The Good Brigade/DigitalVision via Getty Images

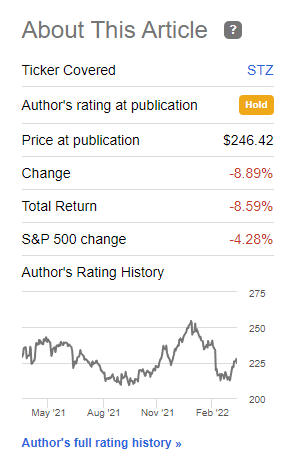

Dear Readers, in my last article on Constellation Brands (NYSE:STZ), I gave the company a PT of $230/share. Since then, the company has actually dropped and now trades at around $224 as of writing this article. This means the company is actually, to my mind, potentially a “BUY” here.

I’ll review the company and change my stance if necessary from the last article.

Constellation Brands Article (Seeking Alpha)

Revisiting Constellation Brands

My original thesis for Constellation Brands was simple and able to be summarized into one single sentence.

It’s a great company, but a bit too expensive.

So when the company drops in price, as it has done for the past few months, that’s a pretty good implication that we might be seeing a prospective “BUY”.

When revisiting Constellation Brands, it’s important to remember the company’s fundamental upsides. It’s superb brand portfolio, including some of the most popular beers on earth.

Constellation Brands Portfolio (STZ IR)

When considering a company, you first want to make sure that they sell a good product or service. Constellation Brands portfolio speaks for itself, and it sales numbers echo this argument.

The company has a best-in-class beer portfolio with a 39-40% operating margin tradition. This is among the best in the entire business. Other segments, such as wine and spirits have margins that are almost 10% lower, but the company is working to increase this through portfolio optimization.

Aside from its class-leading legacy portfolio, the company also has a significant stake in Canopy (CGC). I visited this company’s thesis as part of my original STZ thesis, and I’m not all that positive on it for the time being.

Things are not going that well.

The Canada-based Cannabis business is considered by some to be a bubble, and by others to be one of the best potentials since sliced bread with triple-digit potential capital appreciation.

Me, I see Canopy as an exercise in valuation and fundamentals, namely the following question.

Under what circumstances should you pay 30X Sales for a non-profitable business?

While there might be outlying circumstances and EPS/sales growth numbers that allow for a positive, risk/reward-appealing answer in this (there are always contrarians), my shoot-from-the-hip response would be; Absolutely none – that’s a gods-damned bubble. Not even Tesla (TSLA) is trading at 30X sales.

Yet, at points Canopy traded at 30X sales without being profitable.

(Source: Seeking Alpha STZ Article)

So, for myself, I like to more or less exclude Canopy from the equation here. It’s one of those things that might end up being super-positive for the company – but in the meantime, I really don’t like holdings like these that trade at fantasy-type sales multiples and over 60% negative 1-year returns from fantasy-type valuations.

Instead, Constellation Brands.

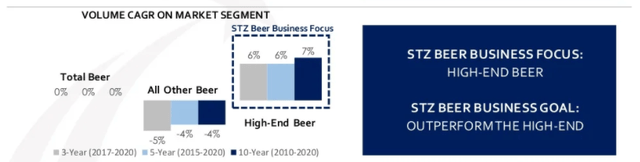

The underlying consumer trends of higher premiumization and interest in hard lemonades and similar products serve Constellation Brands extremely well. The company’s portfolio is aligned with a broader and higher average consumer spend, which seems to be where things with the company are going.

It’s fairly easy to see, looking at sales numbers, that so-called lower end wine and beer brands and products are seeing sales declines of 6-8% on an annual basis, versus higher-end spirits, wines, and beers, all of which are seeing 2-6% sales growth numbers.

STZ has aligned with this development thanks to its powerful brands across the three segments (Beer, Wine, Spirits). High-end beer is more than twice the sales in terms of shipped cases that it was back in 2010 – and that isn’t because we have twice as many beer drinkers today, but because premium beers make up close to 50% of the sales mix these days.

The beer industry is a place of strong domestic high-end, and superb import growth numbers. Imports are up 6% YoY alone. Through a mix of increased consumer demand and expansion in the Hispanic markets and LDA consumers, improved space and distribution planning and brand innovation, the company is expecting significant growth drivers. The main beer brands here are Corona Extra/Premier, Modelo Especial and Pacifico, all of which are considered primary future drivers for increased sales here. Corona is also moving into the hard seltzer space, aligning with the demand for hard lemonade through brands like Corona Limonada and Seltzer. STZ’s targets for operating margins remain at around 39-40%.

Still, I would characterize STZ’s beer segment going into 2022/2023 as a brand-leading beer business with continued shelf space and brand expansion opportunities, thanks to its already-iconic brands. I’m positive on this.

With regards to wine and spirits, it’s an interesting dynamic. Higher-end wine is up – lower-end wine is essentially viewed very unfavorably, translated into sales decline. The company’s strongest industry share is in Prosecco/Sparkling Wine, where the company has almost 60% of the US market and is seeing growth. Meanwhile, things like Chardonnay, Cabernet Sauvignon and other products are either flat or down, and at 15-20% market share. Spirits are better, with high-end whisky, tequila, and brandy showing sales increases, with Rum, Gin, and Vodka (not surprising, given geopolitical tensions), being down.

The biggest opportunities are in Tequila and domestic whisky, with the worst trends in Vodka and Gin. The company has an ongoing strategy to transform its wines/spirits business which it is currently working on.

STZ Transformation Strategy (STZ IR)

The strategy involves, like with beer, premium brands driving company growth, with ultra-premium and super-premium brands leading the charge at double-digit sales increases. Through cost saving, operational improvements, and price mix improvements (higher prices for premium), the company targets an average of 30% operating margin for the entire segment with a 10% SG&A in 2023-2024, which would be on par with some of the best wine/spirits businesses in the entire world. Possible? Absolutely – but I’m going to be conservative here until we start seeing results.

A quick word on recent Canopy results. Supposedly the company is on track to deliver some $200M CAD of cost savings towards 1H23, and massive net sales improvements throughout the next 3 fiscal ending in 2024. STZ expects Canopy to achieve a 20% adjusted EBITDA margin in 2024, and turn “green” (pardon the pun) in early 2023/2024, with positive FCF in 2024.

I remain extremely doubtful of this. However, if one wants to invest in Cannabis, I believe buying STZ is one excellent way to do it, so that your money isn’t just exposed to CGC. Even if Canopy crashes and burns, STZ will be entirely fine. If you invest in CGC and that crashes and burns – your investment won’t be. Like I said earlier, CGC is mainly an exercise in a supposed TAM (total addressable market), to which I say that we’ll see what the company actually manages to capture.

At its heart, STZ is a superb company with a good upside. It doesn’t need CGC to be good, but if CGC works out as well, that’s of course another feather in its cap.

I invest in STZ not because of CGC, but because of the portfolio. And from that perspective, STZ at a cheaper price is looking up.

Constellation Brands Valuation

Now, the valuation for the company has improved. STZ has never been, nor will likely ever be the sort of company that yield-chasers go after. And that is perfectly fine – I’m not a yield chaser. I chase quality.

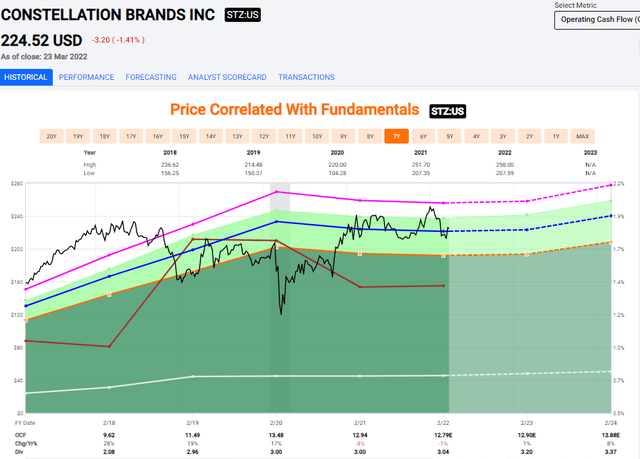

STZ valuation (F.A.S.T. Graphs)

I wouldn’t call Constellation Brands “Undervalued” here. It was undervalued at the onset of COVID-19, where I, unfortunately, didn’t buy much. I loaded up when the company fell below its average premium of around 22.5X, but I still consider the company to be at least partially buyable here, with a current yield of around 1.35%. Yield isn’t the reason to buy Constellation Brands. It’s product/portfolio safety with investment-grade credit, its exposure to a great distiller/vintner, and a $40B+ market cap company with solid fundamentals.

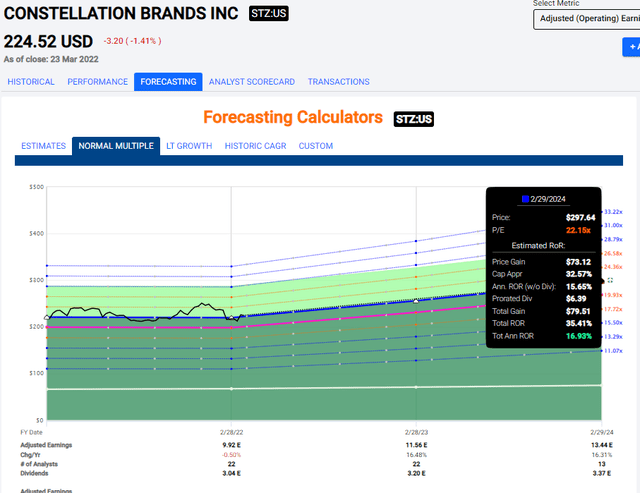

The overall upside for STZ is somewhere around 8-10%. It’s barely in the range of what I would consider an appealing upside in terms of investment. However, the future holds significant EPS growth rates due to the company’s move into premium segments and the materialization of some of its optimizations. EPS growth is expected to be over 15% for both 2023 and 2024, driving expected annualized RoR to over 15% on a forward basis even on a 22X forward P/E.

Overall, I would say that STZ shares the tendencies of some of its European peers, some of which I’ve written about the past year or so. It’s a premium portfolio trading at a high, comparative premium, with a low yield. However, the conservative safety in the investment is an argument in itself for putting capital to work here.

Most analysts would agree with the upside I see here. In fact, S&P Global analysts, 23 of which follow the company with a target price range of $213 on the low end and $310 on the high end come to an average of $272, which is significantly above my own PT for the company. The 21.3% upside analysts see here is a bit rich for my blood, and I would cut that down quite a bit. 11 analysts are a “BUY” here at this valuation.

The high-end price target represents not only a full premium portfolio growth, it also takes into account the potential Canopy Growth upside if that investment turns positive – which to me is a bit doubtful at this point in time.

Still, I agree with the basic thesis that the analysts present here – STZ at this price is undervalued. I would consider a lower PT of $230/share to be good for a nice upside in the stock – and that’s why I remain at this PT, at least for the time being.

The outlying years of 2023-2024 are expected to bring about stronger growth rates, but there’s a lot of Canopy in there that leads me to take a more conservative stance. Even if Canopy fails, $230/share is a good price for the company. $270+ without Canopy, in my view, isn’t. At least not compared to what the rest of the market offers.

Based on the current valuation, I would see STZ as a “BUY” with a $230/share price target.

Thesis

Constellation Brands is a quality company in the beer/wine/spirits space. It also has a strategic investment in Cannabis, which might be a bonus/good one in the future, though it seems unclear at this time, given the recent performance.

For me, it means potentially removing the upside of that investment and focusing on the legacy portfolio, and the work of premiumizing its portfolio. This leads me to a PT of $230/share.

I move from a “HOLD” to a “BUY” here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment