Chainarong Prasertthai

Much unhappiness has come into the world because of bewilderment and things left unsaid. – Fyodor Dostoevsky

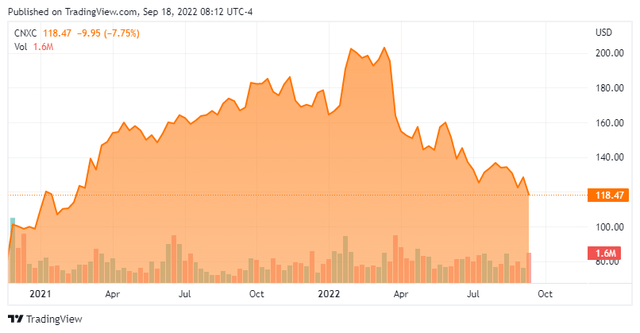

Today, we look at a stock that come substantially down from recent highs after debuting on the market last year. The pullback has brought the valuation down to intriguing territory. An analysis follows below.

Company Overview:

Concentrix Corporation (NASDAQ:CNXC) is a Newark, California based provider of customer experience [CX] and user experience (UX) solutions – third-party call centers and related digital offerings – to over 750 clients in five primary industry verticals. Its workforce of over 290,000 is able to deliver services in 70 languages across six continents from ~270 locations in the Americas, Asia-Pacific, and EMEA. The company was founded in 1983 and became a subsidiary of Synnex (SNX) in 2006. The parent then purchased Convergys in 2018 and merged it with Concentrix, eventually spinning the combined entity off in December 2020 with its first trade transacted at $80.00 per share. After reaching an all-time high of $208.48 in February 2022, shares of CNXC have retreated, and now trade just under $120.00 a share, equating to a market cap slightly north of $6 billion.

The company operates on a fiscal year (FY) ending November 30th.

Concentrix provides customer lifecycle solutions, which broadly entails the acquisition, support, and renewal of customers across all channels (voice, chat, web, email, social media, etc.) with an endgame of increasing customer lifetime value on behalf of its clients. Specifically, the company offers customer care, sales support, digital marketing, technical support, digital self-service, content moderation, content production, and back office services in the hopes of creating a more loyal and stickier customer for its client base. Its operations are conducted in 40 countries with a large footprint in Asia, including India, China, Vietnam, Thailand, and Indonesia.

The company disaggregates its revenue by the five verticals it serves (plus a catchall ‘other’ category), with its four priorities being healthcare (which grew 25% FY21 vs FY20); retail, travel & ecommerce (24%); technology and consumer electronics (24%); as well as banking, financial services, and insurance (21%).

It has grown through acquisition, purchasing nearly a dozen and a half concerns, including CX design engineering firm PK for an aggregate consideration of $1.6 billion in December 2021. The company is also in the process of adding B2B digital sales concern ServiceSource International for $131 million, with the all-cash deal expected to close in 3QFY22.

Concentrix is in the process of evolving from a classic CX business process outsourcing [BPO] firm with a grounding in traditional call centers to a much more technology focused concern that offers holistic solutions leveraging emerging technologies such as AI, machine learning, IoT, robotic process automation, interactive voice response, and voice of the customer, amongst others. The PK acquisition accelerated Concentrix’s digital transformation with a complementary client base across similar verticals. PK is expected to contribute $85 million of Adj. EBITDA on revenue of $530 million during FY22.

CX Market & Concentrix

The CX BPO market is currently estimated at $90 billion. However, management pegs its total addressable market at $550 billion, which includes digital IT services – enhanced by the PK acquisition – and the aforementioned emerging technologies. For its core customer lifecycle solutions, Concentrix competes primarily with Teleperformance (OTCPK:TLPFF) and TELUS International (TIXT), and to a lesser extent the soon-to-be-merged Sitel Group and Majorel Group Luxembourg (OTCPK:MAJLY) in Europe, as well as TaskUs (TASK), TDCX Inc. (TDCX), TTEC Holdings (TTEC), Webhelp (amongst others), along with the in-house efforts of would-be clients.

Concentrix is a major force in the CX solutions industry, boasting as clients eight of the top 10 electronics companies; four of the five top tech concerns; seven of the top 10 fintech firms; the top five U.S. banks; four of the top five health insurance companies; three of the top five ecommerce businesses; and four of the top five social brands. Its top five clients accounted for ~25% of its top line in FY21. From this heady client base it generated FY21 earnings of $10.15 a share and Adj. EBITDA of $874.0 million on sales (ending November 30, 2021) of $5.59 billion, representing increases of 66%, 37%, and 18% (respectively) over a FY20 that essentially flatlined versus FY19 due to the pandemic. That said, boosted by acquisitions, Concentrix has grown substantially over the past decade, boasting a 48% CAGR from FY12 to FY21. These metrics do not include any contribution from PK. Approximately 20% of its FY21 top line was derived from ‘new economy‘ companies and 80% from enterprise clients.

With more complex services such as those provided by PK driving higher margins, management expects to reach an operating margin of ~14.5% (vs 10.2% in FY21) on revenue of $10 billion by FY25, with ~$1.5 billion coming from additional acquisitions.

Stock Price Performance

With the onboarding of PK, management is pivoting Concentrix as a holistic CX solutions provider that can design bespoke offerings by leveraging emerging technologies such as AI, etc., but at its heart it is still a call center business with relatively low-margins, generating FY21 gross profit margin of 35%. As such, valuations never attained irrational levels seen in so many other sectors during 2021. However, that does not mean that it or its industry was not susceptible to multiple contraction in the recent trying economic milieu. At its peak, its stock was trading at less than 2x FY22E revenue and just barely above a forward PE of 17, based on FY22E earnings. And before its 1QFY22 financial report was released on March 29, 2022, its stock price was still hovering around $200 a share.

Even though both earnings of $2.85 a share (non-GAAP) and revenue of $1.54 billion beat Street expectations by $0.14 a share and $10 million (respectively), the market elected to focus on two relatively minor items. First, despite beating Street estimates, it did not raise its FY22 forecast of non-GAAP operating income of $910 million on revenue of $6.53 billion, both based on range midpoints. Second, its outlook for 2QFY22 revenue at a range of $1.57 to $1.60 billion was slightly lower than the consensus estimate (two analysts) of $1.60 billion. Shares of CNXC fell 11% in the subsequent trading session to $173.90, which represented the beginning of a protracted decline which has continued to today.

2Q FY22 Earnings

And when the company reported 2QFY22 financials on June 27, 2022, its revenue came in at the low end of that range ($1.57 billion) while earnings of $2.93 a share (non-GAAP) beat the Street forecast by $0.11 a share. These metrics represented 14% (17% on a constant currency basis) and 24% improvements over 2QFY21 (respectively) as Concentrix realized double-digit top-line increases in its four strategic verticals and a 42% year-over-year increase in revenue from new economy clients to $363 million. Additionally, 2QFY22 Adj. EBITDA climbed 20% to $249.9 million versus $208.3 million in the prior year period.

However, the lower revenue in the quarter, which was essentially a function of both a strong dollar and some clients looking to shift to lower-cost geographies – i.e. employing cheaper Concentrix labor in Asia and Brazil – compelled management to tweaked its FY22 non-GAAP operating income down, from $910.0 million to $902.5 million on a reduced revenue outlook of $6.39 billion (down from $6.53 billion), based on range midpoints. Already down to $147.60 a share prior to the press release, its stock fell another 5% to $139.58 a share in the subsequent trading session, further extending its slide.

Balance Sheet & Analyst Commentary:

As for its balance sheet, the acquisition of PK was financed predominantly by debt, putting the company’s net debt at $2.14 billion on May 31, 2022 and its net leverage at 2.3x. Total liquidity stood at ~$1.3 billion. Although Concentrix has made paying down debt a priority, it did deploy $71.6 million of its free cash flow ($141.3 million in 2QFY22) towards repurchasing ~459,000 shares in FY22 (through June 30, 2022), leaving $403.3 million remaining on its authorization. The company also returns capital to shareholders in the form of a $0.25 quarterly dividend for a current yield of 0.8%.

Given its large presence in its industry, it is surprising to see only three Street analysts currently following Concentrix (versus nine for the smaller TaskUs), all featuring optimistic outlooks defined by one outperform and two buy ratings. Barrington recently reduced its from $202 to $183, with Bank of America (BAC) ($200) and Cross Research ($115) are the only analyst firms I can find with coverage on this company. On average, they expect the company to generate FY22 non-GAAP earnings of $12.14 a share on revenue of revenue of $6.39 billion – more or less in line with management guidance – followed by $12.97 a share on revenue of $6.89 billion in FY23, representing organic growth of 7% and 8%, respectively.

CFO Andre Valentine recently used the weakness in his company’s stock as an investment opportunity, purchasing 2,500 shares just below $127 on July 12th, 2022. It should be noted that other insiders and a beneficial owner have disposed of substantial amounts of stock since this insider purchase. David Einhorn’s Greenlight Capital was a buyer of the shares in the second quarter as well.

Verdict:

Mr. Valentine was likely drawn to his company’s robust free cash flow generation, which should land between $750 million and $775 million in FY22. That cash can be employed to reduce net leverage below 2.0x by YEFY22, finance future acquisitions, repurchase stock, increase its dividend, or some combination thereof. On almost any metric – under 10x FY22E EPS and .95x FY22E revenue – Concentrix is no longer overvalued. However, its stock has shown little sign of putting in a bottom, meaning its descent from over $200 a share could continue, valuations be damned. That said, we will keep an eye on this one for an opportunity to enter once its market dynamics have improved.

Options are available against this equity and they are quite lucrative. Therefore, for those tempted to take a ‘watch item‘ position in CNXC, a covered call strategy is viable and prudent.

Assumptions are the termites of relationships. – Henry Winkler

Be the first to comment