onurdongel/E+ via Getty Images

Comstock Resources (NYSE:CRK) has long been planning for a banner day for natural gas. That day has arrived putting this company in an excellent position to take advantage of the situation. This is one of the lowest cost producers in the industry. Therefore, the company is likely to be one of the more profitable companies even with a hedging program in place.

Already, management has called some debt. The unexpectedly strong pricing has resulted in “bonus cash flow” that will result in early debt retirements here and throughout the industry. After that will likely come dividends and stock purchases and retirements.

Like many companies, management hedges to reduce the cash flow volatility. That helped the company tremendously during the downturn. But it is now holding back profits to the consternation of most investors. Nonetheless, a consistent hedging program is meant to be a zero-sum game. Whether that happens in real life is another matter entirely.

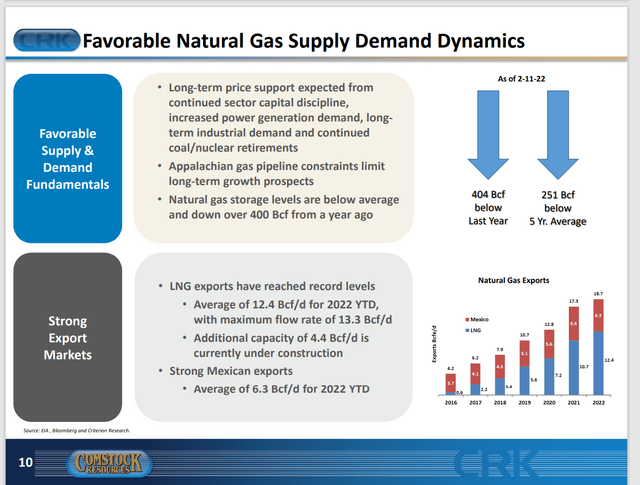

Comstock Resources Bullish Outlook For Natural Gas (And Why) (Comstock Resources Conference Call Presentation Fourth Quarter 2021)

If the situation is close to what management presented above, then the forward curve should begin to reflect the optimism of management. This means the discount in the forward curve should lessen. The ability to join the world natural gas market is a game-changer for North America. This continent is easily one of the cheapest sources of natural gas in the world. The supply is quite large and likely to last generations. Therefore, natural gas companies are likely to post some impressive profits after years of profit pressure from the fast growth of the Permian and other unconventional businesses.

Investors right now are upset with managements that continue to hedge when the forward curve is far lower than current prices. However, many times the situation does not last all that long (even though it seems like forever to investors). Combine that consideration with the idea that the industry has notoriously low visibility and it can be easily seen why companies keep hedging.

It is often far easier for management to justify a capital budget with a hedging program in place. The hedges often assure a reasonable return for the money invested. That stance by management can easily be verified with a series of calculations. On the other hand, the market itself is so volatile that it is very hard to justify much of anything given the low visibility of the industry. In that sense, the market will usually take what certainty it can get over no certainty at all.

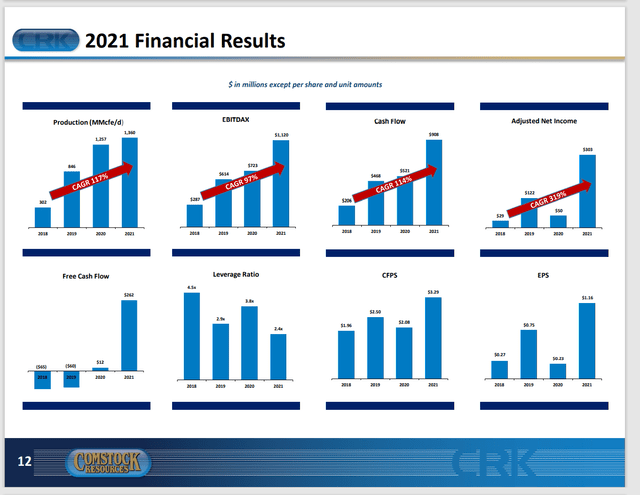

Comstock Resources Presentation Of Financial Progress (Comstock Resources Fourth Quarter 2021, Conference Call Slide Presentation)

Probably the most significant change is the reduction in operating costs to the point where the company has free cash flow. So many times, the unconventional business is labeled “high cost” and “high debt” when neither needs to be the case anymore. The company now generates free cash flow in the current environment. As costs continue to decline because technology is moving forward, the ability to generate free cash flow will happen at lower natural gas prices in the future.

Not many realize that a commodity business often needs to decrease costs between 5% and 15% a year on average for the companies to remain competitive. Long term, this change shows itself in the continually moving definition of Tier 1 acreage. When I was growing up, Tier 1 was a roughly 5,000 ft vertical well that flowed at least 200 BOD and did not dry up unexpectedly. People used to laugh that 10,000-foot-deep wells would never be profitable. Obviously, today it is a completely different story, and it is likely to be a very different story in the future.

In the meantime, the debt markets have changed considerably towards the industry. The likely explanation for this is that the last two industry recoveries were remarkably short-lived because production quickly oversupplied demand. This led to some considerable loan losses. Therefore, there is a demand by lenders for suppliers to live within their means.

That lender demand is coupled with a market demand by Mr. Market to also return some cash to shareholders even though the companies with hedging can justify a far better return to shareholders than management can by returning the money. So, during the good times, there is balance sheet repair, dividends, and stock purchases to take the place of unrestrained growth.

Since there was a huge decrease in production during the coronavirus shutdown, the current administration is all for the unrestrained production growth of the past to put a lid on higher prices. That would at least mitigate the current pressure of high prices. Nonetheless, the extra cash flow provided by strong pricing is allowing managements to “inch up” capital budgets. So, there is likely to be more growth than is currently expected.

Sooner or later (probably a lot later), production will exceed demand to bring an end to the current boom. Generally, the beginning of the end is marked by inexperienced lenders and investors entering the market with unrealistic assumptions to provide that extra production growth. They will also be the ones likely to lose “everything” during the cyclical downturn.

This management has had no trouble selling stock and refinancing loans during the last few years. That is also true for many companies in the industry that know what they are doing. Contrary to the headlines, debt markets and equity market do not “close”. But the price to use the markets can get expensive for those who do not know what they are doing. So far, that has kept industry excesses to a minimum.

Comstock Resources actually has a fairly significant debt load that management will now be able to fix with free cash flow. The company survives decently because operating costs are among the lowest in the industry. This company will be able to cut costs significantly as the strong commodity prices persist. However, should an unexpected downturn occur, then costs are low enough to enable the company to survive a downturn.

This management has very little debt due in the future. What little that is due can be repaid with cash flow. Should management decide to decrease debt further, then bonds can likely be purchased from time to time to reduce debt. Usually, that is far cheaper than doing something formal like calling the debt.

As a low-cost industry leader, this company is a much safer investment than many in the industry. The low cost and reasonable debt part is a fairly new story for Mr. Market. Therefore, Mr. Market is likely to demand some operating history before assigning a reasonable multiple to the earnings power of this company. But that track record is not going to take anything extraordinary from management. The excellent location is not likely to be displaced by a lot of lower cost natural gas in the future (though that is always a risk in the industry). This company is going to be able to thrive under a wider variety of industry scenarios than are a lot of higher cost competitors.

Be the first to comment