SMIs and PMIs

The Sales Managers’ Index, SMI, is akin to but different from the Purchasing Managers’ Index, PMI, that we’re more familiar with. The essential concept is the same – if we want to know what is going to happen then go ask those preparing to create that future.

For example, things that are to be made must be made from something. So, if we ask people what they’re getting now to make stuff from we’ll gain a good handle on what will be made. The concept isn’t all that difficult.

Of course, once the idea has taken hold that we’ve got a guide to the future, there starts a little competition to have that information that little bit earlier. Information processed a little earlier in the month perhaps. So, the SMIs come out a little before the PMIs. The survey panels and methods are different too but the basic underlying concept is similar as World Economics, the producers themselves, tells us “Its parent company Information Sciences Ltd. has a long history of the development of key business information today used throughout the world, including the origination and development of the Purchasing Managers Indexes in China, Japan, India, Europe, America and the UK (now owned by IHS Markit),”

As we might also say competition improves matters.

Our prediction aim

We want to know what’s going to happen to our economy. A logical starting point is what has happened to China’s. Given that, you know, China is a couple of months further through the process than we are.

At which point we face something of a problem. No one really believes economic statistics coming out of China. For good reason too – if you add up the provincial GDP figures they never do equal the national ones. This is because even the central Chinese government realises that the provincial figures are optimistic at best – and heroically so – this they need to be tamed down before anyone will take them seriously.

One way around this is to use private sector Chinese figures, not government. Which is exactly what we’re doing here.

We are also making an assumption that the American experience will be like the Chinese. I regard that as a reasonable one.

China SMI

We now have the latest China SMI. It’s not entirely boom-time, that has to be said:

(China SMI business confidence from World Economics)

That’s marginal expansion. But note that the numbers are month on month – so it’s marginal expansion after the significant falls before, not expansion from our starting point.

Chinese Sales Managers face still worsening problems on the sales front due to

major supply and demand problems

Reopened factories plagued by supply chain issues and depressed demand from many still closed markets overseas

That sounds rather gloomy but it isn’t for a reason we’ll come to.

US SMI

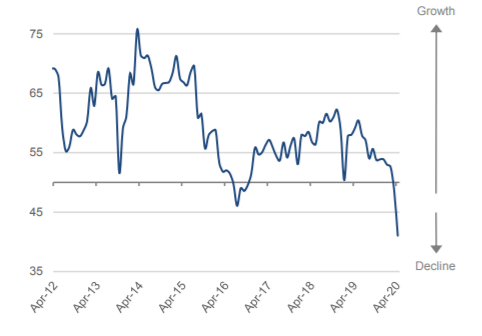

We also have the equivalent US numbers:

In summary, the US economy is shrinking very rapidly. The optimism suggested by the recent stock market buoyancy looks very out of synch with the views of those charged with maintaining sales of products of all kinds both inside and outside the USA.

I consider part of that to be wrong for a reason we’ll also come to:

(US business confidence from World Economics)

(US business confidence from World Economics)

There’s no doubt the US is going through a significant contraction here. But my point is that it’s just like the one that happened in China, the one that happened a couple of months earlier. The one in China that at least has gradual recovery already started happening to it.

The more detailed numbers tell us much the same story. At least, the US is following the same route down the rat hole, it’s reasonable for us to expect it to come out the same way too.

The message here

Oh yes, we’re in a recession and a bad one. Those are not the interesting questions, rather, how long is it going to last and how soon do we come out of it?

My reading of this is as it has been for some time now. The recession is deep – as China proves – and short – as China proves.

Note how we define a recession. It’s two measurement periods – usually quarters – of continually falling output. Output falling in one period then rising in the second even if not to the starting point is not, repeat not, a two-period recession. It’s one at most, for we measure month to month, or period to period, not year on year.

So, China tells us that the recovery starts pretty much as soon as the lockdowns end. We must assume that that’s what happens for us too.

Note what also is happening in China. That we’re not as far along the path as they are in restraining demand for their products. OK, but by the time we come out of it everyone will be recovering so that’s not going to happen to us.

And that then brings us to that idea that stock markets are overvaluing the recovery. Well, no, not really. Because that market valuation is all of the future. OK, discounted to a net present value but still. What happens in the next few months is interesting, it most certainly is. But what drives the valuation of a stock now is what happens in the next two decades. Well, as long as it survives the next few months that is.

My view

That I expect the recession to be deep but short is what leads to the conclusion that the market isn’t overvalued. For the market valuation is a long-term one, not concentrated merely upon short-term factors. Or, perhaps, as long as a stock can survive the short term, then the valuation is based upon the long.

I’d agree, if markets were a valuation of the short-term prospects of the economy then sure, they’re overvalued. But they’re not. We fully expect to be collecting dividends from the DJIA and S&P 500 – or most of it at least – in two decades’ time. What those dividends are in that two decades’ time is still a small influence on today’s price.

The investor view

Yep, times are heard all right but we’ll come out of it. The Chinese evidence is that we’ll come out of it in a pretty short period of time too. To my mind, that means stocks are somewhere between cheap and reasonably priced at present. The advice is therefore to buy into solid and dividend-paying stocks. For in recessions the price of risk always rises, meaning that the more speculative stocks are overvalued compared to the safe and boring.

In economic troubles big, safe and boring is our friend – so that’s where to invest.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment