phongphan5922

Introduction

Following ConocoPhillips (NYSE:COP) enjoying a strong end to 2021, one way or another, it seemed that higher shareholder returns were coming, as my previous article highlighted earlier in 2022. Thankfully they did not disappoint with large variable dividends boosting their cash returns, which if continued at their most recent quarterly rate would see a high yield of 6.75%. Even though shareholders are certainly enjoying this cash windfall along with their strong share price rally, it seems time to take profits off the table given the economic risks on the horizon, as discussed within this follow-up analysis that also covers their subsequently released results for the second quarter of 2022.

Executive Summary & Ratings

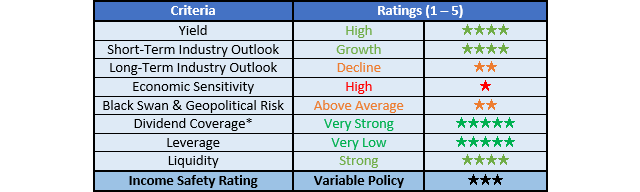

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

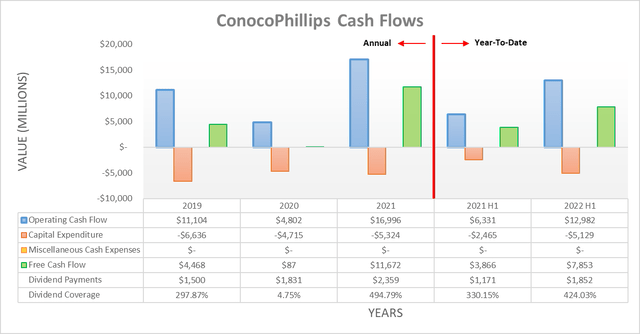

The recovery they enjoyed during 2021 accelerated during the first half of 2022, as widely expected given oil and gas prices surged to levels not seen for around a decade following the Russian invasion of Ukraine. This saw their operating cash flow reach a massive $12.982b for the first half of 2022 that was more than twice its previous result of $6.331b during the first half of 2021. In fact, if removing its $1.381b working capital build, their underlying result of $14.363b is close to their full-year result of $16.996b for 2021, despite being only half the length of time.

In spite of this working capital build and their higher capital expenditure effectively doubling year-on-year to $5.129b during the first half of 2022 from $2.465b during the first half of 2021, they still generated immense free cash flow of $7.853b. Apart from easily funding their dividend payments of $1.852b, it also easily funded their share buybacks of $3.725b, thereby making for very impressive shareholder returns of $5.577b for only half of a year.

Whilst everyone knows that booming oil and gas prices line the pockets of shareholders handsomely with cash, in my eyes, the bigger question going forwards is actually what happens when operating conditions soften. The current global energy shortage provides support and thus reduces the downside risks in the short-term but at the same time, I still feel that it would be prudent for investors to remember the energy sector is notoriously volatile and thus one day, like it or not, these booming operating conditions will soften, even if they avoid a severe downturn.

This consideration is especially relevant at the moment in light of the growing recession risks on the horizon, which have already sent oil prices back below $100 per barrel and could see further weakness and also hurt investor sentiment towards their industry and send their share price lower. Despite their variable dividends providing a tangible cash return to shareholders, circa two-thirds of their shareholder returns during the first half of 2022 came via share buybacks that scale up and down in tandem with their free cash flow. Since their share price would obviously also follow in tandem, it makes their scope for shareholder returns without these booming oil and gas prices especially important to ensure shareholders are not left high and dry when the proverbial tide recedes.

To assess this consideration, I prefer comparing their current valuation against their free cash flow from business-as-usual operating conditions. In my eyes, their results from 2021 provide a suitable basis since its strong end was mirrored by a weak start, thereby averaging out accordingly with free cash flow of $11.672b. If this is compared to their current market capitalization of approximately $140b, it sees a high but still single-digit free cash flow yield of slightly over 8%. Whilst this is not necessarily bad nor exorbitantly expensive, it nevertheless is also not particularly cheap and thus in the medium to long-term, their shares do not appear to offer desirable value without these booming oil and gas prices.

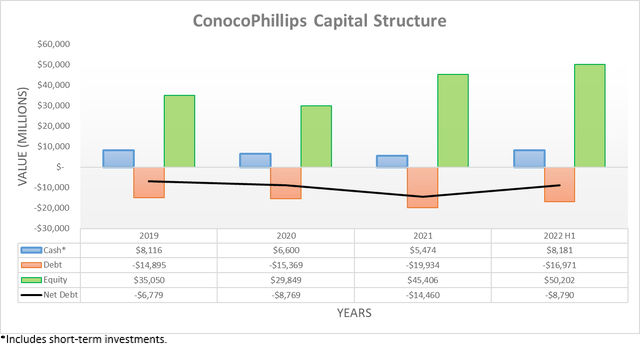

Despite ramping up their shareholder returns during the first half of 2022, their immense free cash flow still sent their net debt plunging to $8.79b, which represents a massive decrease of 39.21% versus its previous level of $14.46b at the end of 2021. After seeing this $5.67b decrease, their net debt is now only an immaterial $21m above its previous level at the end of 2020 and thus effectively saw them repaying their borrowings to fund their 2021 acquisitions of Concho Resources and shale assets from Shell (SHEL). Admittedly, $2.914b of this decrease stemmed from divestitures net of relatively immaterial acquisitions, most notably their shares in Cenovus Energy (CVE) but regardless, it still provides a lasting benefit.

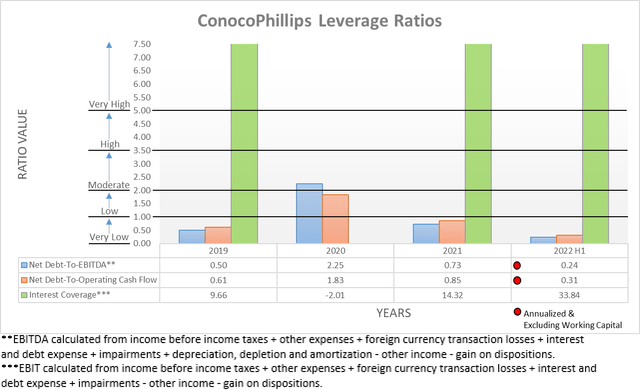

Thanks to repaying their borrowings during 2021, they are now in a far stronger position to handle whatever the future may hold for their industry. Unsurprisingly, this saw their respective net debt-to-EBITDA and net debt-to-operating cash flow drop even lower to 0.24 and 0.31 than their already very low previous respective results of 0.73 and 0.85 at the end of 2021.

These results already ended 2021 below the threshold of 1.00 for the very low territory but if they were to have faced another severe downturn before repaying their additional borrowings, their leverage would have skyrocketed. To provide an example, if comparing their net debt of $14.46b from the end of 2021 against their downturn-impacted financial performance of 2020, it creates a net debt-to-EBITDA of 3.01 and a net debt-to-operating cash flow of 3.71, the latter of which would have been within the high territory of between 3.51 and 5.00.

Whilst these results would not necessarily have endangered their solvency, they nevertheless would have still hindered their shareholder returns and likely suppressed their share price as higher leverage equals higher risks and thus as a result, translates into a lower valuation. Whereas now that their net debt is essentially back to its previous level from the end of 2020, even if this same scenario were to transpire now, their net debt-to-EBITDA and net debt-to-operating cash flow would obviously only revert back to their previous results of 2.25 and 1.83 at the end of 2020. Apart from the former only sitting within the moderate territory of 2.01 and 3.50 and thus lowering risks from a hypothetical severe downturn, this lasting benefit also lessens any requirement for deleveraging going forwards.

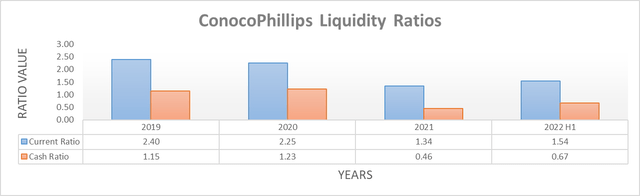

After seeing their immense free cash flow during the first half of 2022, it was not surprising that their already strong liquidity further improved with their respective current and cash ratios increasing to 1.54 and 0.67, versus their previous respective results of 1.34 and 0.46. Whilst this may ebb and flow up and down going forwards, their ability to generate free cash flow and large operational size should ensure they always retain easy access to debt markets should they elect to refinance instead of repaying future debt maturities, even if central banks further tighten monetary policy.

Conclusion

They have produced strong fundamental improvements during the first half of 2022, such as repaying their borrowings from 2021, although it nevertheless seems time to take profits off the table after their strong share price rally. Even though no one can see the future, there are economic risks on the horizon with concerns of a recession only growing as the Federal Reserve lifts interest rates to bring inflation back under control, thereby enhancing the likelihood of operating conditions softening. At least their share price is not exorbitantly expensive and thus as a result, I only believe that downgrading my buy rating to a hold rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from ConocoPhillips’ SEC filings, all calculated figures were performed by the author.

Be the first to comment