TongTa/iStock via Getty Images

Change takes time, but Columbus McKinnon (NASDAQ:CMCO) has made it clear that they’re serious about transforming into a higher-value-added provider of automation-enabling machinery and generating stronger margins in the process. Multiple M&A transactions have augmented the company’s product lineup, while the newest iteration of the company’s Blueprint for Growth strategy continues to offer avenues to margin improvement.

When I wrote about Columbus last summer, I said I saw a window of opportunity in the shares. That window has stayed propped open longer than I expected, though the shares have kept pace with the wider industrial sector while slightly underperforming the S&P over that time. With mid-single-digit long-term revenue growth potential, improving margins, and the possibility of double-digit ROIC in FY’23, I still see meaningful potential in these shares today.

An Interesting Short/Long-Cycle Mix

A lot of shorter-cycle industrials have lost favor as this recovery has continued on, but Columbus offers a more interesting mix of short-cycle and longer-cycle leverage. There’s no doubt that a significant part of the business is short-cycle, including the 20% leverage to “general industrial” markets and the 10% or so exposure to material handling and industrial automation.

There is also quite a bit of later-cycle exposure, though, including meaningful leverage to energy/utilities, chemicals/paper/metals, construction, and oil/gas (collectively around a third of the business). Core sales are still below pre-pandemic levels, suggesting an ongoing runway for recovery growth.

There continues to be considerable construction activity in the warehouse/logistics and industrial segments (moreso warehouses, but industrial construction has also picked up). In past cycles, Columbus has usually seen a pickup in demand for its lifting solutions around a year or so after construction activity picks up, leading me to think that there will still be a healthy backlog of business well into 2023.

What does all this mean in plainer English? Basically that I think Columbus still has a good runway of business opportunities. Although volume has certainly slowed in recent quarters, I think it will stabilize and continue to drive growth from here. I also want to comment that the old rules about short-cycle/long-cycle are never hard-and-fast rules. For instance, while pulp & paper is generally considered a longer-cycle industry (as is metal processing), capacity growth in those end-markets in response to demand is driving more activity earlier in the cycle.

Automation Remains A Real Driver

One of the keys to the Columbus story is how the business has transformed and continues to transform.

Columbus is a leader in lifting solutions and has found ways to invigorate the business through product development, as well as improving the profitability through product line simplification, but it’s a business that will generally grow more or less in line with GDP.

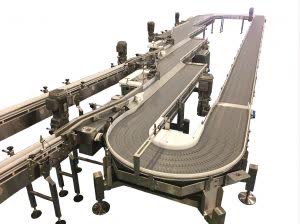

What’s more exciting is the expansion and growth into areas of automation, including linear motion, motion control, conveying, and the products brought in with the Garvey deal. Columbus acquired Garvey for $74M late in 2021, adding the company’s accumulation systems, specialty conveyors, and other specialized products (vial loaders, et al) to the mix.

Accumulation systems basically help balance the product flow between machines and keep production lines running more smoothly and efficiently. It’s a good add-on for Columbus’s conveying business, and I like the additional leverage it brings to food/bev, life sciences, and biopharma – some of the most attractive markets in automation right now.

Garvey

Between Dorner and Garvey, Columbus has not only made deals that have added to its automation capabilities, they’ve been margin-accretive. With these deals, and complementary product development, the legacy lifting business is becoming less significant and the company is boosting both its long-term growth rate and its margins.

The Outlook

My thesis on Columbus is effectively this – the company is now better-positioned to take advantage of ongoing adoption of automation across a range of industrial markets, particularly now that labor availability has become such a challenge for so many businesses. Columbus is likewise leveraged to underlying capacity growth in end-markets like food/beverage, biopharma, and packaging, and has a growing portfolio of machinery that is relevant to the needs of warehouse and logistics automation.

On top of what I believe will be above-cycle growth (though not completely acyclical growth), I see room for further margin expansion. Some of this expansion will come simply from mix, as value-added automation-enabling machinery becomes a larger part of sales, but some of it too will come from internal efforts, including ongoing product line simplification and an increased use of common parts across products.

I’ve modestly tweaked my estimates since my last update, slightly reducing my FY’22 estimate on supply chain headwinds/limitations, while boosting FY’23-FY’25 a bit as that revenue is recaptured later and Columbus continues to benefit from its expanded product line-up. I’m looking for over 5% long-term adjusted revenue growth.

On the margin side, I expect Columbus to see fairly rapid acceleration toward high-teens EBITDA margins over the next couple of years. I’m expecting that to translate into low-to-mid-teens FCF margins, with long-term adjusted FCF growth in the neighborhood of 7%.

Using a discounted cash flow approach, I believe Columbus shares are more than 25% undervalued today and priced for a healthy double-digit long-term annualized total return. I see similar undervaluation on the basis of my 12-month EBITDA estimate, with Columbus’s near-term margins and returns (ROIC, et al) supporting a multiple just under 12x. As management delivers on margin improvement, that multiple should grow over time.

The Bottom Line

What Columbus does, and the markets they serve, isn’t so much in favor now, but I believe the future opportunities for the company are getting better and better. This will never be a particularly flashy or “sexy” call, but I think it’s the sort of long-term self-improvement story that can do well for patient investors. I don’t know that Columbus will ever truly be a “compounder”, but I do like the outlook for above-cycle growth, growing brand value, improving margins, and low capital intensity as the business evolves more toward automation-enabling.

Be the first to comment