Bet_Noire/iStock via Getty Images

Introduction

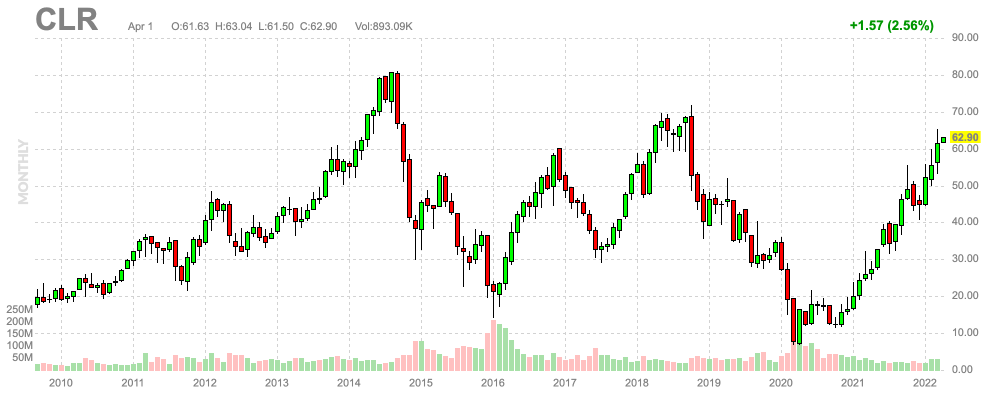

Oklahoma-based Continental Resources, Inc. (NYSE:CLR) has been in my trading “toolbox” for years as it’s a perfect way to get exposure to oil. The company is one of America’s largest onshore oil producers, it does not hedge its production, its debt load is quickly falling, and it is quickly turning into a high-yield investment for its shareholders. My most recent article was published in August of 2021 when I covered it after it had doubled. Now it has doubled again as it has become one of the hottest large-cap stocks in America.

In this article, I will re-assess the situation and shed a light on the company’s ability to generate cash as well as new developments that impact the industry. So, bear with me!

Oil Is Back

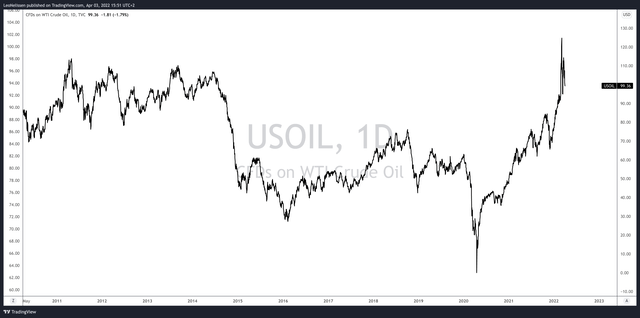

What a ride for oil since the Great Financial Crisis. In 2011, oil lost steam as industrial metals and soft commodities started to weaken due to peak economic growth. Then it got hit very hard at the end of 2014 due to accelerating production in the US (shale boom) and a rapidly appreciating dollar due to tightening by the Fed and QE in the euro area. Then it rebounded. However, the rally got killed by higher production and by slower economic growth (2018). Before it had a chance to come back it was hit by the global pandemic, which briefly pushed oil into negative territory due to storage issues.

Now, oil is back – and what a comeback!

Believe it or not, the bull case is driven partially by ESG – environment, social, and governance. Because of the push for environmental standards, companies have refrained from increasing production. They were like, “fine, let’s focus on free cash flow instead.” After all, every penny that is not spent on higher production can end up in investors’ pockets via dividends and buybacks.

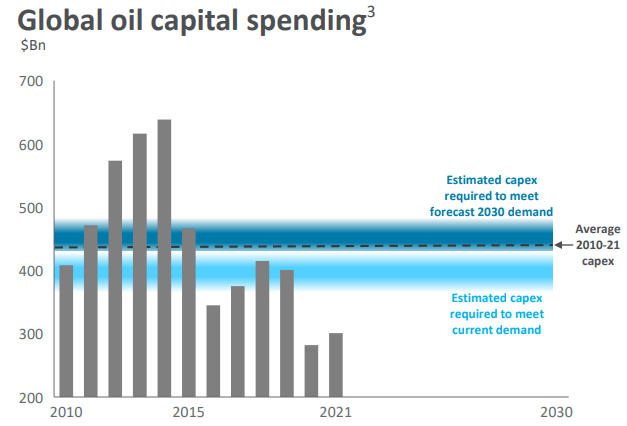

The graph below shows this terrible situation. In order to satisfy the expected 2030 oil demand, capital expenditures will have to bounce back to the $440-$450 billion area. Right now, that does not seem likely.

Seeking Alpha

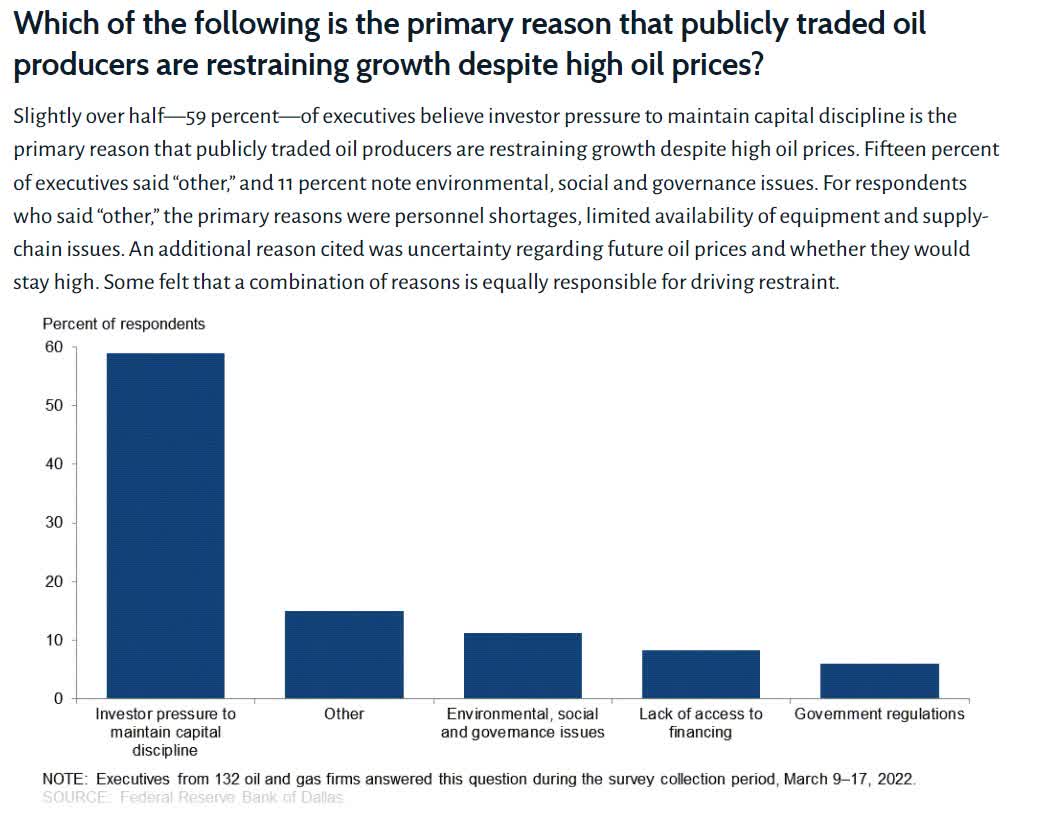

One reason is investor behavior as I discussed in a recent Pioneer Natural Resources (PXD) article. The graph below shows that investors are now the number one reason to refrain from hiking production – despite the rising need to increase production to combat energy inflation.

Dallas Federal Reserve

This is what I wrote on that in my PXD article:

The problem is that the current problems are justified. Oil and gas companies get attacked by environmentalists 24/7 for “polluting the world.” That’s one reason to focus on free cash flow instead of production. However, a lot of smaller producers, sometimes referred to as Sh*tCos have a terrible track record of investing in their business. In that case, it’s understandable that investors prefer free cash flow.

Especially now as the West is looking to boycott Russian oil and gas, it could do a number on the already tight supply. Hence, oil is trading close to $100 with an upside to $150 this summer if demand comes back – and without improvement on the supply side.

Before I look into the risks, let’s assess how CLR delivers value for its shareholders. After all, a lot has changed since my 2021 article.

CLR Shareholder Value

Continental Resources has a market cap of currently $22.9 billion. The company has high insider representation as 6 of the top 25 holders are insiders. Founder Harold Hamm, for example, owns 50.7% of the shares outstanding.

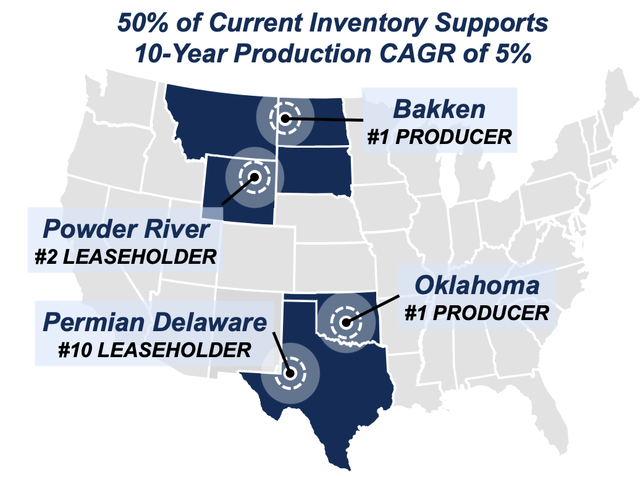

The company is the number one producer in Oklahoma and in the Bakken Basin. It is the number two leaseholder in the Powder Basin, and a top 10 leaseholder in the popular Permian Basin.

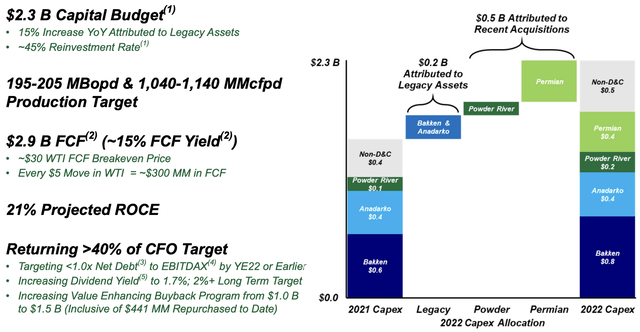

You probably already expected this after my comments, but the company’s capital budget is aimed to maintain operations, instead of growing them. The graph below compares 2021 CapEx to the expected 2022 CapEx.

The increase in CapeEx mainly comes from the acquisition of Permian and Powder River assets. Just $200 million is attributed to legacy Bakken assets.

In this case, the company’s guidance is based on oil production of 195-205 thousand barrels per day. Natural gas production will be somewhere between 1.04 and 1.14 million cubic feet per day.

The beauty of all of this is that rising oil prices and flat CapEx mean high free cash flow. In this case, the company is free cash flow breakeven at $30 WTI. This means that if oil were at $30, the company would be able to satisfy capital expenditure needs. It does not include dividends or buybacks. Every $5 move in WTI oil indicates an additional $300 million in free cash flow.

Free cash flow is basically net income adjusted for non-cash items and the aforementioned capital expenditures. To give you an idea of how much $300 million in additional free cash flow is, we’re using the company’s $22.9 billion market cap.

$300 million in free cash flow is 1.3% of the company’s market cap. In other words, with every $5 increase in WTI, the free cash flow yield rises by 130 basis points using the current market cap.

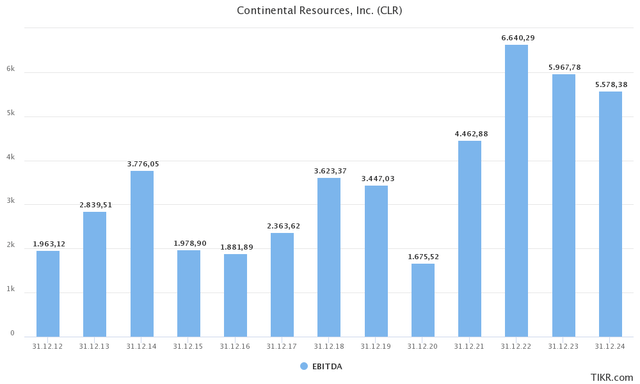

With that said, it’s additional free cash flow. On a full-year basis, analysts expect Continental Resources to do $3.7 billion in TOTAL free cash flow this year. That’s 16.2% of the company’s market cap (free cash flow yield)!

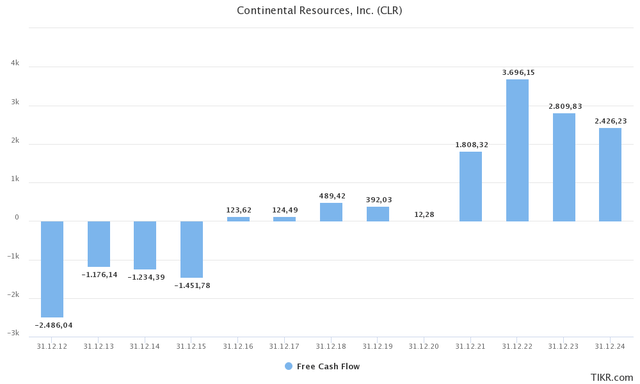

Also, note how everything changed after 2020. The company went from negative free cash flow prior to 2016 due to the shale boom to an explosion in (potential) free cash flow.

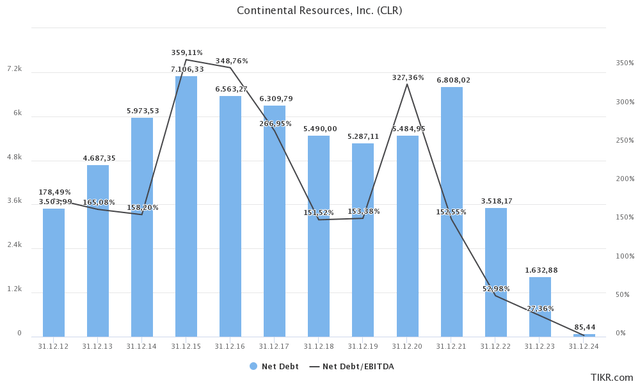

The company uses high free cash flow to reduce net debt. In 2021, the company had net debt valued at 1.5x EBITDAX. This is EBITDA without exploration expenses.

This year, the company is looking to lower this ratio to less than 1 (based on $80 WTI).

The graph below shows net debt as a % of EBITDA as well as total net debt. In this case, the sell-side agrees with CLR as it expects the net debt ratio to drop to a mere 0.5x this year. Followed by a decline to almost net cash (more cash than gross debt) in 2024/2025. Such an improvement will protect the company when oil crashes in the future (whenever that may be). In the past few cycles, the company always went into downswings with elevated debt. That’s different now.

This allows the company to use sky-high (future) free cash flow to distribute a high dividend. This is what the company commented with regard to dividends:

Third, we increased our cash returns. We recently increased our quarterly dividend by 15% to $0.23 per share, which equates to a $0.92 annualized dividend and approximately 1.7% yield as of February 8th. This is a 360% increase versus 2019 and is competitive with our peers and the broader market.

Fourth, we also repurchased 3.2 million shares at an average price of $38.74 during 2021. Since we started the program in 2019, we have repurchased 17 million shares at an average price of $26.

In this case, the company does not promise anything except that it will use free cash flow to boost shareholder returns. By 2025, the company could buy back 30% of the current share float as cumulative free cash flow is expected to be 58% of the current market cap by then (based on $80 WTI). Even based on $60 WTI, that number drops from 58% to 33%, which is still very high.

And believe it or not, even after doubling twice since I am bullish, the stock is still not overvalued.

Valuation

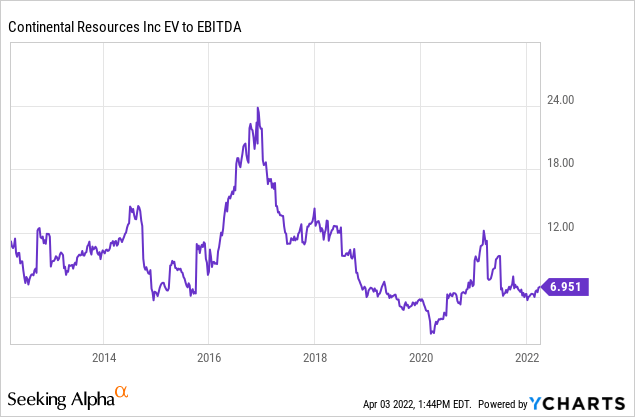

Continental has a $22.9 billion market cap. Net debt is expected to fall to $1.6 billion next year. I’m going with that number as I am positive that free cash flow will be high enough to reduce debt that much. It’s a way to incorporate free cash flow growth.

This gives us an enterprise value of $24.5 billion. That’s 4.1x EBITDA. In this case, I’m using $6 billion in expected EBITDA until 2024, which is roughly the 3-year average.

4.1x expected EBITDA is cheap. It’s even cheaper when using 2022 estimates.

So, let’s summarize the situation.

Takeaway

Something changed in 2020. A bull market in oil was born that would exceed anything we have seen since the Great Financial Crisis. We’re dealing with a significant demand/supply imbalance that is made worse by the war in Ukraine. Demand is coming back to roughly 100 million barrels per day. Yet, supply is too low to sustain current and future demand.

As a result, low-cost oil producers are flying high. Continental Resources has very low breakeven prices, high oil production, and mind-blowing free cash flow capabilities. The company is about to erase all of its net debt and fuel shareholder returns.

Right now, investors are rushing to buy oil and gas. And that’s fine – to a certain extent.

I believe that Continental Resources can move to $80-$90 over the summer months if the war in Ukraine escalates. Demand will come back, creating a situation where the bull market continues.

FINVIZ

However, I’ve turned neutral as I explained in my Pioneer article. The reason is the risk/reward. I know that many buy for income. A lot of investors have forgotten how volatile companies like CLR are. I wouldn’t sleep at night if my followers were overweight midcap oil and gas stocks. The biggest risk, right now, is a mix of higher production if that’s the only way to avoid a recession. If that’s not happening, we could indeed be looking at a recession fueled by high inflation.

I don’t like referring to an article twice, but my thoughts on higher production are summarized in my Pioneer Natural Resources article linked above, which will take you just a few minutes to read.

So, with that said, it’s perfectly fine to buy CLR for income. I think they are in a terrific spot to boost dividends and buybacks. If oil remains high (>$70) on a long-term basis, I see high special dividends on top of buybacks.

If you buy, please be aware that we’re in a mature stage of the cycle. Keep your position small. Also, investors looking for a more stable income might consider buying the big guys Exxon Mobil (XOM) and Chevron (CVX). I own both as well.

Long story short, oil is set to provide producers with the option to boost shareholder value on a long-term basis. Even if oil drops, I don’t see a decline to levels we saw in prior cycles (sub-$50). Yet, I do not recommend going overweight energy at these levels. The yield is very good and it screams “buy,” yet in these situations, I like to play it safe.

(Dis)agree? Let me know in the comments!

Be the first to comment