Paul Morigi

Introduction

I first covered Comcast Corporation (NASDAQ:CMCSA) in a comparative analysis back in April, when the stock was trading in the mid-$40 range. Even then, I thought it was an acceptable value, but in the meantime, things have turned out much better from the perspective of a contrarian value investor.

In this article, I will outline why I think the stock is a highly promising value, especially for dividend growth investors, based on the company’s second quarter 2022 results.

Key Takeaways from Comcast’s Second Quarter Earnings Call

Strong Free Cash Flow From The Cable Segment

Primarily due to the difficult environment due to the virus-related lockdowns in 2020, many companies were faced with significant working capital-related challenges in 2020 and 2021. The consequences in 2022 in many cases are bloated inventories, and with consumer sentiment increasingly deteriorating, many companies are forced to mark down items to generate needed operating cash flow.

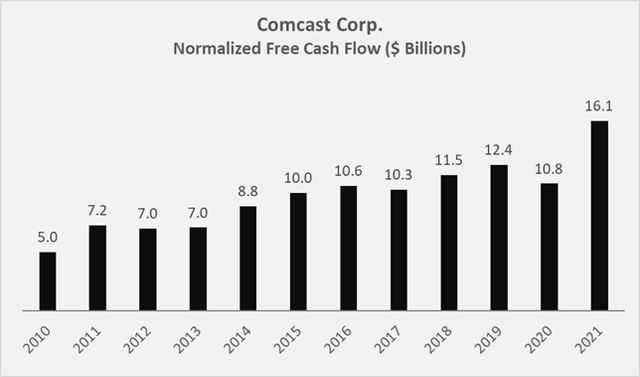

Comcast, as a telecommunications company, does not rely on substantial working capital in the traditional sense (i.e., inventories). For this reason, and because the company relies heavily on cable fees, it continued to generate strong free cash flow in 2020, even though the company’s Theme Parks and Studios segments suffered a major setback due to pandemic-related measures. Figure 1 shows Comcast’s free cash flow trajectory from 2010 to 2021, normalized for working capital movements, stock-based compensation expense and impairment charges. While the $16.1 billion in free cash flow generated in 2021 looks like a one-time event, Comcast can be expected to generate at least $16 billion in free cash flow in 2022, as the company has already generated $8.6 billion in the first half of the year, representing 6.4% year-over-year growth. That puts its forward free cash flow yield at a whopping 11.5%.

Figure 1: Comcast’s historical normalized free cash flow (own work, based on the company’s 2012 to 2021 10-Ks)

Importantly, free cash flow growth was driven by customer relationship growth (+1.7% year-over-year in Q2 2022) and strong revenue growth (+3.7% year-over-year in Q2 2022). In the last twelve months, the company added 775 thousand broadband customers (revenue growth of 6.8% to $6.1 billion).

The number of customers remained unchanged from the previous quarter, while the company was expected to add 84 thousand net new subscribers in Q2 2022. This was the main reason for CMCSA’s sharp sell-off on the day it released its second-quarter results. Reasons for the lower-than-expected performance included weaker economic conditions that slowed move rates, reversal of customer trends adopted during the pandemic, and finally competition from fixed wireless. Competition from 5G networks is an oft-cited threat, and while network speeds are theoretically competitive, scaling in terms of data volume remains a major challenge. It therefore seems overstated to view this type of competition as a direct threat to Comcast’s dominant position in the cable business.

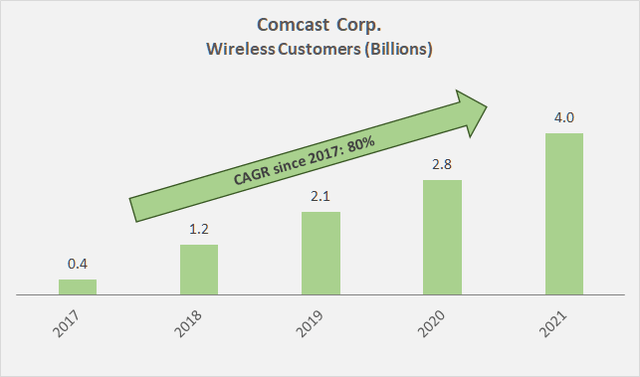

The company added more than 300 thousand wireless lines during the quarter. This is the company’s best performance since the launch of its wireless service in 2017 (Figure 2) and resulted in nearly 30% growth in wireless revenue for the trailing twelve-month (TTM) period. With TTM revenue of $722 million, the segment is still very small but playing an increasingly important role.

To be able to compete with Netflix (NFLX), Disney (DIS) or other streaming giants, more than organic growth is certainly required, so it does not seem unlikely that management is considering, for example, the acquisition of Warner Bros. Discovery (WBD), which was formed only a few months ago from the merger of Discovery and AT&T’s (T) WarnerMedia business unit. However, this is pure speculation at this point, also from the point of view of the tax treatment of the AT&T spin-off. From a price point of view, the takeover seems in principle manageable for CMCSA. WBD’s current market capitalization is $29 billion, and even at a 30% premium (i.e., a $16 share price), $38 billion hardly seems out of reach. Of course, WBD’s net debt of $50 billion at the end of the second quarter of 2022 must also be considered (p. 6, second quarter 2022 10-Q). Personally, I would prefer that management not pursue such an acquisition at this time, and instead wait for the dust to settle in the still highly competitive streaming business (see my article on Netflix) to potentially get a much better deal in the future.

Figure 2: The growth trajectory of Comcast’s wireless segment (own work, based on the company’s 2017 to 2021 10-Ks)

NBCUniversal – Studios And Theme Parks Have Returned To Growth

In the NBCUniversal (NBCU) business unit, Comcast reports results of the Media, Studios and Theme Parks segments. On a consolidated basis, NBCU’s second quarter 2022 revenues grew nearly 19% year-over-year and adjusted EBITDA grew nearly 20% year-over-year. This was primarily driven by strong demand at U.S. theme parks and Universal Studios in Japan, while the Beijing theme park was closed for most of the quarter due to ongoing restrictions from China’s zero COVID policy. Due in part to easing pandemic-related restrictions in most other parts of the world, the company reported significantly higher content licensing revenue. In the media segment, Comcast saw distribution revenue increase more than 8% year-over-year, while advertising revenue declined 1.3%.

Peacock, the streaming service launched in 2020, is also reported in this segment. I discussed it in detail in my previous article, and it’s hardly surprising that Peacock continues to burn money (adjusted EBITDA loss of $467 million) due to high content spending. Personally, I am not a big fan of streaming services, as they are part of an extremely competitive and increasingly commoditized industry. However, Comcast definitely has very lucrative content franchises to offer, such as Jurassic World and Despicable Me, and the DreamWorks assets should not be forgotten either. In Q3 2022, Peacock did pretty well, according to NBCU CEO Jeff Shell, as the streaming service added more than 2 million paid subscribers in the quarter, bringing the total to more than 15 million – still not a lot, but the growth is promising.

Sky – After All The Praise Some Negative News

Comcast took control of Sky in 2018. The $50 billion acquisition (16 times 2019 EBITDA) was partly the result of a bidding war with Fox and Disney. Sky is the largest pay-TV operator in the United Kingdom (market share of nearly 50% of households) and also dominates in Germany, Austria and Italy. The acquisition was an expensive but smart move as it allows the company to distribute content outside the United States. Sky has exclusive rights to content such as the English Premier League. According to the company, 50% of the viewed content comes from Sky’s own portfolio, which hardly seems surprising given that the company has also built its own entertainment studio and continues to invest in Sky News.

I suspect that Comcast’s poor share price performance in recent months, following the broadband subscriber-driven sell-off in late July, is at least partly attributable to the Sky segment. The number of subscriber relationships declined from 23 million at the end of Q4 2021 to 22.7 million at the end of the second quarter, largely related to the end of the football season but also, more importantly, to an increasingly difficult economic environment in Europe. While quarterly revenue was down 3.5%, adjusted EBITDA was up more than 70% to $863 million, driven by lower sports programming and production costs associated with resets in Comcast’s sports rights.

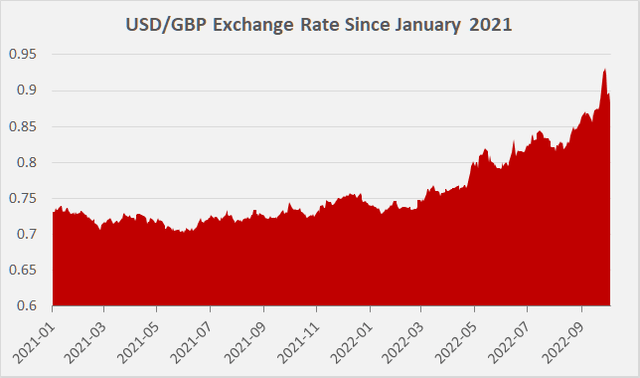

However, investors should also keep in mind that the U.S. dollar has strengthened significantly against the British pound (Figure 3), which translates into lower Sky-related earnings in dollar terms.

Figure 3: USD/GBP exchange rate since January 2021 (own work, based on the currency’s pair’s daily closing price according to Yahoo Finance)

A Disciplined Approach To Deleveraging

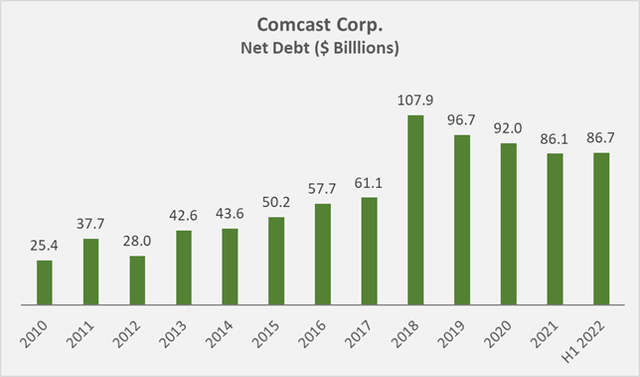

The aforementioned acquisition of Sky in 2018 understandably increased Comcast’s leverage significantly. However, the company has been very disciplined in reducing debt, and at the end of the second quarter of 2022, net debt was $86.7 billion, a decrease of $21.2 billion from the all-time high at the end of 2018 (Figure 4). Comcast’s self-reported net debt ratio on a consolidated basis and adjusted for Universal Beijing Resort was 2.3x at the end of Q2 2022, down slightly from 2.6x at the end of Q2 2021.

Figure 4: Comcast’s historical net debt, calculated as long- and short-term financial debt minus cash and cash equivalents (own work, based on the company’s 2021 10-K and the second quarter 2022 10-Q)

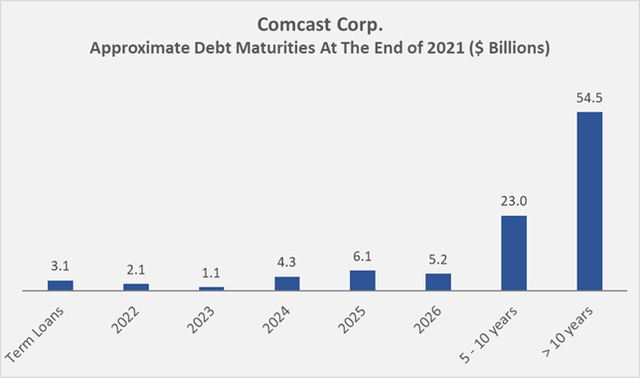

While I believe the company’s own estimate of leverage is somewhat aggressive, I still recognize the disciplined repayment of debt. Interest rates are rising, and therefore a significantly leveraged company like Comcast is likely to face higher interest expense going forward. However, the company’s maturity profile has a significant negative skew (Figure 5), with 55% of Comcast’s debt maturing after more than ten years, and only about 11% ($10.7 billion, including term loans) maturing by the end of 2024. At the end of 2021, Comcast’s weighted-average interest rate was 3.74%, translating to an interest coverage ratio of 4.8 times free cash flow before interest. This is not ideal, of course, but still very acceptable given Comcast’s highly predictable cash flows.

The company’s long-term debt was rated A3 with a stable outlook by Moody’s, but the rating is somewhat outdated (September 24, 2018). The most recent rating from Standard & Poor’s is A-, which is comparable to Moody’s rating and represents the lowest grade in the group of high investment grade ratings.

Since the end of 2020, Comcast’s five-year credit default swap (CDS) spread has widened from about 20 basis points to 80 points in September 2022, largely due to rising interest rates and significant exposure to the UK and also continental Europe. Nevertheless, I would argue that this increase in the risk premium should be considered normal and in line with the broader market, as most companies’ CDS spreads have increased significantly due to rising interest rates.

Figure 5: Comcast’s approximate debt maturities at the end of 2021 (own work, based on the data found on p. 84 of the company’s 2021 10-K).

Comcast Will Continue To Shower Shareholders With Cash

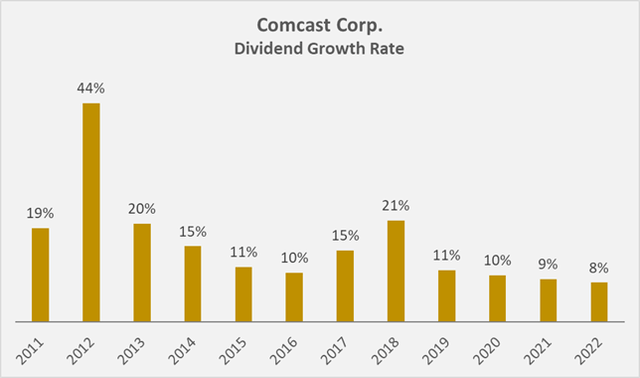

Comcast’s management arguably pays itself well, but it also returns appropriate amounts to shareholders. The company’s dividend growth trend since 2011 is shown in Figure 6. Dividend growth has arguably slowed in recent years, but it does not seem unreasonable to expect an increase in growth as Comcast continues to reduce debt. Finally, the payout ratio is very modest at only about 30% of 2021 normalized free cash flow. It should also be remembered that Comcast regularly buys back shares. The company’s weighted average diluted shares have declined from 5.6 billion in 2010 to 4.7 billion in 2021. So far in 2022, the company has made good use of the falling share price, buying back shares for $6.3 billion.

Figure 6: Comcast’s historical dividend growth rate since 2011 (own work, based on the dividends declared each year)

From a dividend growth investor’s perspective, it is always important to hear reassuring statements from management that confirm the company’s positioning in terms of shareholder returns. In this context, I would like to share with you an excerpt from CEO Brian Roberts’ remarks during the second quarter earnings conference call:

I think all parts of the company are really doing a great job in some interesting times. By the way, our treasury department went out while interest rates were low and we’ve basically repriced the whole balance sheet for something on the order of 18 years average maturity at record low rates. So I feel we are able to return capital to shareholders. I think that’s been a real focus and I think we did it again this quarter.

– Brian Roberts, CEO of Comcast

Conclusion – Why CMCSA Is a Buffett-Style Fat Pitch

Comcast exhibits monopolistic tendencies and benefits from large economies of scale and network effects. Its bold (but expensive) acquisitions of NBCU and Sky have laid the foundation for strong synergies, especially related to content distribution. Its brand portfolio is very strong, and the company has been successful in diversifying its cash flows from its cash cow, the cable business. Nevertheless, Comcast continues to perform surprisingly well in this area, and investor service Morningstar has assigned the company a wide economic moat with a stable trend, largely due to the extremely high barriers to entry and Comcast’s dominant position.

Unlike phone companies, which are the biggest competitors, cable companies can easily increase network speeds and gain market share as a result. Competition from 5G networks is an oft-cited threat, and while network speeds are theoretically competitive, scaling in terms of data volume remains a major challenge.

Comcast has managed the pandemic particularly well, especially given its exposure to theme parks, some of which continue to suffer from ongoing constraints (Universal Studios Beijing).

Comcast also generated very strong cash flow in 2022 and remains committed to returning cash to shareholders. In the first half of the year, the company repurchased more than $6 billion worth of shares and paid $2.4 billion in dividends. Due in part to the low payout ratio, I expect the company’s expected dividend increase in January to even outpace the current high inflation rates.

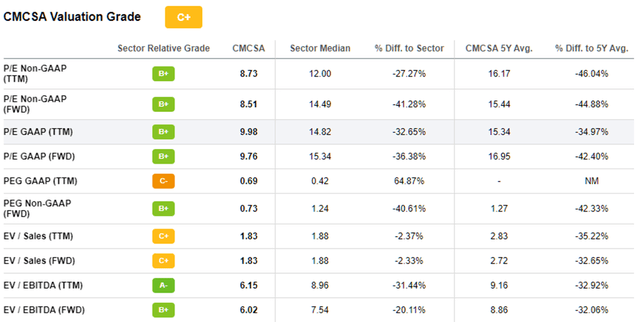

Largely due to rising interest rates, fears of a recession, significant inflation, and an ever-stronger U.S. dollar, CMCSA shares have come under heavy pressure. Since the beginning of the year, the stock has fallen nearly 40%. With a price-to-earnings ratio of less than 9 and a free cash flow yield of 11.5%, the stock can hardly be called expensive (Table 1). The current dividend yield of 3.5% also indicates that the stock is significantly undervalued, compared with the average dividend yields of the last five and ten years of 2.0% and 1.7%, respectively. Just imagine the yield on cost that could be achieved after a few years of patience. Morningstar sees CMCSA’s fair value at $60 with medium uncertainty and rates the stock a five-star opportunity at a 49% discount (as of October 4, 2022).

Table 1: Selected valuation metrics for CMCSA (taken from Seeking Alpha’s stock quote page on October 4, 2022)

It should therefore come as no surprise that I added significantly to my CMCSA position last week at a price of around $30. For the reasons outlined in this and the previous article, I remain very optimistic about the future of this very well-managed company and therefore consider it a very good buy at current levels.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment