, I offer this “thesis statement” paragraph. Here, you get most of the analysis “flavour” without all of the “bad joke” calories. In my view, the dividend is very secure here, but the valuation is very rich, and for that reason I would recommend avoiding the shares. I would also remind people that investing is a relativistic process, meaning that if I buy X, I am by definition eschewing alternative uses of that capital. In that context, I would ask investors to remember that the yield on the U.S. 10-year Treasury note is currently 2.9%. Given that you can receive a risk free rate of 2.9% from ‘Murica, why would you settle for 223 basis points less from a company, even one as profitable as this? I think the issue comes down to one question: “At what rate will the dividend need to grow for investors to match (let alone exceed) the cash flows they’d receive from the risk free government note over the next decade?” I think this question will become increasingly relevant to stock investors in general, which calls current valuations to account in my view. Finally, I know from personal experience that some folks in “The Land of the Free and the Home of the Brave” get a bit touchy if I refer to their homeland as “‘Murica.” If that’s you, dear reader, you should know that a strange artifact of Irish culture is that if we make fun of that which we love. I admit that I occasionally make fun of some aspects of American culture and foreign policy. Just know that when I do that, I’m doing it out of love. Also know that I’m not making direct eye contact, I’m moving slowly, and I’m making soft purring noises to hopefully calm the world’s big, red, white, and blue gorilla. I hope we’re good.

Financial Snapshot

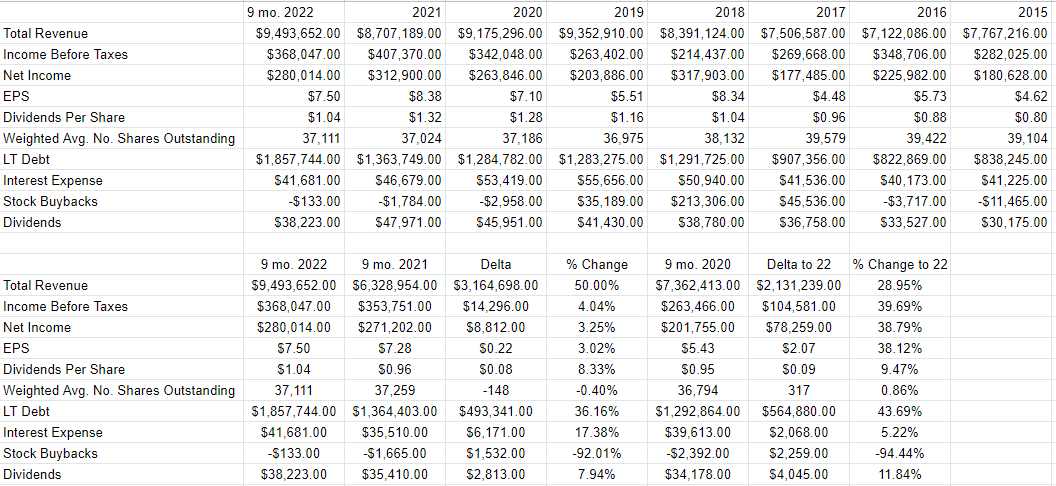

I think the most recent financial performance has been quite good for this company in many ways. In particular, both revenue and net income were up dramatically in the first nine months of 2022 relative to the same period in 2021. The top line galloped higher by about 50%, and net income increased by a far less impressive 3.25%. Shareholders have been rewarded for this improved performance with an extra 7.9% of dividend payments.

If you were worried that the first nine months of 2022 looked good relative to 2021 because the latter was uniquely bad, worry no further. The company did well relative to that period, too. Specifically, revenue and net income during the first nine months of 2022 were 29% and 39% higher respectively. Dividends were also just under 12% higher in 2022 relative to the same period in 2019.

It’s not all sunshine and lollipops at Casey’s, though. The company had ~$493 million more debt at the end of the most recent period than it did in 2021, and interest payments were about 17% higher. The reason I fret about capital structures so much is that at some point they may impact dividend sustainability.

Dividend Sustainability

Writing of dividend sustainability, I think it would be worthwhile spending some time writing about it for two reasons. First, it’s supportive of price, meaning that the stock of a company that pays a regular, sustainable dividend has a price floor below which it won’t go. Second, investors like predictability, and there’s nothing bad about a predictable injection of dividend cash into your account.

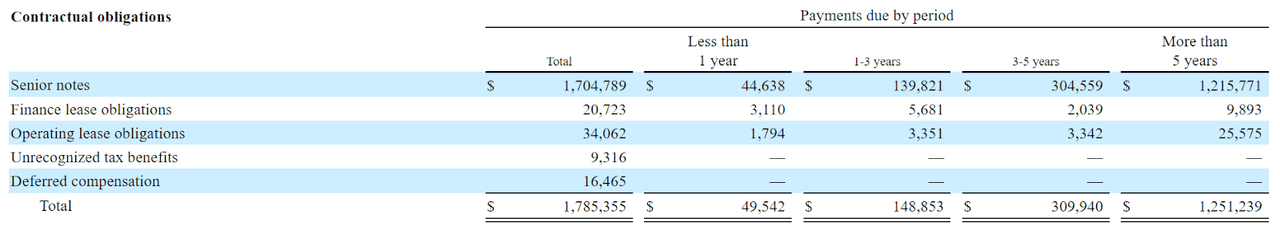

As my regulars know, when it comes to dividends, I remove my “accrual hat” and put on my “cash flow hat” as I compare the size and timing of future cash obligations with the size and timing of current and likely future sources of cash. Let’s start by looking at the obligations, shall we? I’ve copied the following table of contractual obligations from page 26 of the latest 10-K so you won’t have to. You’re welcome. We see from this that the company will spend ~$49.5 million on various obligations this year, and an average of ~$74.4 million over the subsequent two years.

Casey’s Contractual Obligations (Casey’s latest 10-K)

Against these obligations, the company currently has about $43.5 million in cash. Additionally, over the past three years, they’ve generated an average of about $613 million from cash from operations. At the same time, they’ve spent an average of $456 million funding the business via CFI activities.

All of this suggests to me that the dividend is reasonably well covered here, and so I’d be willing to buy the shares at the right price.

Casey’s General Stores Financials (Casey’s General Stores investor relations)

The Stock

Some of you who follow me for some reason know that this is the point in the article when I turn into, to quote my niece, “watermelancholy”. It apparently means “depressive.” It’s here where I start writing about risk-adjusted returns, and how even the stock of a sustainable dividend machine can be a terrible investment at the wrong price. A company can make a great deal of money, but the investment can still be a terrible one if the shares are too richly priced. This is because all businesses are essentially just organisations that take a bunch of inputs, add value to those inputs, and then sell products or services (hopefully) for a profit. The stock, on the other hand, is a proxy whose changing prices reflect more about the mood of the crowd than anything to do with the business. In my view, stock price changes are much more about the expectations about a company’s future. This is why I look at stocks as things apart from the underlying business.

Forgive me as I indulge my tendency to “drone on” about an idea. I feel a need to demonstrate the importance of looking at the stock as a thing distinct from the business by using Casey’s stock itself as an example. The company released its latest quarterly results on March 9th. If you bought this stock that day, you’re up about 12.5% since then. If you waited until April 13th for the stock price to “prove” that it’s a good investment, you’re down about 1% since. Not enough changed at the firm over this short span of time to warrant a 13.5% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

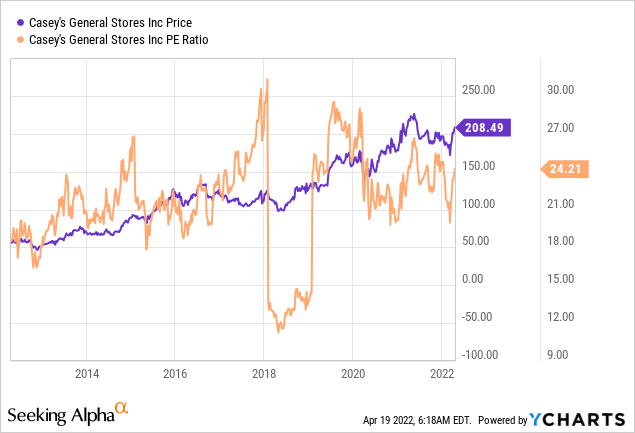

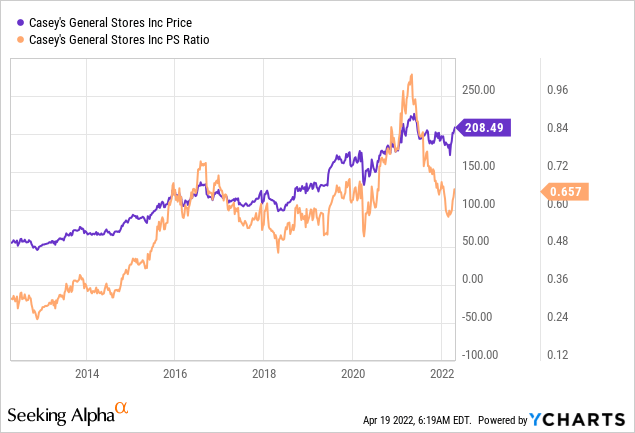

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I fretted that the PE was about 25.65. Not much has changed on that front, per the following:

While shares are slightly less expensive on a PE basis, they are currently priced on the high side relative to the historical record. As should be expected, shares are priced on the high side relative to the past few years.

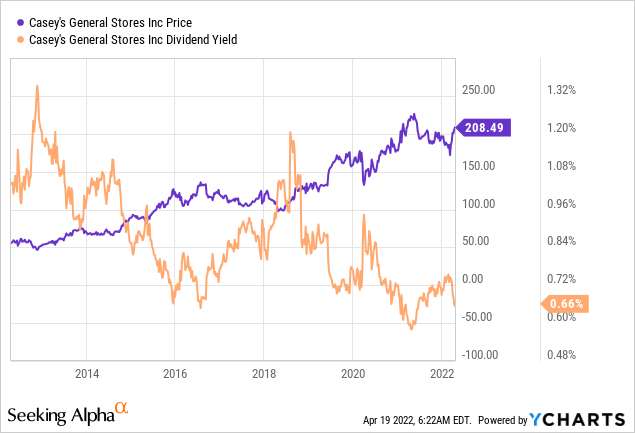

At the time that investors are paying near record levels for the shares, they’re getting near record low dividend yields, per the following:

I don’t know about you, dear reader, but I am not a fan of paying more and getting less. I don’t think tolerating that dynamic is conducive to long term investment success.

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Applying this approach to Casey’s at the moment suggests the market is assuming that this company will grow at a rate of ~7.9% in perpetuity, which I consider to be very optimistic. Given all of the above, I continue to recommend avoiding these shares.

Options Risk Review

Because I don’t think there’s value at $208.50 doesn’t mean I wouldn’t be willing to buy at the right price. For me that price is ~$125 per share. That value lines up with a dividend yield of ~1.1%. Before the bulls “freak out” at my suggestion that this price is “crazy”, please remember that U.S. Treasury note is currently yielding 2.9%. Why would I risk the loss of capital and less income on a stock when I can sleep at night with a far higher stream of cash flows?

Anyway, at the moment, the premia on offer for $125 strikes are so thin as to make selling puts pointless. I do want to remind investors of a risk that I identified in my previous article on this name. Some put options are quite thinly traded, so the bid-ask spread is quite wide. Thus, when it comes to such options, I would recommend that investors treat them as “European” style options, and hold them to expiry. The reason for this is that if the investor needs to close the position, they will be hammered by the huge spread between bid and ask.

Conclusion

While I think the dividend is sustainable here, I don’t think the stock’s worth the current price. Investing is a relativistic game, meaning that when we buy X, we eschew Y by definition. In a world where you can receive 2.9% from Uncle Sam, why would you settle on a dividend yield as small as this? I’ll repeat a question I asked earlier. “At what rate will the dividend need to grow to even match (let alone exceed) the cash flows investors could receive from the risk free rate over the next 10 years?” I think this question will become increasingly relevant to all stock investors, and for that reason I would recommend continuing to avoid these shares.

Be the first to comment