xijian/E+ via Getty Images

Investment thesis

Cohen & Steers, Inc. (NYSE:CNS) reported good fourth-quarter results and I expect that the company will deliver a solid first quarter despite the external market challenges. I believe CNS is a more stable asset manager than its peers due to the location and the mix of its assets. Almost two-thirds of its assets are in real estate and real estate funds, and, as long as the U.S. real estate market is stable, the company will experience net inflows to these assets. The vast majority of CNS’s net inflows and growing AUM were due to this asset class in Q4, and I expect nothing but the same in the first-quarter results. However, my position on CNS has not changed since my last article and I am still neutral on the company due to its fair valuation.

Business model

Cohen & Steers is a publicly owned asset management holding company. Their primary focus is the real-estate sector and alternative investment vehicles. This is one of the main reasons why CNS is less volatile than most of its peers. Approximately 93.1% of their revenue comes from investment advisory and administration fees, and most of their revenue is recognized in the U.S. In addition, more than half of their assets are in U.S. real estate and two-thirds of their assets are in real estate both domestic and abroad.

Full Year 2021 Earnings Presentation

Q4 results and Q1 expectations

CNS reported good third-quarter results with growing AUM and declining expenses. The management could grow the company’s average AUM by 9.6% and the ending AUM by 2.4% compared to the previous quarter. In addition, the net flow was also positive with $1.8 billion of net inflows in Q4 2021. This is higher than the Q3 results of $1.3 billion but far from the year-on-year net inflows of $3.9 billion. The fourth-quarter net inflow was almost entirely because of the U.S. real estate investment strategy, other investment vehicles had slightly negative or slightly positive inflows.

CNS will report its first-quarter results on April 20, 2022, after market close, and will report the second-quarter results on July 19, 2022. The company could also grow its AUM in the first quarter, and I expect that the company will report around $101.9-102.3 billion AUM for the first quarter. Most of the asset managers reported a slight decline or a slight growth for March AUM while CNS reported a figure much better than the industry average. The company’s AUM was up by 3.2% from February 2022. This increase is mainly due to market appreciation and not because of net inflows.

Valuation

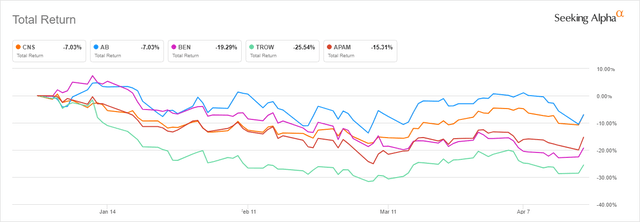

In my previous article about CNS, I calculated the company’s valuation based on the discounted cash flow model. Now, let’s have a look at CNS’s valuation from a different perspective. Since my last article (at the beginning of December), the price has dropped by almost 6%. In the same period, the S&P 500 had a return of -3.66%. Comparing CNS to its peers, we can say that the company is more stable in turbulent times than its peers, which makes it a safer choice for investors. This is mainly due to the funds that it manages. CNS outperformed its peers, hand in hand with Alliance Bernstein Holding L.P. (AB)

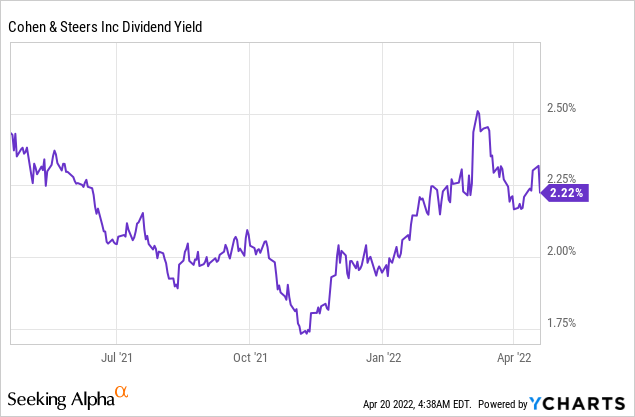

Since my last article, the valuation based on P/E metrics got a bit more attractive because, in December 2021, CNS had a forward Non-GAAP P/E ratio of 23.43 and at the moment it has a forward P/E ratio of 20.83. In terms of dividend yield, CNS is trading at a fairly good price. You could have bought the company with a better dividend yield than the current one approximately 28-30% of the time in the last 12 months. This suggests to me that the current valuation is fair, and a great dividend yield for CNS would be above 2.4% (based on Ycharts’ graph and without special dividends). Based on all these factors, I am still neutral on CNS despite the better P/E ratio, better dividend yield, and lower price than in December.

Company-specific risks

I mentioned in my previous article that one of the risk factors is the asset concentration of Daiwa Asset Management. This has not changed since because approximately 25.5% of the institutional account assets the company manages, and approximately 10.2% of their total assets under management, were derived from Daiwa. However, to put it into contrast, while at the end of 2020 this client represented 7.8% of CNS’s total revenue, by the end of last year this figure dropped to 5.4%. This suggests to me that the management is well aware of this situation and tries to diversify the company’s AUM. In addition, the overall health of the real estate market is key for CNS, because, as of December 31, 2021, approximately 65% of the assets they managed were concentrated in real estate securities strategies, including approximately 24% in different CNS real estate securities funds.

CNS has a seed investment part which is riskier than any other part of its portfolio. The management does this because they believe that the seed investments they made will support the launch of new strategies and products. However, any seed investment is highly volatile and risky, and many of the company’s seed investments did not return the expected results in 2021.

Dividend

Not many things have changed since December with regard to CNS’s dividend. You might find it boring, however, a good dividend-paying company is often boring, and that is the sign of a good company. This is why Warren Buffett is the biggest practitioner of boring investments.

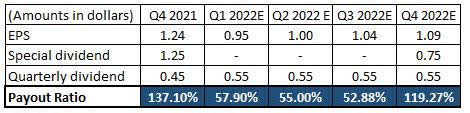

CNS has a forward dividend yield of 2.58% without the regular special dividend. The management usually announces the special dividend at the end of the year, when the management sees the yearly results. This is not a very uncommon practice for asset managers, Artisan Partners Asset Management Inc. (APAM) does the same. Taking into consideration a special dividend of $0.75 per share, CNS would have a dividend yield of 3.45%. I calculated a lower special dividend than in 2021 due to the rising interest rates and also considering the not-so-good first-quarter results of asset managers. However, the management increased the quarterly dividend in February 2022 by a whopping 22.22% to $0.55 per share.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

CNS is a solid asset manager and less volatile than most of its peers due to the investment vehicles they use. The management is devoted to paying a reliable dividend over the long term and the dividend is covered as well. In my opinion, as long as the U.S. housing market is stable, CNS will experience net inflows to its real estate funds while most of its peers could struggle in the choppy market. However, I am still neutral on CNS due to its fair valuation.

Be the first to comment