Leon Neal/Getty Images News

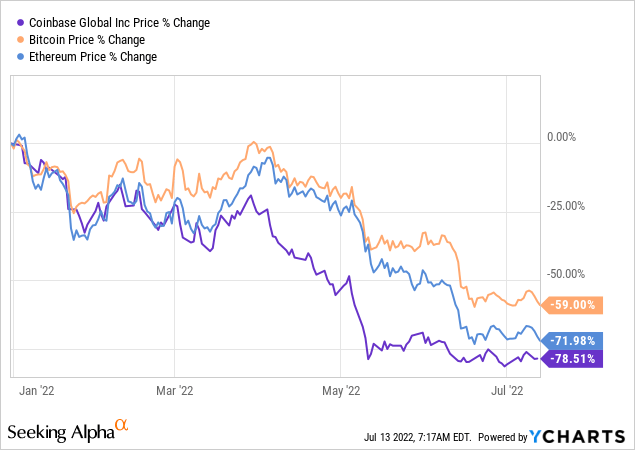

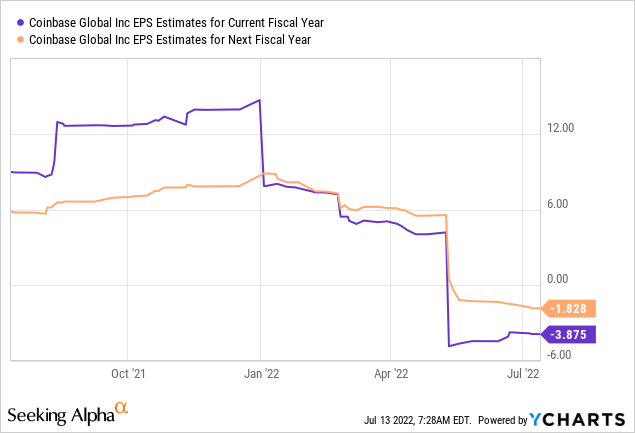

Shares of Coinbase Global (NASDAQ:COIN) cratered 79% in 2022 due to deteriorating crypto market conditions and steep declines in prices for crypto assets. As a result, Coinbase Global saw declines in all of its major platform metrics including monthly transacting users, trading volume and net revenues in the first-quarter. Going forward, I believe that investors must expect a slowdown in asset growth on the platform, especially from institutional investors, as well as weaker platform metrics across the board. EPS estimates are also declining rapidly, suggesting that an upwards revaluation — unless conditions in the crypto markets fundamentally change in the second half of the year — is unlikely to happen any time soon.

Deteriorating crypto market conditions foreshadow an awful Q2’22

Coinbase’s platform business was deeply affected by the decline in crypto prices this year. Major digital currencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD) slumped to new lows in 2022, dragging the entire crypto market down, including the share price of Coinbase.

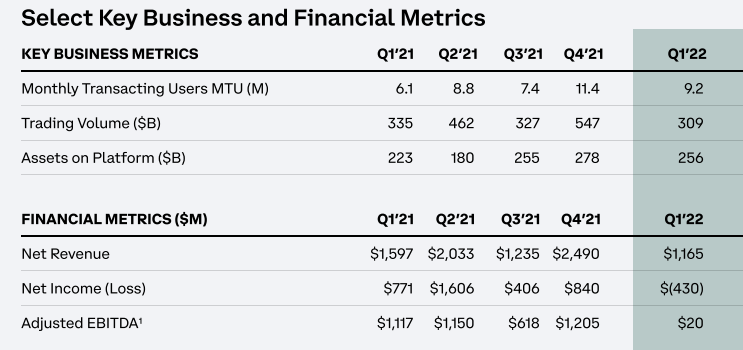

Because of broad-based declines in cryptocurrency prices, Coinbase is set to submit an earnings card for the second-quarter in August that will likely see a serious deterioration in all of its key platform metrics. Coinbase Global’s most important metric — the number of monthly transacting users on the platform — saw a significant drop-off of 2.2M in the first-quarter and I expect that second-quarter numbers are not going to be great either. I estimate that the number of monthly transacting users declined another 1.3-1.5M in Q2’22 due to a broad-based slump in cryptocurrency prices. Unless market conditions fundamentally improve in the second half of the year, the user trend is set to stay negative for Coinbase for the foreseeable future. Because MTUs are in a decline, I also anticipate a 15-20% decline in revenues compared to the first-quarter and continual platform losses.

Coinbase

Prepare for a cyclical decline in institution-driven asset growth on Coinbase Global

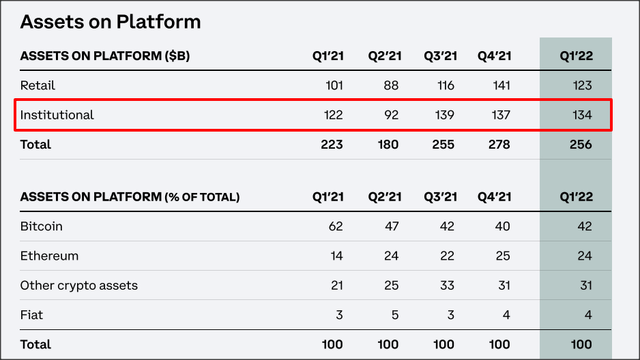

Coinbase’s retail customers generated total revenues of 965.8M in Q1’22 while institutions, which are more buy-and-hold investors, generated just $47.2M in revenues. Retail traders accounted for 95% of the firm’s transaction revenues in the first-quarter and they will remain key to Coinbase’s platform profitability. Over the longer term, however, Coinbase is likely going to woo institutional investors more by building out its blockchain service and custody businesses.

Retail traders are driving Coinbase’s transaction revenues, but institutions have historically driven the platform’s asset growth. But, with crypto asset prices decreasing as rapidly as they did so far in 2022, including in the second-quarter, institutions may adopt a “wait-and-see” approach and reduce their capital commitments to the crypto space going forward… which could then result in a serious asset drawdown from Coinbase.

Institutional assets declined to $134B in Q1’22 and the second-quarter will likely have seen a steep drop-off in this metric as well. While I expect that retail traders will continue to dominate trading of cryptocurrencies, the asset side of Coinbase’s platform business may suffer severely in FY 2022. For the second-quarter, I expect a 10% drawdown in asset values on the Coinbase platform with both retail and institutional investors seeing declines.

Coinbase Global

Coinbase has seen steep declines in EPS estimates

Coinbase’s earnings prospects and platform profitability depend to a large extent on (retail) trading activity. Because of the decline in crypto prices, earnings estimates for COIN have also declined rapidly. Coinbase is now expected to generate negative EPS in FY 2022 and FY 2023 which is a dramatic reversal from positive EPS predictions at the beginning of the year. If market conditions continue to deteriorate, there is a risk that EPS estimates will continue to trend downwards in FY 2022.

Expect a weak outlook for Q3’22

Because of the broad-based weakness in cryptocurrency prices and negative user trends, Coinbase is set to submit an outlook for Q3’22 in August that is likely going to be less than inspiring. A weak user and revenue outlook in and of itself may be a reason for many investors to give up and sell their shares in the cryptocurrency exchange, adding to existing pressure on Coinbase.

Risks with Coinbase Global

Besides EPS risks and volatile platform profitability, there are other risks. The biggest commercial risk for Coinbase right now is the possibility of a prolonged crypto winter which would most likely result in severe declines in the number of users, trading volume and assets on the platform.

Additionally, bankruptcies are spreading in the crypto sector: indebted crypto lender Voyager Digital recently filed for bankruptcy while BlockFi was sold to crypto exchange FTX in a $25M fire sale. While crypto exchanges are safer than lenders (which have credit risk), the entire industry may be set for a painful period of restructuring. Coinbase has already announced that it will lay off 18% of its workforce to account for the possibility of a crypto winter.

Also a risk: More challenging market conditions could pressure Coinbase’s fee structure. With prices trending down, customers that trade consistently become more valuable. Coinbase has one of the highest fees in the industry and is vulnerable to rivals offering zero-fee trading to attract new customers. Binance just rolled its zero-fee trading program out to its global customer base which is a threat to Coinbase.

Final thoughts

Coinbase is not much more than a “hold” now that EPS predictions have completed collapsed. User, asset and platform trends are negative and indicate that the platform will submit a very weak earnings card for the second-quarter and outlook for Q3’22… which could drive a further down-ward revaluation of Coinbase’s shares. With risks of a recession increasing, digital asset prices may continue to face considerable headwinds. While I believe in Coinbase’s platform and growing density of products and services, the short term outlook has deteriorated quite dramatically!

Be the first to comment