primeimages

Investment Thesis

ConocoPhillips (NYSE:COP) is determined to return a significant amount of capital to shareholders.

Meanwhile, we must acknowledge that WTI prices have taken a significant hit in the past few days. However, I believe that in the same way as WTI prices in the spot market went negative in 2020, and that was clearly irrational, I similarly believe that WTI prices are unduly depressed at present.

There’s a lot to be bullish about COP and investors should stay the course.

What is Going On?

The underlying oil market is falling. And yet, equities have remained relatively unchanged. This is the first ”real test” that oil equity investors are facing.

All the fear and trepidation for why oil companies have remained so cheap is that investors simply don’t believe in the sustainability of the underlying WTI market.

And that’s what I find utterly perplexing. A lot of analysts comment on the energy crisis and the cost of living crisis. How consumers are struggling with the cost of heating their homes. Analysts declare that this will lead to a change in household behavior.

And yet, here’s the actual reality, spending on energy is largely non-discretionary. People have to travel for work. Not only in the US, Latin America, and Europe, but India and other emerging countries too.

Let me put it in more stark terms.

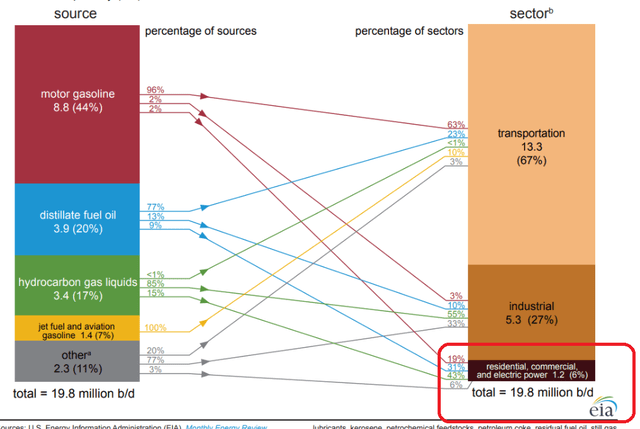

EIA website

In the US, only 6% of petroleum consumption goes into residential, commercial, and electric power. And of that, approximately 40% comes from hydrocarbon gas liquids, essentially gas.

My argument is that nearly 70% of petroleum consumption comes from transportation. And the bulk of that is non-discretionary.

A Very Odd Market

It appears to me that the financial markets are saying that we are about to enter a global recession. But that this global recession is mostly affecting the energy market. This is so odd!

Because many of the large-cap stocks don’t appear to be reflecting an oncoming recession. Allow me to provide an example.

If a household has to cut back on expenses, will they cut back on traveling to work, so they can actually get paid, or will they cut back on their Netflix (NFLX) first? Or will they cut back on purchasing a new iPhone (AAPL)? Because it appears to me that the financial market is bifurcated.

On the one hand, tech companies are still being priced at substantially higher than 18x non-GAAP earnings. While energy companies are nearly all being priced at significantly less than 10x GAAP earnings.

That’s one element. But then, to further confound matters, the underlying spot market has been in freefall in the past few weeks. So, how should we think about COP going ahead?

Getting Back Shareholder Capital

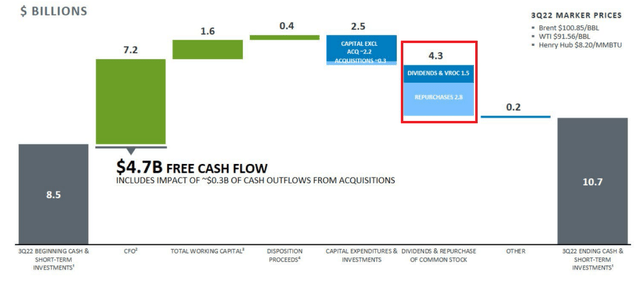

The graphic that follows is the capital return for Q3 2022:

COP Q3 2022

What you see above is that nearly all the free cash flow in the quarter was returned to shareholders; 91.5% of COP’s Q3 free cash flow.

In fact, when asked on the call about COP’s capital returns for 2023, this is what management said,

[…]we’re going to watch the macro because we think it’s going to be incredibly volatile. But we think we’ve just got the right value proposition in combination of VROC-based dividend and how we’re thinking about buying our shares back, that it’s well set up for the kind of volatility we may see. But that would be sort of my comment as you think about going into 2023

This is a reiteration that management is determined to return nearly all its free cash flow back to shareholders, without explicitly saying as much, because the macro environment can rapidly change.

And indeed, even though those comments are now just a little over 20 days old, those insights appear to have come to pass. The macro environment has rapidly deteriorated, with WTI prices sliding.

And this takes me to the big fear facing an investment in COP.

The Big Fear: Too Much Cash

COP has stated that it intends on returning $15 billion to shareholders in 2022. That implies a 9.5% combined return.

But there’s one significant consideration that is likely to cause investors unease.

Consider this, COP holds a net debt position of approximately $6.3 billion. But its free cash flow in Q3 2022 of approximately $4.7 billion is a reminder that if COP so wished, COP could buy back all its debt with the $10.7 billion of cash on its balance sheet, plus around three quarters’ worth of free cash flow.

Put another way, there’s investor trepidation and that COP could deploy its cash war chest on the purchase of a significant oil asset. Why is this a problem?

Because there’s unlikely to be many bargains available for sale at prices that make sense. Simply put, with COP holding such a large cash position, we must be at least tentatively skeptical that cash will be deployed towards an asset purchase, rather than returning capital to shareholders.

To be clear, I acknowledge that COP needs to hold some cash. But does it really need $10 billion of cash?

Next, we’ll discuss COP’s valuation.

COP Stock Valuation — 14x Free Cash Flow

We know that COP made $4.7 billion of free cash flow in Q3 2022 when WTI averaged $91. We also know that its sensitivity analysis points to approximately $120 million of cash flow per $1 of WTI.

Hence, with WTI presently around $74, that means that $17 of WTI lower than Q3. Hence, this translates into $2 billion less free cash flow on a go-forward basis.

Put another way, it’s possible that when all is said and done, if WTI averages $74 in 2023, COP will make approximately $11 billion of free cash flow.

That would put the stock priced at 14x free cash flow, or 7% free cash flow margin.

I should point out that this figure assumes that WTI stays around this ”trough price” on average throughout the whole of 2023.

The Bottom Line

The one-line summary is this: ConocoPhillips is cheaply valued, with attractive returns of capital of 9.5% for 2022.

The more nuanced summary acknowledges that WTI prices have come down a lot in the past several weeks. This may or may not stabilize around this level. Indeed, throughout the early parts of 2022, we were told that WTI prices would go higher than $100 WTI.

And as it transpired, the facts on the ground as we are about to exit 2022 appear to be very different from those speculations.

Meanwhile, I continue to believe that WTI prices will move higher and the spot market is wrong to be so bearish in its outlook for oil.

Be the first to comment