Leon Neal

Because of its short public life, one probably can’t argue that Coinbase (NASDAQ:COIN) should be a core holding for digital asset allocations. But the company provides a unique and somewhat moated position in, and representation of, the crypto space. And despite the $1.09 billion headline loss in the second quarter and the ever mounting SEC legal woes, Coinbase’s strengths are geared toward combating its current threats.

As detailed below, Coinbase has positioned themselves to represent trust, a concept not forefront for the digital asset industry. This lack of trust is especially true among those looking to enter the space. Of course digital assets generally operate in an environment that does not require trust. And cryptos are often described as “trustless”, which does cause some initial confusion and possibly concern among lay investors. Coinbase’s history, investments and commitments counter these trust centered concerns for both retail and institutional investors.

Before directly discussing the trust related elements of security and regulatory compliance, the article below first covers the following concepts:

- Business composition over time: transaction revenue breakout, MTU and ATRPU, subscriptions revenue growth, transaction revenue by digital asset

- 2021 earnings as valuation backstop

- Balance sheet strength, current ratio, and EBITDA losses guardrail

Coinbase Business Composition

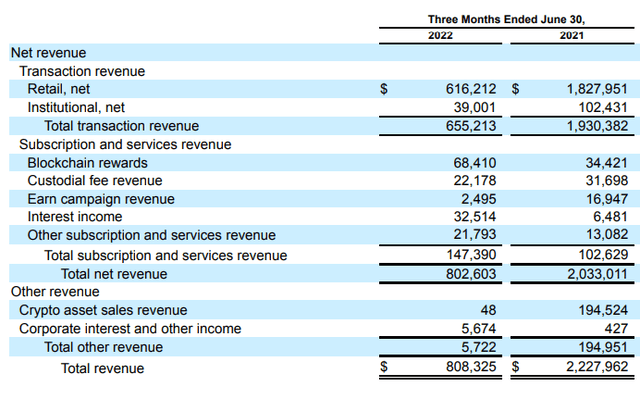

Going back to Q2 of 2021, retail transaction revenue was about 82% of total revenues. For the recent quarter these revenues represented 77% of the total. Retail transaction revenue is and will remain the key metric for Coinbase.

While institutional transaction revenue remains a small portion of the total at 5%, these clients serve an important function from my perspective. Coinbase’s leadership as an institutional custodian and inroads as a leading institutional prime broker serve to bolster trust and underpin retail user growth overtime. A few recent partnerships of note are with BlackRock (BLK) and Meta Platforms (META).

Rightfully there is significant coverage each quarter of Coinbase’s key metrics for Monthly Transacting Users (MTU) and the Average Transaction Revenue Per User (ATRPU). Compared to Q1, MTU were down 2%, but more importantly, the mix shift from trading activity to staking activity hurt ATRPU. Coinbase explained:

As a result of our core retail customer trading less, our MTU mix has trended more towards non-investing activities – notably staking. In Q2, 67% or 6.0 million MTUs transacted with noninvesting products. We have recently begun supporting staking for Cardano (March) and Solana (end of June) which drove this trend. Since trading users have relatively higher levels of revenue per user than non-investing users, we saw downward pressure on our Average Transaction Revenue Per User (ATRPU) metric. That said, year-to-date, ATRPU for trading users is still comfortably higher than the averages observed during the previous market downturn that began in 2018.

Source: Second Quarter 2022 Shareholder Letter, 8/9/2022

Following are four items to keep in mind when comparing the second largest revenue category of Blockchain rewards to the all-important retail transaction revenues:

- Coinbase considers itself the principal in staking transactions and presents Blockchain rewards earned on a gross basis.

- The ATRPU calculation excludes both Subscription and services and Institutional transaction revenues.

- Through Q2, retail ATRPU was $29.

- Blockchain rewards revenues doubled from the prior year quarter.

Coinbase offers staking or staking type yield on six major digital assets. The list and yields can be found here. Blockchain rewards are a small part of Coinbase’s revenues, especially as they are reported on a gross basis. But the program is simple and “built in” and empowers retail traders to easily and meaningfully participate in the major proof-of-stake consensus mechanisms. Over time this feature will bolster retail user growth and retail transaction revenues.

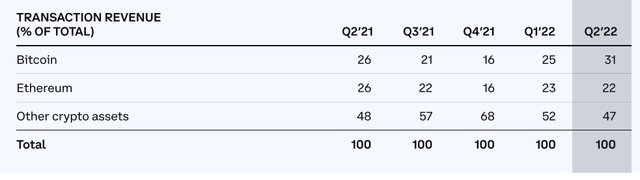

Looking to transaction revenue by asset type, there may a flight to safety with a higher percentage of Bitcoin trading and relatively less smaller-cap altcoin trading. Though this has not particularly been reflected in direct market dominance comparisons.

From my perspective it is hard to fully understand why altcoins have represented such a large portion of Coinbase’s transaction revenue. One pertinent data point is that other than Bitcoin (BTC-USD) and Ethereum (ETH-USD), no coin or token represents more than 10% of the trading volume or Transaction revenue. In any case, as the SEC begins to successfully label a range of Coinbase listed altcoins as securities, this large revenue bucket is threatened (more on SEC below).

For simplicity here, “altcoin” means cryptocurrency other than Bitcoin or Ethereum.

Valuation Backstop and Current Ratio

Buying or holding Coinbase is an investment in the idea that the crypto space is going to a multi-trillion dollar market cap over the next few years. Risks remain with the uncertain political situation in the U.S., especially as anti-crypto advocates likely retain control and leadership of key Senate committees following the midterms. Also, there is an entrenched and increasingly oppositional Securities and Exchange Commission that is advocating for and has actually begun to act with a heavier regulatory hand.

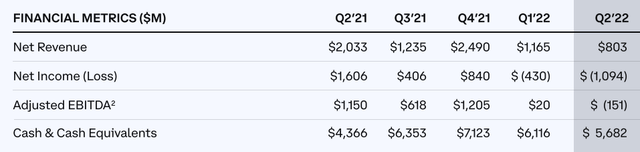

But to weather this threat, Coinbase has a backstop in terms of valuation from its $3.15 billion 2021 EBITDA. It is somewhat unusual for a newly listed, tech and growth oriented investment to show large first year EBITDA relative to its market cap. And though obviously the core revenue generation has been cut by two-thirds with the recent price disruptions, the company is trading at 5 times last year’s EBITDA.

In tech and growth investing, theoretical revenues and earnings often fail to materialize. But Coinbase’s historical revenues and profitability during a stronger market provide definitive support for its thesis.

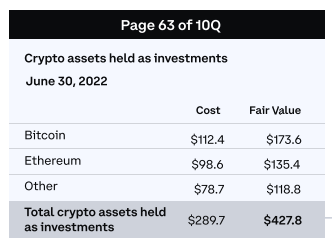

Coinbase also has time to work though current regulatory and overall market challenges. Including their crypto investments, their total capital resources total $6.58 billion. $5.5 billion is directly held in cash and money market funds. Interestingly as seen below and despite the large headline impairments, Coinbase has reasonably strong returns on their crypto assets held as investments. Data below is in millions.

investor.coinbase.com

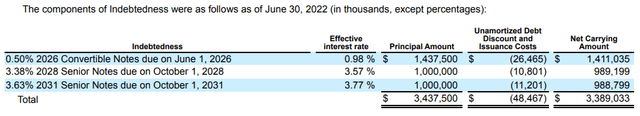

On the liability side, Coinbase has about $670 million in current liabilities and $3.39 billion in conservatively financed long-term debt. Note the rates and due dates in the following graphic.

For this year Coinbase has set a $500 million adjusted EBITDA loss guardrail. They are implementing expense management initiatives including reducing headcount by 18% in June.

…we are cautiously optimistic about our ability to operate within this guardrail. This optimism assumes that crypto market capitalization does not deteriorate meaningfully below July 2022 levels and that we do not see changes in our current customer behaviors.

Source: A message from Coinbase CEO and Cofounder, Brian Armstrong, 6/14/2022

Taking the above together, Coinbase has a strong capital position.

Trust Element and SEC Legal Issues

Coinbase has one of the longest-running platforms in which customers have not lost funds from a security breach. The company has no record of blocking customer withdrawals, recalling loans or changing customer access to credit. And its standard lending practice requires 100%+ in collateral.

Coinbase does not have financing exposure to Three Arrows Capital (3AC), Celsius (CEL-USD) or Voyager (OTCPK:VYGVQ). They have no record of credit losses from financing activities or exposure to customer or counterparty insolvency. Luna (LUNC-USD) was not a supported asset. Though non-material, it should be noted here that Coinbase’s venture program invested in Terraform Labs (UST-USD).

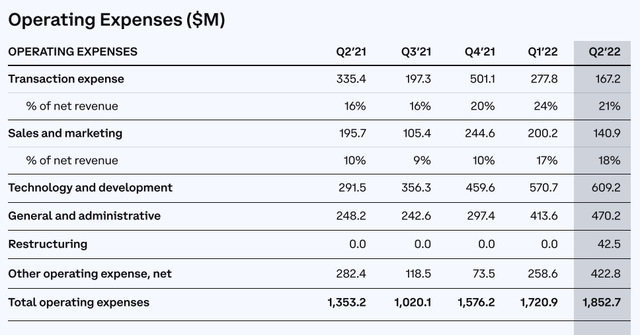

Coinbase has been committed to investing in its technology. Consider the relative spends in the operating expenses below.

Coinbase has a proprietary cold storage system that maintains security while clients trade and stake assets. They have created industry standards for private cryptographic keys and can employ multi-party computation to protect certain assets. They are using data and artificial intelligence to identify and prevent exploits.

For compliance, Coinbase has built a strong KYC and anti-money laundering program. They created bespoke monitoring systems to investigate transactions in real time on various blockchains. The company is also a leader in addressing regulation. For example, consider the following from the recent shareholder letter:

In the U.S., we are regulated by the New York Department of Financial Services with a BitLicense and Custody charter, the U.S. Department of Treasury registration as a Money Services Business, and the CFTC. Internationally we hold a cryptocurrency exchange license in Japan, and the first-ever German crypto license.

However the company is facing increased scrutiny from the SEC. In an October article I covered Coinbase’s skirmish with the SEC over their proposed Lend program. The plan was to allow certain customers to earn interest on digital assets held on the platform, starting by offering 4% APY on USD Coin (USDC-USD). The final takeaway from the situation was that there remain significant unresolved substance and process questions.

On the substance, from my perspective the Lend program is not a security under the Reves decision. The reason… the lend program does not appear to be an investment in a business as it would not be offered broadly and its demand nature is not characteristic of such an investment. In any case, a knowable, well defined regime is needed for these type products as the U.S. looks to lead in the development of digital innovations.

In May the SEC sent Coinbase a request for information on how they list digital assets. And in a July complaint against a former Coinbase employee who was accused of insider trading, the Commission reiterated the hallmark of a security is:

…if it constitutes an investment of money in a common enterprise, with a reasonable expectation of profit derived from the efforts of others.

Source: SEC v. Wahi, et al., sec.gov, 7/21/2022

Importantly, seven of the digital assets implicated as securities in the SEC Wahi filing are listed on Coinbase. On the Coinbase blog Chief Legal Officer Paul Grewal fired back:

None of these assets are securities. Coinbase has a rigorous process to analyze and review each digital asset before making it available on our exchange – a process that the SEC itself has reviewed

Source: Coinbase does not list securities. End of story., 7/21/2022

Naturally Grewal is biased toward Coinbase’s positions. But his previous experience as U.S. Magistrate Judge for the U.S. District Court for the Northern District of California gives his opinion more weight. And the SEC’s reasoning and frameworks have been challenged recently as seen with Grayscale’s efforts to convert their Bitcoin trust to an ETF.

However, if any of tokens face SEC litigation, it is likely Coinbase will suspend trading as they did in the case of Ripple’s XRP token (XRP-USD). The direct revenue and indirect sentiment effects for Coinbase would be negative and likely proportional to the size of the assets.

COIN Stock Rating

Coinbase has a proven record of profitability during a bull market. The company is well capitalized for the current crypto cold snap. Key advantages include leadership in technology and a deserved reputation of trust. Recognition of growing institutional adoption and robust, easy to use non-trading features will drive retail user growth and the all-important retail transaction revenues.

In the short term Coinbase faces a high level of regulatory related uncertainty, especially the SEC’s movement against a range of less commodity like altcoins. While not indicating all of Coinbase’s listed altcoins could be effected, combined these coins and tokens surprising represent 50% of Coinbase’s transaction revenues.

Considering together these two themes of a compelling business foundation but regulatory headwinds, I am maintaining my hold rating Coinbase. This is indicative of an expectation that the stock will market and industry perform.

My new marketplace service is coming soon. Complete Crypto Analytics is launching in the near future and will have an in-depth, dedicated Bitcoin miner comparison feature. Please keep reading my articles here for updates. There will be a generous introductory price for early subscribers. Thank you for following my work.

Be the first to comment