Shaun Heasley

As a result of the ongoing bear market, Comcast (NASDAQ:CMCSA) shares have fallen 40% since the start of the year. Despite the prevailing negative sentiment, revenue growth remains robust, with the company generating solid free cash flow, which allows it to service its debt, as well as direct funds to dividends, buybacks, and new projects.

Despite significant macro risks remaining, I remain positive on Comcast stock given the low valuation and strong diversified business.

Comcast’s cheap valuation

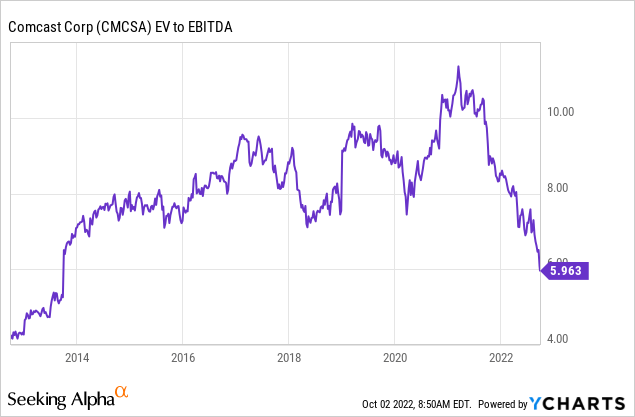

Although Comcast is now at its 2016 levels, profits and revenues are almost 50% higher than they were 6 years ago.

Thus, the company’s valuation is at the level of a 9-year low.

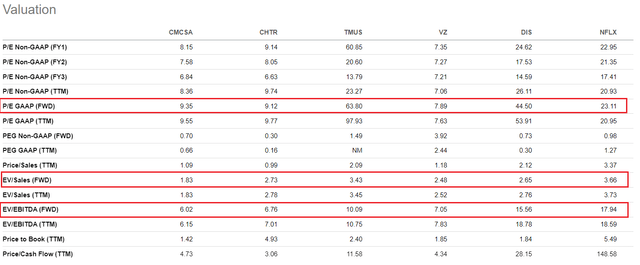

A 40% drop also led to an undervaluation in relation to its peers as forward EV/Sales, P/E and other ratios appear to be lower than those of its competitors.

Given the industry’s average P/E ratio of 17.2x, Comcast has a great upside potential of 80%. However, given the prevailing bearish trend in the US market in general and in the TMT sector in particular, as well as growing concerns about the start of a recession in the US, I don’t believe that the full upside potential will materialize. Thus, I would stick to a 20%-25% upside in the mid-term.

Sustainability through a strong diversified business

Cable Communication segment condition

The backbone of Comcast’s business is cable communications. The company provides services of cable television, subscriber television, etc for households. For corporate customers, Comcast offers corporate mobile services, as well as smart office, digital transformation, and cloud solutions. The company operates a business model similar to Amazon (AMZN), in which one high-margin segment pays for another, giving it a huge competitive advantage in streaming. Thus, cable communications revenue is strategically important for Comcast as it accounts for 55% of Comcast’s total revenue.

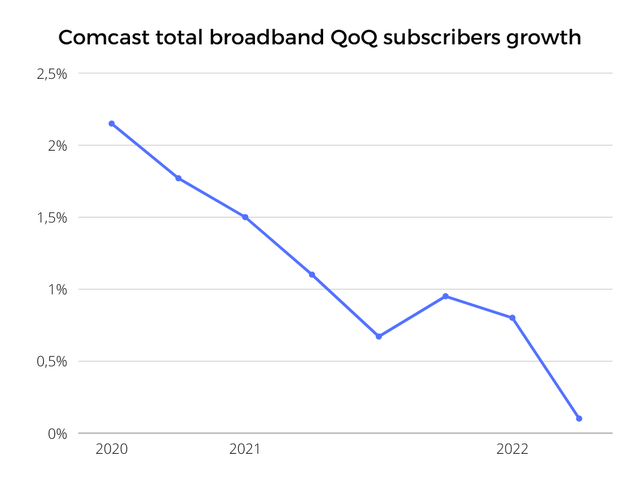

In 2Q22, the total subscriber base of the cable segment decreased by 28,000 to 34.38 million subscribers as the global cord-cutting trend continues to push consumers away from cable and pay TV. The number of fixed broadband subscribers was flat at 32.2 million. The general trend does not look positive. The growth has slowed over the past two years and approached zero in the last quarter.

It’s important to understand though that this is happening across the industry, not just at Comcast.

However, there is still a growing demand for higher Internet speeds from households and businesses, and Comcast is unrivaled in this. The company is actively implementing its DOCSIS 4.0 technology, which so far is the only one in the country that provides multi-gigabit speeds for incoming and outgoing Internet traffic over a hybrid fiber optic network. Thus, thanks to Comcast’s competitive advantage over both other fixed broadband companies and mobile broadband, its performance and wireless bandwidth limitations will provide a natural limit to mobile broadband penetration, and the cable communication segment will likely remain the reliable cash machine for the company.

NBCUniversal

NBCUniversal is Comcast’s fastest-growing segment, and the company is betting big on it. The segment includes national, regional, and international cable TV channels, radio stations, film studios, Universal theme parks, and the Peacock streaming service. The total audience reaches 226 million adults every month.

Universal theme parks are performing well despite a general slowdown in business activity and economic growth around the world. In recent quarters, attendance at two US parks has consistently been above pre-pandemic levels. Theme park revenue jumped 65% in Q2 despite the Beijing park being closed from April to May. A strong brand portfolio and well-organized parks help attract new tourists and engage them in the vast NBCU universe.

Peacock, another strong growth driver for the segment, remained at 27 million subscribers and 13 million paid subscribers level in Q2. Peacock’s main selling point is the low cost of a $4.99 subscription. The service is viewed by users more as a kind of iconic content library. To attract users, the possibility of early access to the premieres of Universal Studios has been added. Thus, Peacock will receive unique content that will allow it to increase the cost of a subscription, take the service out of operating losses and develop further as a full-fledged part of the ecosystem. Peacock will not be developed as a standalone product, but as an addition to its core business, helping to increase the company’s advertising revenue.

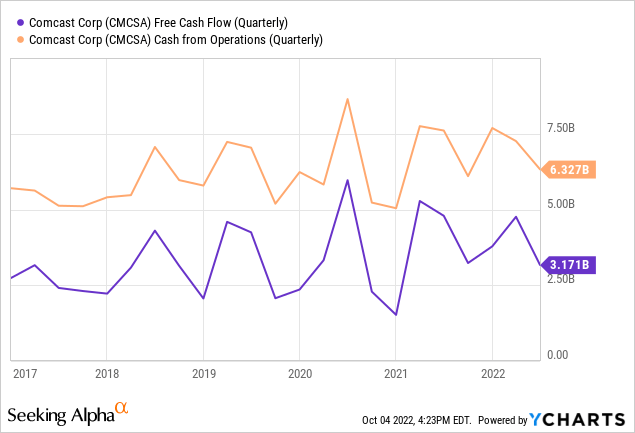

Comcast has a healthy FCF, but a heavy debt load

Comcast continues to generate massive free and operating cashflows. In Q2, the company reported consistently strong OCF of $6.3 billion and FCF of $3.2 billion.

A stable cash flow is very important to Comcast, as the company has more than $90 billion in net debt. With the debt load heavy like this, the company might not be able to continue increasing its CAPEX, which will have a long-term impact. However, I still think that Comcast will have just enough funds to make this work as the cable communication segment revenue will likely continue to grow at 7-10% in the coming years.

Conclusion

I see real undervaluation in Comcast. The $30 level is a good opportunity to invest in a value stock with stable dividends and generous buybacks. The business is in good condition and has a bright future ahead.

Even taking into account the risks associated with a high debt load, further tightening of US monetary policy, a potential recession, and a slowdown in the cable and pay TV industry, I would rate CMCSA as a Buy.

Be the first to comment